Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Share:

Arthur Hayes forecasts a major crypto rally due to a projected $572 billion liquidity injection from the Treasury. This is driven by a reduction in the Treasury General Account and debt buybacks, potentially boosting Bitcoin prices as historic trends show that greater liquidity typically propels risk assets. Hayes believes the worst phase for crypto is over, setting up a favorable environment for Bitcoin's price increase.

Arthur Hayes just switched gears. The BitMEX co founder is now calling for a major crypto rally, and he is tying it to a $572 billion liquidity wave coming from Washington.

The trigger? A Treasury shift involving the TGA and heavier buybacks. In simple terms, more cash flowing back into the system.

Hayes calls it monetary morphine. And in his view, that shot of liquidity means the worst of the downturn is already behind us.

- The Thesis: A synchronized drawdown of the Treasury General Account and debt buybacks will flood markets with cash.

- The Numbers: Hayes calculates roughly $572 billion in net liquidity hitting the financial system before year-end.

- The Timeline: This injection creates a high-probability environment for a Bitcoin surge starting now.

Why Is Hayes Calling This a Liquidity Event?

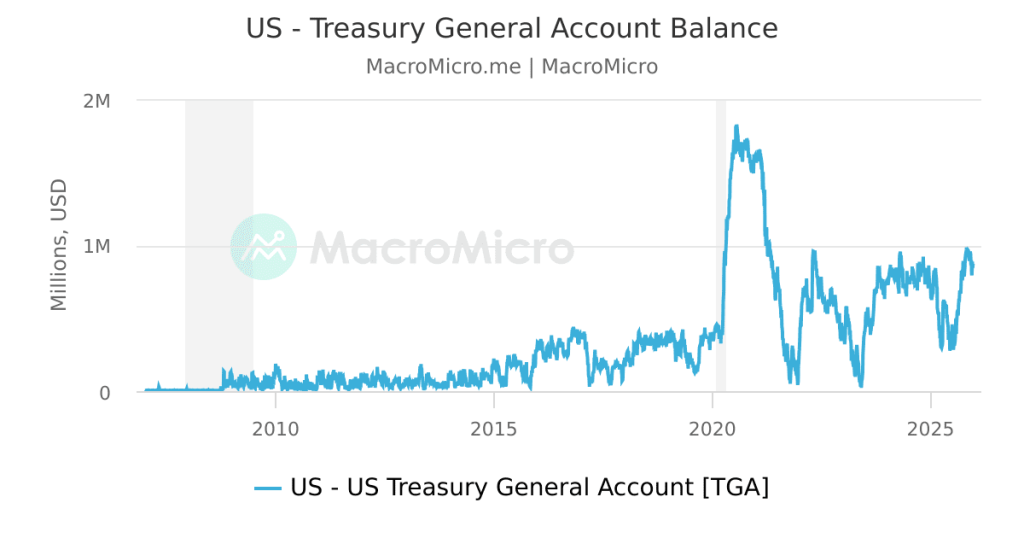

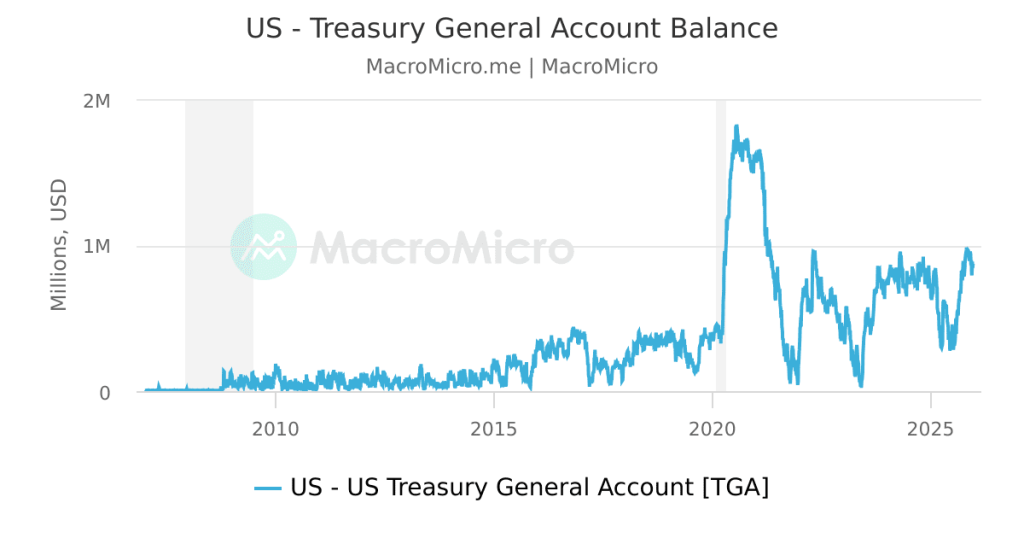

To get Hayes point, you have to look at how the Treasury actually works. The Treasury General Account is basically the government checking account at the Fed. When that balance is high, cash just sits there. When it gets spent down, that money flows into the banking system and boosts overall liquidity.

Hayes says this is stealth stimulus. While the Fed keeps talking tough about tightening, the Treasury is quietly pushing cash back into circulation to stabilize the debt market. That gap between messaging and action is where he sees opportunity.

In simple terms, liquidity is being injected even if it is not labeled as easing. And in markets driven by flows, that matters more than headlines. If the faucet is open, risk assets like Bitcoin tend to respond.

Breaking Down the Numbers: The $1 Trillion Question

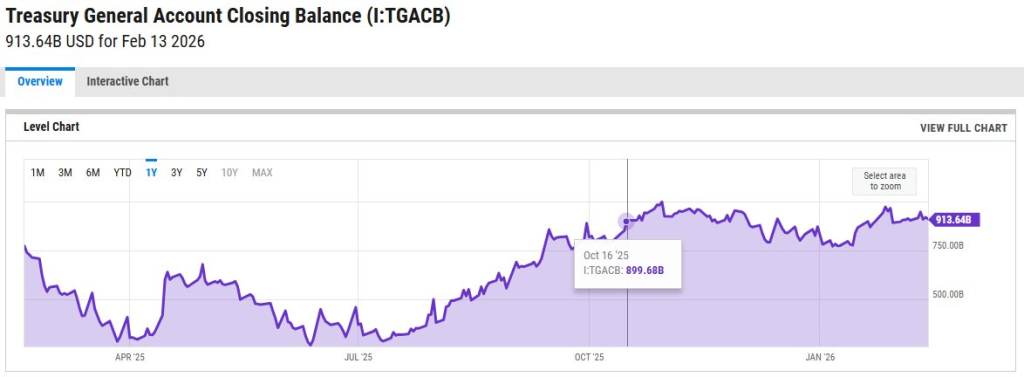

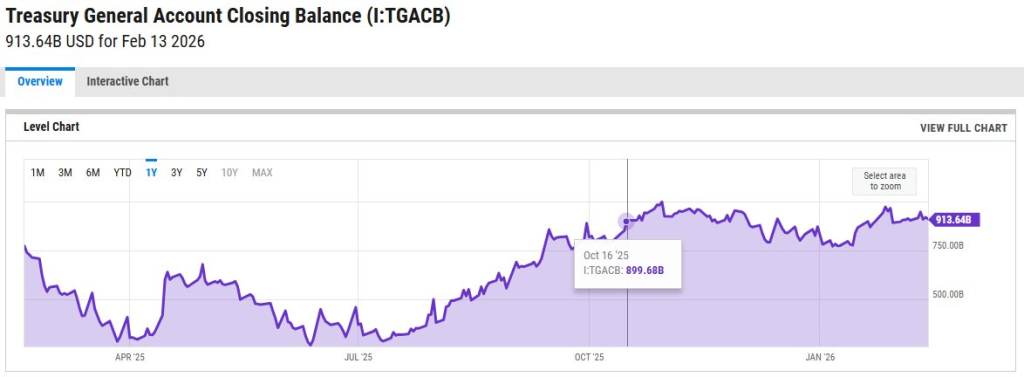

Hayes is not being subtle about the scale. The TGA balance is sitting near $750 billion, while Treasury guidance points to a target closer to $450 billion. That difference alone implies roughly $301 billion flowing back into the system as the balance gets drawn down.

Then add the buybacks. The Treasury has started repurchasing older bonds to support market functioning. Hayes estimates that program could inject another $271 billion per year at the current pace. Put together, that is about $572 billion in liquidity.

From his perspective, that kind of flow offsets much of the Federal Reserve quantitative tightening. It is not labeled as easing, but the effect can feel similar. And when liquidity rises, risk assets usually do not stay quiet for long.

What Does This Mean for Bitcoin Price?

Hayes is calling it plainly. In his view, the bad phase for crypto is behind us. Bitcoin has historically moved with global liquidity, and if dollars are expanding again, that shifts the balance in BTC favor.

More supply of USD often means stronger upside pressure on scarce assets.

The setup is already tilted bullish. Funding rates have been extreme, hinting at a crowded short trade. If fresh Treasury liquidity starts flowing while shorts are leaning the wrong way, that combination can turn into a fast squeeze. Hayes thinks that opens the door to a run back toward all time highs, even $100,000.

He is not alone in that stance. Big players are quietly stepping back in, adding exposure during dips. The message from Hayes is simple. When liquidity turns, markets move. And this time, he believes the move is up, not down.

Discover: Here are the crypto likely to explode!

The post Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally appeared first on Cryptonews.

Read More

Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Share:

Arthur Hayes forecasts a major crypto rally due to a projected $572 billion liquidity injection from the Treasury. This is driven by a reduction in the Treasury General Account and debt buybacks, potentially boosting Bitcoin prices as historic trends show that greater liquidity typically propels risk assets. Hayes believes the worst phase for crypto is over, setting up a favorable environment for Bitcoin's price increase.

Arthur Hayes just switched gears. The BitMEX co founder is now calling for a major crypto rally, and he is tying it to a $572 billion liquidity wave coming from Washington.

The trigger? A Treasury shift involving the TGA and heavier buybacks. In simple terms, more cash flowing back into the system.

Hayes calls it monetary morphine. And in his view, that shot of liquidity means the worst of the downturn is already behind us.

- The Thesis: A synchronized drawdown of the Treasury General Account and debt buybacks will flood markets with cash.

- The Numbers: Hayes calculates roughly $572 billion in net liquidity hitting the financial system before year-end.

- The Timeline: This injection creates a high-probability environment for a Bitcoin surge starting now.

Why Is Hayes Calling This a Liquidity Event?

To get Hayes point, you have to look at how the Treasury actually works. The Treasury General Account is basically the government checking account at the Fed. When that balance is high, cash just sits there. When it gets spent down, that money flows into the banking system and boosts overall liquidity.

Hayes says this is stealth stimulus. While the Fed keeps talking tough about tightening, the Treasury is quietly pushing cash back into circulation to stabilize the debt market. That gap between messaging and action is where he sees opportunity.

In simple terms, liquidity is being injected even if it is not labeled as easing. And in markets driven by flows, that matters more than headlines. If the faucet is open, risk assets like Bitcoin tend to respond.

Breaking Down the Numbers: The $1 Trillion Question

Hayes is not being subtle about the scale. The TGA balance is sitting near $750 billion, while Treasury guidance points to a target closer to $450 billion. That difference alone implies roughly $301 billion flowing back into the system as the balance gets drawn down.

Then add the buybacks. The Treasury has started repurchasing older bonds to support market functioning. Hayes estimates that program could inject another $271 billion per year at the current pace. Put together, that is about $572 billion in liquidity.

From his perspective, that kind of flow offsets much of the Federal Reserve quantitative tightening. It is not labeled as easing, but the effect can feel similar. And when liquidity rises, risk assets usually do not stay quiet for long.

What Does This Mean for Bitcoin Price?

Hayes is calling it plainly. In his view, the bad phase for crypto is behind us. Bitcoin has historically moved with global liquidity, and if dollars are expanding again, that shifts the balance in BTC favor.

More supply of USD often means stronger upside pressure on scarce assets.

The setup is already tilted bullish. Funding rates have been extreme, hinting at a crowded short trade. If fresh Treasury liquidity starts flowing while shorts are leaning the wrong way, that combination can turn into a fast squeeze. Hayes thinks that opens the door to a run back toward all time highs, even $100,000.

He is not alone in that stance. Big players are quietly stepping back in, adding exposure during dips. The message from Hayes is simple. When liquidity turns, markets move. And this time, he believes the move is up, not down.

Discover: Here are the crypto likely to explode!

The post Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally appeared first on Cryptonews.

Read More