ATOM Pops 4% on Heavy Buying, But Rally Stalls Late

- ATOM surged 4% to $4.55 after Coinbase added native dYdX support.

- Final-hour reversal broke $4.58 support, leaving $4.55 as key short-term support.

- $4.58–$4.60 zone now acts as resistance until buying momentum returns.

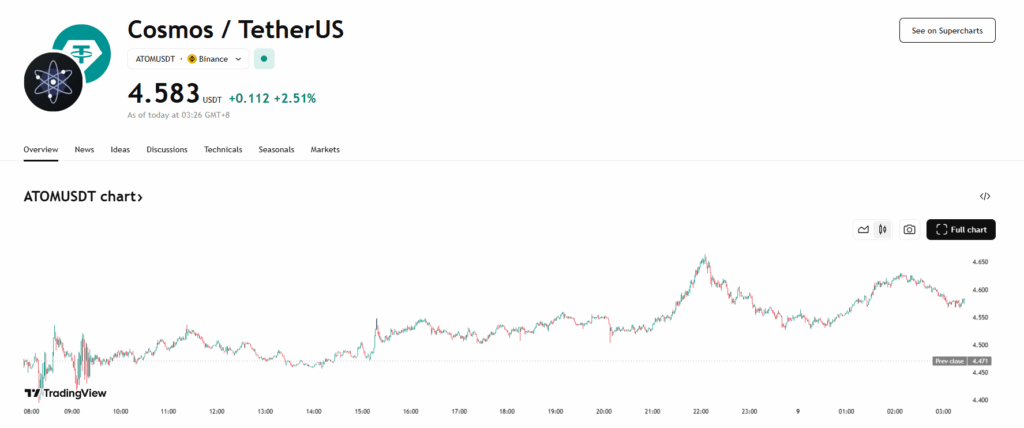

ATOM had a lively session on August 8, climbing from $4.36 to $4.55 for a clean 4% gain. The push came with exceptional volume—2.19 million units changing hands, far above its daily average—and was sparked by institutional interest in Cosmos ecosystem tokens. The buying wave followed Coinbase’s launch of native dYdX (COSMOSDYDX) support, a move analysts say tightens the link between centralized and decentralized trading while spotlighting the growing appeal of interoperable blockchain infrastructure.

Sharp Reversal in the Final Hour

The bullish run didn’t carry through to the close. Between 14:39 and 15:38 UTC, ATOM spiked to $4.60 before losing steam, sliding back to $4.56 in under an hour. The drop accelerated when $4.58 support gave way at 15:03, triggering a quick burst of selling—about 26,000 units dumped in just four minutes. By the closing bell, volume had dried up completely, leaving traders to reassess their positions and eyeing $4.55 as the key level to hold.

Resistance Forms, Momentum in Question

With the rally fizzling, the $4.58–$4.60 zone has now flipped into short-term resistance. Market watchers note that while institutional demand remains strong, this abrupt late-session pullback shows how fragile momentum can be in a market still adjusting to macro forces. The backdrop included Bitcoin testing the $116,000 resistance mark, with capital rotating into select large-cap altcoins and utility tokens. For ATOM, breaking back above $4.60 will likely be the test for whether buyers still have conviction.

Technical Picture

The day’s action carved a $0.34 trading range, with lows at $4.32 and highs at $4.67. The breakout above $4.55 happened at 13:00 UTC, with a surge to $4.65 confirming strength on massive volume. Support has been repeatedly tested and held at $4.46, but the failed breakout attempt above $4.60 now makes $4.55–$4.67 a critical battleground. Without renewed buying pressure, ATOM could remain stuck below resistance until momentum rebuilds.

The post ATOM Pops 4% on Heavy Buying, But Rally Stalls Late first appeared on BlockNews.

ATOM Pops 4% on Heavy Buying, But Rally Stalls Late

- ATOM surged 4% to $4.55 after Coinbase added native dYdX support.

- Final-hour reversal broke $4.58 support, leaving $4.55 as key short-term support.

- $4.58–$4.60 zone now acts as resistance until buying momentum returns.

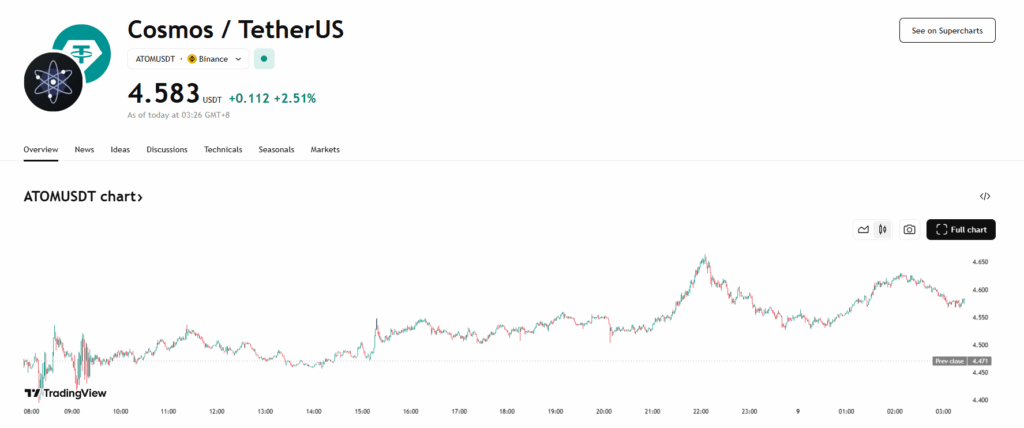

ATOM had a lively session on August 8, climbing from $4.36 to $4.55 for a clean 4% gain. The push came with exceptional volume—2.19 million units changing hands, far above its daily average—and was sparked by institutional interest in Cosmos ecosystem tokens. The buying wave followed Coinbase’s launch of native dYdX (COSMOSDYDX) support, a move analysts say tightens the link between centralized and decentralized trading while spotlighting the growing appeal of interoperable blockchain infrastructure.

Sharp Reversal in the Final Hour

The bullish run didn’t carry through to the close. Between 14:39 and 15:38 UTC, ATOM spiked to $4.60 before losing steam, sliding back to $4.56 in under an hour. The drop accelerated when $4.58 support gave way at 15:03, triggering a quick burst of selling—about 26,000 units dumped in just four minutes. By the closing bell, volume had dried up completely, leaving traders to reassess their positions and eyeing $4.55 as the key level to hold.

Resistance Forms, Momentum in Question

With the rally fizzling, the $4.58–$4.60 zone has now flipped into short-term resistance. Market watchers note that while institutional demand remains strong, this abrupt late-session pullback shows how fragile momentum can be in a market still adjusting to macro forces. The backdrop included Bitcoin testing the $116,000 resistance mark, with capital rotating into select large-cap altcoins and utility tokens. For ATOM, breaking back above $4.60 will likely be the test for whether buyers still have conviction.

Technical Picture

The day’s action carved a $0.34 trading range, with lows at $4.32 and highs at $4.67. The breakout above $4.55 happened at 13:00 UTC, with a surge to $4.65 confirming strength on massive volume. Support has been repeatedly tested and held at $4.46, but the failed breakout attempt above $4.60 now makes $4.55–$4.67 a critical battleground. Without renewed buying pressure, ATOM could remain stuck below resistance until momentum rebuilds.

The post ATOM Pops 4% on Heavy Buying, But Rally Stalls Late first appeared on BlockNews.

175 days of consolidation between $3.5 – $5.2

175 days of consolidation between $3.5 – $5.2 Now showing signs of bullish momentum building up!

Now showing signs of bullish momentum building up! Accumulation Zone: Below $4.5 = Ideal entry

Accumulation Zone: Below $4.5 = Ideal entry Break & Hold above $5 = Partial profit or HODL for…

Break & Hold above $5 = Partial profit or HODL for…  ⫷

⫷ ⫸ (✸,✸).ink

⫸ (✸,✸).ink  ,

,

(@Hkh17764820)

(@Hkh17764820)