BOA Study Flags $30T GDP vs $34T Debt: Dollar Losing Power

Share:

US dollar collapse concerns have actually intensified right now following Bank of America research that’s highlighting America’s troubling GDP vs debt ratio. With national debt reaching $34.62 trillion against a $30.34 trillion GDP, the current US debt crisis has sparked debate about reserve currency status and also investor confidence dollar stability amid mounting economic pressures.

BOA Study Shows US Dollar Collapse Amid Debt Crisis And Investor Risk

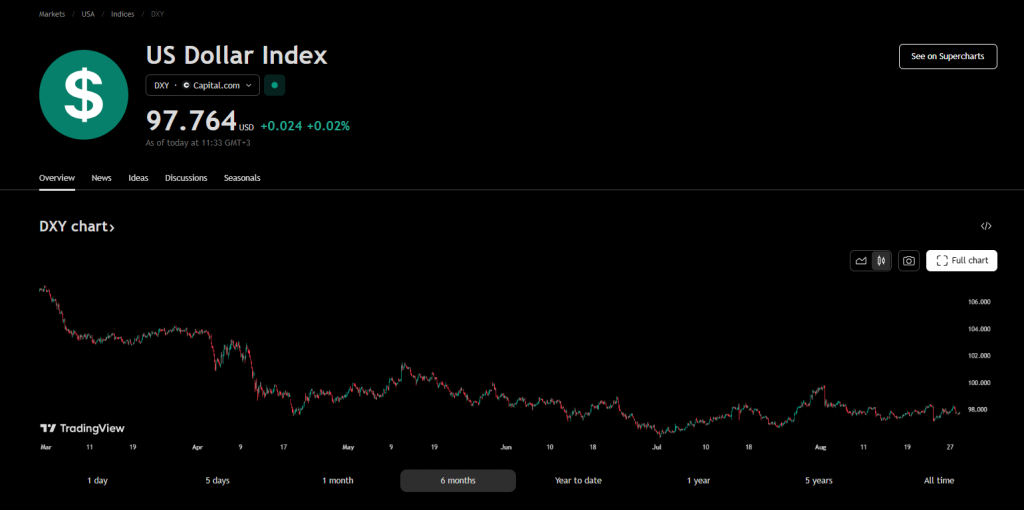

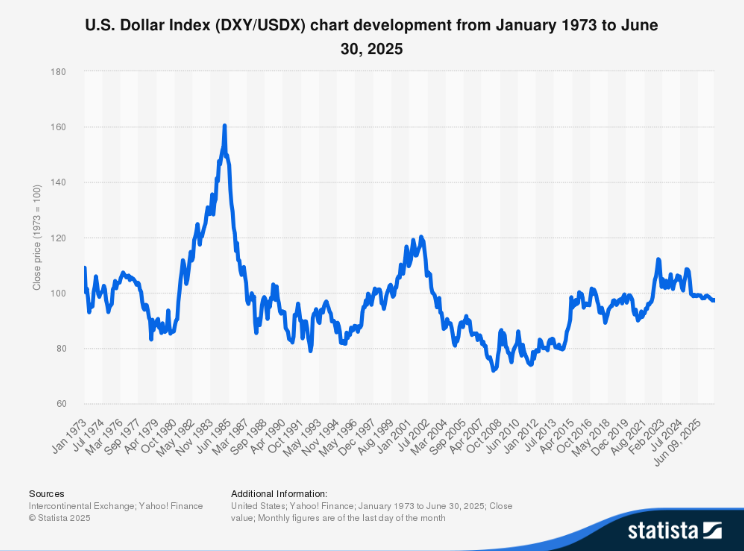

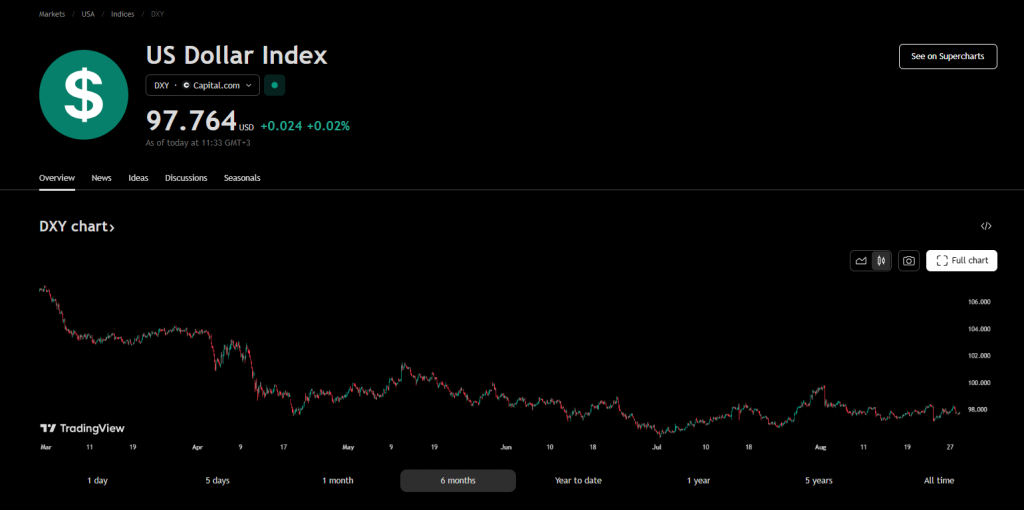

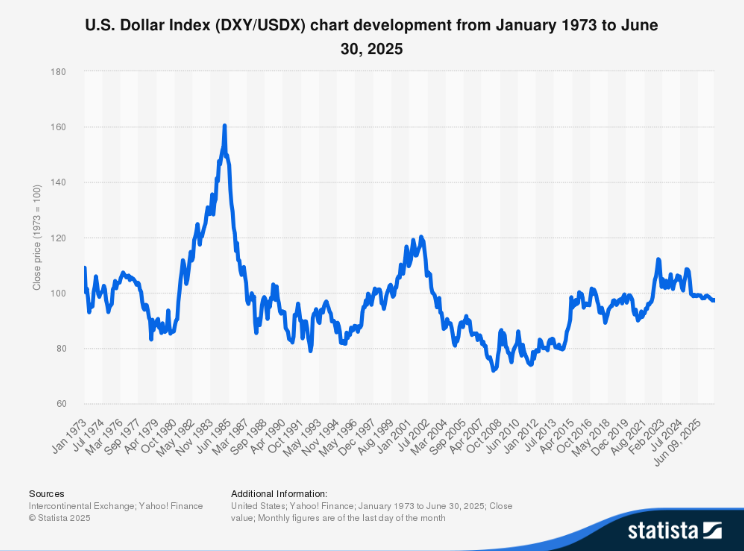

The US dollar collapse fears have been gaining momentum after the currency declined more than 10% in the first half of 2025, which was actually its worst start since 1973. This US debt crisis has prompted analysis of whether America’s reserve currency status can even withstand current economic challenges that are affecting investor confidence dollar markets right now.

Lauren Sanfilippo, who is a Senior Investment Strategist at Bank of America‘s Chief Investment Office, covered the dollar collapse idea. She is convinced about the fact that:

“The U.S. remains the world’s largest, wealthiest and most competitive economy, with innovative companies, a dynamic labor market and a strong and resilient consumer base.”

What Actually Triggers US Dollar Collapse Scenarios

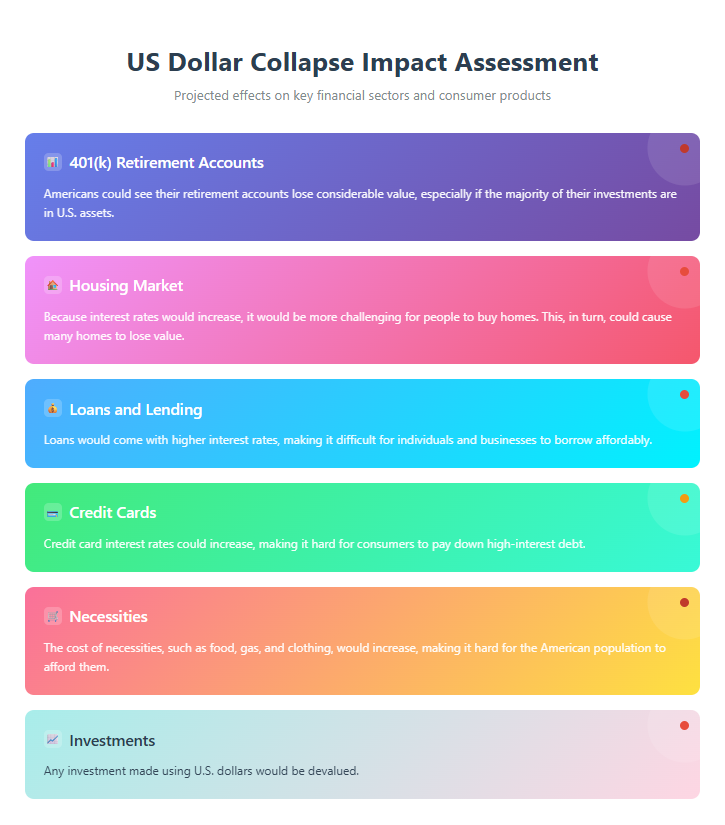

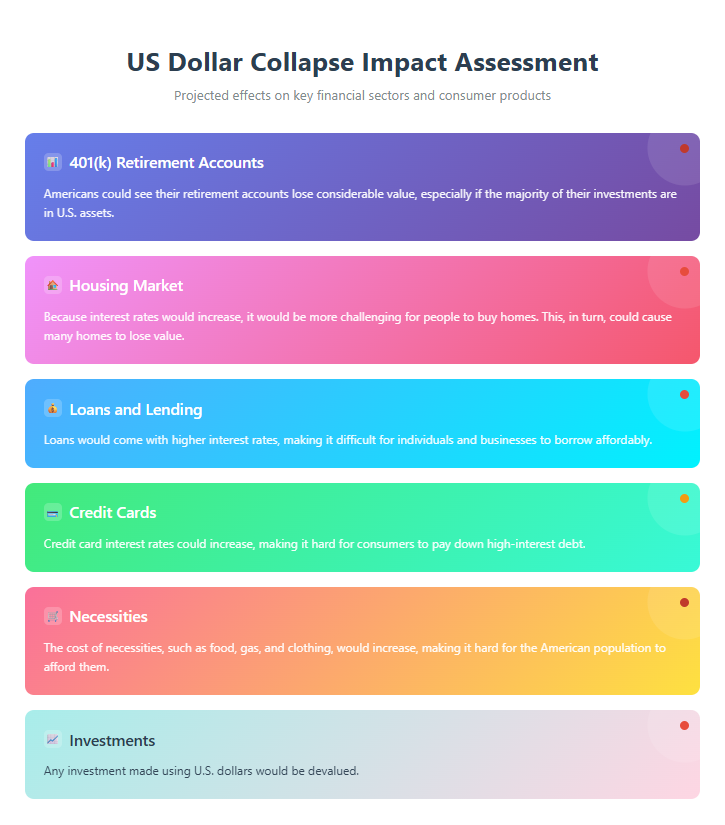

At present, a collection of stuff would completely drive the US dollar into a frenzy. The ratio of GDP to debt is already indicating that the national debt has already exceeded the total output of the whole economy and this is a blunt warning as far fiscal sustainability is concerned. The debt crisis is not better with inflation either, as food prices have increased around 5.8% in just the year of 2023 alone.

The increasing use of alternative currencies like China’s yuan in international trade could also gradually undermine reserve currency status and weaken investor confidence dollar dominance globally.

Also Read: Mastercard Partners With Circle to Deploy $65.2B USDC Globally

Economic Analysis of US Dollar Collapse Probability

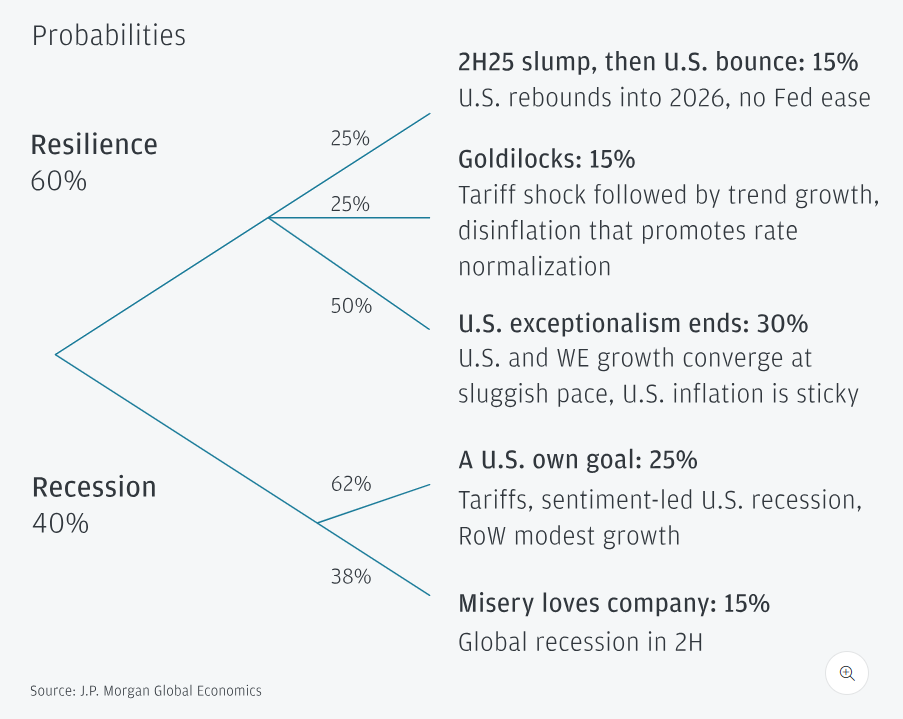

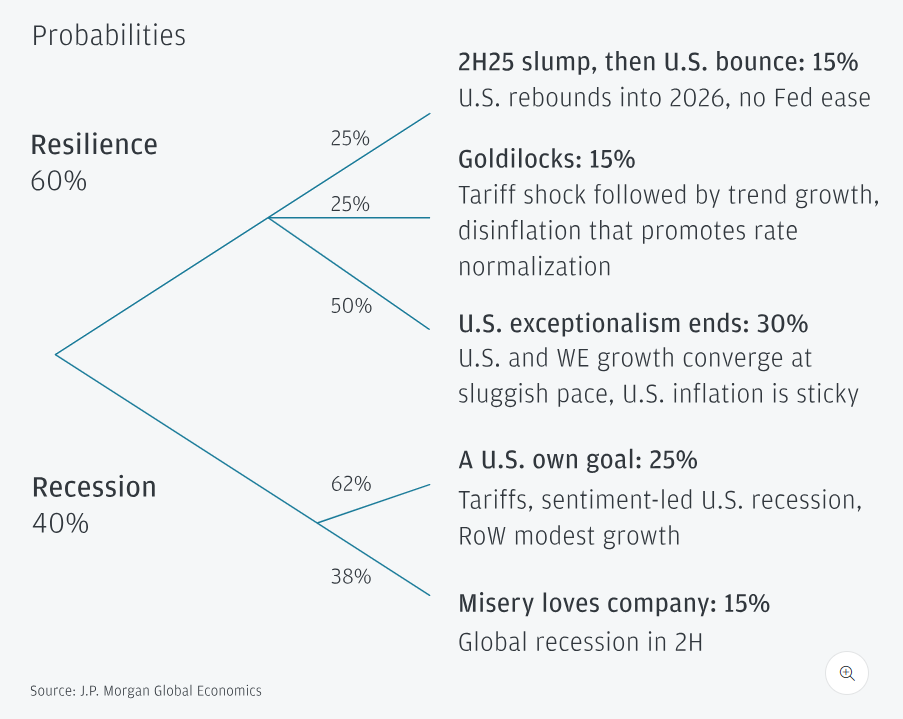

According to a study by JP Morgan, there are 40% odds that the economy will plunge into a downturn by the conclusion of 2025; however, the majority of economists are confident that the dollar is not just going to collapse. GDP-debt ratio remains sketchy, yet the dollar reached record highs on January 6, 2025 and then fell again.

Kathy Jones from Schwab Center for Financial Research stated:

“The dollar remains close to a 10-year high versus currencies of countries with which the U.S. trades.”

The current US debt crisis and reserve currency status concerns may actually be overblown, according to financial experts who point to underlying economic fundamentals supporting investor confidence dollar stability.

According to the analysis of the Bank of America, the recent panic that the US dollar will collapse is nothing more than a normal wobble in the market, and not a structural crash. The GDP-to-debt ratio is headache-inducing sure yet the US controls the economy and is able to intervene to stabilize the situation at this point in time.

Also Read: $35B Stablecoin Surge as USD Collapses in Egypt, Nigeria, Argentina

BOA Study Flags $30T GDP vs $34T Debt: Dollar Losing Power

Share:

US dollar collapse concerns have actually intensified right now following Bank of America research that’s highlighting America’s troubling GDP vs debt ratio. With national debt reaching $34.62 trillion against a $30.34 trillion GDP, the current US debt crisis has sparked debate about reserve currency status and also investor confidence dollar stability amid mounting economic pressures.

BOA Study Shows US Dollar Collapse Amid Debt Crisis And Investor Risk

The US dollar collapse fears have been gaining momentum after the currency declined more than 10% in the first half of 2025, which was actually its worst start since 1973. This US debt crisis has prompted analysis of whether America’s reserve currency status can even withstand current economic challenges that are affecting investor confidence dollar markets right now.

Lauren Sanfilippo, who is a Senior Investment Strategist at Bank of America‘s Chief Investment Office, covered the dollar collapse idea. She is convinced about the fact that:

“The U.S. remains the world’s largest, wealthiest and most competitive economy, with innovative companies, a dynamic labor market and a strong and resilient consumer base.”

What Actually Triggers US Dollar Collapse Scenarios

At present, a collection of stuff would completely drive the US dollar into a frenzy. The ratio of GDP to debt is already indicating that the national debt has already exceeded the total output of the whole economy and this is a blunt warning as far fiscal sustainability is concerned. The debt crisis is not better with inflation either, as food prices have increased around 5.8% in just the year of 2023 alone.

The increasing use of alternative currencies like China’s yuan in international trade could also gradually undermine reserve currency status and weaken investor confidence dollar dominance globally.

Also Read: Mastercard Partners With Circle to Deploy $65.2B USDC Globally

Economic Analysis of US Dollar Collapse Probability

According to a study by JP Morgan, there are 40% odds that the economy will plunge into a downturn by the conclusion of 2025; however, the majority of economists are confident that the dollar is not just going to collapse. GDP-debt ratio remains sketchy, yet the dollar reached record highs on January 6, 2025 and then fell again.

Kathy Jones from Schwab Center for Financial Research stated:

“The dollar remains close to a 10-year high versus currencies of countries with which the U.S. trades.”

The current US debt crisis and reserve currency status concerns may actually be overblown, according to financial experts who point to underlying economic fundamentals supporting investor confidence dollar stability.

According to the analysis of the Bank of America, the recent panic that the US dollar will collapse is nothing more than a normal wobble in the market, and not a structural crash. The GDP-to-debt ratio is headache-inducing sure yet the US controls the economy and is able to intervene to stabilize the situation at this point in time.

Also Read: $35B Stablecoin Surge as USD Collapses in Egypt, Nigeria, Argentina