Cardano (ADA) Riding Bullish Wave as Derivatives Data Signals More Upside

- Cardano trades above $0.82 after an 11% weekly gain, with Open Interest hitting $1.44B — the highest since late July.

- Funding rates turned positive, signaling bullish sentiment as longs pay shorts, often a precursor to strong rallies.

- A daily close above $0.84 could target $0.93, while failure risks a pullback to the $0.77 support zone.

Cardano’s price is pushing higher, holding above $0.82 after climbing nearly 11% last week. Derivatives data is flashing strong bullish sentiment, hinting that the rally might just be getting started.

Derivatives Point to Growing Market Confidence

Open Interest (OI) in Cardano futures jumped from $1.20 billion on August 3 to $1.44 billion by Monday — the highest since late July. This rise signals fresh money flowing into the market, which often fuels further price gains. At the same time, ADA’s funding rate has flipped positive and continues to climb, meaning long traders are paying shorts. Historically, such reversals from negative to positive have preceded strong ADA rallies.

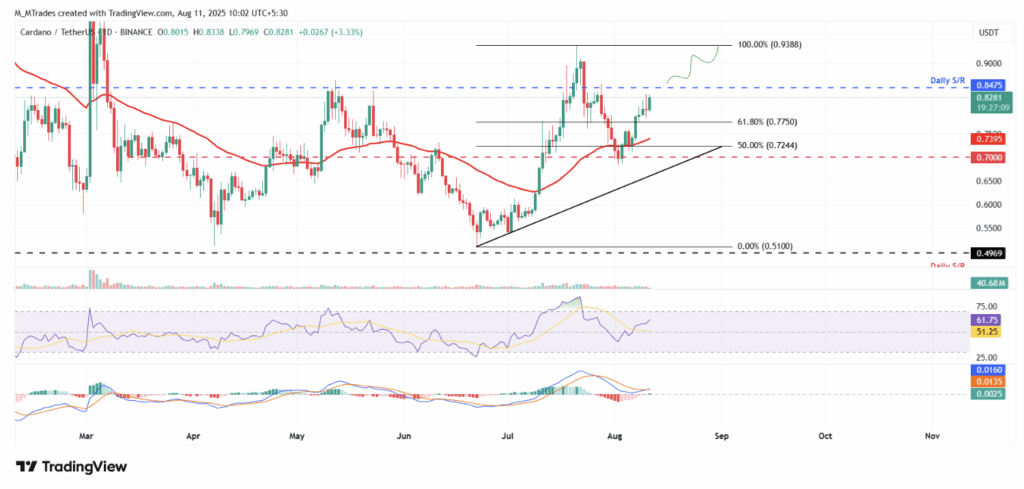

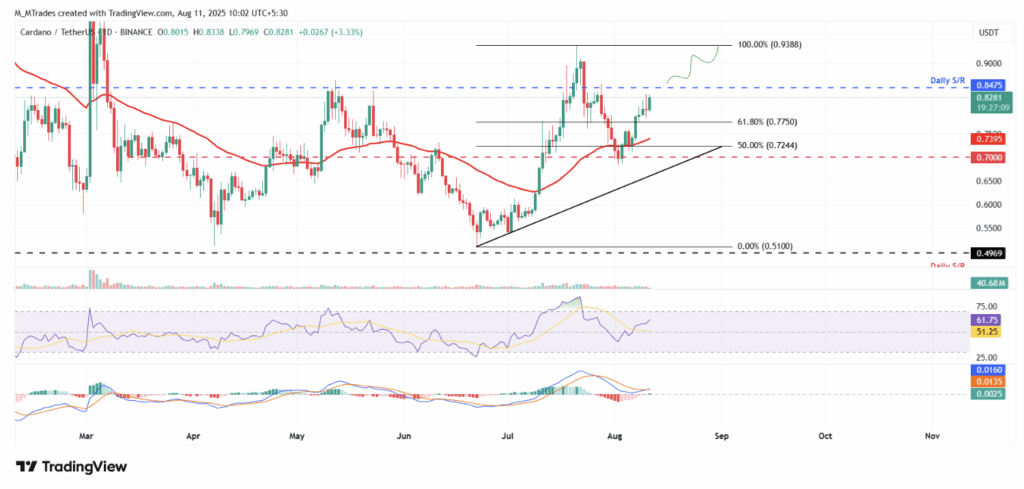

Price Action and Momentum Indicators Support Bulls

After finding solid support at $0.70 on August 3, ADA rallied almost 15% before tacking on another 3% to trade above $0.82 on Monday. A daily close above the $0.84 resistance could open the door to the July 21 high at $0.93. The Relative Strength Index (RSI) sits at 61, well above neutral, suggesting growing bullish momentum. The MACD also shows a bullish crossover, reinforcing the upward bias.

Downside Risk if Resistance Holds

If ADA fails to break $0.84, it could slip back toward its 61.8% Fibonacci retracement level at $0.77. Still, as long as support levels hold and derivatives sentiment remains strong, Cardano’s path of least resistance appears to be upward.

The post Cardano (ADA) Riding Bullish Wave as Derivatives Data Signals More Upside first appeared on BlockNews.

Read More

Ripple’s $19 Trillion Tokenization Vision and XRP’s Potential Upside

Cardano (ADA) Riding Bullish Wave as Derivatives Data Signals More Upside

- Cardano trades above $0.82 after an 11% weekly gain, with Open Interest hitting $1.44B — the highest since late July.

- Funding rates turned positive, signaling bullish sentiment as longs pay shorts, often a precursor to strong rallies.

- A daily close above $0.84 could target $0.93, while failure risks a pullback to the $0.77 support zone.

Cardano’s price is pushing higher, holding above $0.82 after climbing nearly 11% last week. Derivatives data is flashing strong bullish sentiment, hinting that the rally might just be getting started.

Derivatives Point to Growing Market Confidence

Open Interest (OI) in Cardano futures jumped from $1.20 billion on August 3 to $1.44 billion by Monday — the highest since late July. This rise signals fresh money flowing into the market, which often fuels further price gains. At the same time, ADA’s funding rate has flipped positive and continues to climb, meaning long traders are paying shorts. Historically, such reversals from negative to positive have preceded strong ADA rallies.

Price Action and Momentum Indicators Support Bulls

After finding solid support at $0.70 on August 3, ADA rallied almost 15% before tacking on another 3% to trade above $0.82 on Monday. A daily close above the $0.84 resistance could open the door to the July 21 high at $0.93. The Relative Strength Index (RSI) sits at 61, well above neutral, suggesting growing bullish momentum. The MACD also shows a bullish crossover, reinforcing the upward bias.

Downside Risk if Resistance Holds

If ADA fails to break $0.84, it could slip back toward its 61.8% Fibonacci retracement level at $0.77. Still, as long as support levels hold and derivatives sentiment remains strong, Cardano’s path of least resistance appears to be upward.

The post Cardano (ADA) Riding Bullish Wave as Derivatives Data Signals More Upside first appeared on BlockNews.

Read More