Ethereum Stablecoin Usage Jumps 400% in 30 Days as Whales Buy the Dip — $5K ETH Next?

Share:

Stablecoin usage on Ethereum has surged 400% in the last 30 days to reach a new all-time high of $580.9 billion with a transfer count of over 12.5 million, according to data from Token Terminal.

Ethereum’s stablecoin market cap now exceeds $163 billion.

On-chain data from Arkham Intelligence shows that most of the stablecoin transfer activity comes from whales buying the current ETH dip after the leading altcoin plunged 4.61% in the last 7 days to test the $3,738 support.

Particularly, a newly created wallet 0x86Ed spent $32.47M to acquire 8,491 ETH in the past 3 hours.

Similarly, recently liquidated whale Machi Big Brother deposited 284K USDC into Hyperliquid to keep longing ETH.

Why Institutions Are All-In on ETH o $5k

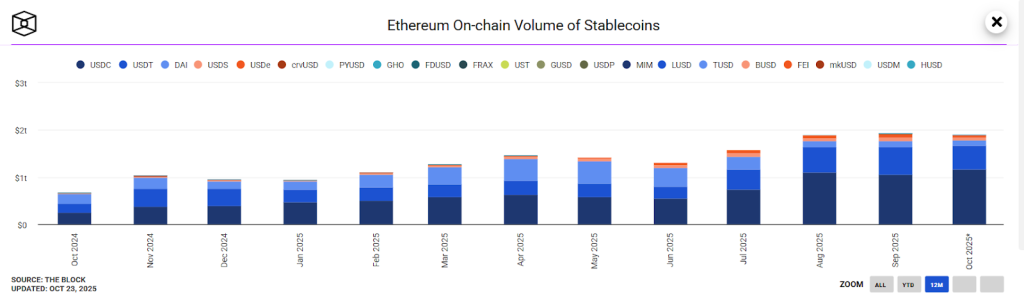

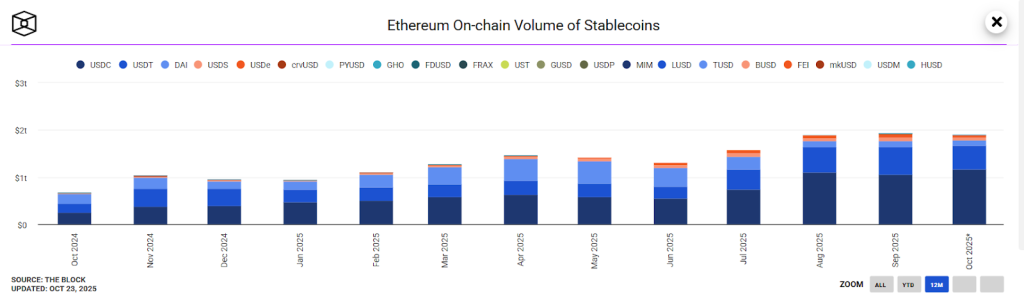

So far in October, on-chain data from TheBlock shows that total stablecoin transaction volume on Ethereum exceeded $1.91 trillion for the second time ever.

This increasing stablecoin usage and whale accumulation have led analysts to project that ETH might finally be heading to the highly coveted $5,000 mark, which it attempted to achieve back in August when it was rejected around $4,953.

Matt Sheffield, CIO at Ethereum treasury strategy company Sharplink Gaming, said that following the major leverage washouts the crypto market witnessed two weeks ago, it’s expected that the price would deviate materially from adoption.

But the reality is that Ethereum adoption, despite the market-wide panic, keeps happening at “breakneck speed”.

According to him, “if you zoom out, it’s clear how much room there is to go. SWIFT processes ~$150T in payments per year. That is 20x current USDT volumes on Ethereum, where the largest institutional transactions happen most.”

CME Futures Explode As Institutions Position for Major ETH Breakout

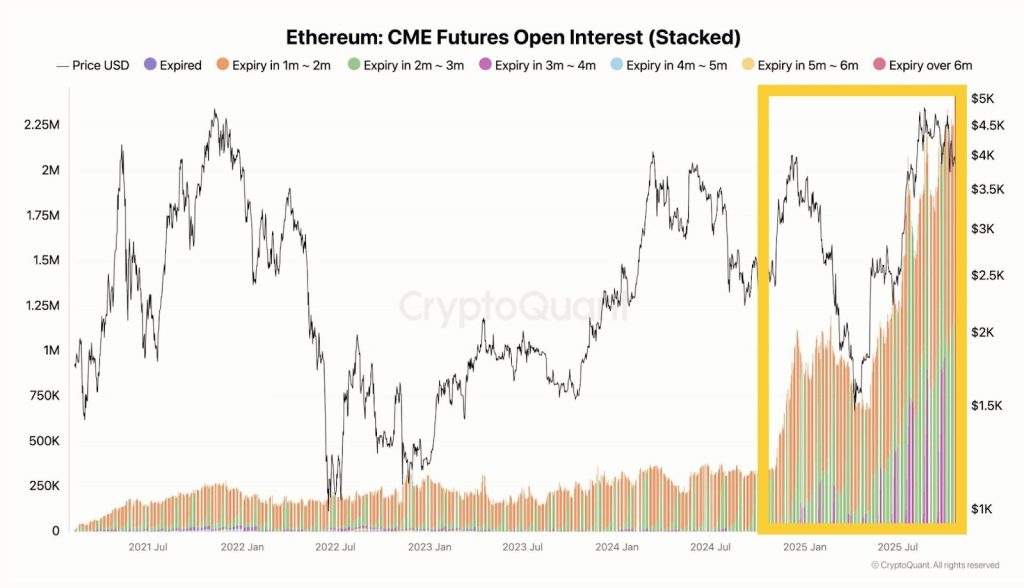

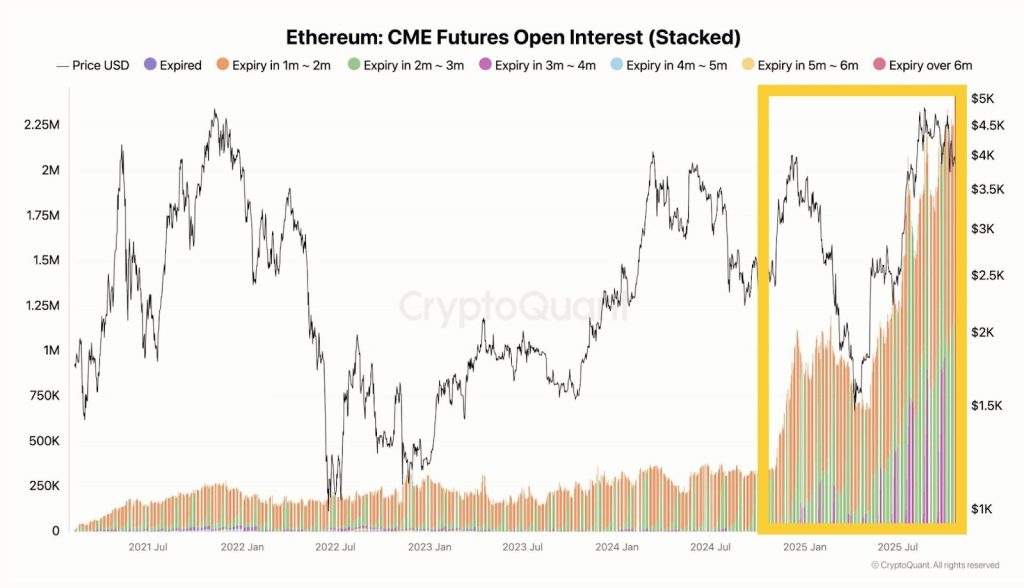

Data from CryptoQuant confirmed this, showing that Ethereum institutional interest is rising fast, seen in the surge in CME futures open interest, indicating that smart money is gearing up for a major ETH move ahead.

This aligns with what Fundstrat Capital CIO Tom Lee recently said, that Ethereum could rally toward $5,000 if the ETH/BTC pair breaks above the 0.087 resistance level.

According to Lee, a clean breakout above 0.087 would mark a structural shift for Ethereum, similar in scale to the macroeconomic transitions that reshaped Wall Street in the 20th century.

Crypto analysts have pointed out that ETH just confirmed a triple bottom at the $3,600 level, which is a bullish signal for a leg up toward $5,000.

Chart expert Ash Crypto also shared that Ethereum is forming a Wyckoff re-accumulation pattern, which is pointing to $8,000-$10,000 ETH before the end of the bull run.

Technical analysis: Elliott Wave, Fibonacci Charts Reveal ETH to $5,000 Path

On the technical front, the Ethereum (ETH/USD) chart illustrates an Elliott Wave structure suggesting the completion of wave (4) and a potential start of wave (5) toward higher levels.

The current price, around $3,887, sits just above the 0.618 Fibonacci retracement at $3,781, a key support area where a bullish reversal typically forms.

The 50-day moving average (red line) is acting as dynamic resistance, while the 200-day moving average (blue line) remains well below, confirming a broader uptrend structure.

If ETH holds above the 0.786 retracement level ($3,640) and avoids invalidation at $3,443, the chart projects a rally targeting $5,125 at the 1.618 Fibonacci extension, with potential to reach as high as $6,021 if wave (5) fully unfolds.

Momentum will remain bullish as long as ETH stays above the invalidation zone, and reclaiming the descending trendline could confirm the start of the next impulsive leg upward.

The post Ethereum Stablecoin Usage Jumps 400% in 30 Days as Whales Buy the Dip — $5K ETH Next? appeared first on Cryptonews.

Ethereum Stablecoin Usage Jumps 400% in 30 Days as Whales Buy the Dip — $5K ETH Next?

Share:

Stablecoin usage on Ethereum has surged 400% in the last 30 days to reach a new all-time high of $580.9 billion with a transfer count of over 12.5 million, according to data from Token Terminal.

Ethereum’s stablecoin market cap now exceeds $163 billion.

On-chain data from Arkham Intelligence shows that most of the stablecoin transfer activity comes from whales buying the current ETH dip after the leading altcoin plunged 4.61% in the last 7 days to test the $3,738 support.

Particularly, a newly created wallet 0x86Ed spent $32.47M to acquire 8,491 ETH in the past 3 hours.

Similarly, recently liquidated whale Machi Big Brother deposited 284K USDC into Hyperliquid to keep longing ETH.

Why Institutions Are All-In on ETH o $5k

So far in October, on-chain data from TheBlock shows that total stablecoin transaction volume on Ethereum exceeded $1.91 trillion for the second time ever.

This increasing stablecoin usage and whale accumulation have led analysts to project that ETH might finally be heading to the highly coveted $5,000 mark, which it attempted to achieve back in August when it was rejected around $4,953.

Matt Sheffield, CIO at Ethereum treasury strategy company Sharplink Gaming, said that following the major leverage washouts the crypto market witnessed two weeks ago, it’s expected that the price would deviate materially from adoption.

But the reality is that Ethereum adoption, despite the market-wide panic, keeps happening at “breakneck speed”.

According to him, “if you zoom out, it’s clear how much room there is to go. SWIFT processes ~$150T in payments per year. That is 20x current USDT volumes on Ethereum, where the largest institutional transactions happen most.”

CME Futures Explode As Institutions Position for Major ETH Breakout

Data from CryptoQuant confirmed this, showing that Ethereum institutional interest is rising fast, seen in the surge in CME futures open interest, indicating that smart money is gearing up for a major ETH move ahead.

This aligns with what Fundstrat Capital CIO Tom Lee recently said, that Ethereum could rally toward $5,000 if the ETH/BTC pair breaks above the 0.087 resistance level.

According to Lee, a clean breakout above 0.087 would mark a structural shift for Ethereum, similar in scale to the macroeconomic transitions that reshaped Wall Street in the 20th century.

Crypto analysts have pointed out that ETH just confirmed a triple bottom at the $3,600 level, which is a bullish signal for a leg up toward $5,000.

Chart expert Ash Crypto also shared that Ethereum is forming a Wyckoff re-accumulation pattern, which is pointing to $8,000-$10,000 ETH before the end of the bull run.

Technical analysis: Elliott Wave, Fibonacci Charts Reveal ETH to $5,000 Path

On the technical front, the Ethereum (ETH/USD) chart illustrates an Elliott Wave structure suggesting the completion of wave (4) and a potential start of wave (5) toward higher levels.

The current price, around $3,887, sits just above the 0.618 Fibonacci retracement at $3,781, a key support area where a bullish reversal typically forms.

The 50-day moving average (red line) is acting as dynamic resistance, while the 200-day moving average (blue line) remains well below, confirming a broader uptrend structure.

If ETH holds above the 0.786 retracement level ($3,640) and avoids invalidation at $3,443, the chart projects a rally targeting $5,125 at the 1.618 Fibonacci extension, with potential to reach as high as $6,021 if wave (5) fully unfolds.

Momentum will remain bullish as long as ETH stays above the invalidation zone, and reclaiming the descending trendline could confirm the start of the next impulsive leg upward.

The post Ethereum Stablecoin Usage Jumps 400% in 30 Days as Whales Buy the Dip — $5K ETH Next? appeared first on Cryptonews.