Bitwise Files With SEC to Launch First Uniswap ETF in U.S. Markets

Share:

- Bitwise filed with the SEC for the first ETF focused on Uniswap.

- The ETF would provide regulated exposure to the UNI token without staking.

- It illustrates that there is growing institutional interest in DeFi investment products.

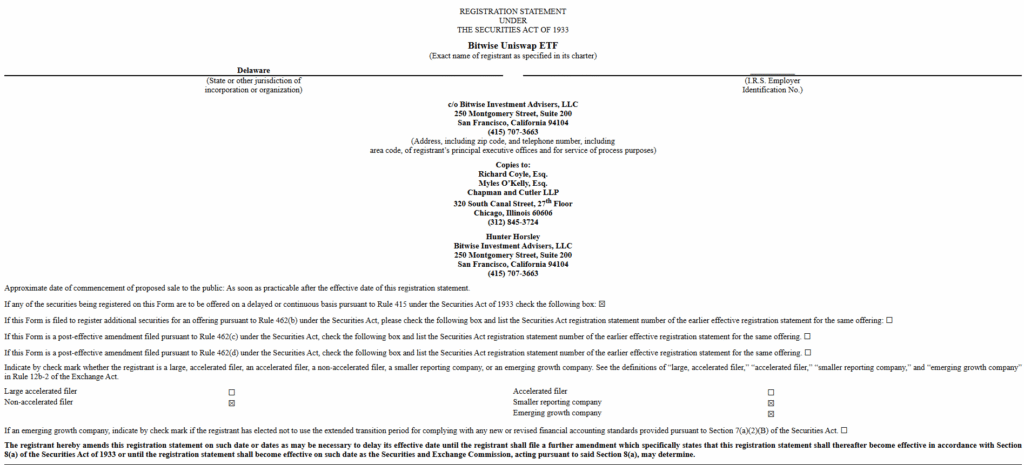

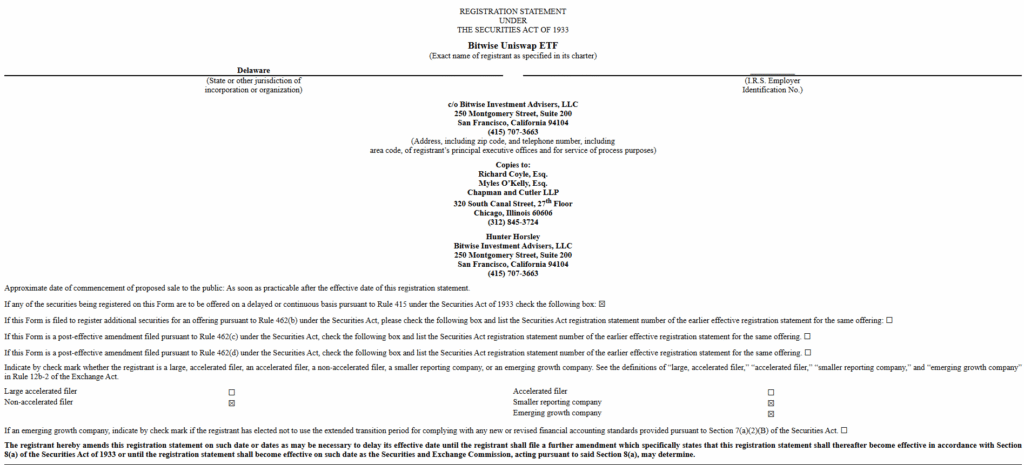

Bitwise Asset Management has filed a registration statement with the U.S. Securities and Exchange Commission to launch an exchange-traded fund focused on Uniswap. The offering would give investors regulated exposure to the governing UNI token via a traditional investment vehicle. If approved, it will become the first ETF to focus on a DeFi protocol token in the United States.

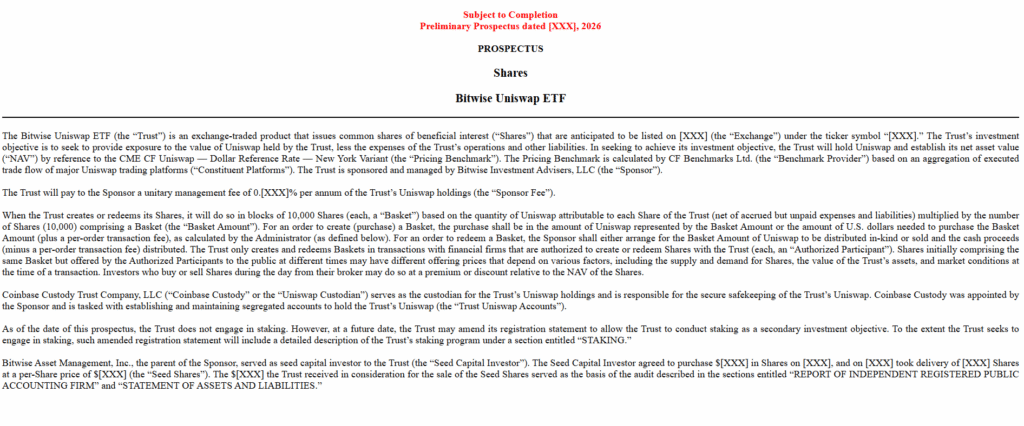

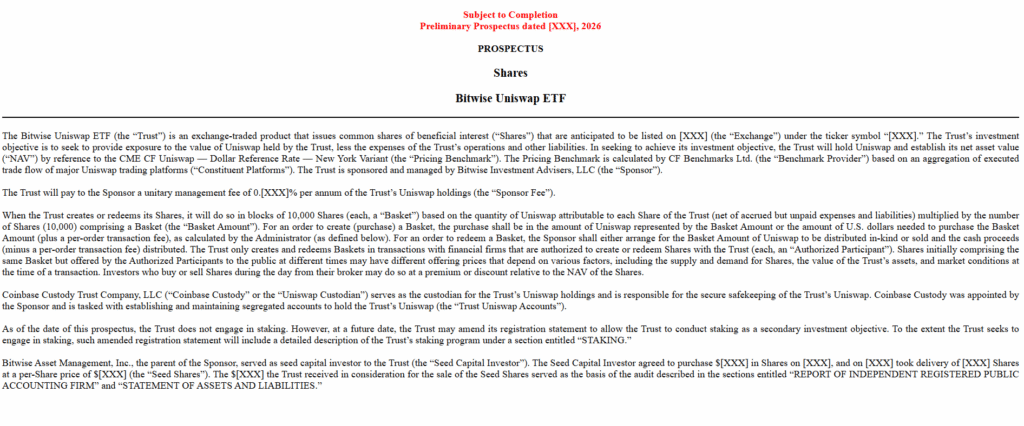

The Bitwise Uniswap ETF would have the UNI token as its main asset for tracking investor exposure. “The Trust’s investment objective is to provide exposure to the value of UNI, less the Trust’s expenses”. If approved, Coinbase Custody Trust Company will serve as the ETF custodian. Meanwhile, Bitwise has confirmed there will be no staking of UNI tokens associated with the proposed ETF at the time of its inception.

On Thursday, the SEC officially made the filing, bringing the product a step closer to the general financial markets. Indeed, access to DeFi coins via traditional applications has been a major focus for the firm, as stated, as an emerging trend with institutional investment demand. Brokerage accounts could potentially facilitate the ETF, opening more avenues for the UNI asset class. This filing will be part of a trend in crypto ETF filings in the U.S., which started in 2021 with the change in regulations.

Regulatory and Market Context

This comes when the SEC concluded its investigation into the case involving Uniswap Labs last year, which eased regulation issues facing the decentralized finance protocols. Delaware statutory trust filings were the foundation before submitting to the SEC for its approval. Trust filings are technical processes before an actual filing is made to the SEC.

An actual filing of the S-1 form signifies their readiness to start the regulatory process for their Uniswap ETF product. Analysts have revealed that it remains to be seen when the ETF will complete the review and approval process when it is sent to the SEC for processing. The ETF’s standard to trade on the US stock exchange will be determined by the SEC.

Bitwise filing for a Uniswap ETF with the SEC marks a new milestone for bringing a DeFi governance token into a regulated investment product. The new fund would be designed to give investors traditional exposure to UNI without token staking, pending regulatory approval. This action underscores ongoing institutional appetite for regulated crypto-investment vehicles linked to decentralized finance protocols.

Highlighted Crypto News:

Public Retirement Funds Hit by Sharp Decline Amid Bitcoin Slump

Read More

Bitwise Files With SEC to Launch First Uniswap ETF in U.S. Markets

Share:

- Bitwise filed with the SEC for the first ETF focused on Uniswap.

- The ETF would provide regulated exposure to the UNI token without staking.

- It illustrates that there is growing institutional interest in DeFi investment products.

Bitwise Asset Management has filed a registration statement with the U.S. Securities and Exchange Commission to launch an exchange-traded fund focused on Uniswap. The offering would give investors regulated exposure to the governing UNI token via a traditional investment vehicle. If approved, it will become the first ETF to focus on a DeFi protocol token in the United States.

The Bitwise Uniswap ETF would have the UNI token as its main asset for tracking investor exposure. “The Trust’s investment objective is to provide exposure to the value of UNI, less the Trust’s expenses”. If approved, Coinbase Custody Trust Company will serve as the ETF custodian. Meanwhile, Bitwise has confirmed there will be no staking of UNI tokens associated with the proposed ETF at the time of its inception.

On Thursday, the SEC officially made the filing, bringing the product a step closer to the general financial markets. Indeed, access to DeFi coins via traditional applications has been a major focus for the firm, as stated, as an emerging trend with institutional investment demand. Brokerage accounts could potentially facilitate the ETF, opening more avenues for the UNI asset class. This filing will be part of a trend in crypto ETF filings in the U.S., which started in 2021 with the change in regulations.

Regulatory and Market Context

This comes when the SEC concluded its investigation into the case involving Uniswap Labs last year, which eased regulation issues facing the decentralized finance protocols. Delaware statutory trust filings were the foundation before submitting to the SEC for its approval. Trust filings are technical processes before an actual filing is made to the SEC.

An actual filing of the S-1 form signifies their readiness to start the regulatory process for their Uniswap ETF product. Analysts have revealed that it remains to be seen when the ETF will complete the review and approval process when it is sent to the SEC for processing. The ETF’s standard to trade on the US stock exchange will be determined by the SEC.

Bitwise filing for a Uniswap ETF with the SEC marks a new milestone for bringing a DeFi governance token into a regulated investment product. The new fund would be designed to give investors traditional exposure to UNI without token staking, pending regulatory approval. This action underscores ongoing institutional appetite for regulated crypto-investment vehicles linked to decentralized finance protocols.

Highlighted Crypto News:

Public Retirement Funds Hit by Sharp Decline Amid Bitcoin Slump

Read More