Litecoin Defies Market Drop With 10% Daily Surge — Here’s What’s Fueling the Rally

- Litecoin surged 10% in one day, defying a broader crypto market correction.

- ETF speculation and rate cut expectations are driving bullish momentum.

- Analysts say an ETF approval could trigger another leg up for LTC into year-end.

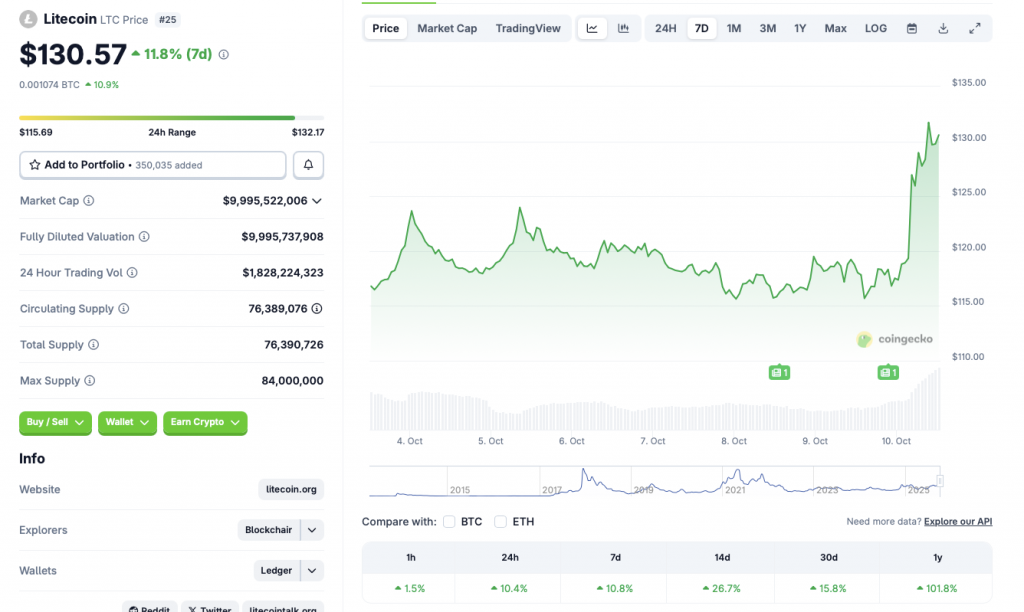

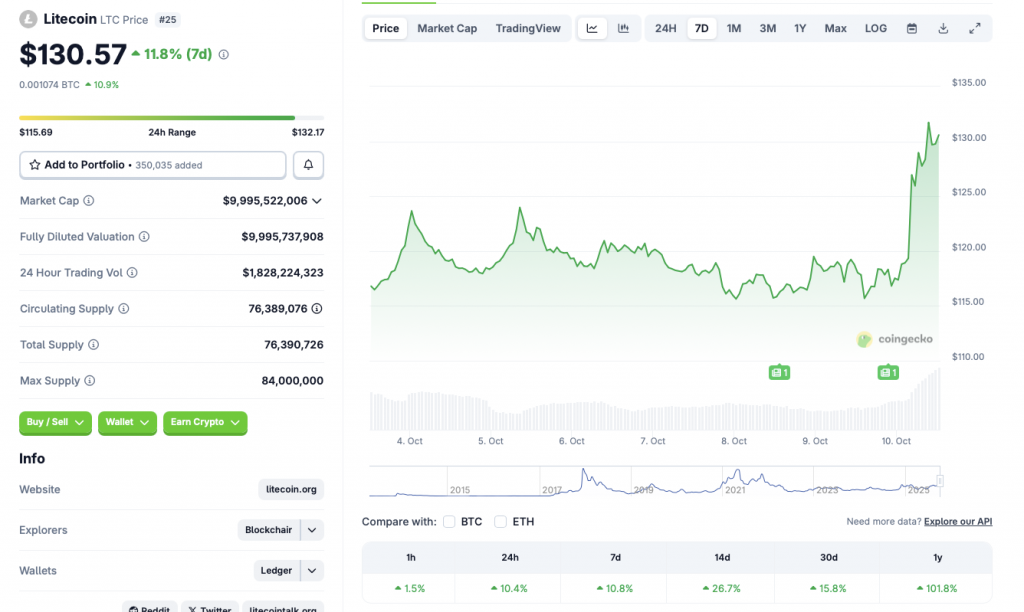

In a day when most of the crypto market turned red, Litecoin (LTC) surged 10.4%, outperforming nearly every major asset. According to CoinGecko, LTC is trading higher across all timeframes — up 10.8% weekly, 26.7% over two weeks, and 15.8% over the past month. The token’s price has more than doubled since October 2024, signaling a strong comeback for one of crypto’s oldest networks.

While Bitcoin, Ethereum, and Solana all saw declines amid heavy liquidations and macro jitters, Litecoin’s rally shows clear signs of a decoupling trend — one driven by mounting anticipation of an ETF approval and renewed investor confidence.

ETF Optimism Drives Momentum

The biggest factor behind Litecoin’s surge is growing ETF speculation. Canary Capital recently filed final amendments for its Litecoin spot ETF, which analysts view as a key precursor to regulatory approval. An approved LTC ETF would mark a major milestone — not only for the project but also for expanding institutional access to alternative Layer-1 assets.

Historically, ETF launches have been game-changers for crypto assets. Bitcoin’s ETF inflows helped push BTC to new all-time highs above $126,000, while Ethereum’s ETF debut fueled a breakout earlier this year. Traders now see Litecoin as the next candidate in line, potentially positioning itself for a similar wave of institutional demand.

Macro Tailwinds Add Fuel to the Fire

Adding to the bullish setup, the Federal Reserve is expected to cut interest rates by 25 basis points in its upcoming meeting — a move that could boost risk-on assets like crypto. Lower borrowing costs generally drive capital toward higher-yielding markets, and Litecoin, with its lean supply structure and low transaction costs, stands to benefit.

Market strategists say that a combination of ETF approval and rate cuts could set up LTC for a breakout beyond its current resistance levels, extending its year-long uptrend. However, if the SEC delays its ETF decision, short-term corrections could follow as traders unwind speculative positions.

What’s Next for Litecoin

Despite the uncertainty, the tone around Litecoin remains decisively bullish. The project’s strong fundamentals, growing on-chain activity, and regulatory clarity have reinforced its image as a reliable “digital silver” counterpart to Bitcoin’s “digital gold.”

If ETF approval comes through, analysts expect Litecoin to test multi-year highs, possibly entering a new phase of institutional adoption. For now, LTC’s ability to rally against the broader market downtrend highlights one clear message — investors are betting that the next big ETF wave could have a silver lining.

The post Litecoin Defies Market Drop With 10% Daily Surge — Here’s What’s Fueling the Rally first appeared on BlockNews.

Litecoin Defies Market Drop With 10% Daily Surge — Here’s What’s Fueling the Rally

- Litecoin surged 10% in one day, defying a broader crypto market correction.

- ETF speculation and rate cut expectations are driving bullish momentum.

- Analysts say an ETF approval could trigger another leg up for LTC into year-end.

In a day when most of the crypto market turned red, Litecoin (LTC) surged 10.4%, outperforming nearly every major asset. According to CoinGecko, LTC is trading higher across all timeframes — up 10.8% weekly, 26.7% over two weeks, and 15.8% over the past month. The token’s price has more than doubled since October 2024, signaling a strong comeback for one of crypto’s oldest networks.

While Bitcoin, Ethereum, and Solana all saw declines amid heavy liquidations and macro jitters, Litecoin’s rally shows clear signs of a decoupling trend — one driven by mounting anticipation of an ETF approval and renewed investor confidence.

ETF Optimism Drives Momentum

The biggest factor behind Litecoin’s surge is growing ETF speculation. Canary Capital recently filed final amendments for its Litecoin spot ETF, which analysts view as a key precursor to regulatory approval. An approved LTC ETF would mark a major milestone — not only for the project but also for expanding institutional access to alternative Layer-1 assets.

Historically, ETF launches have been game-changers for crypto assets. Bitcoin’s ETF inflows helped push BTC to new all-time highs above $126,000, while Ethereum’s ETF debut fueled a breakout earlier this year. Traders now see Litecoin as the next candidate in line, potentially positioning itself for a similar wave of institutional demand.

Macro Tailwinds Add Fuel to the Fire

Adding to the bullish setup, the Federal Reserve is expected to cut interest rates by 25 basis points in its upcoming meeting — a move that could boost risk-on assets like crypto. Lower borrowing costs generally drive capital toward higher-yielding markets, and Litecoin, with its lean supply structure and low transaction costs, stands to benefit.

Market strategists say that a combination of ETF approval and rate cuts could set up LTC for a breakout beyond its current resistance levels, extending its year-long uptrend. However, if the SEC delays its ETF decision, short-term corrections could follow as traders unwind speculative positions.

What’s Next for Litecoin

Despite the uncertainty, the tone around Litecoin remains decisively bullish. The project’s strong fundamentals, growing on-chain activity, and regulatory clarity have reinforced its image as a reliable “digital silver” counterpart to Bitcoin’s “digital gold.”

If ETF approval comes through, analysts expect Litecoin to test multi-year highs, possibly entering a new phase of institutional adoption. For now, LTC’s ability to rally against the broader market downtrend highlights one clear message — investors are betting that the next big ETF wave could have a silver lining.

The post Litecoin Defies Market Drop With 10% Daily Surge — Here’s What’s Fueling the Rally first appeared on BlockNews.