Trump-Backed American Bitcoin Secures Spot In Elite Corporate Crypto Circle

Share:

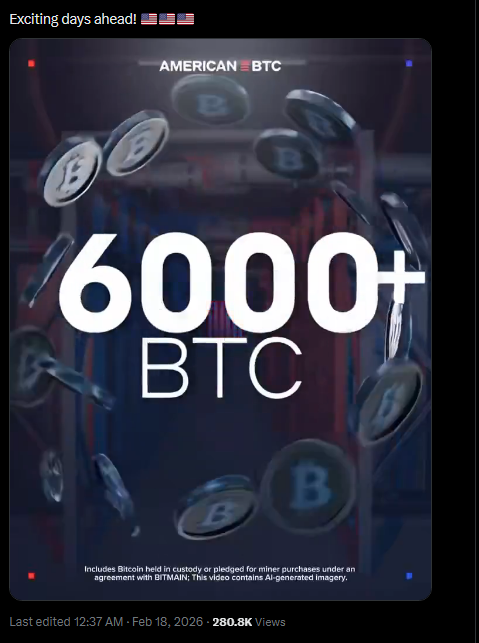

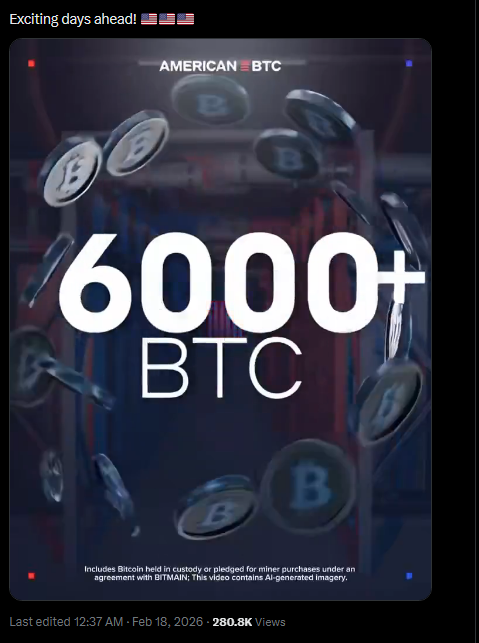

American Bitcoin Corp has accumulated 6,039 BTC in under six months, ranking it among the top 20 public Bitcoin treasuries globally. The firm added 217 BTC in January through mining and open market purchases. Despite its growing Bitcoin holdings, shares have dropped around 80% since its Nasdaq debut, highlighting investor concerns surrounding governance and execution risks.

According to BitcoinTreasuries.net, American Bitcoin Corp now holds 6,039 BTC, placing the firm among the top 20 public corporate Bitcoin treasuries in the world.

That number is big on its face. It also carries more questions than answers for anyone who follows both crypto and small-cap stocks.

Fast Accumulation Through Mining And Purchases

Reports note the company has been piling on coins by keeping what it mines and by buying on the open market. Blockchain trackers and industry write-ups say roughly 217 BTC were added over the course of January alone, a fast clip for a company that listed barely six months ago.

Today we reached an incredible milestone for American Bitcoin — Crossing 6,000 BTC in under 6 months since our Nasdaq debut!

Today is a testament to @ABTC execution which has build one of the fastest-growing Public Bitcoin reserves in the world, outpacing many established… pic.twitter.com/JNjYZfeajL

— Eric Trump (@EricTrump) February 17, 2026

Eric Trump Celebrates

Eric Trump broadcast the milestone on social media, framing it as proof the plan works and that the treasury build was rapid and deliberate.

The message landed with fans. The rest of the market has been less kind. Shares have tumbled hard since the Nasdaq debut, with multiple reports showing equity losses in the area of 80% from early highs.

A stock that drops this far while its balance sheet grows makes clear that ownership of Bitcoin alone has not calmed investor nerves.

How The Rank Compares To OthersJUST IN: Trump family-backed #Bitcoin miner American Bitcoin Corp $ABTC increased its holdings by 196 BTC and now holds a total of 6,039 BTC.

Bitcoin 100 Ranking: 17

pic.twitter.com/ydp2wbN1Xn

— BitcoinTreasuries.NET (@BTCtreasuries) February 17, 2026

The firm now sits ahead of household names on the list, including GameStop and Gemini Space Station Inc in raw BTC held.

That comparison grabs headlines. It also masks the difference between a company that treats Bitcoin as a treasury reserve versus firms that hold BTC as one of many assets.

The venture carries a clear political stamp, with ties to the family of US President Donald Trump. That connection brings attention and capital at times, and it draws scrutiny at others.

For investors who prefer to keep politics off their balance sheets, the association will affect sentiment just as surely as quarterly numbers do.

Reports say analysts have mixed views: some see a bet on Bitcoin’s next leg higher, others point to governance, execution risk, and thin market float.

A firm that refuses to sell mined coins essentially doubles down on the coin’s future price. That can be wildly profitable in a rally. It can be brutal in a drawdown.

The math is plain — holding inventory exposes the company to the same swings retail holders face, but with public shares amplifying the effects.

Featured image from Unsplash, chart from TradingView

Read More

Trump-Backed American Bitcoin Secures Spot In Elite Corporate Crypto Circle

Share:

American Bitcoin Corp has accumulated 6,039 BTC in under six months, ranking it among the top 20 public Bitcoin treasuries globally. The firm added 217 BTC in January through mining and open market purchases. Despite its growing Bitcoin holdings, shares have dropped around 80% since its Nasdaq debut, highlighting investor concerns surrounding governance and execution risks.

According to BitcoinTreasuries.net, American Bitcoin Corp now holds 6,039 BTC, placing the firm among the top 20 public corporate Bitcoin treasuries in the world.

That number is big on its face. It also carries more questions than answers for anyone who follows both crypto and small-cap stocks.

Fast Accumulation Through Mining And Purchases

Reports note the company has been piling on coins by keeping what it mines and by buying on the open market. Blockchain trackers and industry write-ups say roughly 217 BTC were added over the course of January alone, a fast clip for a company that listed barely six months ago.

Today we reached an incredible milestone for American Bitcoin — Crossing 6,000 BTC in under 6 months since our Nasdaq debut!

Today is a testament to @ABTC execution which has build one of the fastest-growing Public Bitcoin reserves in the world, outpacing many established… pic.twitter.com/JNjYZfeajL

— Eric Trump (@EricTrump) February 17, 2026

Eric Trump Celebrates

Eric Trump broadcast the milestone on social media, framing it as proof the plan works and that the treasury build was rapid and deliberate.

The message landed with fans. The rest of the market has been less kind. Shares have tumbled hard since the Nasdaq debut, with multiple reports showing equity losses in the area of 80% from early highs.

A stock that drops this far while its balance sheet grows makes clear that ownership of Bitcoin alone has not calmed investor nerves.

How The Rank Compares To OthersJUST IN: Trump family-backed #Bitcoin miner American Bitcoin Corp $ABTC increased its holdings by 196 BTC and now holds a total of 6,039 BTC.

Bitcoin 100 Ranking: 17

pic.twitter.com/ydp2wbN1Xn

— BitcoinTreasuries.NET (@BTCtreasuries) February 17, 2026

The firm now sits ahead of household names on the list, including GameStop and Gemini Space Station Inc in raw BTC held.

That comparison grabs headlines. It also masks the difference between a company that treats Bitcoin as a treasury reserve versus firms that hold BTC as one of many assets.

The venture carries a clear political stamp, with ties to the family of US President Donald Trump. That connection brings attention and capital at times, and it draws scrutiny at others.

For investors who prefer to keep politics off their balance sheets, the association will affect sentiment just as surely as quarterly numbers do.

Reports say analysts have mixed views: some see a bet on Bitcoin’s next leg higher, others point to governance, execution risk, and thin market float.

A firm that refuses to sell mined coins essentially doubles down on the coin’s future price. That can be wildly profitable in a rally. It can be brutal in a drawdown.

The math is plain — holding inventory exposes the company to the same swings retail holders face, but with public shares amplifying the effects.

Featured image from Unsplash, chart from TradingView

Read More