Kerrisdale Takes Aim at BitMine’s $10B ETH Strategy—Should You Be Concerned?

- BitMine’s stock slipped after Kerrisdale Capital released a short report criticizing its Ethereum-focused business model and heavy stock issuance.

- The report claimed BitMine raised $10B in three months to buy ETH, narrowing its premium to net asset value and sparking investor fatigue.

- Kerrisdale argued investors should buy Ethereum directly instead of paying a premium through BitMine’s constantly diluted stock.

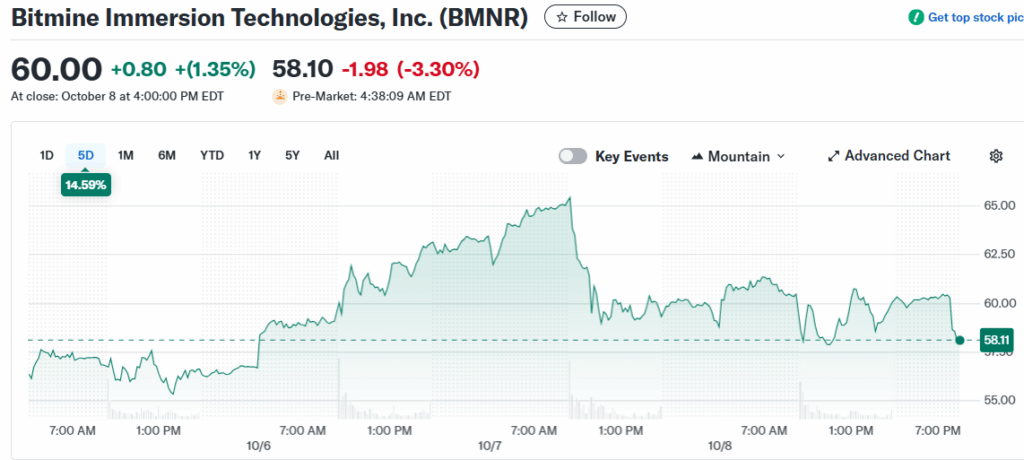

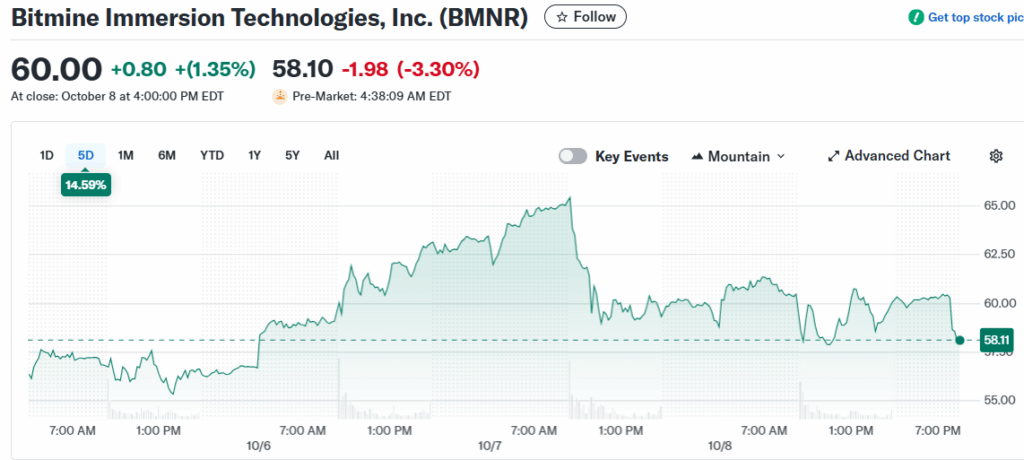

BitMine’s stock took a hit this week after short-seller Kerrisdale Capital dropped a critical report questioning the company’s business model. The report, published early Tuesday, accused BitMine of relying too heavily on aggressive stock issuance to fuel its Ethereum purchases — calling it “a strategy that’s running out of time.” Shares initially fell over 5% before clawing back to close slightly higher at $60, but the debate around its long-term model is heating up fast.

Kerrisdale, known for its sharp takes on overvalued crypto firms, revealed it’s shorting BitMine stock. The firm’s main argument? BitMine is essentially selling massive amounts of new shares — about $10 billion worth in just three months — to buy more Ethereum, betting that the rising token price offsets dilution. The report claimed the company’s premium over its net asset value (NAV) has already shrunk from 2x in August to just 1.2x by late September. In short, investors are paying too much for what they could buy cheaper by just holding ETH directly.

“A Model on Its Way to Extinction”

Once a Bitcoin miner, BitMine pivoted earlier this year to become an Ethereum treasury company, shifting its entire focus to accumulating ETH. It now holds around 2.83 million Ether—worth about $12.5 billion—making it the largest public holder of the asset. But Kerrisdale says the model only works as long as investors keep buying new shares faster than the company can issue them. “It’s a cycle of hype, dilution, and short-lived rallies,” the report stated bluntly.

The short-seller didn’t pull punches when criticizing BitMine’s latest $365 million stock offering either. Management called it “materially accretive,” but Kerrisdale argued it was really “a discounted giveaway,” pointing to the warrants attached to the deal. The repeated share sales, the firm said, have created fatigue among investors who now expect every rally to be followed by another capital raise.

Leadership Under Fire

Kerrisdale even took aim at BitMine’s leadership, drawing a comparison between Executive Chair Tom Lee and MicroStrategy’s Michael Saylor. “Tom Lee brings name recognition, but not the cult-like trust Saylor enjoys,” the report said, suggesting that BitMine lacks the charisma or scarcity needed to sustain investor enthusiasm through continued dilution. Without a clear differentiator, Kerrisdale warned, BitMine risks becoming “just another treasury stock chasing Ethereum’s coattails.”

Still, the competition for market share in crypto treasuries is growing fast. According to The Block, similar U.S.-listed firms are expected to raise more than $100 billion in 2025. That means even minor missteps could cause investors to shift toward leaner or more transparent alternatives.

Kerrisdale’s Argument: “Just Buy Ethereum Instead”

While the tone of the report was harsh, Kerrisdale clarified it isn’t bearish on Ethereum itself — just on BitMine’s way of offering exposure to it. The firm argued that anyone bullish on ETH would be better off simply buying the token directly, staking it for yield, or holding an ETH ETF once those markets expand. Doing that, it said, avoids the constant dilution and inflated premiums that come with owning BitMine shares.

It’s not Kerrisdale’s first rodeo in the crypto sector either. The firm previously targeted Riot Platforms and MicroStrategy, both of which publicly fired back. For now, BitMine hasn’t responded to the latest short report, but the damage may already be done. Even with shares recovering slightly, the question hanging over investors’ heads is clear — how long can BitMine keep issuing stock faster than it builds actual value?

The post Kerrisdale Takes Aim at BitMine’s $10B ETH Strategy—Should You Be Concerned? first appeared on BlockNews.

Kerrisdale Takes Aim at BitMine’s $10B ETH Strategy—Should You Be Concerned?

- BitMine’s stock slipped after Kerrisdale Capital released a short report criticizing its Ethereum-focused business model and heavy stock issuance.

- The report claimed BitMine raised $10B in three months to buy ETH, narrowing its premium to net asset value and sparking investor fatigue.

- Kerrisdale argued investors should buy Ethereum directly instead of paying a premium through BitMine’s constantly diluted stock.

BitMine’s stock took a hit this week after short-seller Kerrisdale Capital dropped a critical report questioning the company’s business model. The report, published early Tuesday, accused BitMine of relying too heavily on aggressive stock issuance to fuel its Ethereum purchases — calling it “a strategy that’s running out of time.” Shares initially fell over 5% before clawing back to close slightly higher at $60, but the debate around its long-term model is heating up fast.

Kerrisdale, known for its sharp takes on overvalued crypto firms, revealed it’s shorting BitMine stock. The firm’s main argument? BitMine is essentially selling massive amounts of new shares — about $10 billion worth in just three months — to buy more Ethereum, betting that the rising token price offsets dilution. The report claimed the company’s premium over its net asset value (NAV) has already shrunk from 2x in August to just 1.2x by late September. In short, investors are paying too much for what they could buy cheaper by just holding ETH directly.

“A Model on Its Way to Extinction”

Once a Bitcoin miner, BitMine pivoted earlier this year to become an Ethereum treasury company, shifting its entire focus to accumulating ETH. It now holds around 2.83 million Ether—worth about $12.5 billion—making it the largest public holder of the asset. But Kerrisdale says the model only works as long as investors keep buying new shares faster than the company can issue them. “It’s a cycle of hype, dilution, and short-lived rallies,” the report stated bluntly.

The short-seller didn’t pull punches when criticizing BitMine’s latest $365 million stock offering either. Management called it “materially accretive,” but Kerrisdale argued it was really “a discounted giveaway,” pointing to the warrants attached to the deal. The repeated share sales, the firm said, have created fatigue among investors who now expect every rally to be followed by another capital raise.

Leadership Under Fire

Kerrisdale even took aim at BitMine’s leadership, drawing a comparison between Executive Chair Tom Lee and MicroStrategy’s Michael Saylor. “Tom Lee brings name recognition, but not the cult-like trust Saylor enjoys,” the report said, suggesting that BitMine lacks the charisma or scarcity needed to sustain investor enthusiasm through continued dilution. Without a clear differentiator, Kerrisdale warned, BitMine risks becoming “just another treasury stock chasing Ethereum’s coattails.”

Still, the competition for market share in crypto treasuries is growing fast. According to The Block, similar U.S.-listed firms are expected to raise more than $100 billion in 2025. That means even minor missteps could cause investors to shift toward leaner or more transparent alternatives.

Kerrisdale’s Argument: “Just Buy Ethereum Instead”

While the tone of the report was harsh, Kerrisdale clarified it isn’t bearish on Ethereum itself — just on BitMine’s way of offering exposure to it. The firm argued that anyone bullish on ETH would be better off simply buying the token directly, staking it for yield, or holding an ETH ETF once those markets expand. Doing that, it said, avoids the constant dilution and inflated premiums that come with owning BitMine shares.

It’s not Kerrisdale’s first rodeo in the crypto sector either. The firm previously targeted Riot Platforms and MicroStrategy, both of which publicly fired back. For now, BitMine hasn’t responded to the latest short report, but the damage may already be done. Even with shares recovering slightly, the question hanging over investors’ heads is clear — how long can BitMine keep issuing stock faster than it builds actual value?

The post Kerrisdale Takes Aim at BitMine’s $10B ETH Strategy—Should You Be Concerned? first appeared on BlockNews.