Gold vs. Silver vs. Bitcoin: Which Asset Will Lead by the End of Q1?

Share:

Bitcoin is trading at $82,078, down 6.9% daily and 7.1% monthly, reflecting a 35% drop from its October all-time high. Divergent price movements of gold, silver, and Bitcoin highlight shifting investor sentiment and risk appetite amid changing macroeconomic conditions.

- Gold and silver rallied to record levels in early 2026 before significant pullbacks.

- Bitcoin trades near $82,000 after daily and monthly declines.

- Leadership by quarter-end depends on macro signals, risk appetite, and rotation trends.

Gold, silver, and Bitcoin are posting divergent price moves in Q1 2026 amid shifting macroeconomic conditions. Recent gains in precious metals and Bitcoin’s weakness highlight changing investor positioning. Policy signals, liquidity trends, and market flows are expected to determine asset leadership by quarter-end.

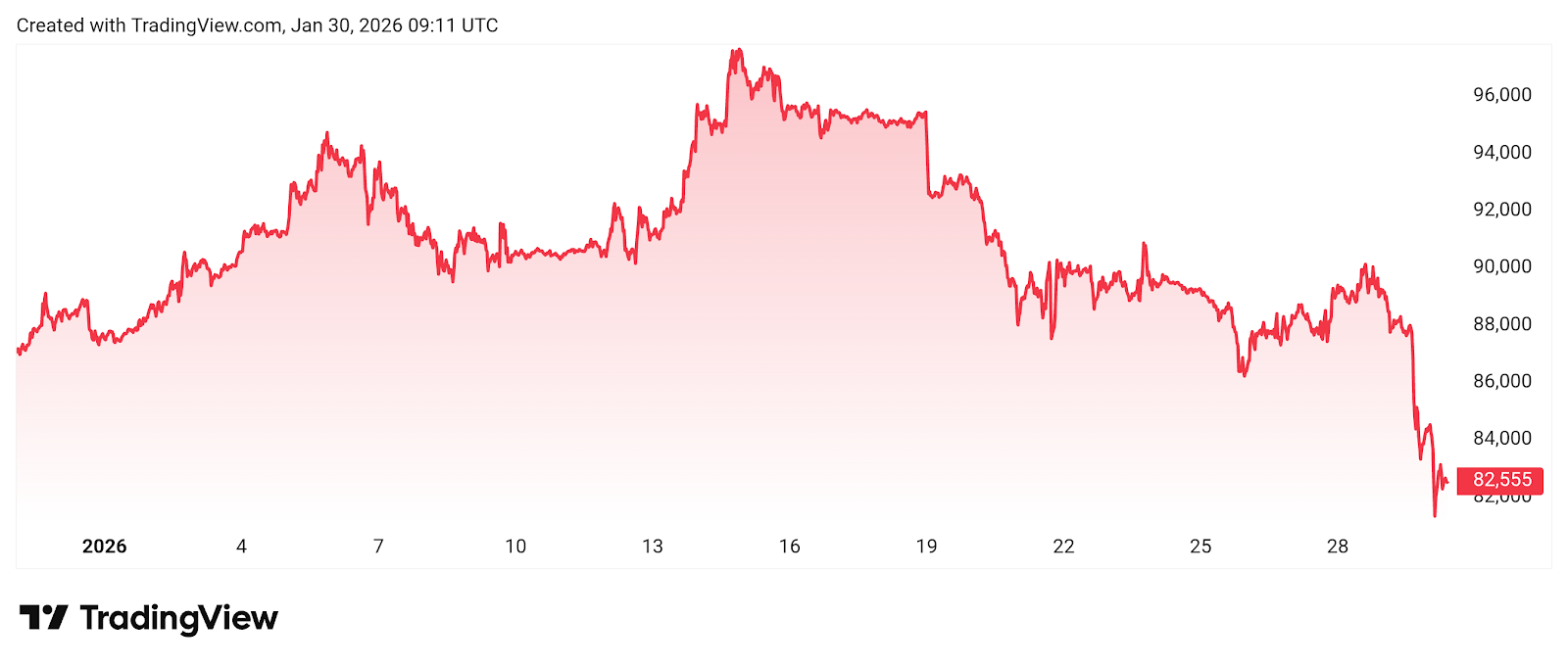

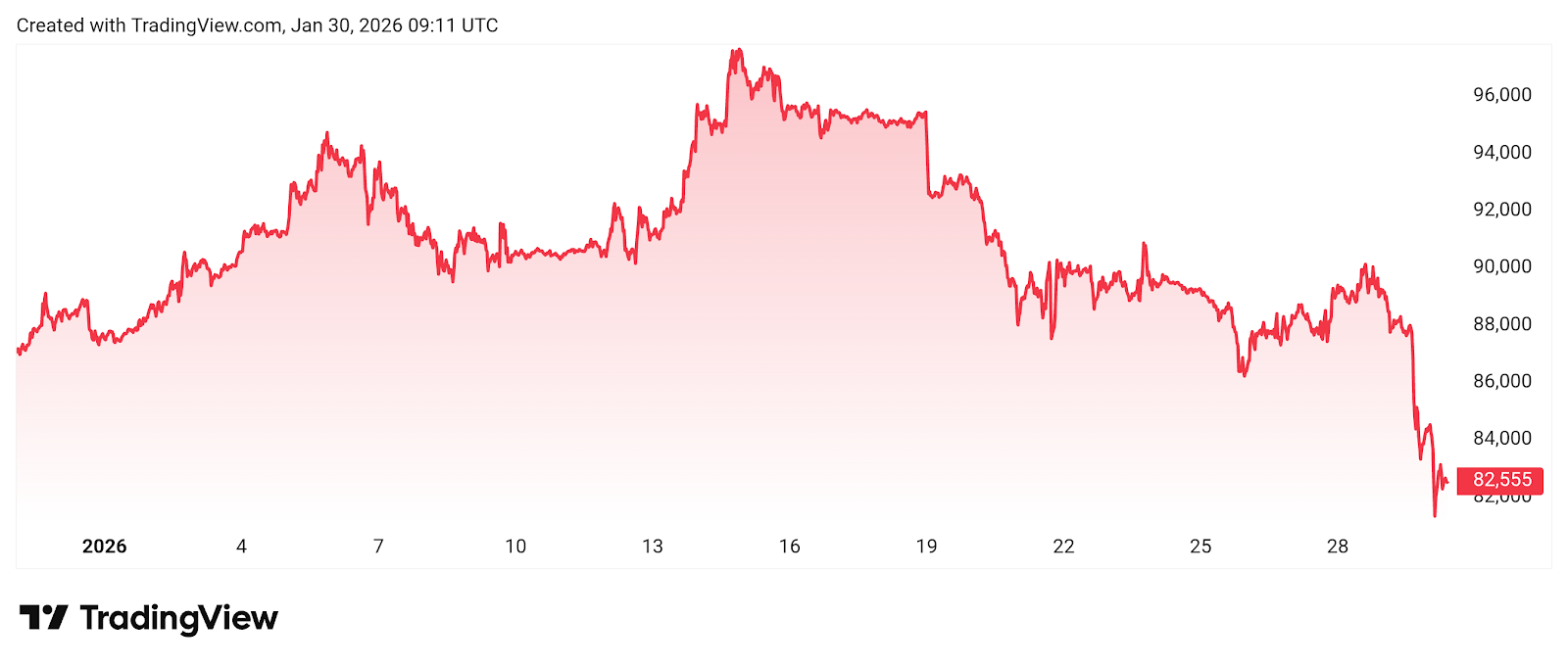

Bitcoin Slips Amid Risk-Off Sentiment

Source: TradingView

Bitcoin is trading at $82,078, down 6.9% over the past day and 7.1% over the past month, according to market data. The decline, roughly 35% below its all-time high above $126,000 set in October, reflects weaker risk appetite and reduced speculative activi…

Read The Full Article Gold vs. Silver vs. Bitcoin: Which Asset Will Lead by the End of Q1? On Coin Edition.

Gold vs. Silver vs. Bitcoin: Which Asset Will Lead by the End of Q1?

Share:

Bitcoin is trading at $82,078, down 6.9% daily and 7.1% monthly, reflecting a 35% drop from its October all-time high. Divergent price movements of gold, silver, and Bitcoin highlight shifting investor sentiment and risk appetite amid changing macroeconomic conditions.

- Gold and silver rallied to record levels in early 2026 before significant pullbacks.

- Bitcoin trades near $82,000 after daily and monthly declines.

- Leadership by quarter-end depends on macro signals, risk appetite, and rotation trends.

Gold, silver, and Bitcoin are posting divergent price moves in Q1 2026 amid shifting macroeconomic conditions. Recent gains in precious metals and Bitcoin’s weakness highlight changing investor positioning. Policy signals, liquidity trends, and market flows are expected to determine asset leadership by quarter-end.

Bitcoin Slips Amid Risk-Off Sentiment

Source: TradingView

Bitcoin is trading at $82,078, down 6.9% over the past day and 7.1% over the past month, according to market data. The decline, roughly 35% below its all-time high above $126,000 set in October, reflects weaker risk appetite and reduced speculative activi…

Read The Full Article Gold vs. Silver vs. Bitcoin: Which Asset Will Lead by the End of Q1? On Coin Edition.