We are excited to be the first DEX to offer Korean equity perps! These markets are live at 10X leverage: $HYUNDAI, $SAMSUNG, $SKHYNIX and the $KRCOMP (Korean Composite) index.

Korean stocks meet DeFi as Lighter lists Samsung, SK Hynix and Hyundai perps

Share:

Decentralized exchange Lighter has launched on-chain perpetual futures linked to major Korean companies like Samsung and Hyundai, marking a first in combining crypto derivatives with traditional equities. The contracts enable up to 10x leverage and are settled in crypto, providing traders global access without the need for brokers. This move broadens the decentralized trading landscape and aligns with rising demand in the semiconductor sector, particularly driven by AI and data center growth.

Decentralised exchange Lighter has moved beyond crypto tokens and into South Korea’s equity market.

On Feb. 11, the platform confirmed it has launched on-chain perpetual futures tied to Samsung Electronics, SK Hynix, Hyundai Motor, and a Korean Composite index.

The contracts allow up to 10x leverage and are settled in crypto, giving traders round-the-clock global access to some of Korea’s most influential companies and sectors.

The rollout makes Lighter the first decentralised exchange to introduce crypto-based derivatives linked to major Korean blue-chip stocks.

The move brings traditional equities into a structure typically reserved for digital assets and blockchain-native markets.

On-chain perps expand equity access

The new contracts function like crypto perpetual futures but reference listed Korean companies instead of tokens.

Traders can take long or short positions without using brokers, custody services, or observing traditional market hours.

Positions remain open as long as margin requirements are met. Settlement takes place in crypto rather than fiat currency, removing the need for local brokerage accounts or cross-border intermediaries.

Lighter said its zero-knowledge design is intended to reduce trading costs and improve execution efficiency.

Transactions are processed without revealing sensitive user data on-chain, while fees are kept low compared with many conventional platforms.

By applying the mechanics of Bitcoin and Ethereum perpetuals to listed equities, the exchange is widening the scope of decentralised trading infrastructure beyond purely digital assets.

Semiconductor momentum boosts demand

Interest in Korean stocks has strengthened in recent months, particularly in the semiconductor sector.

SK Hynix and Samsung have benefited from rising demand for memory chips linked to artificial intelligence development and data centre expansion.

SK Hynix’s lead in high-bandwidth memory has been a key factor in its recent performance.

Samsung, with its global semiconductor and electronics footprint, remains closely tied to supply chains that serve advanced computing and AI workloads.

Hyundai Motor has also gained support from global auto sales trends and export resilience. Together, these firms represent core pillars of South Korea’s export-driven economy.

Semiconductor-focused funds have delivered notable gains, with some leveraged products reporting returns between 70% and 80% in recent months.

The performance has reinforced demand for instruments that provide amplified exposure.

Leveraged products reshape the landscape

South Korean regulators have approved a new wave of 2x leveraged exchange-traded funds tied to leading domestic companies, including Samsung and Hyundai. The ETFs are scheduled to launch in 2026.

Officials have indicated that investor education programmes will be introduced ahead of the launch to explain the risks associated with leveraged products.

Lighter’s perpetual contracts offer higher leverage and continuous access compared with traditional ETFs.

At the same time, they operate outside South Korea’s regulated securities framework.

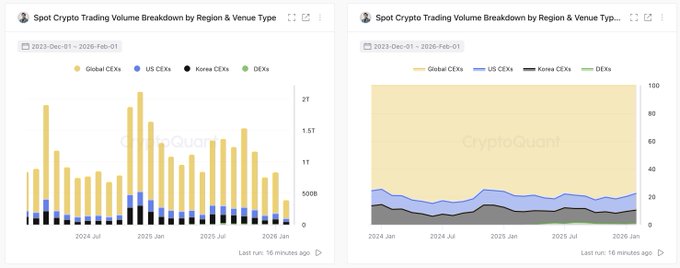

South Korea remains active in digital asset markets despite a broader slowdown in global trading volumes.

CryptoQuant founder Ki Young Ju recently stated that local exchanges account for about 9.54% of global spot trading volume.

Total crypto spot trading volume is declining, but Korean exchanges still hold 9.54% market share. cryptoquant.com/community/dash…

By combining equity exposure with crypto-native settlement, Lighter is positioning its platform at the intersection of decentralised finance and traditional stock markets.

The post Korean stocks meet DeFi as Lighter lists Samsung, SK Hynix and Hyundai perps appeared first on Invezz

Read More

Korean stocks meet DeFi as Lighter lists Samsung, SK Hynix and Hyundai perps

Share:

Decentralized exchange Lighter has launched on-chain perpetual futures linked to major Korean companies like Samsung and Hyundai, marking a first in combining crypto derivatives with traditional equities. The contracts enable up to 10x leverage and are settled in crypto, providing traders global access without the need for brokers. This move broadens the decentralized trading landscape and aligns with rising demand in the semiconductor sector, particularly driven by AI and data center growth.

Decentralised exchange Lighter has moved beyond crypto tokens and into South Korea’s equity market.

On Feb. 11, the platform confirmed it has launched on-chain perpetual futures tied to Samsung Electronics, SK Hynix, Hyundai Motor, and a Korean Composite index.

The contracts allow up to 10x leverage and are settled in crypto, giving traders round-the-clock global access to some of Korea’s most influential companies and sectors.

The rollout makes Lighter the first decentralised exchange to introduce crypto-based derivatives linked to major Korean blue-chip stocks.

The move brings traditional equities into a structure typically reserved for digital assets and blockchain-native markets.

On-chain perps expand equity access

The new contracts function like crypto perpetual futures but reference listed Korean companies instead of tokens.

Traders can take long or short positions without using brokers, custody services, or observing traditional market hours.

Positions remain open as long as margin requirements are met. Settlement takes place in crypto rather than fiat currency, removing the need for local brokerage accounts or cross-border intermediaries.

Lighter said its zero-knowledge design is intended to reduce trading costs and improve execution efficiency.

Transactions are processed without revealing sensitive user data on-chain, while fees are kept low compared with many conventional platforms.

By applying the mechanics of Bitcoin and Ethereum perpetuals to listed equities, the exchange is widening the scope of decentralised trading infrastructure beyond purely digital assets.

Semiconductor momentum boosts demand

Interest in Korean stocks has strengthened in recent months, particularly in the semiconductor sector.

SK Hynix and Samsung have benefited from rising demand for memory chips linked to artificial intelligence development and data centre expansion.

SK Hynix’s lead in high-bandwidth memory has been a key factor in its recent performance.

Samsung, with its global semiconductor and electronics footprint, remains closely tied to supply chains that serve advanced computing and AI workloads.

Hyundai Motor has also gained support from global auto sales trends and export resilience. Together, these firms represent core pillars of South Korea’s export-driven economy.

Semiconductor-focused funds have delivered notable gains, with some leveraged products reporting returns between 70% and 80% in recent months.

The performance has reinforced demand for instruments that provide amplified exposure.

Leveraged products reshape the landscape

South Korean regulators have approved a new wave of 2x leveraged exchange-traded funds tied to leading domestic companies, including Samsung and Hyundai. The ETFs are scheduled to launch in 2026.

Officials have indicated that investor education programmes will be introduced ahead of the launch to explain the risks associated with leveraged products.

Lighter’s perpetual contracts offer higher leverage and continuous access compared with traditional ETFs.

At the same time, they operate outside South Korea’s regulated securities framework.

South Korea remains active in digital asset markets despite a broader slowdown in global trading volumes.

CryptoQuant founder Ki Young Ju recently stated that local exchanges account for about 9.54% of global spot trading volume.

Total crypto spot trading volume is declining, but Korean exchanges still hold 9.54% market share. cryptoquant.com/community/dash…

By combining equity exposure with crypto-native settlement, Lighter is positioning its platform at the intersection of decentralised finance and traditional stock markets.

The post Korean stocks meet DeFi as Lighter lists Samsung, SK Hynix and Hyundai perps appeared first on Invezz

Read More