Saudi Arabia Could Cripple Russia With New Oil Policies & Help the US

Share:

Saudi Arabia’s new oil policies might hurt Russia’s war effort and help the US. These changes could affect global oil prices and markets.

Also Read: How High Will Shiba Inu Rise If Its Market Cap Hits $500 Billion?

Impact of Saudi Oil Policies on Russia’s War Effort and Global Market

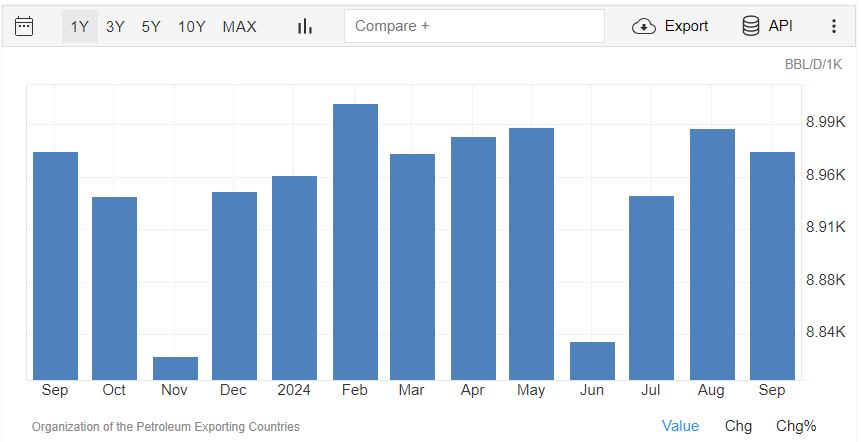

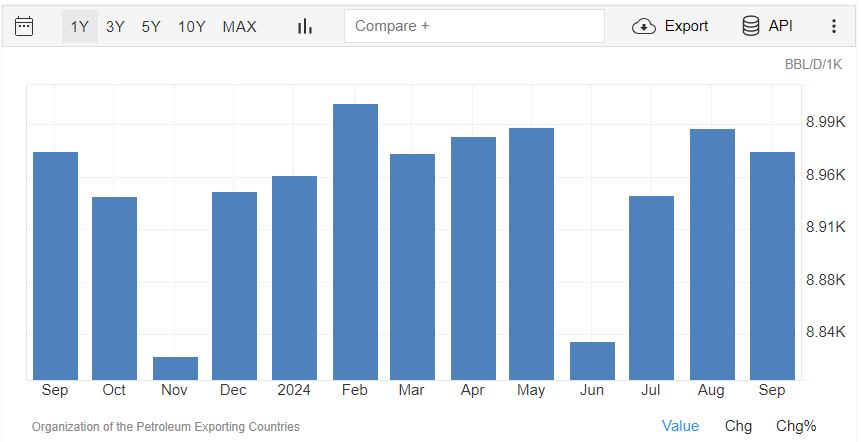

OPEC+, led by Saudi Arabia, plans to pump more oil from December. They’ll add 180,000 barrels daily and undo current cuts by 2025. This is happening even though OPEC expects lower oil demand growth.

Saudi Arabia seems to be changing its strategy. It may stop aiming for $100 per barrel to gain more market share. This could lower oil prices and hit Russia’s economy hard.

Russia’s economy depends heavily on oil prices. Oil and gas make up 30% of its budget. Luke Cooper from the London School of Economics says:

“With Russia already selling its oil at discounted rates and with higher production costs, a low-price environment in oil markets may impact its ability to finance its aggression in Ukraine.”

Cooper adds:

“Oil is therefore both a source of power that has funded its war of aggression and a potential vulnerability, due to its sensitivity to movements in the global market price.”

Also Read: Barclays Raise Microstrategy Stock Price Post BTC Rally: Target $225

If Saudi Arabia pushes for market share, oil prices could drop a lot. This would hurt Russia’s war funds and change global energy markets. The last time Saudi Arabia did this in 2020, oil prices fell sharply.

Russia is trying to rely less on oil money. Finance Minister Anton Siluanov says oil and gas in budget revenues will drop from 35-40% to 27% next year and 23% by 2027.

Stefan Hedlund from Uppsala University explains Russia’s current growth:

“Large amounts of money are being funneled to contracting Russian soldiers, many of whom will be killed in Ukraine, and to the production of military hardware, much of which will be destroyed on the battlefield.”

He also adds:

“Neither of these outputs can be justified in the long term.”

Also Read: Cardano Price Prediction: Will ADA Drop Below $0.25? Experts Weigh In

These Saudi oil policy changes could greatly affect global politics and economies. How they’ll impact Russia’s war and energy markets remains to be seen.

Saudi Arabia Could Cripple Russia With New Oil Policies & Help the US

Share:

Saudi Arabia’s new oil policies might hurt Russia’s war effort and help the US. These changes could affect global oil prices and markets.

Also Read: How High Will Shiba Inu Rise If Its Market Cap Hits $500 Billion?

Impact of Saudi Oil Policies on Russia’s War Effort and Global Market

OPEC+, led by Saudi Arabia, plans to pump more oil from December. They’ll add 180,000 barrels daily and undo current cuts by 2025. This is happening even though OPEC expects lower oil demand growth.

Saudi Arabia seems to be changing its strategy. It may stop aiming for $100 per barrel to gain more market share. This could lower oil prices and hit Russia’s economy hard.

Russia’s economy depends heavily on oil prices. Oil and gas make up 30% of its budget. Luke Cooper from the London School of Economics says:

“With Russia already selling its oil at discounted rates and with higher production costs, a low-price environment in oil markets may impact its ability to finance its aggression in Ukraine.”

Cooper adds:

“Oil is therefore both a source of power that has funded its war of aggression and a potential vulnerability, due to its sensitivity to movements in the global market price.”

Also Read: Barclays Raise Microstrategy Stock Price Post BTC Rally: Target $225

If Saudi Arabia pushes for market share, oil prices could drop a lot. This would hurt Russia’s war funds and change global energy markets. The last time Saudi Arabia did this in 2020, oil prices fell sharply.

Russia is trying to rely less on oil money. Finance Minister Anton Siluanov says oil and gas in budget revenues will drop from 35-40% to 27% next year and 23% by 2027.

Stefan Hedlund from Uppsala University explains Russia’s current growth:

“Large amounts of money are being funneled to contracting Russian soldiers, many of whom will be killed in Ukraine, and to the production of military hardware, much of which will be destroyed on the battlefield.”

He also adds:

“Neither of these outputs can be justified in the long term.”

Also Read: Cardano Price Prediction: Will ADA Drop Below $0.25? Experts Weigh In

These Saudi oil policy changes could greatly affect global politics and economies. How they’ll impact Russia’s war and energy markets remains to be seen.