U.S. SEC Clarifies Rules for Tokenized Securities Under Federal Law

Share:

- The U.S. SEC statement clarifies rules for tokenized securities, placed under federal securities laws

- The SEC’s guidance comes as Congress considers the Market Structure Bill.

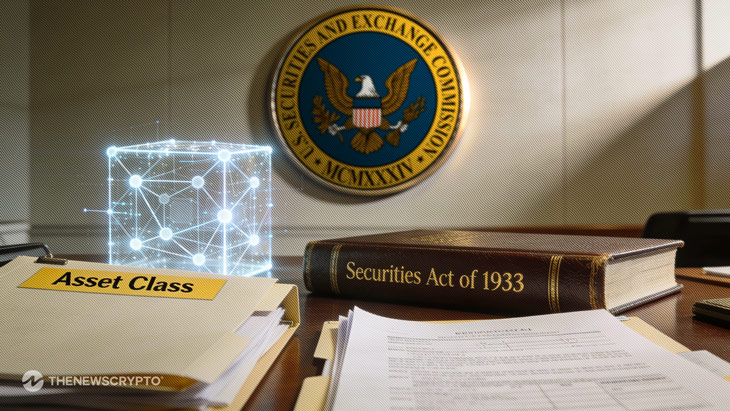

The U.S. Securities and Exchange Commission published a statement on January 28, which clarified rules for tokenized securities that are governed under federal securities laws.

The statement, prepared through guidance from the Division of Corporation Finance, Division of Investment Management, and Division of Trading and Markets, outlines that tokenization models, whether issued by the original issuer or by third parties, fall within the agency’s regulatory framework as the market structure bill advances in Congress.

“A tokenized security is a financial instrument enumerated in the definition of ‘security’ under the federal securities laws that is formatted as or represented by a crypto asset, where the record of ownership is maintained in whole or in part on or through one or more crypto networks,” noted in the SEC’s statement.

SEC Clarifies Categories of Tokenized Securities

As per the SEC clarification, there are two main categories of tokenized securities, namely, “issuer-sponsored tokenized securities” and “third-party sponsored securities.”

The first category allows companies to issue securities directly on blockchain networks, where the on-chain ledger serves as part of the official ownership record. As they eliminate conventional, off-chain database records. However, using blockchain does not change a security’s legal status and does not exempt issuers from registration, disclosure, and compliance under federal securities laws.

Then, the second category is third-party sponsored securities, which have two models. Firstly, custodial Tokenized Securities, a third party holds the underlying security in custody, where the crypto asset represents the holder’s indirect interest through a security entitlement with transfers recorded on-chain, but the format does not change the application of federal securities laws.

As with the second model, Synthetic Tokenized Securities, an issuer tokenizes a security issued by another person and provides economic exposure without granting direct ownership or shareholder rights.

With that, the overall SEC’s statement is mainly about clarifying the existing rules, not changing the law itself, and reinforces that blockchain-based securities are not a loophole. Also, in recent weeks NewYork Stock Exchange planned a 24/7 blockchain venue to trade tokenized U.S. equities and exchange-traded funds, and is waiting for approval.

Highlighted Crypto News Today:

Bitcoin Slips to $88K as Asian Markets Turn Mixed, Gold Hits Record

U.S. SEC Clarifies Rules for Tokenized Securities Under Federal Law

Share:

- The U.S. SEC statement clarifies rules for tokenized securities, placed under federal securities laws

- The SEC’s guidance comes as Congress considers the Market Structure Bill.

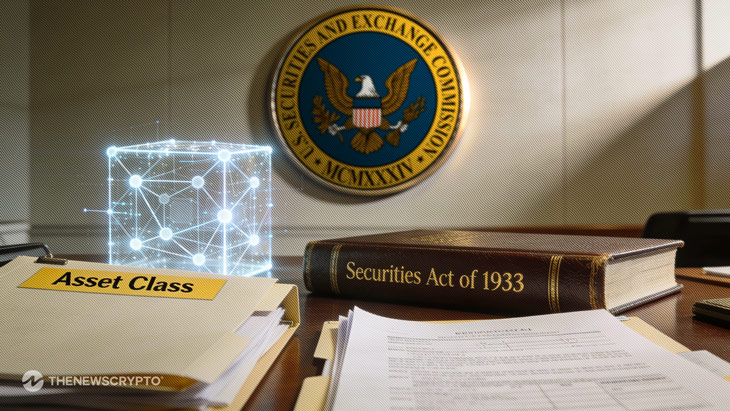

The U.S. Securities and Exchange Commission published a statement on January 28, which clarified rules for tokenized securities that are governed under federal securities laws.

The statement, prepared through guidance from the Division of Corporation Finance, Division of Investment Management, and Division of Trading and Markets, outlines that tokenization models, whether issued by the original issuer or by third parties, fall within the agency’s regulatory framework as the market structure bill advances in Congress.

“A tokenized security is a financial instrument enumerated in the definition of ‘security’ under the federal securities laws that is formatted as or represented by a crypto asset, where the record of ownership is maintained in whole or in part on or through one or more crypto networks,” noted in the SEC’s statement.

SEC Clarifies Categories of Tokenized Securities

As per the SEC clarification, there are two main categories of tokenized securities, namely, “issuer-sponsored tokenized securities” and “third-party sponsored securities.”

The first category allows companies to issue securities directly on blockchain networks, where the on-chain ledger serves as part of the official ownership record. As they eliminate conventional, off-chain database records. However, using blockchain does not change a security’s legal status and does not exempt issuers from registration, disclosure, and compliance under federal securities laws.

Then, the second category is third-party sponsored securities, which have two models. Firstly, custodial Tokenized Securities, a third party holds the underlying security in custody, where the crypto asset represents the holder’s indirect interest through a security entitlement with transfers recorded on-chain, but the format does not change the application of federal securities laws.

As with the second model, Synthetic Tokenized Securities, an issuer tokenizes a security issued by another person and provides economic exposure without granting direct ownership or shareholder rights.

With that, the overall SEC’s statement is mainly about clarifying the existing rules, not changing the law itself, and reinforces that blockchain-based securities are not a loophole. Also, in recent weeks NewYork Stock Exchange planned a 24/7 blockchain venue to trade tokenized U.S. equities and exchange-traded funds, and is waiting for approval.

Highlighted Crypto News Today:

Bitcoin Slips to $88K as Asian Markets Turn Mixed, Gold Hits Record