Bitcoin’s Digital Gold Thesis Faces Reality As Gold Surges Ahead

Share:

Gold has outperformed Bitcoin significantly, rising 55% over the past year while Bitcoin remains flat. Central banks are purchasing gold at historic rates, seeking stability amid geopolitical risks and inflation, which puts pressure on Bitcoin's role as a store of value. Analysts predict that gold will continue to outperform Bitcoin in the near future, reflecting a shift in investor sentiments towards safer assets.

Bitcoin was designed to function as digital gold, a decentralised store of value that protects wealth from inflation, currency debasement, and the long-term dominance of the dollar. Currently, the market behaviour is telling a different story as de-dollarisation accelerates and investors seek safety from geopolitical risk and inflation pressures, with gold capturing the bulk of that capital.

Is Bitcoin Still A Store Of Value Or A Risk Asset?

Crypto investor Himanshu Sinha has stated on X that Bitcoin was supposed to be digital gold because it was built for de-dollarisation, but gold and silver are winning the trade and fulfilling that role. Over the past year, gold has risen by roughly 55%, silver has surged around 150%, while BTC has remained flat.

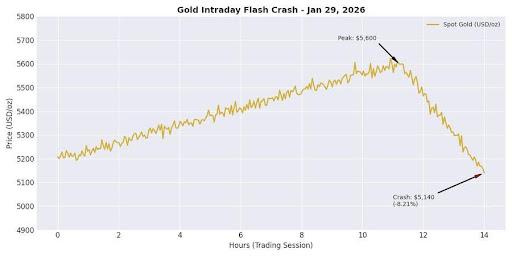

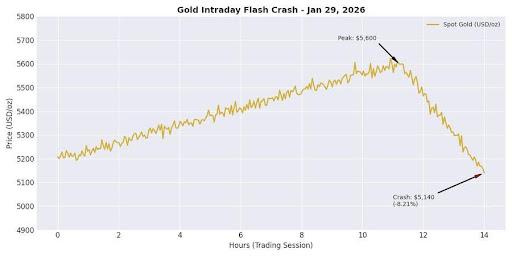

The Central banks are the drivers; they don’t want volatility that they can’t manage, and they don’t want an asset that moves in lockstep with the Nasdaq. Instead, they want a controllable monetary infrastructure, and they’re buying gold at the highest rate in history. Just hours ago, gold hit $5,600, then collapsed by 8.21% in a straight vertical drop to $5,140, which is a textbook margin liquidation.

At the same time, Microsoft dropped 11.7% as tech sold their gold because it was their only profitable asset, and the investors needed cash fast. This is the same liquidity contagion that used to be seen in the crypto market.

According to Sinha, gold cannot be sanctioned in a bar. As the West weaponizes the dollar through sanctions and financial controls, the rest of the world needs a neutral exit. In the end, BTC still proved it is a speculative tool, while gold is proving to be the replacement.

Why Gold Is Likely To Keep Outperforming Bitcoin

A crypto trader known as Doctor Profit pointed out that nearly a year ago, he shared a Gold versus Bitcoin chart, highlighting that once 0.02 BTC equals 1 ounce of gold, it should mark the top for BTC. Meanwhile, when 0.11 BTC equals 1 ounce of gold, it marks the bottom for BTC. This happened in 2021 during the BTC top and during the BTC bottom in 2022.

According to Doctor Profit, the analysis was later proven right this year by calling the BTC top at $125,000 at 0.02 for 1 ounce of gold. Calculating this move, if 1 BTC is $5,500 in gold price and divided by 0.11, it should be $50,000 BTC, which matches the analysis of BTC bottom for this cycle between $50,000 and $60,000 BTC.

However, the analysis played out as expected. If calculated with a gold price of $7,000, the equivalent of BTC bottom should be around $63,000, which also aligns with the bottom target. In the Doctor Profit view, gold might continue to outperform BTC in the coming months.

Bitcoin’s Digital Gold Thesis Faces Reality As Gold Surges Ahead

Share:

Gold has outperformed Bitcoin significantly, rising 55% over the past year while Bitcoin remains flat. Central banks are purchasing gold at historic rates, seeking stability amid geopolitical risks and inflation, which puts pressure on Bitcoin's role as a store of value. Analysts predict that gold will continue to outperform Bitcoin in the near future, reflecting a shift in investor sentiments towards safer assets.

Bitcoin was designed to function as digital gold, a decentralised store of value that protects wealth from inflation, currency debasement, and the long-term dominance of the dollar. Currently, the market behaviour is telling a different story as de-dollarisation accelerates and investors seek safety from geopolitical risk and inflation pressures, with gold capturing the bulk of that capital.

Is Bitcoin Still A Store Of Value Or A Risk Asset?

Crypto investor Himanshu Sinha has stated on X that Bitcoin was supposed to be digital gold because it was built for de-dollarisation, but gold and silver are winning the trade and fulfilling that role. Over the past year, gold has risen by roughly 55%, silver has surged around 150%, while BTC has remained flat.

The Central banks are the drivers; they don’t want volatility that they can’t manage, and they don’t want an asset that moves in lockstep with the Nasdaq. Instead, they want a controllable monetary infrastructure, and they’re buying gold at the highest rate in history. Just hours ago, gold hit $5,600, then collapsed by 8.21% in a straight vertical drop to $5,140, which is a textbook margin liquidation.

At the same time, Microsoft dropped 11.7% as tech sold their gold because it was their only profitable asset, and the investors needed cash fast. This is the same liquidity contagion that used to be seen in the crypto market.

According to Sinha, gold cannot be sanctioned in a bar. As the West weaponizes the dollar through sanctions and financial controls, the rest of the world needs a neutral exit. In the end, BTC still proved it is a speculative tool, while gold is proving to be the replacement.

Why Gold Is Likely To Keep Outperforming Bitcoin

A crypto trader known as Doctor Profit pointed out that nearly a year ago, he shared a Gold versus Bitcoin chart, highlighting that once 0.02 BTC equals 1 ounce of gold, it should mark the top for BTC. Meanwhile, when 0.11 BTC equals 1 ounce of gold, it marks the bottom for BTC. This happened in 2021 during the BTC top and during the BTC bottom in 2022.

According to Doctor Profit, the analysis was later proven right this year by calling the BTC top at $125,000 at 0.02 for 1 ounce of gold. Calculating this move, if 1 BTC is $5,500 in gold price and divided by 0.11, it should be $50,000 BTC, which matches the analysis of BTC bottom for this cycle between $50,000 and $60,000 BTC.

However, the analysis played out as expected. If calculated with a gold price of $7,000, the equivalent of BTC bottom should be around $63,000, which also aligns with the bottom target. In the Doctor Profit view, gold might continue to outperform BTC in the coming months.