Strategy Acquires 4,225 BTC for $472.5M, Boosts YTD Bitcoin Yield to 20.2% in 2025

Share:

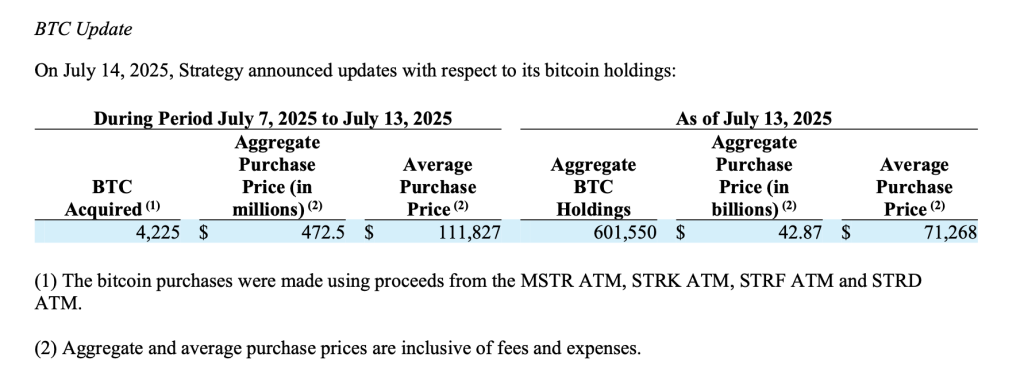

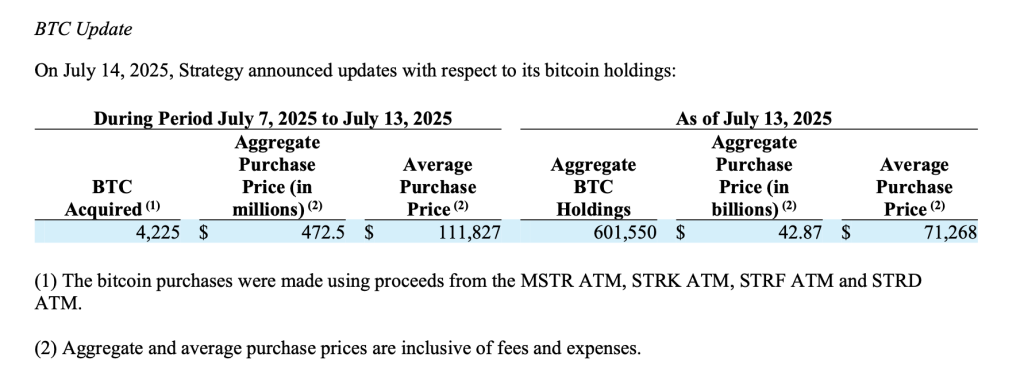

Strategy (formerly MicroStrategy) has added 4,225 BTC to its treasury in a single week, spending $472.5 million at an average price of $111,827 per bitcoin.

The latest acquisition, announced on July 14, brings Strategy’s total BTC holdings to 601,550, purchased at an average price of $71,268 per coin, amounting to a total investment of $42.87 billion.

The move reaffirms the company’s long-standing conviction in Bitcoin as a strategic treasury reserve asset.

With this purchase, Strategy’s Bitcoin-related yield year-to-date has surged to 20.2%, underscoring the performance edge the company has enjoyed in 2025’s bullish digital asset environment.

Funding Strategy: Preferred Stock Offerings Fuel Growth

To fund its latest Bitcoin accumulation, Strategy tapped into multiple at-the-market (ATM) offering programs, including its common stock (MSTR) and three distinct preferred share offerings: STRK (Strike), STRF (Strife), and STRD (Stride).

Between July 7 and July 13, 2025, Strategy sold nearly 2 million shares across these instruments, raising a combined $472.3 million in net proceeds. The largest tranche came from the common stock ATM, which generated $330.9 million.

The STRK preferred shares contributed $57.4 million, STRF added $44.4 million, and STRD rounded out the raise with $15.8 million. Each preferred share class offers annual dividends ranging from 8.00% to 10.00%, giving investors exposure to income-generating equity tied to Strategy’s long-term Bitcoin vision.

These instruments also reflect Strategy’s financial creativity, offering scalable fundraising mechanisms without diluting common shareholders excessively.

Transparent Reporting and Long-Term Positioning

As part of its commitment to transparency, Strategy says it continues to maintain a publicly accessible dashboard at www.strategy.com, where it discloses real-time Bitcoin purchases, aggregate holdings, security market data, and key financial metrics.

By integrating Bitcoin acquisition updates with structured equity offerings, Strategy has positioned itself as both a technology firm and a de facto Bitcoin ETF.

Bitcoin Breaks $123K ATH

Earlier today, Bitcoin has shattered all previous records by reaching a new all-time high (ATH) of $123,091, prompting former Binance CEO Changpeng Zhao (CZ) to put the milestone in historical perspective by calling it “just a fraction” of what’s to come.

CZ reminded followers that after buying Bitcoin in 2014, it took three years to reach $1,000 again in January 2017, noting that today’s excitement over current highs will seem minimal in future years.

Bitcoin ATH Wipes Out $1.3B Short Positions

The latest surge liquidated $1.3 billion in short positions in less than 60 seconds as Bitcoin skipped past $120,000 and went directly to $121,000.

At $2.39 trillion market capitalization, Bitcoin has now officially become larger than Amazon and ranks as the world’s fifth-largest asset by market value.

Crypto markets have added $1.2 trillion in market cap since President Trump paused “reciprocal tariffs” on April 9th, with Bitcoin gaining $15,000 since the House passed Trump’s “Big Beautiful Bill” on July 3rd

The post Strategy Acquires 4,225 BTC for $472.5M, Boosts YTD Bitcoin Yield to 20.2% in 2025 appeared first on Cryptonews.

Strategy Acquires 4,225 BTC for $472.5M, Boosts YTD Bitcoin Yield to 20.2% in 2025

Share:

Strategy (formerly MicroStrategy) has added 4,225 BTC to its treasury in a single week, spending $472.5 million at an average price of $111,827 per bitcoin.

The latest acquisition, announced on July 14, brings Strategy’s total BTC holdings to 601,550, purchased at an average price of $71,268 per coin, amounting to a total investment of $42.87 billion.

The move reaffirms the company’s long-standing conviction in Bitcoin as a strategic treasury reserve asset.

With this purchase, Strategy’s Bitcoin-related yield year-to-date has surged to 20.2%, underscoring the performance edge the company has enjoyed in 2025’s bullish digital asset environment.

Funding Strategy: Preferred Stock Offerings Fuel Growth

To fund its latest Bitcoin accumulation, Strategy tapped into multiple at-the-market (ATM) offering programs, including its common stock (MSTR) and three distinct preferred share offerings: STRK (Strike), STRF (Strife), and STRD (Stride).

Between July 7 and July 13, 2025, Strategy sold nearly 2 million shares across these instruments, raising a combined $472.3 million in net proceeds. The largest tranche came from the common stock ATM, which generated $330.9 million.

The STRK preferred shares contributed $57.4 million, STRF added $44.4 million, and STRD rounded out the raise with $15.8 million. Each preferred share class offers annual dividends ranging from 8.00% to 10.00%, giving investors exposure to income-generating equity tied to Strategy’s long-term Bitcoin vision.

These instruments also reflect Strategy’s financial creativity, offering scalable fundraising mechanisms without diluting common shareholders excessively.

Transparent Reporting and Long-Term Positioning

As part of its commitment to transparency, Strategy says it continues to maintain a publicly accessible dashboard at www.strategy.com, where it discloses real-time Bitcoin purchases, aggregate holdings, security market data, and key financial metrics.

By integrating Bitcoin acquisition updates with structured equity offerings, Strategy has positioned itself as both a technology firm and a de facto Bitcoin ETF.

Bitcoin Breaks $123K ATH

Earlier today, Bitcoin has shattered all previous records by reaching a new all-time high (ATH) of $123,091, prompting former Binance CEO Changpeng Zhao (CZ) to put the milestone in historical perspective by calling it “just a fraction” of what’s to come.

CZ reminded followers that after buying Bitcoin in 2014, it took three years to reach $1,000 again in January 2017, noting that today’s excitement over current highs will seem minimal in future years.

Bitcoin ATH Wipes Out $1.3B Short Positions

The latest surge liquidated $1.3 billion in short positions in less than 60 seconds as Bitcoin skipped past $120,000 and went directly to $121,000.

At $2.39 trillion market capitalization, Bitcoin has now officially become larger than Amazon and ranks as the world’s fifth-largest asset by market value.

Crypto markets have added $1.2 trillion in market cap since President Trump paused “reciprocal tariffs” on April 9th, with Bitcoin gaining $15,000 since the House passed Trump’s “Big Beautiful Bill” on July 3rd

The post Strategy Acquires 4,225 BTC for $472.5M, Boosts YTD Bitcoin Yield to 20.2% in 2025 appeared first on Cryptonews.