Bitcoin Price Correction Triggers $296 Million In Liquidations – Can BTC Still Hit ATH?

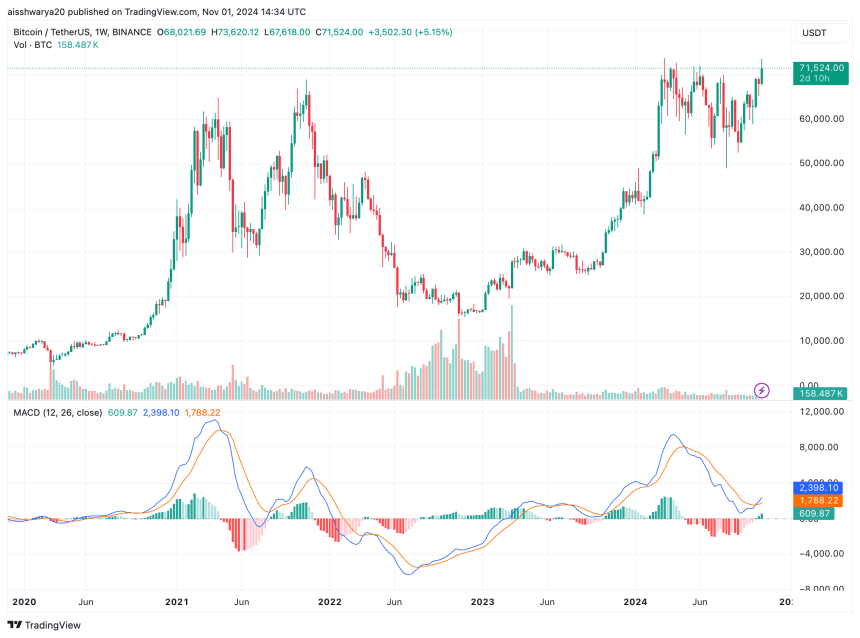

Bitcoin (BTC) has had a volatile 24 hours, hitting as low as $68,830 on the Binance crypto exchange before recovering some losses.

Liquidation Data At A Glance

Although BTC is trading close to its all-time high (ATH) value of $73,737, yesterday’s quick drop in price cast doubts on whether the top digital asset will be able to record a new ATH.

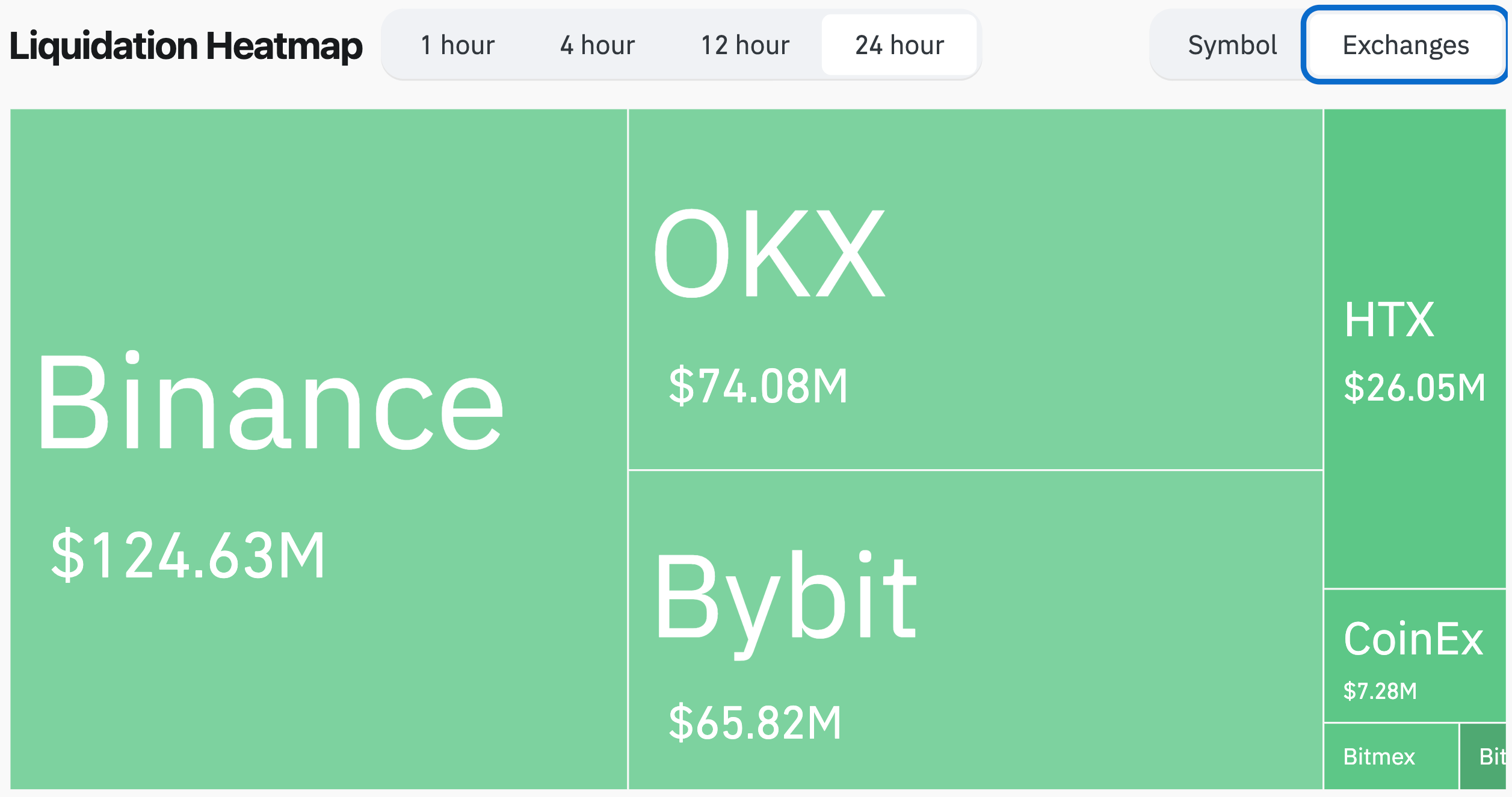

According to CoinGlass data from the crypto liquidations tracker, more than $296 million of active positions were liquidated in the last 24 hours.

Nearly 77% were long positions, indicating that traders were largely betting on BTC’s continued upward momentum. Binance saw the most liquidations at $124 million, followed by OKX with $74 million and Bybit with $65 million.

In digital assets, Bitcoin led with over $97 million worth of positions liquidated, followed by Ethereum (ETH) at $47 million, and Solana at nearly $17 million.

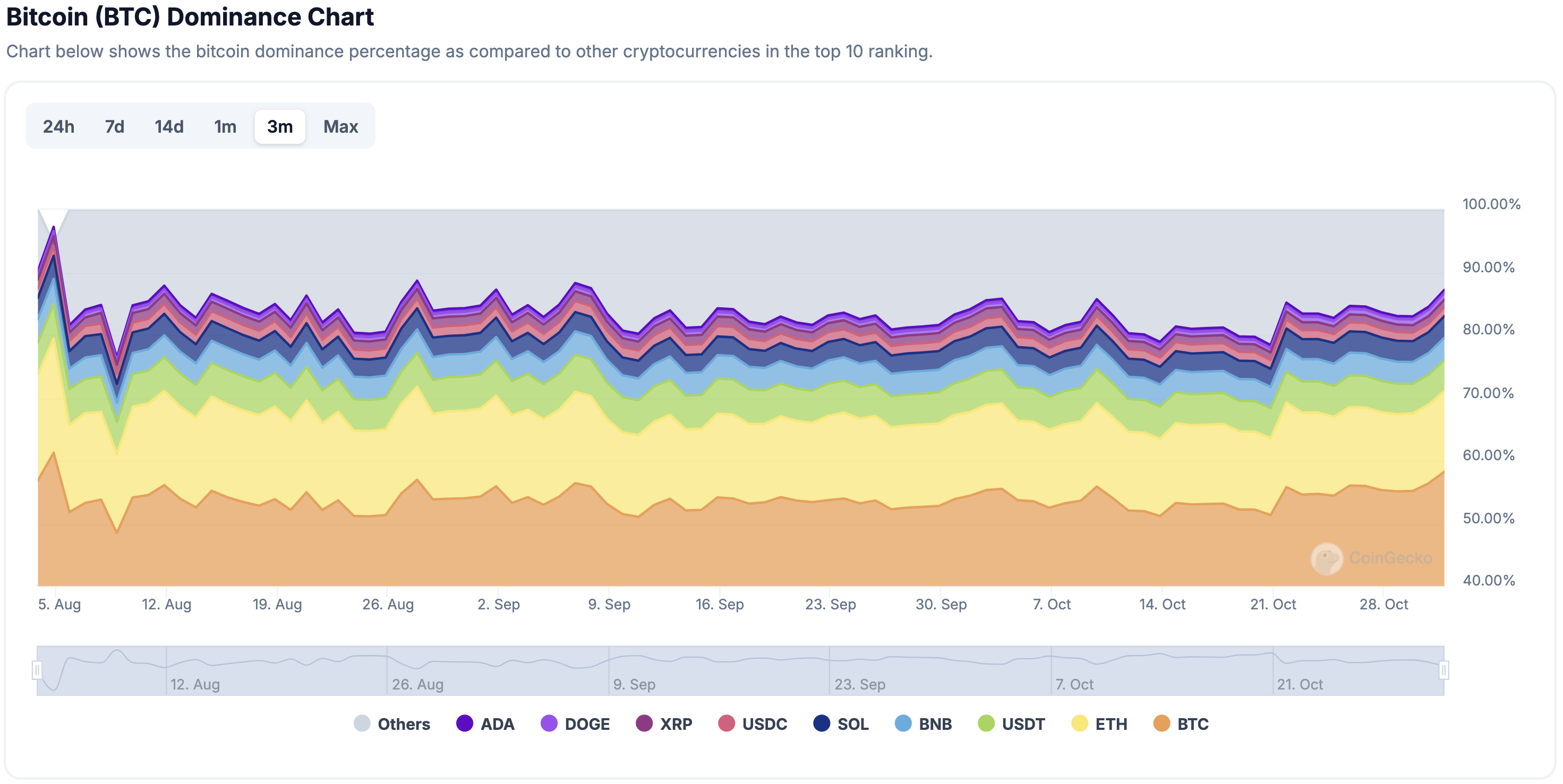

With yesterday’s slump, the total crypto market cap has shrunk by about 3.5%, currently valued at $2.48 trillion. It is worth noting that although BTC is close to its ATH, the total crypto market cap is still considerably far from its ATH of $2.98 trillion recorded in November 2021.

The gap between BTC’s performance and the overall market cap suggests that altcoins have not kept pace with BTC’s recent gains, contributing to the disparity. This could also indicate a cautious investor sentiment, favoring BTC over altcoins during uncertain periods.

At the same time, it suggests that there is still a lot of room for altcoins to grow, which could tempt some more risk-seeking investors to accumulate altcoins in hopes of extraordinary gains relative to BTC.

That said, Bitcoin dominance – a metric that gauges the proportion of the overall crypto market cap commanded by BTC – is steadily climbing toward 60%. A higher BTC dominance could spell disaster for altcoins already trailing BTC in price action.

Can Bitcoin Still Hit ATH?

The question on the minds of crypto enthusiasts is whether BTC will achieve a new ATH during this rally. The answer is not straightforward.

Factors supporting a potential new ATH include the increased likelihood of pro-crypto US presidential candidate Donald Trump winning the election, the effects of BTC halving, increased inflows to BTC exchange-traded funds (ETF), and a low interest rate environment.

On the contrary, sentiment indicators like the Fear and Greed Index suggest the market is still in a ‘greed’ phase, hinting that there could be more pain for the market before the next leg up.

Regardless of the outcome, the crypto market will likely remain volatile in the coming days. However, long-term BTC holders do not appear fazed by this prospect, as profit-taking remained relatively muted when the digital asset crossed $71,000.

At press time, BTC trades at $71,524, up a modest 0.6% in the past 24 hours, with a reported market cap of $1.41 trillion.

Social Media Crypto Influencer MrBeast Accused of Profiting Over $23 Million Pump-and-Dump Scheme

HodlX Guest Post Submit Your Post

MrBeast, a prominent crypto influencer with 31.2 million followers, has found himself in a weird dispute after allegedly discovered to have made millions through the so-called crypto pump-and-dump scheme.

A popular blockchain analytics platform, Lookonchain, shared some significant revelations on the X platform, indicating that MrBeast profited more than $23 million by endorsing various low-cap tokens and later selling them.

Most of these cryptocurrencies have currently lost 90% of their value, with some of them rebranding after huge losses.

MrBeast allegedly invested only $100,000 in a project called SuperFarmDAO (now SuperVerse) and used his influence to pump the value of the project’s token, SUPER.

As per revelations, after promoting the token, MrBeast sold off his holdings, converting millions of dollars’ worth of SUPER into ETH, eventually profiting over $11.5 million.

MrBeast further engaged in a similar activity in other projects including ERN (Ethernity Chain), PMON (Protocol Monsters), STAK (Jigstack) and AIOZ (AIOZ Network) where he allegedly promoted and ultimately sold off his assets, making another total profit worth $8.7 million.

It remains unclear whether MrBeast intentionally faked his participation in these crypto projects or unknowingly participated in what has been considered a market manipulation scheme.

The accusations against MrBeast come amid current conversations within the crypto community concerning the detrimental effect of market manipulation activities on small tokens.

Many people in the crypto sector are distressed by such activities that weaken the value of crypto projects and even undermine the reputation of the entire industry.

In many cases, insiders and influencers develop hype around low-cap tokens, motivating retail investors to purchase them before selling off their own assets.

Influencers engaging in pump-and-dump schemes often target social media platforms and use complicated tactics to convince innocent investors to join.

In certain cases, they have impersonated prominent market analysts and renowned investment advisors to lure investors into the scheme.

Nicholas Otieno is a fintech writer specializing in cryptocurrency markets. Since 2019, he has written articles to educate readers about cryptocurrency and its substantial positive impact on global prosperity. Nicholas is a Bitcoin holder, believing firmly in its fundamentals.

Follow Us on Twitter Facebook Telegram

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/eliahinsomnia/Sensvector

The post Social Media Crypto Influencer MrBeast Accused of Profiting Over $23 Million Pump-and-Dump Scheme appeared first on The Daily Hodl.