Cardano Prepares for Another Push Toward $1

- Cardano [ADA] is testing the $1 resistance again after dropping to $0.86, with charts hinting at a possible move toward $1.20 if momentum holds.

- On-chain data is mixed: development activity has fallen, and transaction volume is down 90% from late 2024, though daily active addresses remain steady.

- Profit-taking risk is rising as more holders sit on gains, but low dormant circulation and a recent uptick in mean coin age suggest quiet accumulation.

Cardano [ADA] is once again circling the $1 psychological barrier, even as Bitcoin’s [BTC] latest pullback drags on. Since the weekend, BTC has slipped 4.6%, falling from $117K to around $111.5K as of August 25.

Over the same stretch, ADA has dropped roughly 6.6%, sliding from $0.93 to $0.86. Still, the daily chart paints a surprisingly bullish picture. Volume through August has held up well, and the structure suggests traders might not be done testing the $1 zone. If ADA can crack it this time, the Fibonacci levels hint at $1.20 as the next target.

Mixed On-Chain Signals

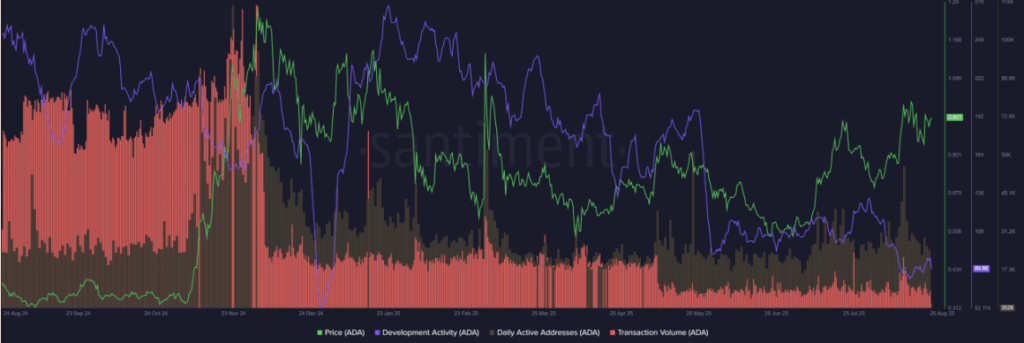

Cardano’s on-chain story is a bit more complicated. Development activity—an area where ADA usually outshines rivals—has been trending lower this year, sitting near 80 at press time. That’s still miles ahead of Ethereum’s 25, but the dip could spook long-term believers.

Transaction volume is an even bigger concern. The chain has seen two sharp declines since late 2024, with on-chain volume down about 90% compared to last November. And yet, daily active addresses have been remarkably steady throughout 2025, hinting that core usage hasn’t completely dried up.

Profits and Risks

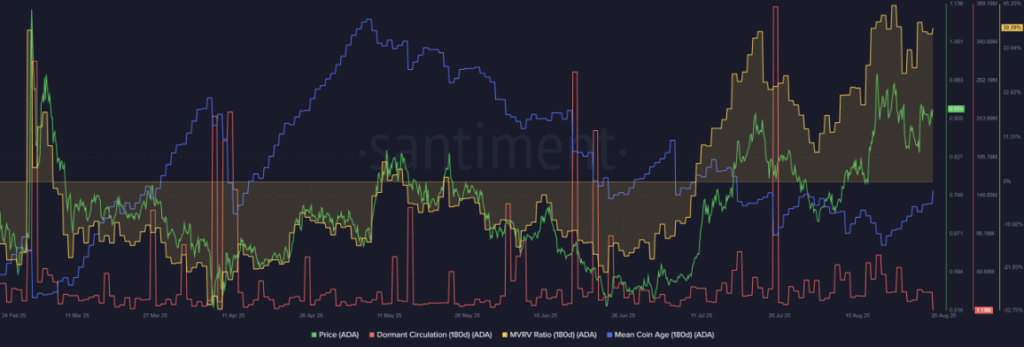

With ADA pressing back toward $1, more holders are sitting on gains. The 180-day MVRV ratio highlights this, showing a large slice of the network deep in profit. That always raises the risk of a round of profit-taking.

So far, though, that wave hasn’t arrived. Dormant circulation has stayed low in August, and one promising sign comes from the mean coin age (MCA). After months of decline, MCA has ticked upward in the past two weeks—a sign that investors might be quietly accumulating again.

The Road Ahead

Cardano is balancing between opportunity and caution. On one hand, charts and technicals point toward another $1 test and possibly higher. On the other, falling dev activity and weaker transaction volume put some weight on the bullish case. If accumulation keeps rising and BTC steadies, ADA may yet get the push it needs to finally flip $1 into support.

The post Cardano Prepares for Another Push Toward $1 first appeared on BlockNews.

Read More

ETH Price Analysis: Can Ethereum Recover After Slipping Below $4,200?

Cardano Prepares for Another Push Toward $1

- Cardano [ADA] is testing the $1 resistance again after dropping to $0.86, with charts hinting at a possible move toward $1.20 if momentum holds.

- On-chain data is mixed: development activity has fallen, and transaction volume is down 90% from late 2024, though daily active addresses remain steady.

- Profit-taking risk is rising as more holders sit on gains, but low dormant circulation and a recent uptick in mean coin age suggest quiet accumulation.

Cardano [ADA] is once again circling the $1 psychological barrier, even as Bitcoin’s [BTC] latest pullback drags on. Since the weekend, BTC has slipped 4.6%, falling from $117K to around $111.5K as of August 25.

Over the same stretch, ADA has dropped roughly 6.6%, sliding from $0.93 to $0.86. Still, the daily chart paints a surprisingly bullish picture. Volume through August has held up well, and the structure suggests traders might not be done testing the $1 zone. If ADA can crack it this time, the Fibonacci levels hint at $1.20 as the next target.

Mixed On-Chain Signals

Cardano’s on-chain story is a bit more complicated. Development activity—an area where ADA usually outshines rivals—has been trending lower this year, sitting near 80 at press time. That’s still miles ahead of Ethereum’s 25, but the dip could spook long-term believers.

Transaction volume is an even bigger concern. The chain has seen two sharp declines since late 2024, with on-chain volume down about 90% compared to last November. And yet, daily active addresses have been remarkably steady throughout 2025, hinting that core usage hasn’t completely dried up.

Profits and Risks

With ADA pressing back toward $1, more holders are sitting on gains. The 180-day MVRV ratio highlights this, showing a large slice of the network deep in profit. That always raises the risk of a round of profit-taking.

So far, though, that wave hasn’t arrived. Dormant circulation has stayed low in August, and one promising sign comes from the mean coin age (MCA). After months of decline, MCA has ticked upward in the past two weeks—a sign that investors might be quietly accumulating again.

The Road Ahead

Cardano is balancing between opportunity and caution. On one hand, charts and technicals point toward another $1 test and possibly higher. On the other, falling dev activity and weaker transaction volume put some weight on the bullish case. If accumulation keeps rising and BTC steadies, ADA may yet get the push it needs to finally flip $1 into support.

The post Cardano Prepares for Another Push Toward $1 first appeared on BlockNews.

Read More