Why Ethereum Supply Squeeze and Stablecoin Growth Signal a Bullish Q4

- Ethereum kicks off Q4 with record stablecoin supply and shrinking exchange balances

- $4.5k is the crucial level to confirm a higher low before a push toward $5k

- Supply squeeze and liquidity inflows are reinforcing Ethereum’s bullish setup

Ethereum has started Q4 with some serious momentum, and the reasons aren’t just technical hype. On-chain activity shows strong flows, stablecoin supply hitting records, and a tightening supply squeeze that’s boosting demand on the spot market. These factors are reinforcing bids around critical levels and keeping traders on edge. Even after a messy September dip, liquidity has returned fast, and Ethereum looks like it’s setting the stage for a bigger breakout.

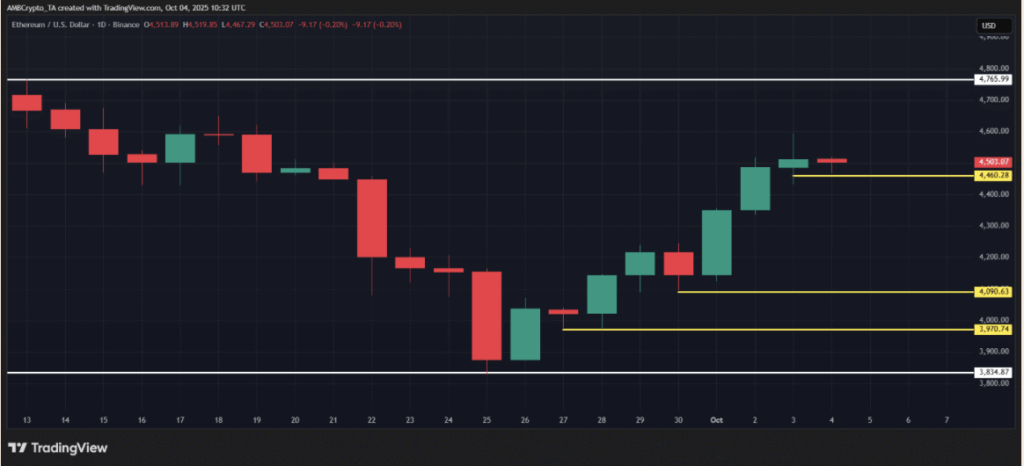

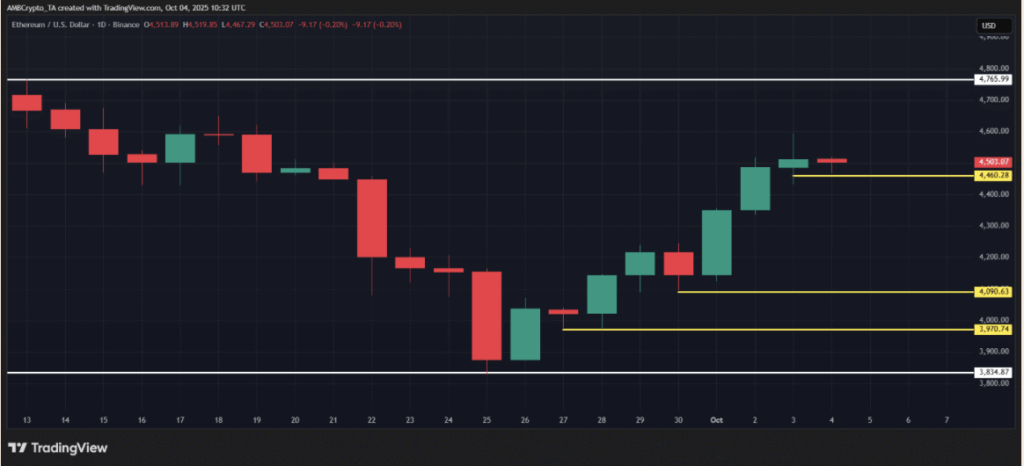

Key Price Level for Ethereum Traders to Watch

For traders eyeing the charts, $4.5k is the line in the sand. ETH has already printed two higher lows, each one followed by a push past resistance, and another similar move here could be enough to spark FOMO. A clean hold above $4.5k sets up the next leg higher toward $5k, but the ride won’t be smooth. Last cycle, Bitcoin outpaced ETH by nearly double, and with institutional capital flowing heavily into BTC ETFs again, ETH still faces headwinds from Bitcoin dominance.

Record Stablecoin Supply and Shrinking ETH Reserves

What makes this setup different is the strength of Ethereum’s on-chain data. Stablecoin supply on ETH has surged to a record $172 billion, up 44% year-to-date, with nearly $1 billion added in October alone. That surge pushed Total Value Locked back up to $167 billion, levels not seen since 2021. Exchange reserves tell a similar story—dropping to an eight-year low of 16 million ETH, with around 183k leaving exchanges in a week. Add to that 36 million ETH already staked, and it’s clear the liquid supply available to sell is shrinking fast.

Ethereum’s Supply Squeeze and Q4 Price Outlook

All of this points to a tightening supply-demand squeeze. While Bitcoin usually takes the spotlight in Q4, Ethereum’s 9% rally this past week isn’t a fluke. It’s fueled by fresh capital, strong on-chain flows, and holders positioning for the long run. If the $4.5k level holds as a third higher low, the setup favors a breakout toward $5k sooner rather than later. The combination of staked supply, ETF inflows, and record stablecoin liquidity makes Ethereum’s Q4 outlook structurally bullish—even if the path is choppy along the way.

The post Why Ethereum Supply Squeeze and Stablecoin Growth Signal a Bullish Q4 first appeared on BlockNews.

Why Ethereum Supply Squeeze and Stablecoin Growth Signal a Bullish Q4

- Ethereum kicks off Q4 with record stablecoin supply and shrinking exchange balances

- $4.5k is the crucial level to confirm a higher low before a push toward $5k

- Supply squeeze and liquidity inflows are reinforcing Ethereum’s bullish setup

Ethereum has started Q4 with some serious momentum, and the reasons aren’t just technical hype. On-chain activity shows strong flows, stablecoin supply hitting records, and a tightening supply squeeze that’s boosting demand on the spot market. These factors are reinforcing bids around critical levels and keeping traders on edge. Even after a messy September dip, liquidity has returned fast, and Ethereum looks like it’s setting the stage for a bigger breakout.

Key Price Level for Ethereum Traders to Watch

For traders eyeing the charts, $4.5k is the line in the sand. ETH has already printed two higher lows, each one followed by a push past resistance, and another similar move here could be enough to spark FOMO. A clean hold above $4.5k sets up the next leg higher toward $5k, but the ride won’t be smooth. Last cycle, Bitcoin outpaced ETH by nearly double, and with institutional capital flowing heavily into BTC ETFs again, ETH still faces headwinds from Bitcoin dominance.

Record Stablecoin Supply and Shrinking ETH Reserves

What makes this setup different is the strength of Ethereum’s on-chain data. Stablecoin supply on ETH has surged to a record $172 billion, up 44% year-to-date, with nearly $1 billion added in October alone. That surge pushed Total Value Locked back up to $167 billion, levels not seen since 2021. Exchange reserves tell a similar story—dropping to an eight-year low of 16 million ETH, with around 183k leaving exchanges in a week. Add to that 36 million ETH already staked, and it’s clear the liquid supply available to sell is shrinking fast.

Ethereum’s Supply Squeeze and Q4 Price Outlook

All of this points to a tightening supply-demand squeeze. While Bitcoin usually takes the spotlight in Q4, Ethereum’s 9% rally this past week isn’t a fluke. It’s fueled by fresh capital, strong on-chain flows, and holders positioning for the long run. If the $4.5k level holds as a third higher low, the setup favors a breakout toward $5k sooner rather than later. The combination of staked supply, ETF inflows, and record stablecoin liquidity makes Ethereum’s Q4 outlook structurally bullish—even if the path is choppy along the way.

The post Why Ethereum Supply Squeeze and Stablecoin Growth Signal a Bullish Q4 first appeared on BlockNews.