Crypto-Linked Violations Rack Up $2.8B in SEC Fines in 2023

Share:

A Cornerstone Research report published Wednesday showed that crypto fines against digital asset market participants hit $2.89b by the end of 2023.

That’s an 11% jump from the $2.6b in fines imposed through 2022.

The findings show that as the crypto market grows, so does the SEC’s role in protecting investors.

Lawmakers globally, and especially in the US, have sought to balance industry regulation with innovation.

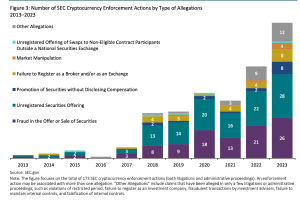

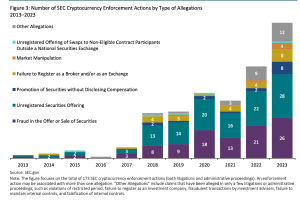

The report further showed that the SEC initiated a total of 46 crypto-related enforcement actions, a 53% jump compared to 2022.

Fraud and unregistered securities offerings were the most frequent allegations.

Additionally, actions alleging unauthorized securities promotion, market manipulation, and failure to register as broker-dealers increased.

Both Coinbase and Binance, two major players in the industry, faced enforcement actions around the same time in June.

The report also highlighted external agencies and organizations that assisted.

Federal agencies like the US Attorneys’ offices, the Federal Bureau of Investigation (FBI), the Commodity Futures Trading Commission, and the Internal Revenue Service frequently offered their support.

Crypto fines and enforcement actions hit new heights in last two years

Under SEC Chair Gary Gensler’s administration, international assistance has notably increased.

However, certain Republican lawmakers have criticized his approach, fearing his moves could push innovation abroad and harm American competitiveness.

“The number of SEC enforcement actions brought in the crypto space has ramped up over the last two years,” Simona Mola, a principal at Cornerstone Research, said in the report.

“We will be watching to see what 2024 brings, particularly in light of the SEC’s recent approval of the first Bitcoin ETFs.”

Despite the Chairman’s apparent deep skepticism about cryptocurrencies, the SEC recently approved 11 spot Bitcoin ETFs.

This marks a major win for the industry, and the approval is considered a game changer as it opens doors for many new investors.

SEC Chair Gensler made it clear that although specific spot Bitcoin ETFs received approval, the agency did not directly endorse Bitcoin itself.

Moreover, the agency emphasized its commitment to enforcing standards of conduct for transactions involving the approved funds.

Earlier, a Financial Times report revealed that a total of $5.8 billion in penalties were imposed on crypto firms by global authorities in 2023.

The post Crypto-Linked Violations Rack Up $2.8B in SEC Fines in 2023 appeared first on Cryptonews.

Read More

Crypto-Linked Violations Rack Up $2.8B in SEC Fines in 2023

Share:

A Cornerstone Research report published Wednesday showed that crypto fines against digital asset market participants hit $2.89b by the end of 2023.

That’s an 11% jump from the $2.6b in fines imposed through 2022.

The findings show that as the crypto market grows, so does the SEC’s role in protecting investors.

Lawmakers globally, and especially in the US, have sought to balance industry regulation with innovation.

The report further showed that the SEC initiated a total of 46 crypto-related enforcement actions, a 53% jump compared to 2022.

Fraud and unregistered securities offerings were the most frequent allegations.

Additionally, actions alleging unauthorized securities promotion, market manipulation, and failure to register as broker-dealers increased.

Both Coinbase and Binance, two major players in the industry, faced enforcement actions around the same time in June.

The report also highlighted external agencies and organizations that assisted.

Federal agencies like the US Attorneys’ offices, the Federal Bureau of Investigation (FBI), the Commodity Futures Trading Commission, and the Internal Revenue Service frequently offered their support.

Crypto fines and enforcement actions hit new heights in last two years

Under SEC Chair Gary Gensler’s administration, international assistance has notably increased.

However, certain Republican lawmakers have criticized his approach, fearing his moves could push innovation abroad and harm American competitiveness.

“The number of SEC enforcement actions brought in the crypto space has ramped up over the last two years,” Simona Mola, a principal at Cornerstone Research, said in the report.

“We will be watching to see what 2024 brings, particularly in light of the SEC’s recent approval of the first Bitcoin ETFs.”

Despite the Chairman’s apparent deep skepticism about cryptocurrencies, the SEC recently approved 11 spot Bitcoin ETFs.

This marks a major win for the industry, and the approval is considered a game changer as it opens doors for many new investors.

SEC Chair Gensler made it clear that although specific spot Bitcoin ETFs received approval, the agency did not directly endorse Bitcoin itself.

Moreover, the agency emphasized its commitment to enforcing standards of conduct for transactions involving the approved funds.

Earlier, a Financial Times report revealed that a total of $5.8 billion in penalties were imposed on crypto firms by global authorities in 2023.

The post Crypto-Linked Violations Rack Up $2.8B in SEC Fines in 2023 appeared first on Cryptonews.

Read More