Bitcoin trades around $57K for the first time since the crypto winter

Bitcoin has surged past the $57,000 price level, marking a significant milestone as it reaches this price point for the first time since late 2021. This surge comes amidst a period of renewed interest and investor confidence in the cryptocurrency market, fueled by various factors such as market demand and Bitcoin ETFs.

Bitcoin shines back to its glory days

Bitcoin’s price volatility was minimal between February 15 and 25, but buyers appear to have made a comeback in the last two days, with BTC reaching $57,073 on Binance.

The BTC price has reached a fresh yearly high of $57,000 for the first time in more than two years. The bull run that began in 2023 is still ongoing and shows no signs of slowing. This change was made feasible by the roughly 5% increase seen on Tuesday and the 5% increase on Monday.

The digital asset rose as high as 4.4% to $57,039 before losing some of its gains to trade at $56,085 as of 6 a.m. Tuesday in London. Bitcoin’s price has risen 32% since the turn of the year, extending a long-running boom that has fueled speculative interest in smaller tokens like Ether and Dogecoin.

According to CoinGecko, the total value of digital assets is now above $2.2 trillion, up from a low of around $820 billion during the 2022 bear market when FTX and other crypto platforms crashed.

A total of $6.1 billion has been invested in a number of landmark BTC ETFs that began trading in the United States on January 11, indicating that interest in the currency extends beyond ardent digital asset enthusiasts. An imminent reduction in Bitcoin supply growth, known as the halving, adds to the optimism.

MicroStrategy, an enterprise software company that buys Bitcoin as part of its corporate strategy, announced Monday that it has purchased another 3,000 or so coins this month. The corporation now holds around $10 billion of Bitcoin.

FOMO and liquidations grace the market

Digital tokens are rising despite investors’ reduced expectations for softer monetary policy this year, as demonstrated by an increase in US Treasury yields.

According to CoinGlass data, this dramatic move liquidated almost $250 million in positions on Monday and $120 million as of February 27th.

BTC has outperformed traditional assets this year, including stocks and gold. A ratio comparing the token’s price to the precious metal has reached its greatest level in more than two years.

Crypto-related stocks rose in the United States on Monday. MicroStrategy grew 16%, Coinbase Global Inc. increased 17%, and Marathon Digital Holdings Inc. increased 22%.

Positive optimism carried to Asian digital asset stocks, with Tuesday’s gains in companies such as Japan’s Monex Group and South Korea’s Woori Technology Investment Co.

With the advent of the Bitcoin market, ETFs have also come into the spotlight. Spot Bitcoin ETFs have lately seen a huge increase in trading volume, reaching a record $3.24 billion. This spike reflects the growing interest in Bitcoin exchange-traded funds and a significant shift in investor opinion toward the cryptocurrency industry.

The increase in spot Bitcoin ETF trading volume is evidence of a supply shock in the Bitcoin market. A supply shock happens when there is an unexpected lack of supply relative to demand, causing major price fluctuations. In this instance, the influx of funds into spot BTC ETFs worsens the supply shock, resulting in an imbalance between supply and demand dynamics.

Read More

Emerging Address Poisoning Attack on Bitcoin Blockchain, Casa Executive Warns

Fidelity leads Bitcoin ETFs 4th best day since launch reaching $6 billion total net inflows

Quick Take

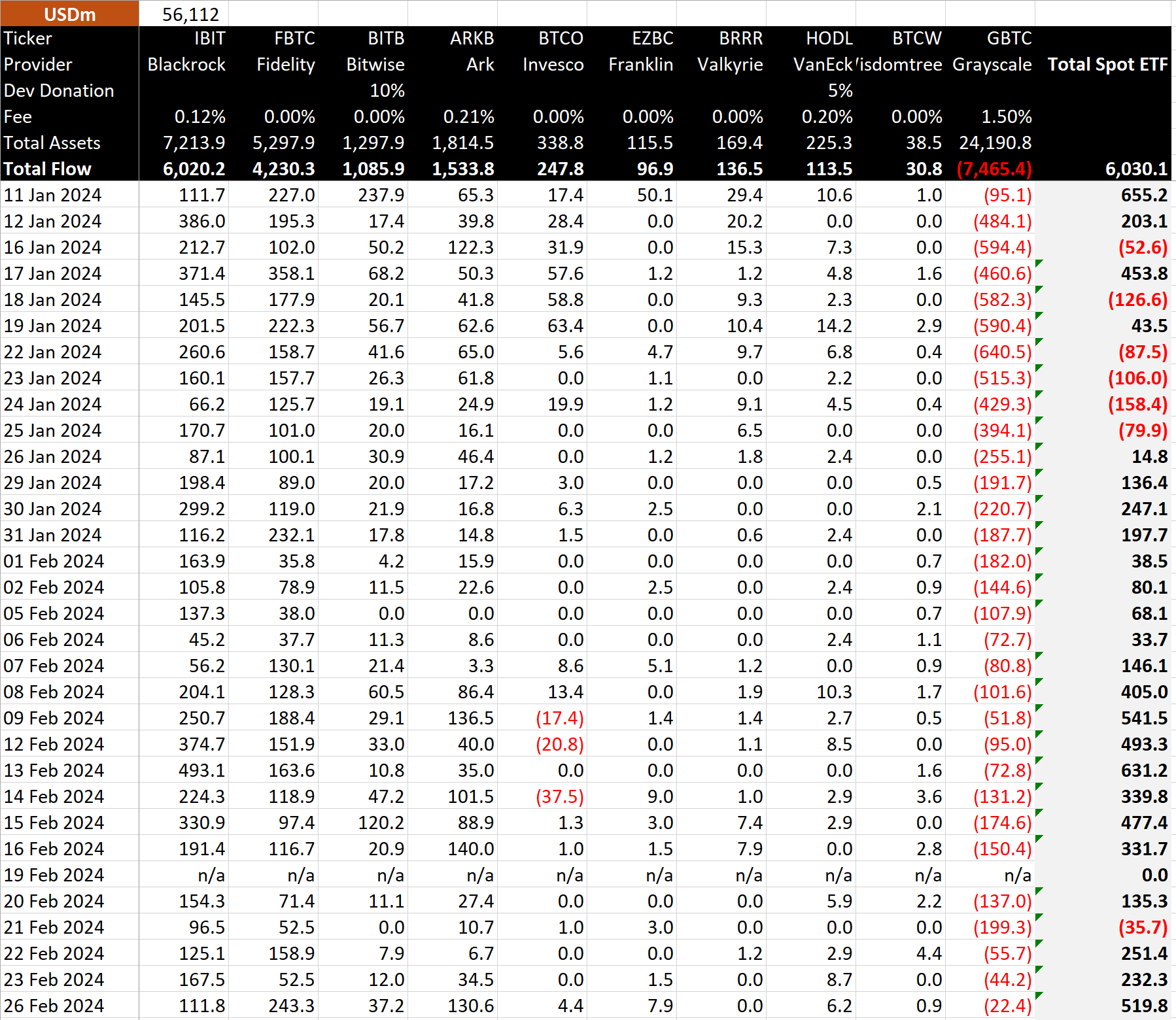

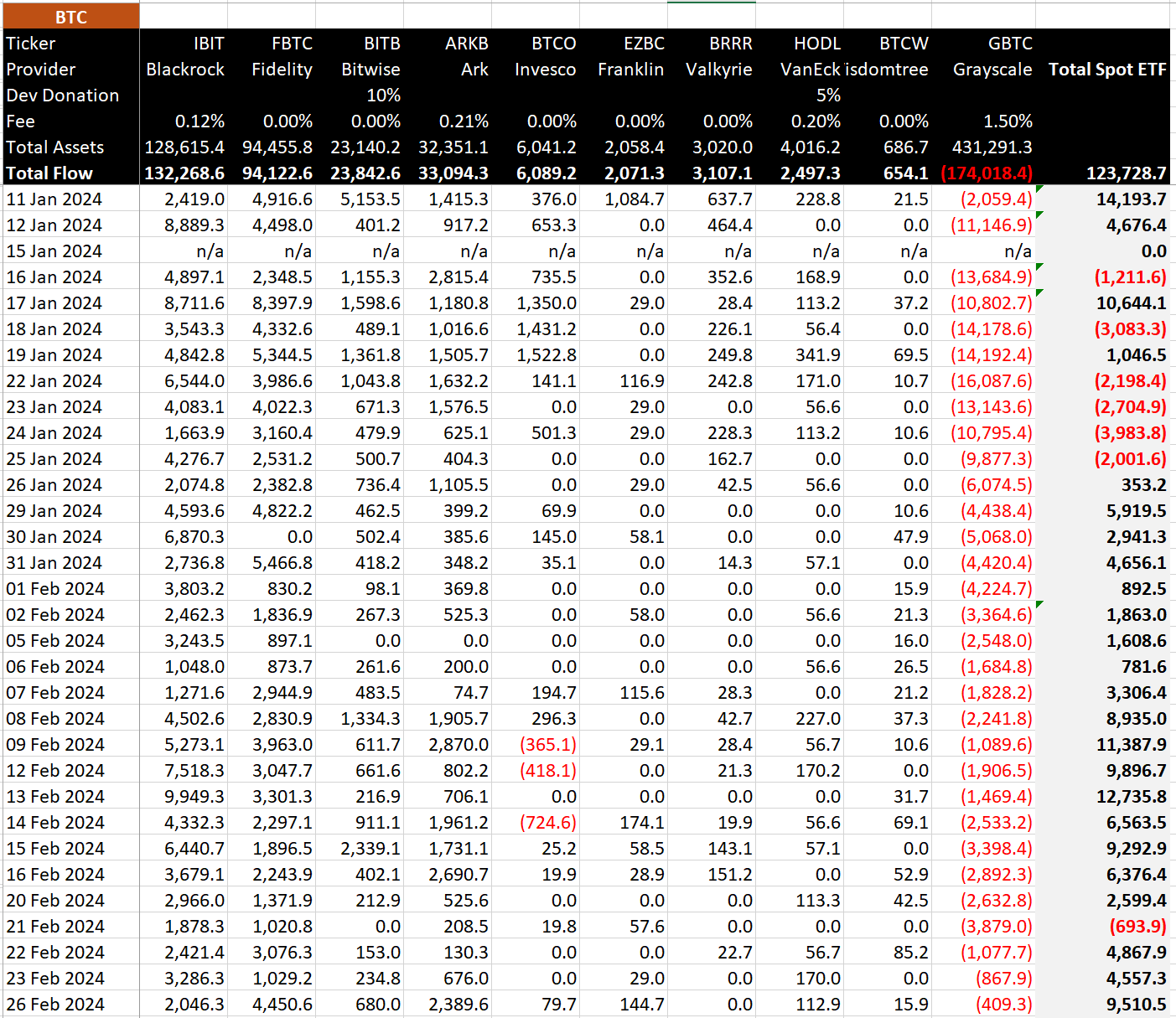

There is a notable surge in capital inflows into Bitcoin ETFs, a trend clearly highlighted by recent capital movements. BitMEX data shows that ETFs saw a massive net inflow of $520 million, or the equivalent of 9,510 BTC, on Feb. 26.

GBTC, once a favored choice among investors, continues to experience outflows with a record of $7.5 billion in total outflows. Interestingly, the outflow trend has been steadily dwindling over three consecutive trading days, dropping from $56 million to $22 million, according to BitMEX.

BitMEX data shows that Fidelity’s FBTC is experiencing a formidable upsurge, with a massive $243 million inflow on a single day, propelling their total net flows to an impressive $4.2 billion. Similarly, Ark Invest ARKB and BlackRock IBIT enjoyed strong inflow days, adding $131 million and $112 million, respectively, to their coffers.

This trend represents an aggregate net inflow of over $6 billion for all spot US ETFs or the equivalent amount of 123,729 BTC, according to Bitmex.

The post Fidelity leads Bitcoin ETFs 4th best day since launch reaching $6 billion total net inflows appeared first on CryptoSlate.