Uniswap V4 Expected To Be Huge, But Is This Requirement A Dealbreaker?

Share:

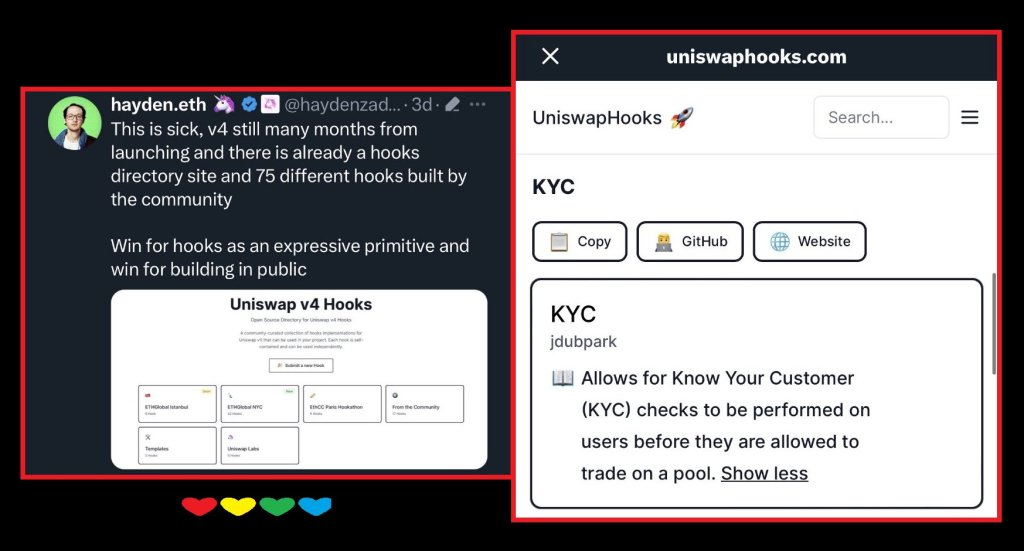

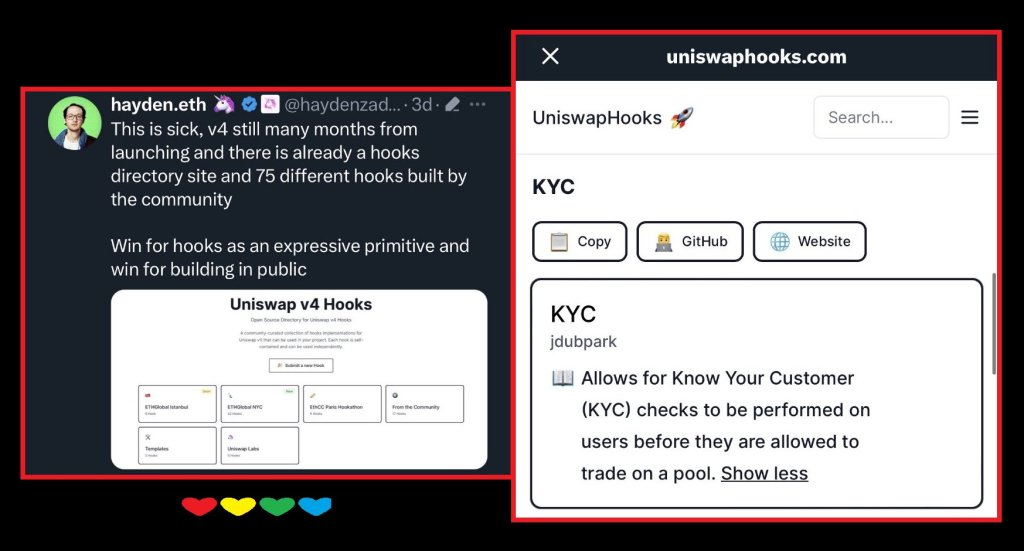

Due to its innovation, Uniswap Labs plans to introduce Hooks in the upcoming Uniswap v4, putting the world’s leading decentralized exchange in the spotlight. According to a critic on social media platform X, the DEX is on the know-your-customer (KYC)-verification route once Hooks on Uniswap v4 are released.

Uniswap v4 Hooks Is The Beginning Of Censorship?

Sharing screenshots, the user shared insights and said the exchange brings KYC verifications on the latest iteration. At the same time, the platform plans to use the “permission required” off-chain server on UniswapX for performance enhancements.

UniswapX is an open-source solution allowing permissionless and open trading across Automated Market Makers (AMMs) and other liquidity sources. It is currently being tested on the Ethereum mainnet.

Though the community has embraced these developments, the critic said these requirements, especially the identity verification requirement on Hooks, will be available as an option before being gradually made mandatory down the line.

Uniswap v4 is being developed, and Hooks will be one of the key updates. Hooks are programmable extensions for customizing pool and trade behavior, tightly integrated with Uniswap’s core protocol.

With Hooks, it becomes easier for developers to implement other features such as dynamic fees, on-chain limit orders, and overly improved customization. In this way, it will also be possible to integrate Uniswap v4 into other protocols.

Uniswap Evolution: Building “Real” DeFi?

The DEX has constantly evolved and released new features since the first version went live in late 2018. Uniswap v1 introduced AMM, opening up decentralized finance (DeFi). This allowed liquidity providers (LPs) to be crucial to market making.

In Uniswap v3, the exchange released concentrated liquidity (CL). This feature allows LPs to specify a price range within which they are willing to provide liquidity. In Uniswap v2, LPs provided liquidity across the entire price range of the token pair. In v3, liquidity depth increases while traders get better pricing.

Despite the criticism, Hooks has been supported in some quarters. For instance, the user acknowledged that the feature would amplify the value proposition of some protocols, making them real “DeFi” platforms. At the same time, while responding to the critic, another commentator said the feature will do more than what anybody else has done for “real DeFi.”

Uniswap V4 Expected To Be Huge, But Is This Requirement A Dealbreaker?

Share:

Due to its innovation, Uniswap Labs plans to introduce Hooks in the upcoming Uniswap v4, putting the world’s leading decentralized exchange in the spotlight. According to a critic on social media platform X, the DEX is on the know-your-customer (KYC)-verification route once Hooks on Uniswap v4 are released.

Uniswap v4 Hooks Is The Beginning Of Censorship?

Sharing screenshots, the user shared insights and said the exchange brings KYC verifications on the latest iteration. At the same time, the platform plans to use the “permission required” off-chain server on UniswapX for performance enhancements.

UniswapX is an open-source solution allowing permissionless and open trading across Automated Market Makers (AMMs) and other liquidity sources. It is currently being tested on the Ethereum mainnet.

Though the community has embraced these developments, the critic said these requirements, especially the identity verification requirement on Hooks, will be available as an option before being gradually made mandatory down the line.

Uniswap v4 is being developed, and Hooks will be one of the key updates. Hooks are programmable extensions for customizing pool and trade behavior, tightly integrated with Uniswap’s core protocol.

With Hooks, it becomes easier for developers to implement other features such as dynamic fees, on-chain limit orders, and overly improved customization. In this way, it will also be possible to integrate Uniswap v4 into other protocols.

Uniswap Evolution: Building “Real” DeFi?

The DEX has constantly evolved and released new features since the first version went live in late 2018. Uniswap v1 introduced AMM, opening up decentralized finance (DeFi). This allowed liquidity providers (LPs) to be crucial to market making.

In Uniswap v3, the exchange released concentrated liquidity (CL). This feature allows LPs to specify a price range within which they are willing to provide liquidity. In Uniswap v2, LPs provided liquidity across the entire price range of the token pair. In v3, liquidity depth increases while traders get better pricing.

Despite the criticism, Hooks has been supported in some quarters. For instance, the user acknowledged that the feature would amplify the value proposition of some protocols, making them real “DeFi” platforms. At the same time, while responding to the critic, another commentator said the feature will do more than what anybody else has done for “real DeFi.”