Breaking: Michael Saylor’s MicroStrategy Buys 130 BTC for $11.7M, MSTR Stock Falls

Share:

Key Insights:

- Michael Saylor’s MicroStrategy, now Strategy, added 130 BTC for $11.7 million, expanding its total Bitcoin holdings to 650,000 BTC.

- The Bitcoin treasury firm announces the establishment of $1.44 billion USD reserve for dividends.

- MSTR stock dropped more than 4% as Bitcoin price tumbled below $85K again.

Michael Saylor’s Strategy has purchased an additional 130 BTC for $11.7 million. The largest corporate Bitcoin treasury has boosted its total Bitcoin holdings to 650,000 BTC following its latest purchase.

MicroStrategy (MSTR) stock price dropped more than 4% on Monday as the firm established a USD Reserve of $1.44 billion to support dividend payments.

Michael Saylor’s MicroStrategy Expands Bitcoin Treasury to 650,000 BTC

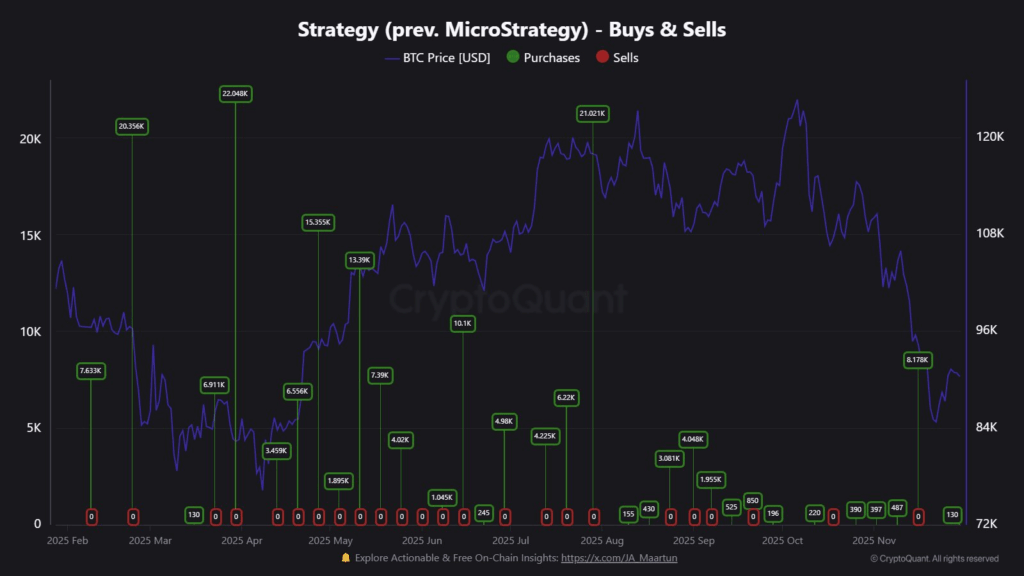

According to a press release on December 1, Strategy (formerly MicroStrategy) purchased 130 BTC at an average price of $89,960 per coin between November 17 and 30.

The largest corporate Bitcoin treasury purchased these BTC using proceeds from MSTR shares sold at-the-market (ATM) offerings.

Executive chairman Michael Saylor took to X to reach out to its shareholders and the broader crypto community about the latest Bitcoin purchase and BTC YTD yield of 27.8%.

With the latest purchase, MicroStrategy has increased its total Bitcoin holdings to 650,000 BTC. These BTCs were acquired for a total of $48.38 billion at an average of $74,436 per coin.

The company’s holdings are valued at $55.92 billion as compared with its total investment of $48.38 billion. Strategy’s unrealized gains have reduced to nearly $7.54 billion from a high of $20 billion.

Michael Saylor’s Strategy last acquired 8178 BTC for $835.55 million at an average of $102,171 per coin. The firm remains committed to BTC accumulation despite a massive drop in Bitcoin price and MSTR shares.

MicroStrategy (MSTR) Stock Tanks Amid $1.44 billion USD Reserve

At the time of writing, MSTR stock fell more than 4.62% to $169 during the pre-market trading hours on Monday. This signals negative sentiment among investors as Bitcoin price tumbled below $85K.

MicroStrategy (MSTR) stock closed 0.88% higher at $177.18 on Friday as Michael Saylor cooled concerns after talks on risks of delisting from MSCI and Nasdaq 100. However, trading volumes rose sharply above the 13 million average volumes.

Strategy stock performance continued to decline amid a broader selling pressure as the crypto market transitions into a bear market. As per Google Finance, the YTD 2025 stock return has dropped to a 40% loss.

The firm sold MSTR class A common stock to establish a USD Reserve of $1.44 billion. It will support dividend payments on its preferred stock and interest on its outstanding indebtedness for 12 months.

“Establishing a USD Reserve to complement our BTC Reserve marks the next step in our evolution, and we believe it will better position us to navigate short-term market volatility while delivering on our vision of being the world’s leading issuer of Digital Credit.”

MicroStrategy also expects to sell its BTC holdings when mNAV drops below 1. At the time of writing, mNAV stands at 1.20.

Bitcoin Price Tumbled Below $85K

BTC price fell below $85K today, dropping more than 6% over the past 24 hours ahead of key US macroeconomic events this week. It is one of the prime reasons why MicroStrategy (MSTR) stock could be witnessing a slump today.

At the time of writing, the price was trading at $85,784, with a 24-hour low and high of $85,653 and $91,965, respectively.

Furthermore, the trading volume has increased by 73% in the last 24 hours, indicating interest among traders. Investors now await further cues from ISM Manufacturing PMI data and Jerome Powell’s speech due later today.

Meanwhile, CoinGlass data showed selling in the derivatives market. At the time of writing, the total BTC futures open interest fell 0.10% in the past hour.

Total futures open interest tumbled 2.30% to $58.19 billion in the last 24 hours. It signals bearish sentiment among derivatives traders.

The post Breaking: Michael Saylor’s MicroStrategy Buys 130 BTC for $11.7M, MSTR Stock Falls appeared first on The Coin Republic.

Breaking: Michael Saylor’s MicroStrategy Buys 130 BTC for $11.7M, MSTR Stock Falls

Share:

Key Insights:

- Michael Saylor’s MicroStrategy, now Strategy, added 130 BTC for $11.7 million, expanding its total Bitcoin holdings to 650,000 BTC.

- The Bitcoin treasury firm announces the establishment of $1.44 billion USD reserve for dividends.

- MSTR stock dropped more than 4% as Bitcoin price tumbled below $85K again.

Michael Saylor’s Strategy has purchased an additional 130 BTC for $11.7 million. The largest corporate Bitcoin treasury has boosted its total Bitcoin holdings to 650,000 BTC following its latest purchase.

MicroStrategy (MSTR) stock price dropped more than 4% on Monday as the firm established a USD Reserve of $1.44 billion to support dividend payments.

Michael Saylor’s MicroStrategy Expands Bitcoin Treasury to 650,000 BTC

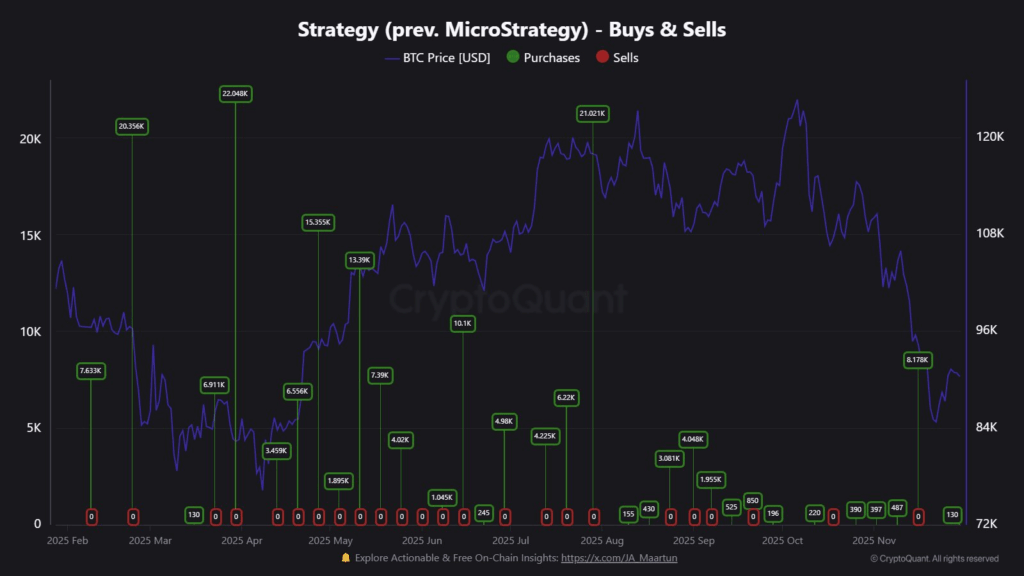

According to a press release on December 1, Strategy (formerly MicroStrategy) purchased 130 BTC at an average price of $89,960 per coin between November 17 and 30.

The largest corporate Bitcoin treasury purchased these BTC using proceeds from MSTR shares sold at-the-market (ATM) offerings.

Executive chairman Michael Saylor took to X to reach out to its shareholders and the broader crypto community about the latest Bitcoin purchase and BTC YTD yield of 27.8%.

With the latest purchase, MicroStrategy has increased its total Bitcoin holdings to 650,000 BTC. These BTCs were acquired for a total of $48.38 billion at an average of $74,436 per coin.

The company’s holdings are valued at $55.92 billion as compared with its total investment of $48.38 billion. Strategy’s unrealized gains have reduced to nearly $7.54 billion from a high of $20 billion.

Michael Saylor’s Strategy last acquired 8178 BTC for $835.55 million at an average of $102,171 per coin. The firm remains committed to BTC accumulation despite a massive drop in Bitcoin price and MSTR shares.

MicroStrategy (MSTR) Stock Tanks Amid $1.44 billion USD Reserve

At the time of writing, MSTR stock fell more than 4.62% to $169 during the pre-market trading hours on Monday. This signals negative sentiment among investors as Bitcoin price tumbled below $85K.

MicroStrategy (MSTR) stock closed 0.88% higher at $177.18 on Friday as Michael Saylor cooled concerns after talks on risks of delisting from MSCI and Nasdaq 100. However, trading volumes rose sharply above the 13 million average volumes.

Strategy stock performance continued to decline amid a broader selling pressure as the crypto market transitions into a bear market. As per Google Finance, the YTD 2025 stock return has dropped to a 40% loss.

The firm sold MSTR class A common stock to establish a USD Reserve of $1.44 billion. It will support dividend payments on its preferred stock and interest on its outstanding indebtedness for 12 months.

“Establishing a USD Reserve to complement our BTC Reserve marks the next step in our evolution, and we believe it will better position us to navigate short-term market volatility while delivering on our vision of being the world’s leading issuer of Digital Credit.”

MicroStrategy also expects to sell its BTC holdings when mNAV drops below 1. At the time of writing, mNAV stands at 1.20.

Bitcoin Price Tumbled Below $85K

BTC price fell below $85K today, dropping more than 6% over the past 24 hours ahead of key US macroeconomic events this week. It is one of the prime reasons why MicroStrategy (MSTR) stock could be witnessing a slump today.

At the time of writing, the price was trading at $85,784, with a 24-hour low and high of $85,653 and $91,965, respectively.

Furthermore, the trading volume has increased by 73% in the last 24 hours, indicating interest among traders. Investors now await further cues from ISM Manufacturing PMI data and Jerome Powell’s speech due later today.

Meanwhile, CoinGlass data showed selling in the derivatives market. At the time of writing, the total BTC futures open interest fell 0.10% in the past hour.

Total futures open interest tumbled 2.30% to $58.19 billion in the last 24 hours. It signals bearish sentiment among derivatives traders.

The post Breaking: Michael Saylor’s MicroStrategy Buys 130 BTC for $11.7M, MSTR Stock Falls appeared first on The Coin Republic.