Market Momentum Turns Bearish, Putting Bitcoin’s $87.5K Support Back in Play: Analyst

Share:

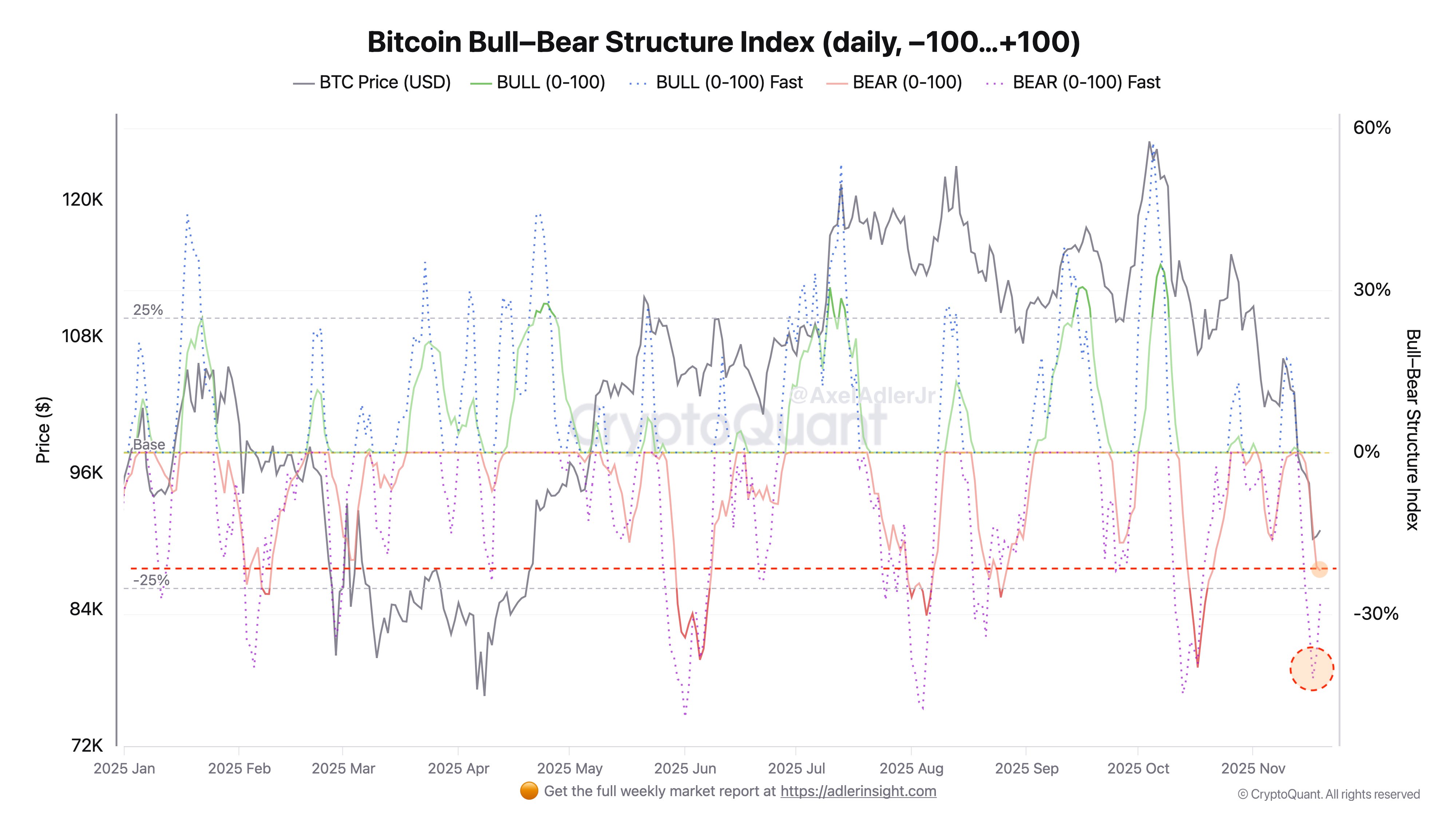

Bitcoin’s momentum has slipped into a deeper correction zone, raising the likelihood of a retest of the $87,500 support, according to on-chain data shared by analyst GugaOnChain.

Key Takeaways:

- Bitcoin’s Composite Index has dropped to 0.72, signaling a deeper correction and raising the risk of a fall toward $87,500.

- Weak liquidity and fading expectations of a December Fed rate cut are amplifying selling pressure.

- A break above 1.0 on the Composite Index would flip momentum bullish again.

The market’s Composite Index, a blend of multiple on-chain and sentiment indicators, has fallen to 0.72, its lowest reading since April 2025.

That level places Bitcoin squarely in the “Pessimism/Correction” band, a zone that historically precedes sharper pullbacks, especially when liquidity conditions are weak.

Bitcoin Risks Drop to $87.5K as Fed Cut Bets Fade, Analyst Warns

The shift comes as traders scale back expectations of a December Federal Reserve rate cut and risk appetite thins across crypto.

GugaOnChain notes that if the ratio drops below 0.75, short-term holders are likely to take profits aggressively, opening the door to a slide toward $87,500, a level that previously acted as strong support in March.

“Selling pressure combined with weak liquidity confirmed a broader downtrend over the weekend,” the analyst wrote.

For now, Bitcoin remains stuck between key zones. A ratio between 0.8 and 1.0 would signal consolidation inside the $90,000–$110,000 range, suggesting traders are holding but not adding fresh exposure.

A decisive break back above 1.0, however, would flip the outlook bullish again, with the Composite Index pointing to potential targets in the $150,000–$175,000 range, consistent with patterns from the 2017 and 2021 cycles.

Bitcoin traded near $92,600 at the time of the report, with the analyst warning that the market remains vulnerable but not without opportunities.

A clear reversal signal, stronger liquidity, or improving macro conditions could stabilize the trend.

Bitcoin Drops Below $90K as Whales Sell and ETF Outflows Deepen

As reported, Cameron Winklevoss has called the recent pullback in Bitcoin price a potential “last chance” to buy the dip.

“This is the last time you’ll ever be able to buy bitcoin below $90k!” he wrote on X.

The drop from October’s $126,000 peak has wiped roughly $600 billion in market value and revived both bullish and bearish arguments across trading desks.

Macro pressure, including a prolonged US government shutdown, trade tensions, and weak liquidity, has weighed on all risk assets.

Bitcoin’s steep slide accelerated after $19 billion in leveraged positions were liquidated last month, while large holders have begun selling into the weakness.

On-chain data shows whale short positions now outweigh longs, and Bitcoin ETFs have seen several consecutive weeks of net outflows.

Traders are watching whether heavy selling, from whales, ETFs and long-term holders, continues to overwhelm thin liquidity.

Options markets show strong demand for downside protection, while analysts point to $93,000 as a critical support level.

Despite the turbulence, institutional buyers like MicroStrategy remain active, reinforcing the recurring belief that deep pullbacks often precede new highs when liquidity conditions eventually improve.

The post Market Momentum Turns Bearish, Putting Bitcoin’s $87.5K Support Back in Play: Analyst appeared first on Cryptonews.

Market Momentum Turns Bearish, Putting Bitcoin’s $87.5K Support Back in Play: Analyst

Share:

Bitcoin’s momentum has slipped into a deeper correction zone, raising the likelihood of a retest of the $87,500 support, according to on-chain data shared by analyst GugaOnChain.

Key Takeaways:

- Bitcoin’s Composite Index has dropped to 0.72, signaling a deeper correction and raising the risk of a fall toward $87,500.

- Weak liquidity and fading expectations of a December Fed rate cut are amplifying selling pressure.

- A break above 1.0 on the Composite Index would flip momentum bullish again.

The market’s Composite Index, a blend of multiple on-chain and sentiment indicators, has fallen to 0.72, its lowest reading since April 2025.

That level places Bitcoin squarely in the “Pessimism/Correction” band, a zone that historically precedes sharper pullbacks, especially when liquidity conditions are weak.

Bitcoin Risks Drop to $87.5K as Fed Cut Bets Fade, Analyst Warns

The shift comes as traders scale back expectations of a December Federal Reserve rate cut and risk appetite thins across crypto.

GugaOnChain notes that if the ratio drops below 0.75, short-term holders are likely to take profits aggressively, opening the door to a slide toward $87,500, a level that previously acted as strong support in March.

“Selling pressure combined with weak liquidity confirmed a broader downtrend over the weekend,” the analyst wrote.

For now, Bitcoin remains stuck between key zones. A ratio between 0.8 and 1.0 would signal consolidation inside the $90,000–$110,000 range, suggesting traders are holding but not adding fresh exposure.

A decisive break back above 1.0, however, would flip the outlook bullish again, with the Composite Index pointing to potential targets in the $150,000–$175,000 range, consistent with patterns from the 2017 and 2021 cycles.

Bitcoin traded near $92,600 at the time of the report, with the analyst warning that the market remains vulnerable but not without opportunities.

A clear reversal signal, stronger liquidity, or improving macro conditions could stabilize the trend.

Bitcoin Drops Below $90K as Whales Sell and ETF Outflows Deepen

As reported, Cameron Winklevoss has called the recent pullback in Bitcoin price a potential “last chance” to buy the dip.

“This is the last time you’ll ever be able to buy bitcoin below $90k!” he wrote on X.

The drop from October’s $126,000 peak has wiped roughly $600 billion in market value and revived both bullish and bearish arguments across trading desks.

Macro pressure, including a prolonged US government shutdown, trade tensions, and weak liquidity, has weighed on all risk assets.

Bitcoin’s steep slide accelerated after $19 billion in leveraged positions were liquidated last month, while large holders have begun selling into the weakness.

On-chain data shows whale short positions now outweigh longs, and Bitcoin ETFs have seen several consecutive weeks of net outflows.

Traders are watching whether heavy selling, from whales, ETFs and long-term holders, continues to overwhelm thin liquidity.

Options markets show strong demand for downside protection, while analysts point to $93,000 as a critical support level.

Despite the turbulence, institutional buyers like MicroStrategy remain active, reinforcing the recurring belief that deep pullbacks often precede new highs when liquidity conditions eventually improve.

The post Market Momentum Turns Bearish, Putting Bitcoin’s $87.5K Support Back in Play: Analyst appeared first on Cryptonews.