Bitcoin ETFs record $621 million inflow amid rare BlackRock outflow following US election

Share:

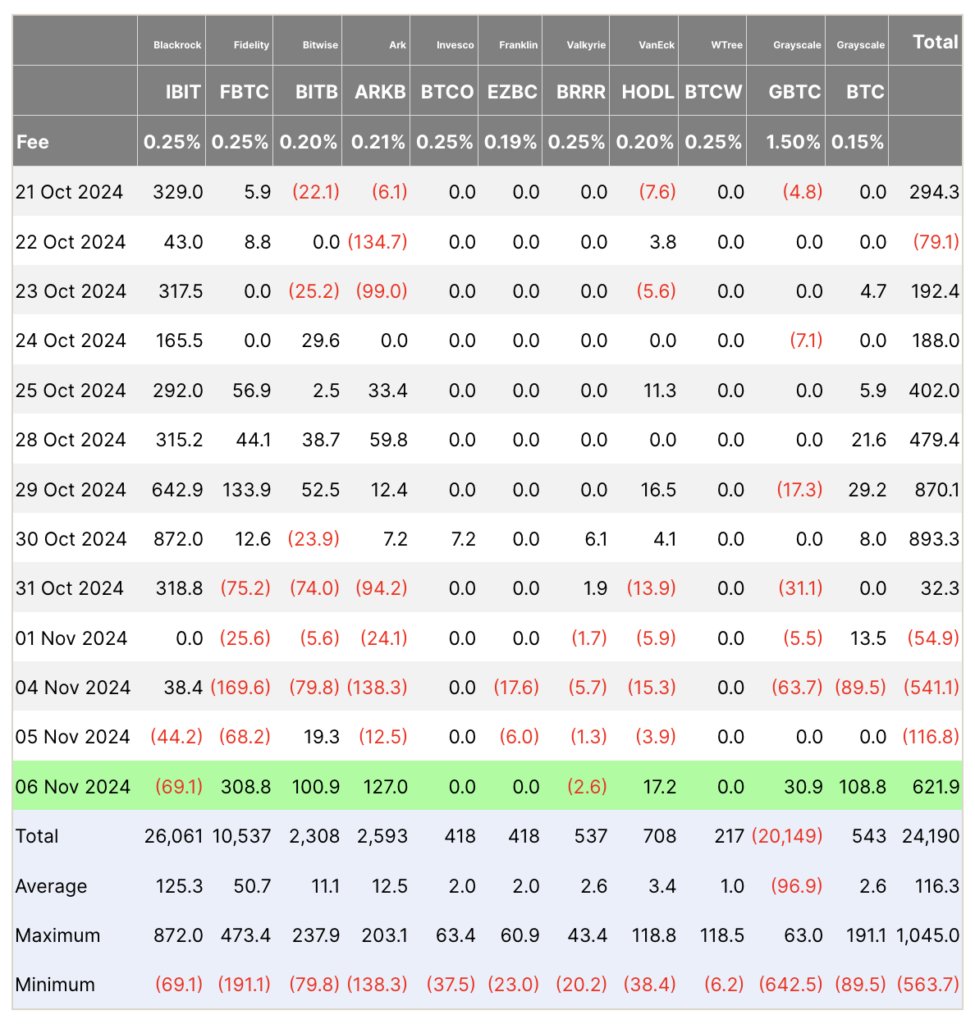

Major asset management firms reported significant inflows in their Bitcoin ETFs following Donald Trump’s victory in the 2024 US presidential election. On Nov. 6, Fidelity’s FBTC saw an inflow of $308.8 million, while BlackRock’s IBIT experienced an outflow of $69.1 million. Grayscale’s GBTC recorded an inflow of $30.9 million, reversing previous outflows.

Bitcoin’s price surged to a new all-time high of $76,400, breaking its previous record twice since the election. This price increase coincided with the substantial ETF inflows, suggesting renewed institutional interest. Ark’s ARKB reported an inflow of $127 million, and Bitwise’s BITB gained $100.9 million on the same day.

The shifts in ETF holdings reflect a complex market response. Companies like Valkyrie and VanEck also reported changes in their Bitcoin ETF positions. Valkyrie’s BRRR had a slight outflow of $2.6 million, while VanEck’s HODL saw an inflow of $17.2 million.

The post Bitcoin ETFs record $621 million inflow amid rare BlackRock outflow following US election appeared first on CryptoSlate.

Bitcoin ETFs record $621 million inflow amid rare BlackRock outflow following US election

Share:

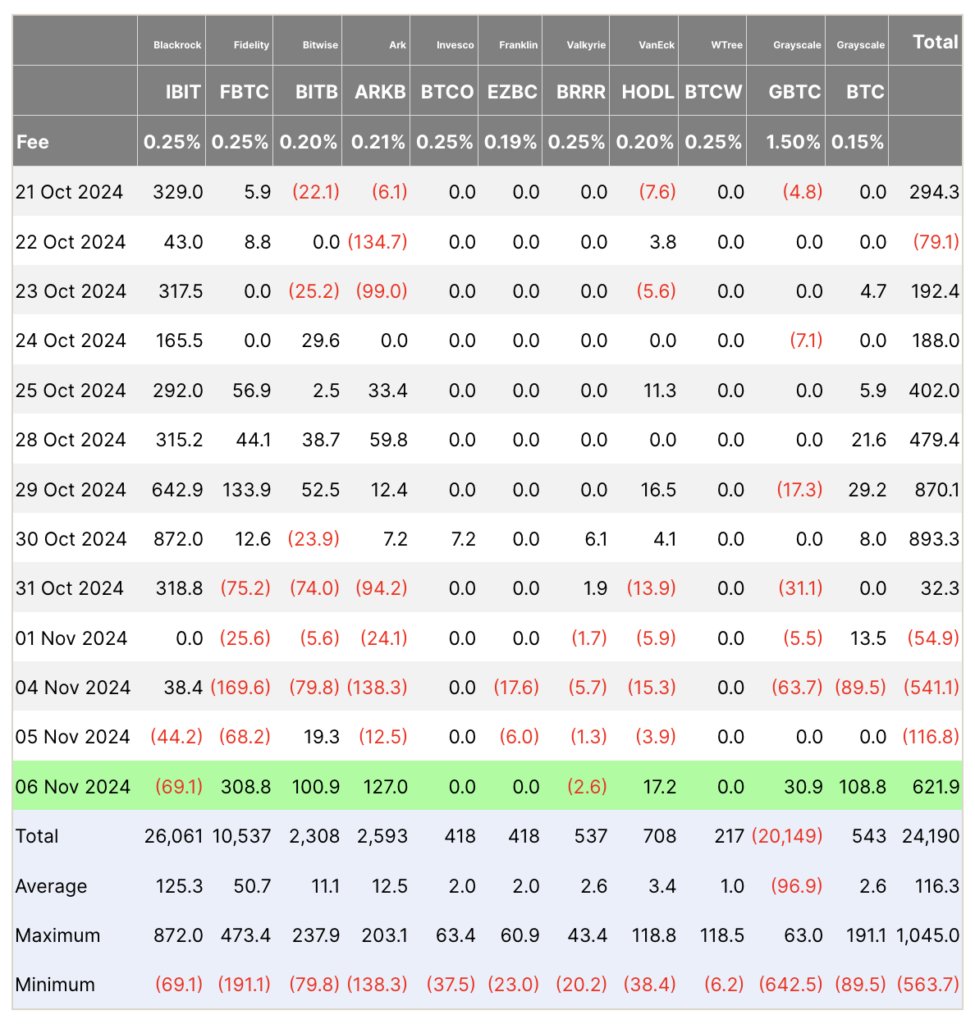

Major asset management firms reported significant inflows in their Bitcoin ETFs following Donald Trump’s victory in the 2024 US presidential election. On Nov. 6, Fidelity’s FBTC saw an inflow of $308.8 million, while BlackRock’s IBIT experienced an outflow of $69.1 million. Grayscale’s GBTC recorded an inflow of $30.9 million, reversing previous outflows.

Bitcoin’s price surged to a new all-time high of $76,400, breaking its previous record twice since the election. This price increase coincided with the substantial ETF inflows, suggesting renewed institutional interest. Ark’s ARKB reported an inflow of $127 million, and Bitwise’s BITB gained $100.9 million on the same day.

The shifts in ETF holdings reflect a complex market response. Companies like Valkyrie and VanEck also reported changes in their Bitcoin ETF positions. Valkyrie’s BRRR had a slight outflow of $2.6 million, while VanEck’s HODL saw an inflow of $17.2 million.

The post Bitcoin ETFs record $621 million inflow amid rare BlackRock outflow following US election appeared first on CryptoSlate.