Major Bitcoin Liquidation Levels Identified at $42,000 and $46,000

Share:

- On-chain data shows that BTC may witness high liquidations between the $42,000 and $46,000 price marks.

- BTC’s price has fallen by almost 10% post-ETF approval.

- There has been a decline in BTC demand since 12 January.

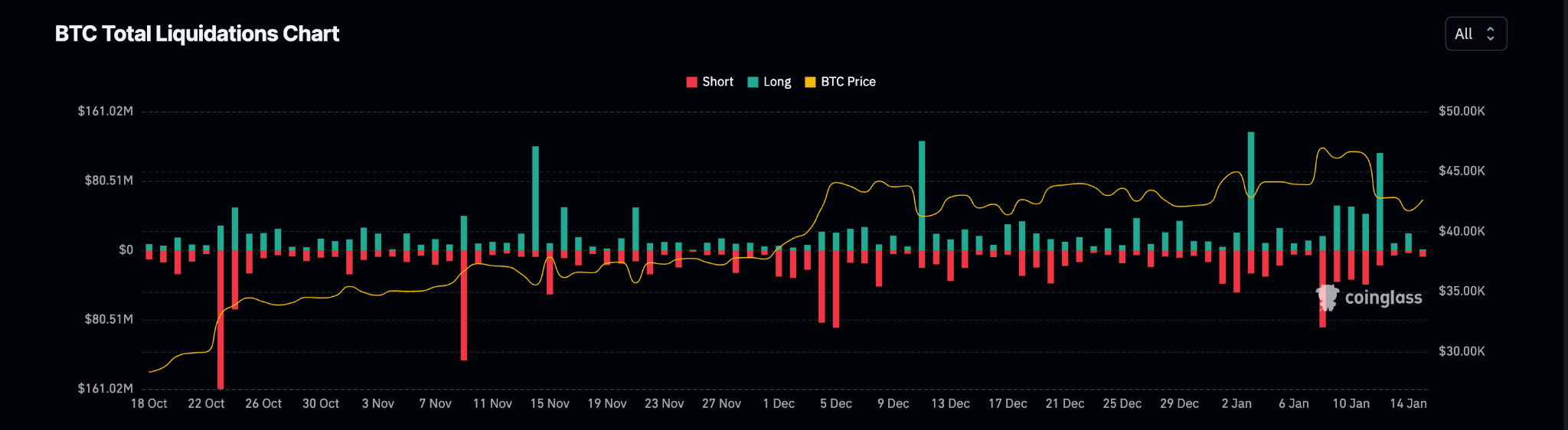

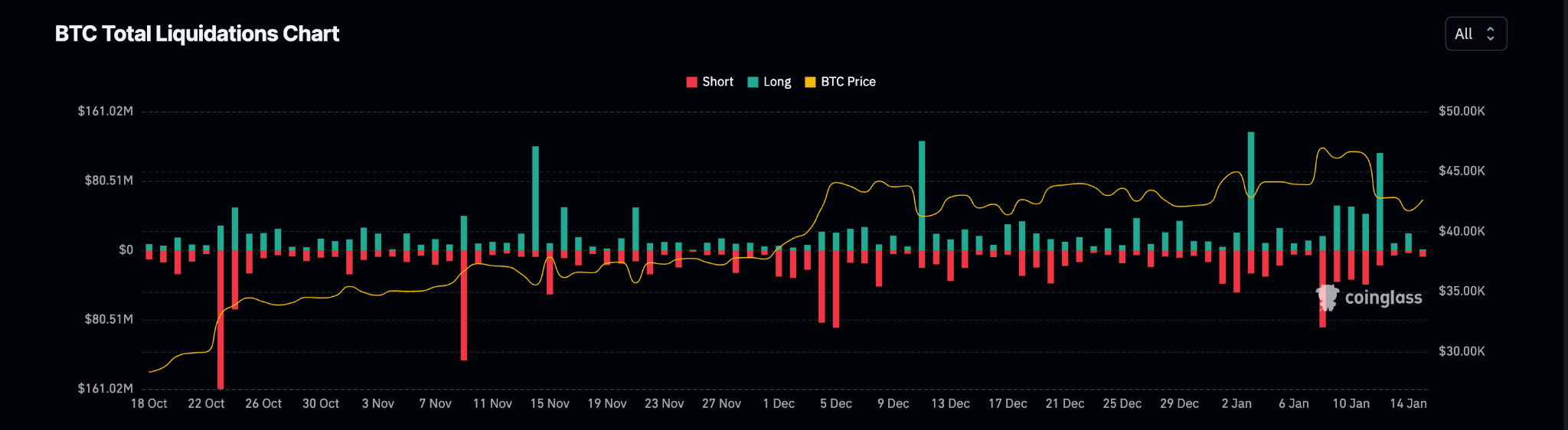

Bitcoin liquidation heatmap assessed on a 3-day chart revealed that the coin’s market is prone to high liquidations between the $42,000 and $46,000 price ranges.

Liquidations occur when traders’ leveraged positions are forced to close because the price of BTC moves against them.

According to data from Coinglass, the BTC market recorded a high long liquidation of $112 million on 12 January, marking its second-highest long liquidation volume since the year began.

This coincided with the 7% price decline recorded on the same day, according to data from CoinMarketCap.

What is Next for BTC?

At press time, the leading crypto asset exchanged hands at $42,658. While many expected a surge above $50,000 post-ETF approval, BTC’s price has plummeted by almost 10% since then.

Daily demand for BTC peaked on 12 January and has since dwindled. On-chain data retrieved from Glassnode sho…

The post Major Bitcoin Liquidation Levels Identified at $42,000 and $46,000 appeared first on Coin Edition.

Major Bitcoin Liquidation Levels Identified at $42,000 and $46,000

Share:

- On-chain data shows that BTC may witness high liquidations between the $42,000 and $46,000 price marks.

- BTC’s price has fallen by almost 10% post-ETF approval.

- There has been a decline in BTC demand since 12 January.

Bitcoin liquidation heatmap assessed on a 3-day chart revealed that the coin’s market is prone to high liquidations between the $42,000 and $46,000 price ranges.

Liquidations occur when traders’ leveraged positions are forced to close because the price of BTC moves against them.

According to data from Coinglass, the BTC market recorded a high long liquidation of $112 million on 12 January, marking its second-highest long liquidation volume since the year began.

This coincided with the 7% price decline recorded on the same day, according to data from CoinMarketCap.

What is Next for BTC?

At press time, the leading crypto asset exchanged hands at $42,658. While many expected a surge above $50,000 post-ETF approval, BTC’s price has plummeted by almost 10% since then.

Daily demand for BTC peaked on 12 January and has since dwindled. On-chain data retrieved from Glassnode sho…

The post Major Bitcoin Liquidation Levels Identified at $42,000 and $46,000 appeared first on Coin Edition.