Bitcoin Resets Open Interest, Targets $100,000 After Holding Key Support – Details

Share:

Bitcoin (BTC) appears to be rebounding from its recent pullback after reaching a new all-time high (ATH) of $99,645 on November 22. Despite liquidations exceeding $500 million during the downturn, the event did not trigger the cascading sell-offs seen in previous market cycles.

Bitcoin Open Interest Resets: Is $100,000 Next?

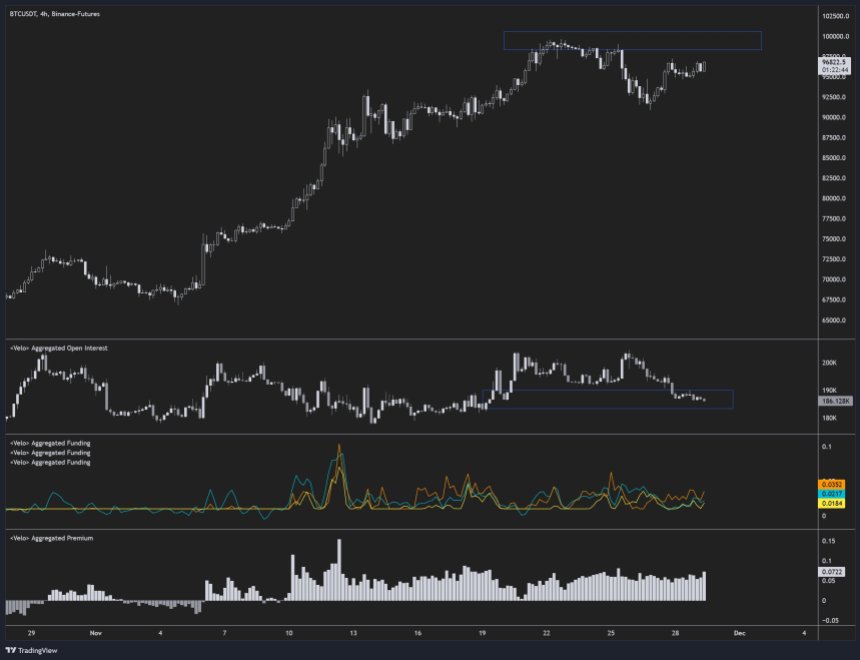

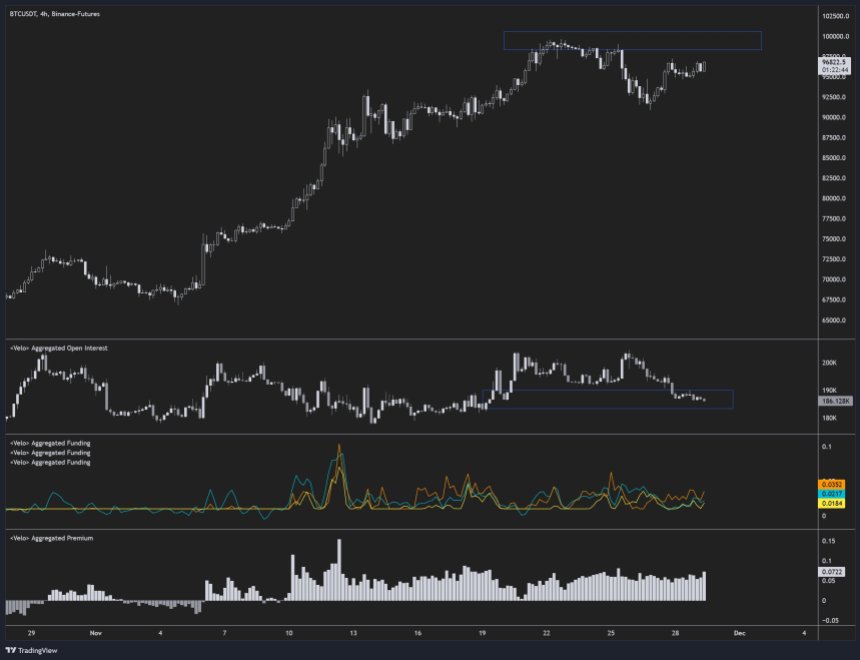

The flagship cryptocurrency seems ready to make another attempt at the $100,000 milestone. According to crypto analyst Byzantine General, the recent BTC price pullback reset open interest to levels last observed when the asset first touched $90,000.

Critically, Bitcoin held support around $90,875, signaling the potential establishment of a new consolidation phase before the next upward move. Byzantine General stated that BTC is poised to “take out the local highs and potentially take a stab at piercing 100k,” noting:

A lot of the passive supply already got taken out in the previous attempt, so there’s a pretty good chance that we will see 100k soon.

Byzantine General’s thoughts were echoed by prominent crypto trader Jelle, who said that $100,000 for BTC was “in sight.” The trader shared the following chart where BTC appears to be breaking through a downward-sloping trendline. At the same time, it is also forming an inverse head-and-shoulders pattern – typically a bullish indicator.

Another crypto analyst Daan Crypto Trades agreed that Bitcoin is within reaching distance of the $100,000 mark. As previously reported, some analysts believe that BTC is mirroring its price action from 2023, which could see the asset’s price reach as high as $200,000 by early 2025.

Healthy Corrections Essential To Fuel Long-Term Growth

Bitcoin was trading just above $69,000 on November 6 before surging past its previous ATH and reaching its current price of $97,150 – a staggering 40.8% gain in less than a month. However, such a rapid rally could signal an overextension.

A slight correction to the low $90,000 level might just have been what was required for BTC to have a more sustained price momentum going forward. Further, it gives time to retail investors – who have been missing from the current market rally – to enter the market and potentially increase the demand-side pressure.

The recent price pullback also cooled down the Bitcoin Fear & Greed Index from extreme greed to more moderate levels, setting the stage for a more organic and sustainable rally across the cryptocurrency market.

Speaking of long-term forecasts, Pantera Capital founder and managing partner Dan Morehead recently predicted an ambitious price target of $740,000 BTC by 2028. At press time, BTC trades at $97,150, up 1.4% in the past 24 hours.

Bitcoin Resets Open Interest, Targets $100,000 After Holding Key Support – Details

Share:

Bitcoin (BTC) appears to be rebounding from its recent pullback after reaching a new all-time high (ATH) of $99,645 on November 22. Despite liquidations exceeding $500 million during the downturn, the event did not trigger the cascading sell-offs seen in previous market cycles.

Bitcoin Open Interest Resets: Is $100,000 Next?

The flagship cryptocurrency seems ready to make another attempt at the $100,000 milestone. According to crypto analyst Byzantine General, the recent BTC price pullback reset open interest to levels last observed when the asset first touched $90,000.

Critically, Bitcoin held support around $90,875, signaling the potential establishment of a new consolidation phase before the next upward move. Byzantine General stated that BTC is poised to “take out the local highs and potentially take a stab at piercing 100k,” noting:

A lot of the passive supply already got taken out in the previous attempt, so there’s a pretty good chance that we will see 100k soon.

Byzantine General’s thoughts were echoed by prominent crypto trader Jelle, who said that $100,000 for BTC was “in sight.” The trader shared the following chart where BTC appears to be breaking through a downward-sloping trendline. At the same time, it is also forming an inverse head-and-shoulders pattern – typically a bullish indicator.

Another crypto analyst Daan Crypto Trades agreed that Bitcoin is within reaching distance of the $100,000 mark. As previously reported, some analysts believe that BTC is mirroring its price action from 2023, which could see the asset’s price reach as high as $200,000 by early 2025.

Healthy Corrections Essential To Fuel Long-Term Growth

Bitcoin was trading just above $69,000 on November 6 before surging past its previous ATH and reaching its current price of $97,150 – a staggering 40.8% gain in less than a month. However, such a rapid rally could signal an overextension.

A slight correction to the low $90,000 level might just have been what was required for BTC to have a more sustained price momentum going forward. Further, it gives time to retail investors – who have been missing from the current market rally – to enter the market and potentially increase the demand-side pressure.

The recent price pullback also cooled down the Bitcoin Fear & Greed Index from extreme greed to more moderate levels, setting the stage for a more organic and sustainable rally across the cryptocurrency market.

Speaking of long-term forecasts, Pantera Capital founder and managing partner Dan Morehead recently predicted an ambitious price target of $740,000 BTC by 2028. At press time, BTC trades at $97,150, up 1.4% in the past 24 hours.