Crypto Stocks to Watch as Bitcoin Targets $90,000 Level Again

Share:

Key Insights:

- Bitcoin holds above $86,000 as traders watch for a possible retest of $90,000.

- Crypto-linked stocks show mixed movement while technical indicators signal steady momentum.

- Bitmine, Strategy Inc, and Gemini Space Station react to shifting market conditions.

Bitcoin’s attempt to retest $90,000 this week could influence several crypto stocks, which showed mixed movement in recent sessions.

The price held above $86,000 after recent selling, and analysts observed early signs of renewed momentum.

Bitcoin Moves Fuels Crypto Stocks Breakout

It is worth mentioning that the crypto stocks market drew attention as Bitcoin traded near $86,800 during the latest session.

Market data shows that the price formed a stable position above $86,000 after a sharp decline earlier in the week.

The move came as traders assessed how the market might react if Bitcoin attempts another retest of the $90,000 level.

Meanwhile, technical indicators showed early strength. The MACD histogram turned positive and signaled increasing momentum.

Both MACD lines crossed upward and suggested improving demand after the correction. The RSI held around 47 and pointed to a neutral trend with a slight advance.

In addition, market watchers stated that a break above $90,000 could push Bitcoin toward $92,000.

A stronger continuation could shift focus to the $100,000 area as a medium-term target.

However, a drop below $84,000 might weaken the current structure. The next support zone near $80,000 remains crucial for broader bullish conditions.

Interestingly, these movements created renewed interest in related crypto stocks, which tracked both volatility and sentiment tied to the broader market.

Bitmine Immersion Technologies Reacts to Market Swings

Bitmine Immersion Technologies traded at $26.00, with a pre-market value of $27.21 as of writing. The move represented an increase of 4.65%.

The crypto stock traded between $24.33 and $26.77 during the prior session. Its year range spanned $3.20 to $161.00, and its market cap stood at $7.40 billion. Average volume reached 39.30 million.

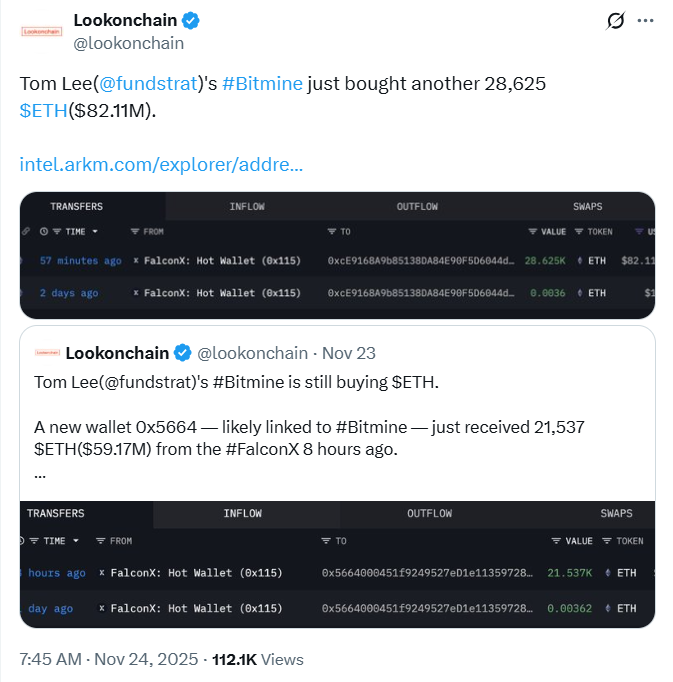

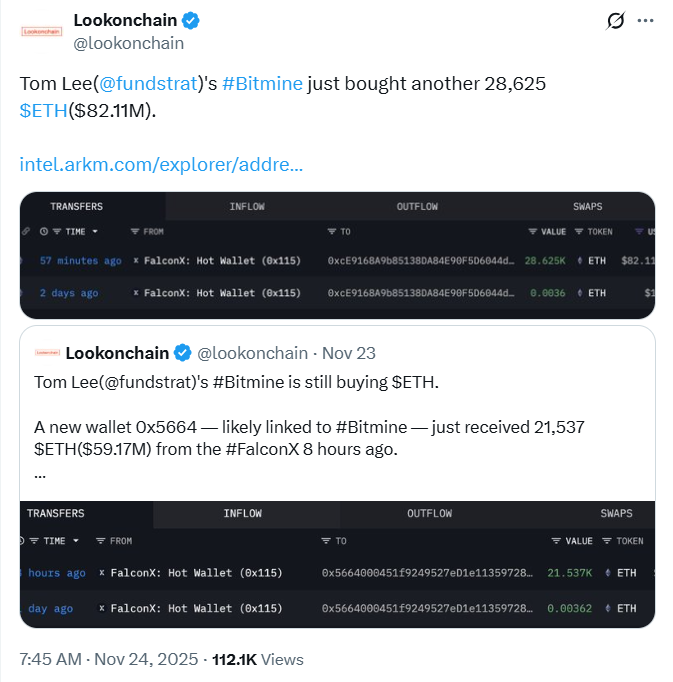

In a separate development, the company drew attention after Lookonchain reported that Tom Lee’s Bitmine acquired 28,625 ETH valued at $82.11 million.

Basically, the activity signaled continued engagement with large digital asset positions.

The update added interest as traders watched how increased exposure might influence BitMine during Bitcoin’s next move.

The stock remained sensitive to market direction. A strong Bitcoin breakout could support sentiment.

However, extended volatility in the crypto market would affect the stock’s near-term behavior.

Strategy Inc and Gemini Space Station Show Mixed Performance

Strategy Inc Class A traded at $170.50 after a 3.74% decline. The pre-market price reached $173.00.

The crypto stock moved between $166.31 and $181.19 during the session.

The company held a market cap of $48.99 billion. Its average volume totaled 13.78 millions, and the P/E ratio stood at 7.93.

Meanwhile, the year range showed a wide band from $166.31 to $457.22.

The performance suggested that the stock responded to broader uncertainty in digital asset markets as Bitcoin remained below its recent highs.

Looking at another crypto stock, Gemini Space Station shares closed at $10.63 after a 0.47% rise. The trading range stood between $10.08 and $10.72.

As detailed, the year range extended from $10.08 to $45.89. The company’s market cap reached $1.25 billion with an average volume of 1.98 million.

In a separate move, the firm appeared in social discussions after Gemini highlighted long-term views on Zcash, a privacy-focused asset.

Nevertheless, the commentary added context but did not change the stock’s short-term technical picture.

Bitcoin’s attempt to approach $90,000 this week could shape movement across several crypto-linked stocks.

More importantly, market participants will watch key indicators closely as market conditions continue to shift.

The post Crypto Stocks to Watch as Bitcoin Targets $90,000 Level Again appeared first on The Coin Republic.

Crypto Stocks to Watch as Bitcoin Targets $90,000 Level Again

Share:

Key Insights:

- Bitcoin holds above $86,000 as traders watch for a possible retest of $90,000.

- Crypto-linked stocks show mixed movement while technical indicators signal steady momentum.

- Bitmine, Strategy Inc, and Gemini Space Station react to shifting market conditions.

Bitcoin’s attempt to retest $90,000 this week could influence several crypto stocks, which showed mixed movement in recent sessions.

The price held above $86,000 after recent selling, and analysts observed early signs of renewed momentum.

Bitcoin Moves Fuels Crypto Stocks Breakout

It is worth mentioning that the crypto stocks market drew attention as Bitcoin traded near $86,800 during the latest session.

Market data shows that the price formed a stable position above $86,000 after a sharp decline earlier in the week.

The move came as traders assessed how the market might react if Bitcoin attempts another retest of the $90,000 level.

Meanwhile, technical indicators showed early strength. The MACD histogram turned positive and signaled increasing momentum.

Both MACD lines crossed upward and suggested improving demand after the correction. The RSI held around 47 and pointed to a neutral trend with a slight advance.

In addition, market watchers stated that a break above $90,000 could push Bitcoin toward $92,000.

A stronger continuation could shift focus to the $100,000 area as a medium-term target.

However, a drop below $84,000 might weaken the current structure. The next support zone near $80,000 remains crucial for broader bullish conditions.

Interestingly, these movements created renewed interest in related crypto stocks, which tracked both volatility and sentiment tied to the broader market.

Bitmine Immersion Technologies Reacts to Market Swings

Bitmine Immersion Technologies traded at $26.00, with a pre-market value of $27.21 as of writing. The move represented an increase of 4.65%.

The crypto stock traded between $24.33 and $26.77 during the prior session. Its year range spanned $3.20 to $161.00, and its market cap stood at $7.40 billion. Average volume reached 39.30 million.

In a separate development, the company drew attention after Lookonchain reported that Tom Lee’s Bitmine acquired 28,625 ETH valued at $82.11 million.

Basically, the activity signaled continued engagement with large digital asset positions.

The update added interest as traders watched how increased exposure might influence BitMine during Bitcoin’s next move.

The stock remained sensitive to market direction. A strong Bitcoin breakout could support sentiment.

However, extended volatility in the crypto market would affect the stock’s near-term behavior.

Strategy Inc and Gemini Space Station Show Mixed Performance

Strategy Inc Class A traded at $170.50 after a 3.74% decline. The pre-market price reached $173.00.

The crypto stock moved between $166.31 and $181.19 during the session.

The company held a market cap of $48.99 billion. Its average volume totaled 13.78 millions, and the P/E ratio stood at 7.93.

Meanwhile, the year range showed a wide band from $166.31 to $457.22.

The performance suggested that the stock responded to broader uncertainty in digital asset markets as Bitcoin remained below its recent highs.

Looking at another crypto stock, Gemini Space Station shares closed at $10.63 after a 0.47% rise. The trading range stood between $10.08 and $10.72.

As detailed, the year range extended from $10.08 to $45.89. The company’s market cap reached $1.25 billion with an average volume of 1.98 million.

In a separate move, the firm appeared in social discussions after Gemini highlighted long-term views on Zcash, a privacy-focused asset.

Nevertheless, the commentary added context but did not change the stock’s short-term technical picture.

Bitcoin’s attempt to approach $90,000 this week could shape movement across several crypto-linked stocks.

More importantly, market participants will watch key indicators closely as market conditions continue to shift.

The post Crypto Stocks to Watch as Bitcoin Targets $90,000 Level Again appeared first on The Coin Republic.