Trump Calls Xi ‘Tough to Deal With’ Amid US-China Trade Strain

Share:

Trump Xi trade tensions have escalated once again after former President Donald Trump’s latest comments about Chinese President Xi Jinping on his Truth Social platform. The Republican leader’s blunt assessment of Xi being extremely difficult to negotiate with has intensified concerns about future US-China relations, and this could potentially affect China US tariff exemptions while also creating additional pressure on the United States dollar. At the time of writing, this development has sparked fresh BRICS news discussions amid growing regulatory uncertainty in global trade markets.

JUST IN:

— Watcher.Guru (@WatcherGuru) June 4, 2025President Trump says "I like President XI of China…but he is very tough and extremely hard to make a deal with." pic.twitter.com/l6OYLb5z80

Also Read: Trump Misleading on China Tariff Talks—Gold Price Dips Amid Chaos

How Trump’s Xi Remarks Intensify Trade Tensions and Impact USD

The former president’s characterization of Xi Jinping as extremely difficult to negotiate with has been interpreted by financial analysts as an early preview of what potential future trade policies might look like. These Trump Xi trade tensions comments suggest that any return to the negotiating table could prove particularly challenging for both nations, and also for global markets watching from the sidelines.

Trump stated on Truth Social:

“I like President XI of China, always have, and always will, but he is VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!”

Immediate Market Response

Currency markets have reacted to the heightened Trump Xi trade tensions with increased volatility in the United States dollar right now. Traders are currently assessing how these comments might influence future China US tariff exemptions and also broader trade relationships between the world’s two largest economies.

The statement comes at a particularly critical time when BRICS news discussions are gaining momentum, with member nations exploring alternatives to traditional Western-dominated trade structures. This regulatory uncertainty has created additional pressure on global financial markets, and it’s affecting investor sentiment across multiple sectors.

Historical Context and Future Implications

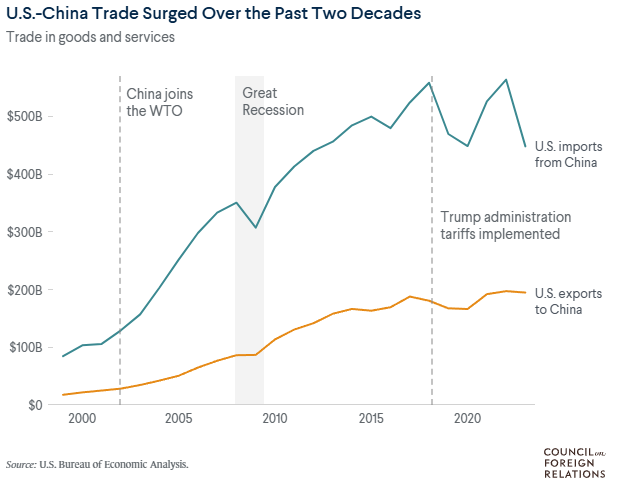

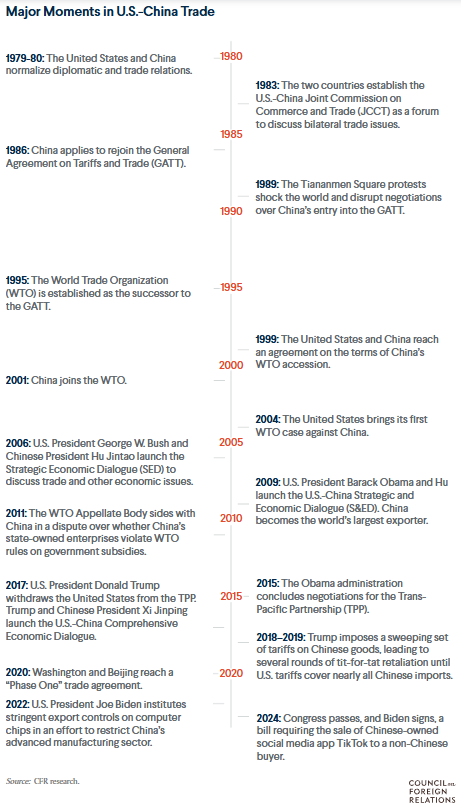

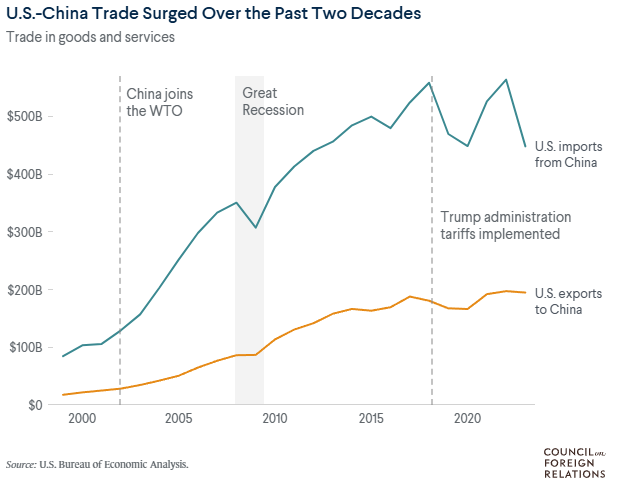

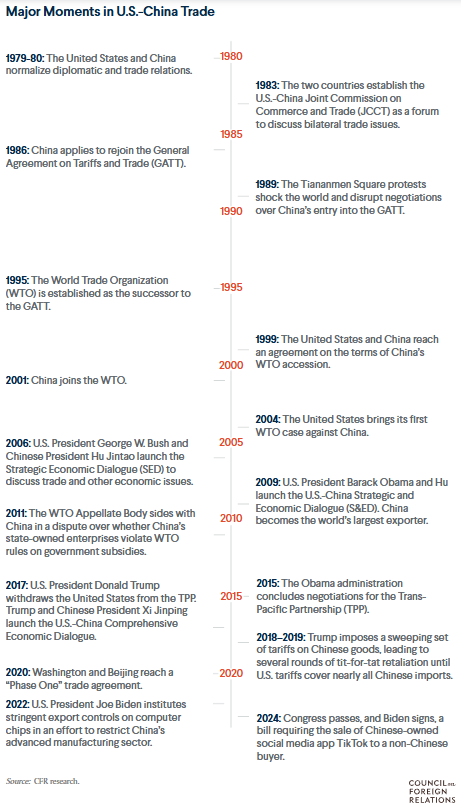

Trump Xi trade tensions have deep historical roots, dating back to their previous negotiations during Trump’s presidency. The Phase One trade deal represented a temporary resolution, but fundamental disagreements clearly persist based on Trump’s latest assessment of the Chinese leader.

The impact on China US tariff exemptions could be substantial if these tensions translate into actual policy changes down the road. Businesses are particularly concerned about the regulatory uncertainty that stems from unpredictable trade relationships between major powers, and this worry extends to supply chain planning.

Current BRICS news indicates that alternative economic partnerships are being explored more seriously as nations seek to reduce their exposure to US-China trade volatility. The United States dollar’s status as the dominant reserve currency faces ongoing challenges from these developments, and central banks are taking notice.

Also Read: De-dollarization: Trump’s 10% Tariffs Fuel Fragile US Dollar Future in Asia

Economic Implications Moving Forward

The persistence of Trump Xi trade tensions creates ongoing challenges for global economic stability right now. Market participants are monitoring how these developments might affect everything from supply chains to currency valuations, and also how they might impact investment flows.

Trump Calls Xi ‘Tough to Deal With’ Amid US-China Trade Strain

Share:

Trump Xi trade tensions have escalated once again after former President Donald Trump’s latest comments about Chinese President Xi Jinping on his Truth Social platform. The Republican leader’s blunt assessment of Xi being extremely difficult to negotiate with has intensified concerns about future US-China relations, and this could potentially affect China US tariff exemptions while also creating additional pressure on the United States dollar. At the time of writing, this development has sparked fresh BRICS news discussions amid growing regulatory uncertainty in global trade markets.

JUST IN:

— Watcher.Guru (@WatcherGuru) June 4, 2025President Trump says "I like President XI of China…but he is very tough and extremely hard to make a deal with." pic.twitter.com/l6OYLb5z80

Also Read: Trump Misleading on China Tariff Talks—Gold Price Dips Amid Chaos

How Trump’s Xi Remarks Intensify Trade Tensions and Impact USD

The former president’s characterization of Xi Jinping as extremely difficult to negotiate with has been interpreted by financial analysts as an early preview of what potential future trade policies might look like. These Trump Xi trade tensions comments suggest that any return to the negotiating table could prove particularly challenging for both nations, and also for global markets watching from the sidelines.

Trump stated on Truth Social:

“I like President XI of China, always have, and always will, but he is VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!”

Immediate Market Response

Currency markets have reacted to the heightened Trump Xi trade tensions with increased volatility in the United States dollar right now. Traders are currently assessing how these comments might influence future China US tariff exemptions and also broader trade relationships between the world’s two largest economies.

The statement comes at a particularly critical time when BRICS news discussions are gaining momentum, with member nations exploring alternatives to traditional Western-dominated trade structures. This regulatory uncertainty has created additional pressure on global financial markets, and it’s affecting investor sentiment across multiple sectors.

Historical Context and Future Implications

Trump Xi trade tensions have deep historical roots, dating back to their previous negotiations during Trump’s presidency. The Phase One trade deal represented a temporary resolution, but fundamental disagreements clearly persist based on Trump’s latest assessment of the Chinese leader.

The impact on China US tariff exemptions could be substantial if these tensions translate into actual policy changes down the road. Businesses are particularly concerned about the regulatory uncertainty that stems from unpredictable trade relationships between major powers, and this worry extends to supply chain planning.

Current BRICS news indicates that alternative economic partnerships are being explored more seriously as nations seek to reduce their exposure to US-China trade volatility. The United States dollar’s status as the dominant reserve currency faces ongoing challenges from these developments, and central banks are taking notice.

Also Read: De-dollarization: Trump’s 10% Tariffs Fuel Fragile US Dollar Future in Asia

Economic Implications Moving Forward

The persistence of Trump Xi trade tensions creates ongoing challenges for global economic stability right now. Market participants are monitoring how these developments might affect everything from supply chains to currency valuations, and also how they might impact investment flows.