Ripple’s $19 Trillion Tokenization Vision and XRP’s Potential Upside

- Ripple forecasts tokenized assets could hit $19T by 2033.

- Real estate ($3.7T) and equities ($2T) are projected to be the largest tokenized sectors.

- XRP could benefit directly as Ripple’s primary settlement and tokenization asset, with long-term upside if adoption accelerates.

Ripple Labs is painting a bold picture for the future of tokenized assets—and it’s one that could have serious implications for XRP. In a new report, the fintech giant projects that by 2033, the total market value of tokenized real-world assets could reach nearly $19 trillion. The sectors leading the charge? Real estate, which Ripple estimates could top $3.7 trillion, and equities, which might add another $2 trillion through tokenization.

Why This Matters for XRP

As the primary bridge for Ripple’s tokenization services, XRP stands to be the first altcoin to feel the benefits. Ripple already works with global banks and major financial institutions, offering blockchain-powered solutions for moving and managing tokenized value. If this projection plays out, tokenized assets could shift from a niche concept to the backbone of global finance—and XRP could be the native liquidity layer supporting it.

The report makes a clear point: tokenization isn’t some distant future—it’s here now. With secure custody infrastructure in place, institutions across Hong Kong, Dubai, the U.S., and beyond are already exploring tokenized gold, real estate, equities, and treasuries. Ripple’s positioning in this space could put XRP in the middle of an institutional wave unlike anything seen before in crypto.

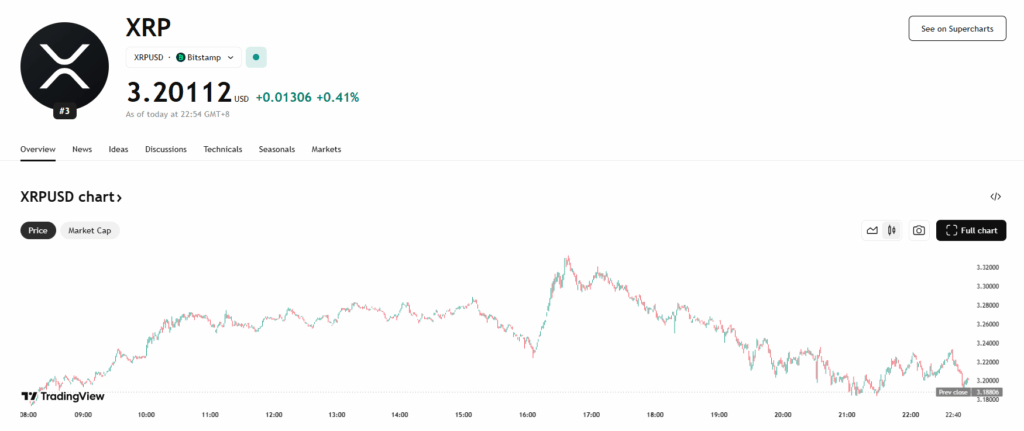

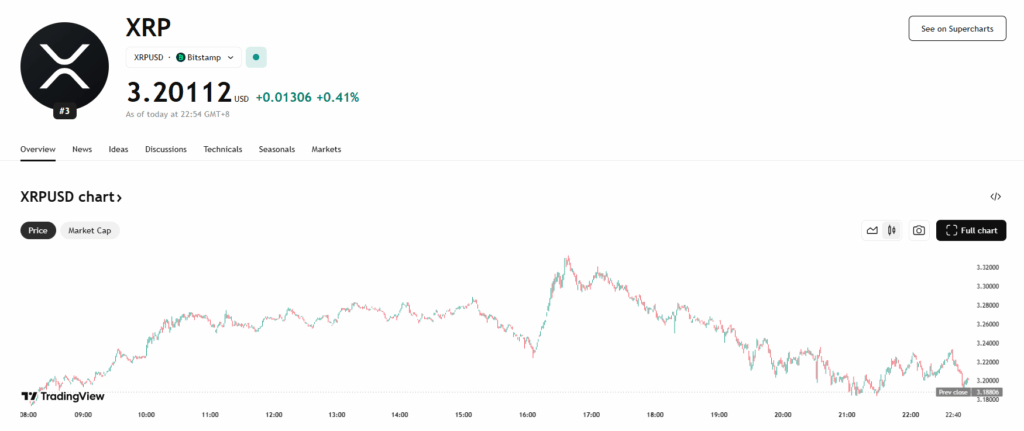

Price Outlook and Strategic Position

XRP is currently hovering around $3.20, holding firm on the bullish side of the market. If tokenization adoption accelerates at the pace Ripple projects, analysts believe XRP could see double-digit percentage gains over the next eight years. In a scenario where tokenized assets become a $19 trillion market, XRP’s role as a liquidity and settlement asset could send it to new highs, potentially setting the stage for price levels that seemed unreachable just a few years ago.

The post Ripple’s $19 Trillion Tokenization Vision and XRP’s Potential Upside first appeared on BlockNews.

Ripple’s $19 Trillion Tokenization Vision and XRP’s Potential Upside

- Ripple forecasts tokenized assets could hit $19T by 2033.

- Real estate ($3.7T) and equities ($2T) are projected to be the largest tokenized sectors.

- XRP could benefit directly as Ripple’s primary settlement and tokenization asset, with long-term upside if adoption accelerates.

Ripple Labs is painting a bold picture for the future of tokenized assets—and it’s one that could have serious implications for XRP. In a new report, the fintech giant projects that by 2033, the total market value of tokenized real-world assets could reach nearly $19 trillion. The sectors leading the charge? Real estate, which Ripple estimates could top $3.7 trillion, and equities, which might add another $2 trillion through tokenization.

Why This Matters for XRP

As the primary bridge for Ripple’s tokenization services, XRP stands to be the first altcoin to feel the benefits. Ripple already works with global banks and major financial institutions, offering blockchain-powered solutions for moving and managing tokenized value. If this projection plays out, tokenized assets could shift from a niche concept to the backbone of global finance—and XRP could be the native liquidity layer supporting it.

The report makes a clear point: tokenization isn’t some distant future—it’s here now. With secure custody infrastructure in place, institutions across Hong Kong, Dubai, the U.S., and beyond are already exploring tokenized gold, real estate, equities, and treasuries. Ripple’s positioning in this space could put XRP in the middle of an institutional wave unlike anything seen before in crypto.

Price Outlook and Strategic Position

XRP is currently hovering around $3.20, holding firm on the bullish side of the market. If tokenization adoption accelerates at the pace Ripple projects, analysts believe XRP could see double-digit percentage gains over the next eight years. In a scenario where tokenized assets become a $19 trillion market, XRP’s role as a liquidity and settlement asset could send it to new highs, potentially setting the stage for price levels that seemed unreachable just a few years ago.

The post Ripple’s $19 Trillion Tokenization Vision and XRP’s Potential Upside first appeared on BlockNews.

Treasuries and money market funds in the EU & USA

Treasuries and money market funds in the EU & USA Agricultural receivables expanding rural access…

Agricultural receivables expanding rural access…