XLM Price Risks Deep Correction as Social Buzz Fades and Bearish Crossover Looms

- XLM price has dropped 11% in a month and 4.2% in 24 hours, diverging from the broader crypto rally.

- Social dominance for Stellar collapsed nearly 70%, and a looming 50/200 EMA “death cross” hints at further downside.

- If $0.38 support breaks, price could slide to $0.36 and even $0.24; bulls need $0.43–$0.45 reclaimed to target $0.52 again.

Stellar hasn’t been moving in sync with the broader market lately. While most of crypto found some air in August, XLM went the other way. It’s down about 11% over the month and just in the last 24 hours, it slipped another 4.2%—worse than the market’s 2% dip. Traders are now asking the obvious: is recovery even possible here, or is Stellar lining up for fresh lows?

Social Signals Point South

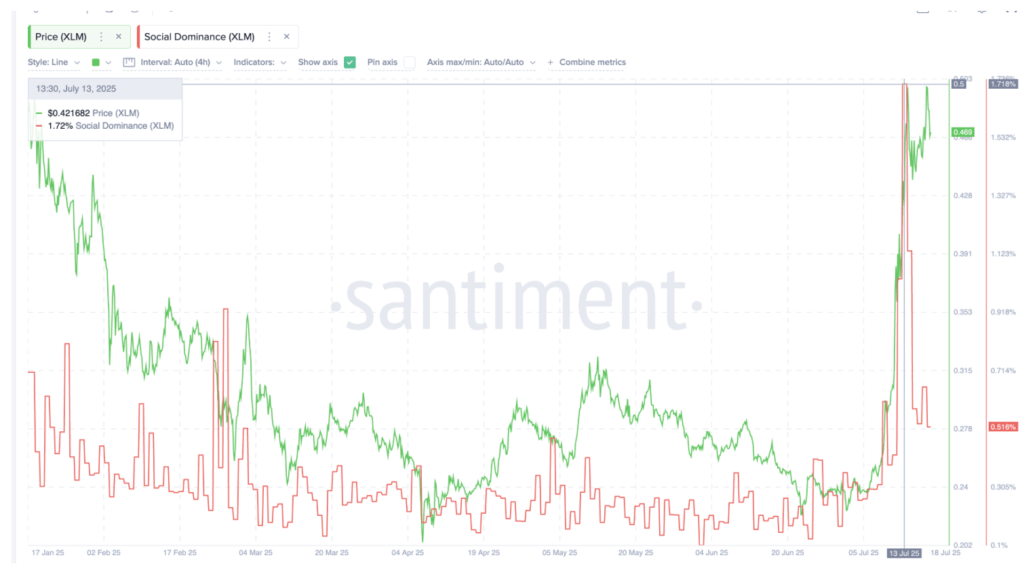

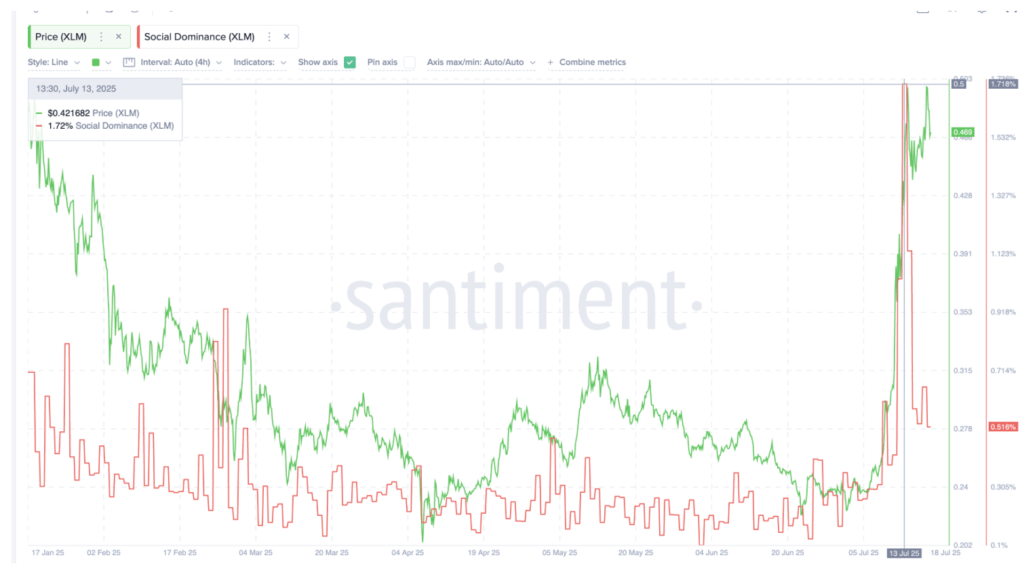

One of the first red flags comes from social dominance—basically, how much people are actually talking about a token compared to the rest of the market. For Stellar, that number has collapsed. Back on July 13, it was 1.71%. Today, just 0.51%. That’s nearly a 70% wipe-out in chatter.

History hasn’t been kind when this happens. In March, the same drop in social dominance was followed by a 30% plunge in price, from $0.35 to $0.25. Now, it feels like déjà vu. And the technical charts aren’t exactly disagreeing either.

Death Cross on the Horizon

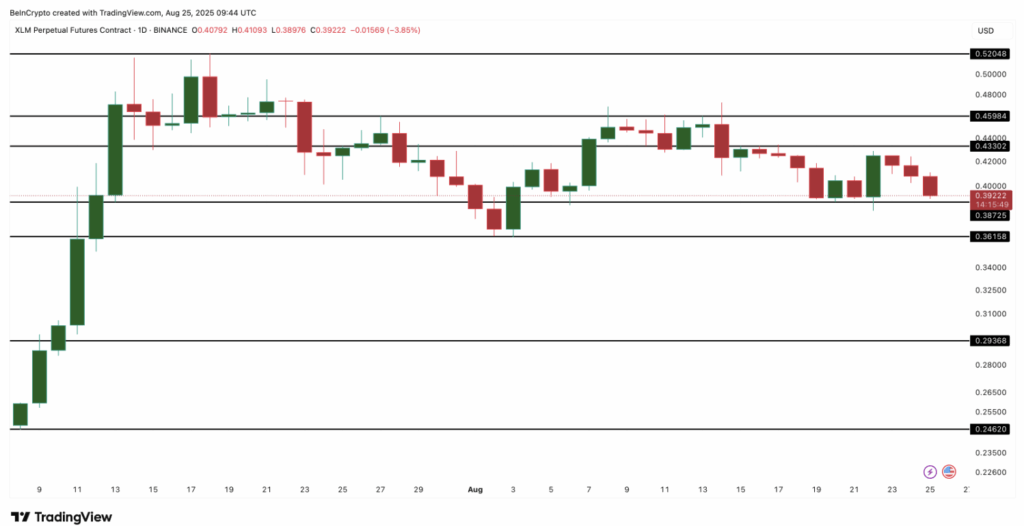

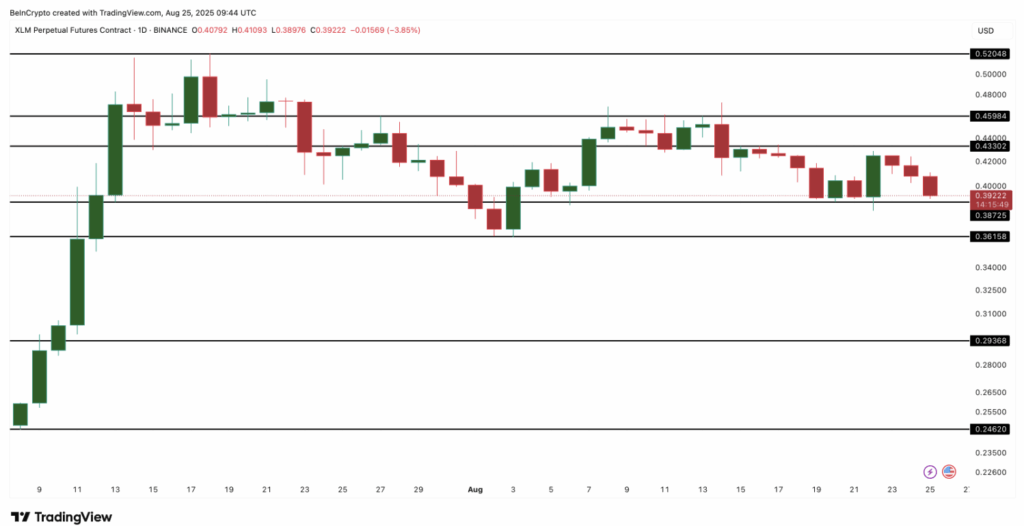

On the 4-hour chart, the 50 EMA is about to cross under the 200 EMA. Traders call this the “death cross,” and it’s rarely a good sign. It signals that short-term momentum is fading fast against the longer trend. If support gives way, these crossovers often spark sharper sell-offs, especially when the market’s already weak.

Put simply: social buzz is gone, momentum is fading, and if the death cross confirms, it might be the trigger that sends Stellar into deeper losses.

What Levels Matter Now

Right now, XLM is clinging around $0.39, just above thin support at $0.38. Lose that level, and things could unravel quickly. Next stop would be $0.36, and from there, a slide down to $0.24 isn’t far-fetched at all—that’s nearly a 40% correction from here.

For bulls to flip the script, they’d need to push Stellar back above $0.43–$0.45. That would open the door to retesting $0.52, which it hit earlier. But without that recovery, the downside case looks stronger, and the looming crossover could be the nail in the coffin.

The post XLM Price Risks Deep Correction as Social Buzz Fades and Bearish Crossover Looms first appeared on BlockNews.

Read More

Pudgy Penguins (PENGU) Inches Toward Breakout as Bull Flag Takes Shape

XLM Price Risks Deep Correction as Social Buzz Fades and Bearish Crossover Looms

- XLM price has dropped 11% in a month and 4.2% in 24 hours, diverging from the broader crypto rally.

- Social dominance for Stellar collapsed nearly 70%, and a looming 50/200 EMA “death cross” hints at further downside.

- If $0.38 support breaks, price could slide to $0.36 and even $0.24; bulls need $0.43–$0.45 reclaimed to target $0.52 again.

Stellar hasn’t been moving in sync with the broader market lately. While most of crypto found some air in August, XLM went the other way. It’s down about 11% over the month and just in the last 24 hours, it slipped another 4.2%—worse than the market’s 2% dip. Traders are now asking the obvious: is recovery even possible here, or is Stellar lining up for fresh lows?

Social Signals Point South

One of the first red flags comes from social dominance—basically, how much people are actually talking about a token compared to the rest of the market. For Stellar, that number has collapsed. Back on July 13, it was 1.71%. Today, just 0.51%. That’s nearly a 70% wipe-out in chatter.

History hasn’t been kind when this happens. In March, the same drop in social dominance was followed by a 30% plunge in price, from $0.35 to $0.25. Now, it feels like déjà vu. And the technical charts aren’t exactly disagreeing either.

Death Cross on the Horizon

On the 4-hour chart, the 50 EMA is about to cross under the 200 EMA. Traders call this the “death cross,” and it’s rarely a good sign. It signals that short-term momentum is fading fast against the longer trend. If support gives way, these crossovers often spark sharper sell-offs, especially when the market’s already weak.

Put simply: social buzz is gone, momentum is fading, and if the death cross confirms, it might be the trigger that sends Stellar into deeper losses.

What Levels Matter Now

Right now, XLM is clinging around $0.39, just above thin support at $0.38. Lose that level, and things could unravel quickly. Next stop would be $0.36, and from there, a slide down to $0.24 isn’t far-fetched at all—that’s nearly a 40% correction from here.

For bulls to flip the script, they’d need to push Stellar back above $0.43–$0.45. That would open the door to retesting $0.52, which it hit earlier. But without that recovery, the downside case looks stronger, and the looming crossover could be the nail in the coffin.

The post XLM Price Risks Deep Correction as Social Buzz Fades and Bearish Crossover Looms first appeared on BlockNews.

Read More