Bancor’s dramatic weekend: Of 18-month spikes and 50% crashes

Share:

- BNT whale transfers leaped to a yearly high in the last 24 hours.

- Liquidations by whale investors sent BNT prices down.

Holders of the decentralized exchange token Bancor [BNT] experienced a frenzy of emotions over the weekend. Following an 18-month high on the back of steady accumulation by whales, BNT lost almost half of its market value as some influential cohorts dumped their holdings.

The rise and fall of BNT

Since the 8th of November, things started to turn around for the small-cap crypto, which has remained fairly quiet in 2o23. In fact, the token recorded astonishing gains of more than 60% in the last week, according to CoinMarketCap.

The pump was significantly aided by the accumulation activity of influential user cohorts. As per on-chain analytics firm Santiment, wallets holding more than 10,000 coins were aggressively stockpiling over the past two weeks.

Source: Santiment

The activity reached a peak in the last 24 hours as Bancor transfers worth over a million leaped to a yearly high, as shown below. In the same period, the supply held by wallets holding over 10,000 coins increased to its highest level since January 2022.

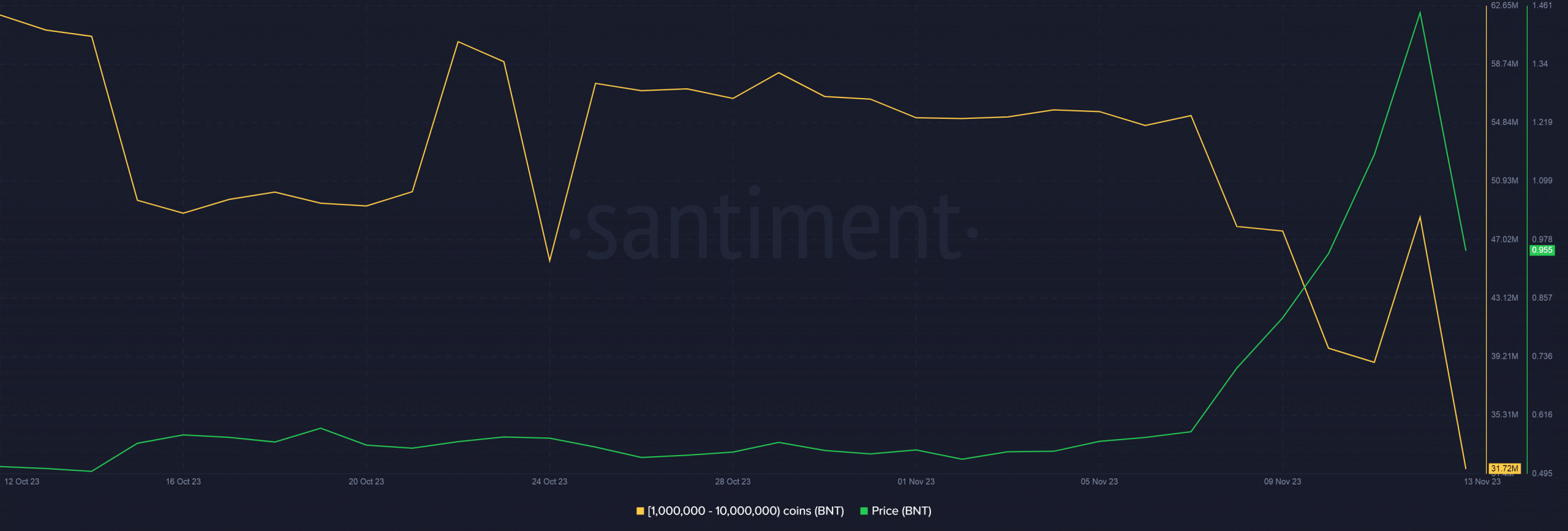

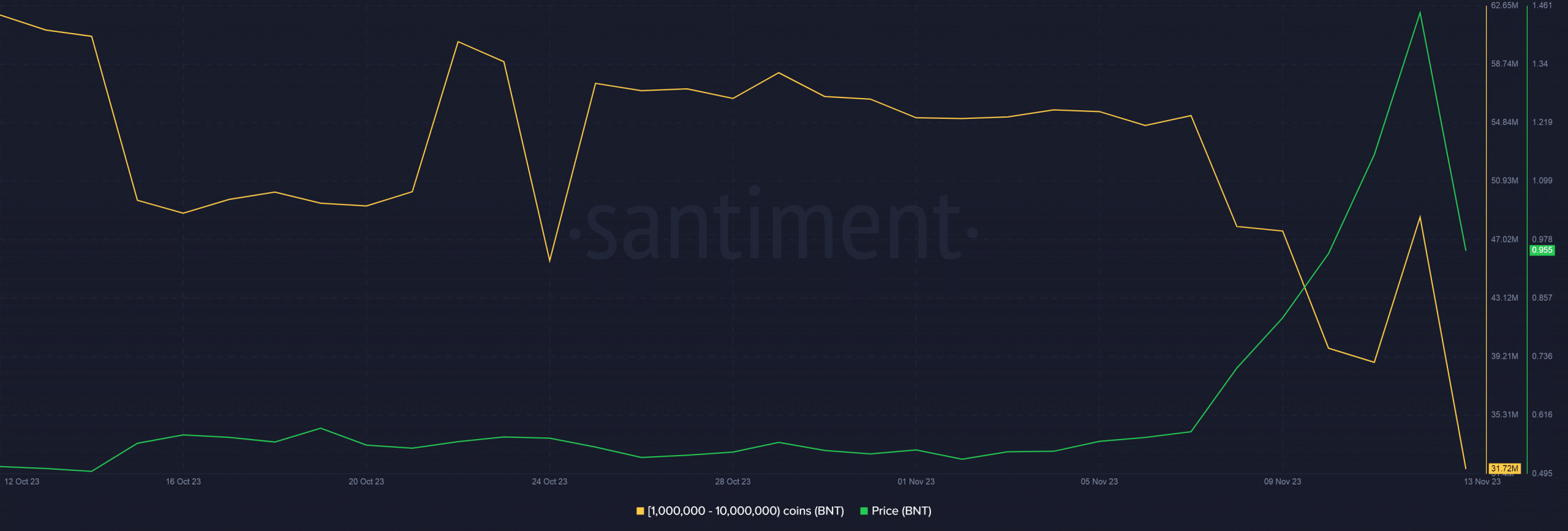

While it was going well, the rally was eventually stopped by profit-hungry traders. AMBCrypto scrutinized Santiment’s data and found a sharp drop in holdings of the cohort with 1 million-10 million BNT coins.

In fact, outflows of more than 16 million were seen after the price broke past $1.8.

Source: Santiment

The liquidations exerted big downward pressure and BNT came crashing down. The market cap worth more than $124 million was wiped within hours and BNT halved in a matter of hours.

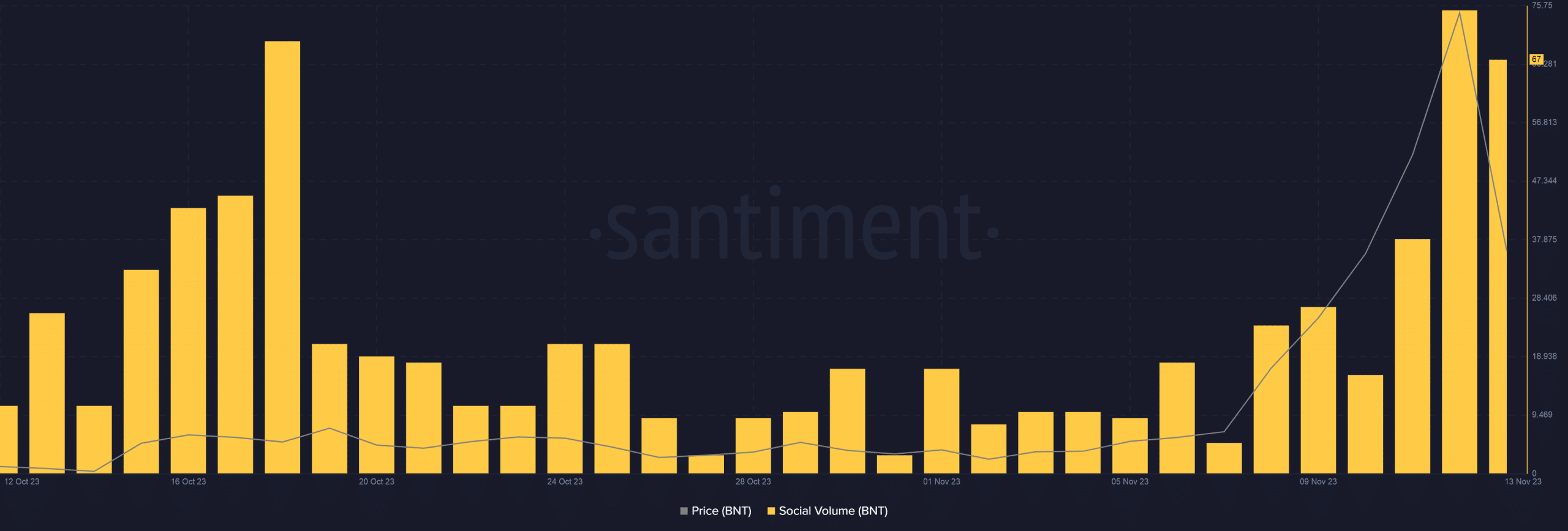

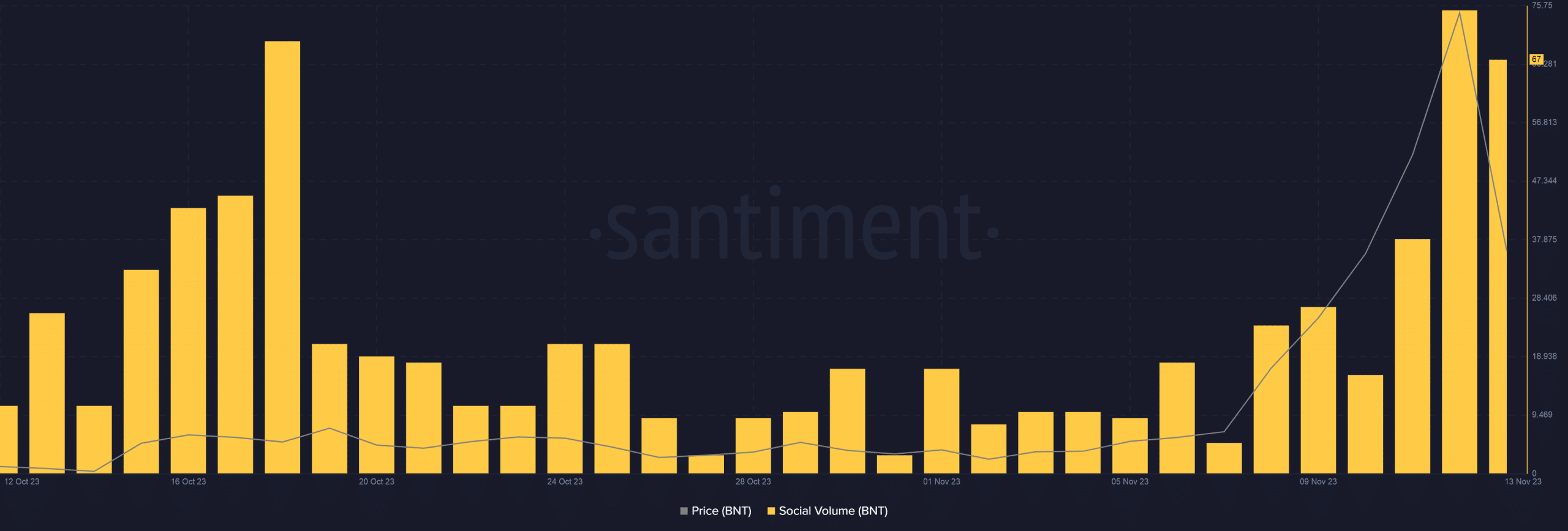

Interestingly, Bancor was the subject of a lot of discussion on crypto-focused social channels. The social volume spiked dramatically in the last 24 hours, as shown below.

Source: Santiment

Concerns of market manipulation

Dramatic fluctuations in the value of small-cap assets have often stoked fears of market manipulation. The pump-and-dump scheme remained the most notorious example of this.

As is well known, it involves artificially inflating the value of an asset with less liquidity through coordinated buying and propaganda. Once unsuspecting retail investors are lured in and the price is sufficiently “pumped,” the holders start dumping their assets at profits.

Read Bancor’s [BNT] Price Prediction 2023-24

In the end, new investors are stuck with a low-value asset and end up being the exit liquidity of whales.

While there was nothing solid to suggest any foul play in the above case, new investors should be cautious while entering the market.

The post Bancor’s dramatic weekend: Of 18-month spikes and 50% crashes appeared first on AMBCrypto.

Bancor’s dramatic weekend: Of 18-month spikes and 50% crashes

Share:

- BNT whale transfers leaped to a yearly high in the last 24 hours.

- Liquidations by whale investors sent BNT prices down.

Holders of the decentralized exchange token Bancor [BNT] experienced a frenzy of emotions over the weekend. Following an 18-month high on the back of steady accumulation by whales, BNT lost almost half of its market value as some influential cohorts dumped their holdings.

The rise and fall of BNT

Since the 8th of November, things started to turn around for the small-cap crypto, which has remained fairly quiet in 2o23. In fact, the token recorded astonishing gains of more than 60% in the last week, according to CoinMarketCap.

The pump was significantly aided by the accumulation activity of influential user cohorts. As per on-chain analytics firm Santiment, wallets holding more than 10,000 coins were aggressively stockpiling over the past two weeks.

Source: Santiment

The activity reached a peak in the last 24 hours as Bancor transfers worth over a million leaped to a yearly high, as shown below. In the same period, the supply held by wallets holding over 10,000 coins increased to its highest level since January 2022.

While it was going well, the rally was eventually stopped by profit-hungry traders. AMBCrypto scrutinized Santiment’s data and found a sharp drop in holdings of the cohort with 1 million-10 million BNT coins.

In fact, outflows of more than 16 million were seen after the price broke past $1.8.

Source: Santiment

The liquidations exerted big downward pressure and BNT came crashing down. The market cap worth more than $124 million was wiped within hours and BNT halved in a matter of hours.

Interestingly, Bancor was the subject of a lot of discussion on crypto-focused social channels. The social volume spiked dramatically in the last 24 hours, as shown below.

Source: Santiment

Concerns of market manipulation

Dramatic fluctuations in the value of small-cap assets have often stoked fears of market manipulation. The pump-and-dump scheme remained the most notorious example of this.

As is well known, it involves artificially inflating the value of an asset with less liquidity through coordinated buying and propaganda. Once unsuspecting retail investors are lured in and the price is sufficiently “pumped,” the holders start dumping their assets at profits.

Read Bancor’s [BNT] Price Prediction 2023-24

In the end, new investors are stuck with a low-value asset and end up being the exit liquidity of whales.

While there was nothing solid to suggest any foul play in the above case, new investors should be cautious while entering the market.

The post Bancor’s dramatic weekend: Of 18-month spikes and 50% crashes appeared first on AMBCrypto.