Bitcoin Bulls Await Rebound as Price Consolidates Near $109K

Share:

- Based on past trends, crypto market analysts predict that the bull market will have to wait for Bitcoin to reach $104,000 before it can resume its upward trajectory.

- The present setup opens the door to $102,000, the analyst said, adding a broader reversal is imminent.

The market structure of Bitcoin is trying to get back on track after last week’s steep correction, according to data. However, bullish investors are still hesitant to open new positions in the futures markets due to the growing hurdles posed by Trump’s renewed tariff war with China and the ongoing US government shutdown.

Based on past trends, crypto market analysts predict that the bull market will have to wait for Bitcoin to reach $104,000 before it can resume its upward trajectory. At roughly $102,500, the 50-week simple moving average—a technical sign of Bitcoin’s long-term support—is now visible, according to TradingView.

Huge Cluster of Liquidity

Analysts predict its return after four instances of robust support since the bull market started in mid-2023. On Thursday, analyst ‘Sykodelic’ said that the market still has a lot of leverage and that there is a huge cluster of liquidity around $104,000.

Before noting that the signal was last touched in April 2025 (when Bitcoin sank to $74,000) and August 2024 (when it collapsed to $49,000), the expert said that the market usually feels the worst immediately before it reverses.

The present setup “opens the door to $102,000,” the analyst said, adding a broader reversal is imminent.

Due to profit-taking and macroeconomic worries, Bitcoin may retrace to $104,000 as a component of a healthy market correction. But institutional interest and underlying fundamentals are still strong, so the bull market might resume strongly.

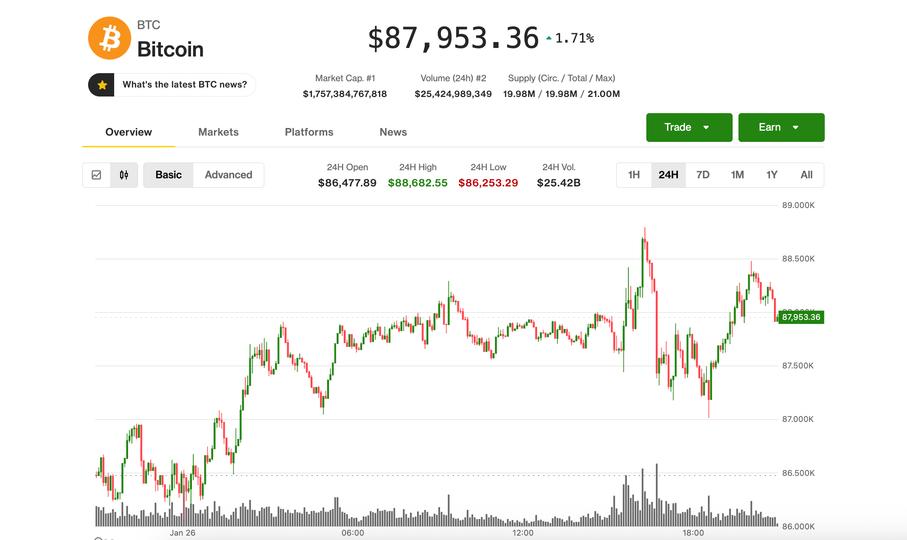

Over the last day, Bitcoin’s price has been stable, circling the $109,000 mark—an important support-turned-resistance zone. On Tuesday, it soared above $113,000 for a short while, but it swiftly dropped down to $107,000. It has since settled at the resistance level and begun to consolidate. At the time of writing, Bitcoin is trading at $109,650, up 1.17% in the last 24 hours as per data from CMC.

On the other hand, investment behemoth VanEck reports that Bitcoin miners’ debt has skyrocketed in the last year, going from $2.1 billion to $12.7 billion, all because they are scrambling to fulfill demand for AI and Bitcoin production.

Bitcoin Bulls Await Rebound as Price Consolidates Near $109K

Share:

- Based on past trends, crypto market analysts predict that the bull market will have to wait for Bitcoin to reach $104,000 before it can resume its upward trajectory.

- The present setup opens the door to $102,000, the analyst said, adding a broader reversal is imminent.

The market structure of Bitcoin is trying to get back on track after last week’s steep correction, according to data. However, bullish investors are still hesitant to open new positions in the futures markets due to the growing hurdles posed by Trump’s renewed tariff war with China and the ongoing US government shutdown.

Based on past trends, crypto market analysts predict that the bull market will have to wait for Bitcoin to reach $104,000 before it can resume its upward trajectory. At roughly $102,500, the 50-week simple moving average—a technical sign of Bitcoin’s long-term support—is now visible, according to TradingView.

Huge Cluster of Liquidity

Analysts predict its return after four instances of robust support since the bull market started in mid-2023. On Thursday, analyst ‘Sykodelic’ said that the market still has a lot of leverage and that there is a huge cluster of liquidity around $104,000.

Before noting that the signal was last touched in April 2025 (when Bitcoin sank to $74,000) and August 2024 (when it collapsed to $49,000), the expert said that the market usually feels the worst immediately before it reverses.

The present setup “opens the door to $102,000,” the analyst said, adding a broader reversal is imminent.

Due to profit-taking and macroeconomic worries, Bitcoin may retrace to $104,000 as a component of a healthy market correction. But institutional interest and underlying fundamentals are still strong, so the bull market might resume strongly.

Over the last day, Bitcoin’s price has been stable, circling the $109,000 mark—an important support-turned-resistance zone. On Tuesday, it soared above $113,000 for a short while, but it swiftly dropped down to $107,000. It has since settled at the resistance level and begun to consolidate. At the time of writing, Bitcoin is trading at $109,650, up 1.17% in the last 24 hours as per data from CMC.

On the other hand, investment behemoth VanEck reports that Bitcoin miners’ debt has skyrocketed in the last year, going from $2.1 billion to $12.7 billion, all because they are scrambling to fulfill demand for AI and Bitcoin production.