Litecoin Pops After MEI Pharma Reveals Surprise $100M Crypto Play

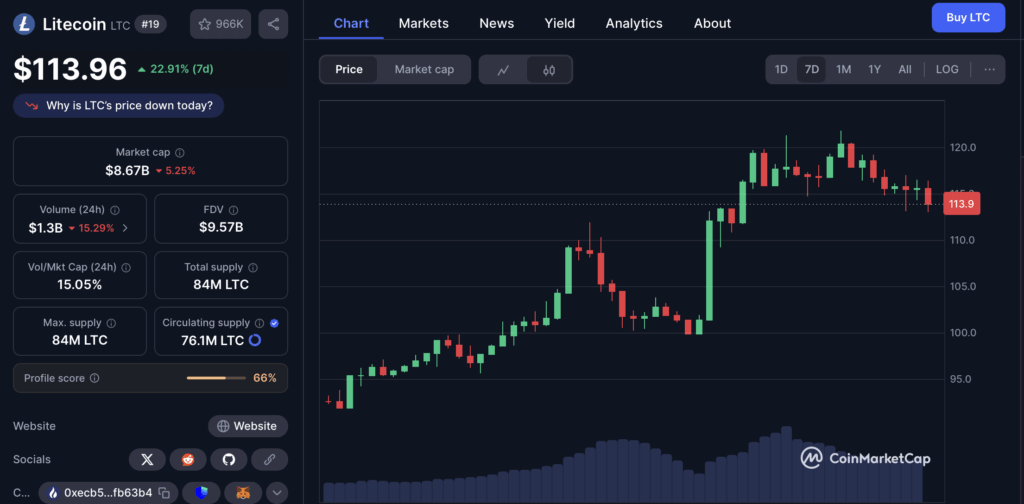

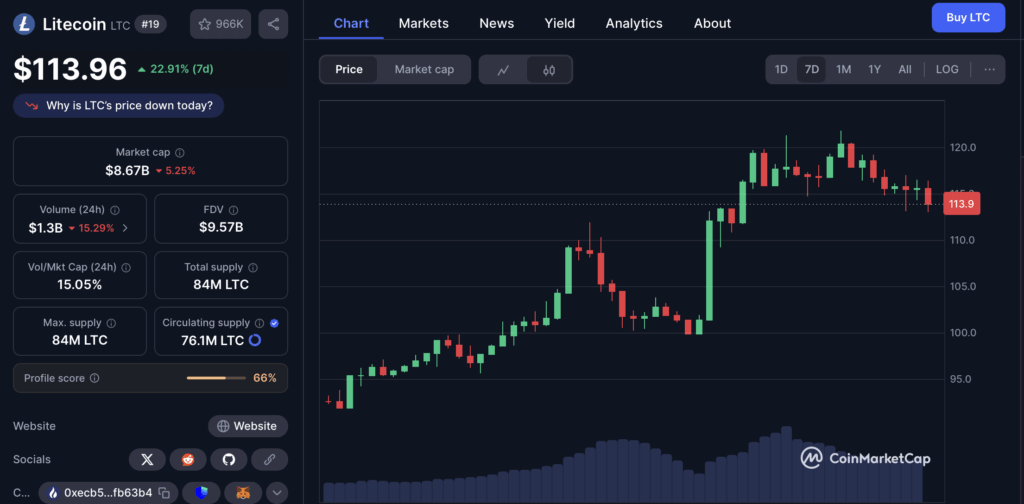

- MEI Pharma announced a $100M private placement to accumulate Litecoin and appointed its creator Charlie Lee to the board.

- This makes MEI the first major public company to build its treasury around LTC instead of BTC.

- The move helped push LTC up 12.6%, riding broader market momentum as Bitcoin topped $120K.

Litecoin’s been making waves again—up about 12.6% since late Friday, and folks are starting to pay closer attention. The spark? MEI Pharma just pulled a wild card, announcing a $100 million private placement to go all-in on a Litecoin accumulation strategy. Oh, and they also brought on none other than Charlie Lee, Litecoin’s creator, to their board. That turned some heads.

MEI Pharma Bets Big—And Weird

While most public companies dabbling in crypto go straight for Bitcoin, MEI’s move is a bit off the beaten path. They’re the first big-name stock-market-listed firm to say, “Nah, let’s stack Litecoin.” It’s bold, maybe risky, but definitely original. They’re following the footsteps of giants like MicroStrategy and Trump Media—just… with a different token.

This all came right before Trump Media made its own splash, announcing another $2 billion in Bitcoin buys. Yeah, billion. So Litecoin’s sudden pump? Makes a bit more sense now.

The Crypto Hype Cycle Is Spinning Again

Bitcoin’s been on fire lately, crossing $120K and breaking records. That hype usually spills over to altcoins, and Litecoin’s no exception. Lawmakers in the U.S. are eyeing regulatory frameworks to bring crypto closer to mainstream finance, which has added fuel to this whole rally.

That said, some folks are still skeptical. Litecoin tends to ride Bitcoin’s coattails more than it charts its own course. Honestly? Unless MEI’s strategy really pays off, Bitcoin probably stays the safer bet. But hey—crypto’s never been known for playing it safe.

The post Litecoin Pops After MEI Pharma Reveals Surprise $100M Crypto Play first appeared on BlockNews.

Litecoin Pops After MEI Pharma Reveals Surprise $100M Crypto Play

- MEI Pharma announced a $100M private placement to accumulate Litecoin and appointed its creator Charlie Lee to the board.

- This makes MEI the first major public company to build its treasury around LTC instead of BTC.

- The move helped push LTC up 12.6%, riding broader market momentum as Bitcoin topped $120K.

Litecoin’s been making waves again—up about 12.6% since late Friday, and folks are starting to pay closer attention. The spark? MEI Pharma just pulled a wild card, announcing a $100 million private placement to go all-in on a Litecoin accumulation strategy. Oh, and they also brought on none other than Charlie Lee, Litecoin’s creator, to their board. That turned some heads.

MEI Pharma Bets Big—And Weird

While most public companies dabbling in crypto go straight for Bitcoin, MEI’s move is a bit off the beaten path. They’re the first big-name stock-market-listed firm to say, “Nah, let’s stack Litecoin.” It’s bold, maybe risky, but definitely original. They’re following the footsteps of giants like MicroStrategy and Trump Media—just… with a different token.

This all came right before Trump Media made its own splash, announcing another $2 billion in Bitcoin buys. Yeah, billion. So Litecoin’s sudden pump? Makes a bit more sense now.

The Crypto Hype Cycle Is Spinning Again

Bitcoin’s been on fire lately, crossing $120K and breaking records. That hype usually spills over to altcoins, and Litecoin’s no exception. Lawmakers in the U.S. are eyeing regulatory frameworks to bring crypto closer to mainstream finance, which has added fuel to this whole rally.

That said, some folks are still skeptical. Litecoin tends to ride Bitcoin’s coattails more than it charts its own course. Honestly? Unless MEI’s strategy really pays off, Bitcoin probably stays the safer bet. But hey—crypto’s never been known for playing it safe.

The post Litecoin Pops After MEI Pharma Reveals Surprise $100M Crypto Play first appeared on BlockNews.