Will Uniswap (UNI) Gain Stronger Traction After Its 5% Leap?

- Uniswap hovers around $8, surging over 5%.

- UNI’s daily trading volume has exploded by 21%.

The turbulent crypto market is erasing recent gains and pushing prices downward. Bitcoin has tumbled to $88.5K, and Ethereum is sliding toward $2.4K, yet Uniswap (UNI) has broken free from the downtrend with a 5.47% daily surge.

UNI has broken through the vital $8.30 and $8.48 resistances before climbing to the daily high of $8.53. The asset opened the day trading at $7.62. At the time of writing, Uniswap trades at $8.19 with its market cap reaching $4.91 billion.

Furthermore, the market has witnessed the liquidation of $640.61K worth of Uniswap during this period. Notably, the daily trading volume has reached $365 million.

Alternatively, the US Securities and Exchange Commission (SEC) is set to drop its multi-year investigation into Uniswap Labs. The SEC issued a Wells Notice last year, claiming that Uniswap Labs operated an unregistered securities exchange, engaged in an unregistered broker or issued an unregistered security.

Is UNI Gearing Up for a Bullish Surge or a Dip?

Uniswap lies within the broader bearish phase. The price might test the nearby support at $8.09. Mounting selling pressure could lead UNI’s price to a gradual drop toward the $7 mark. A bigger drop might open the gates for a sharper fall.

Assuming that UNI bulls turned the tide against the bearish momentum, it will likely retest the $8.31 resistance. Should the altcoin stay on its upward trajectory, Uniswap could touch the long-sought $9 mark and eye further gains.

UNI’s Moving Average Convergence Divergence (MACD) line and signal line are found beneath the zero line. This bearish crossover indicates a strong downtrend and infers continued selling pressure unless a bullish crossover occurs.

Moreover, the Chaikin Money Flow (CMF) indicator of Uniswap is positioned at -0.00. It signals a balance between buying and selling pressure—without a clear directional bias. Meanwhile, the daily trading volume has increased by over 21.94%.

In addition, the trading window of UNI exhibits the Bull Bear Power reading at -0.1133 suggesting the bearish momentum is slightly stronger. The asset is in a weak bearish zone, as the daily relative strength index (RSI) is resting at 41.20.

Pi Network (PI) Hits an ATH: Can the Price Reach $10 This Year?

TL;DR

- PI surged by double digits in the past day, with predictions of a potential Binance listing pushing the token’s price to uncharted territory in the following months.

- Some of the exchanges that have already embraced the asset include Bitget, OKX, and MEXC, while Bybit’s CEO labeled Pi Network a scam.

PI on the Run

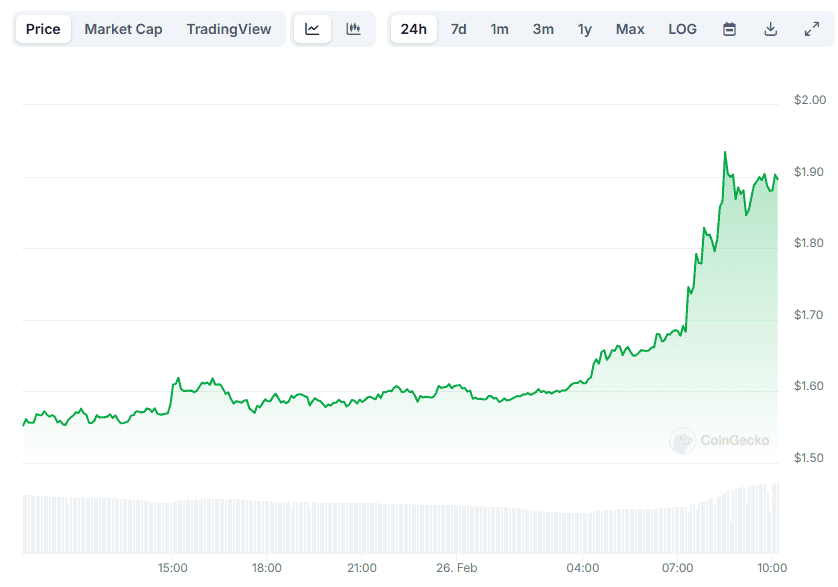

Contrary to the crypto market crash observed in the past few days, the native token of Pi Network – PI – continues to chart substantial gains. Several hours ago, its price hit a new peak of over $1.90 (per CoinGecko’s data) before settling at its current $1.89. This represents an impressive 21% increase on a daily scale.

PI has been the talk of the town for a while now, and many industry participants noticed its solid performance. Some envisioned the ongoing condition could be the starting point of a major bull run.

The X user GEM HUNTER predicted the valuation could soar to as high as $10 by the end of April. The crypto enthusiast based their forecast on the potential support coming from Binance.

The world’s largest cryptocurrency exchange recently held a community vote to determine whether its users would want to see the asset available for trading on its platform. The results will become official on February 27, with over 85% of the voters clicking the “yes” option so far.

Justin Wu also believes that the possibility of a Binance listing could benefit the token. The market observer noted that PI has outperformed well-known cryptocurrencies like Bitcoin (BTC), Solana (SOL), and Ethereum (ETH) lately, claiming that “Binance & Pi Day is coming.”

“If anything, it’s time to shine and gain attention at this moment. It’s PiTime.”

It is worth mentioning that some popular crypto exchanges, such as Bitget, OKX, and MEXC, have already allowed trading services with PI.

Scam or Not?

Pi Network is undoubtedly among the hottest topics in the crypto space, but it has also been the subject of huge controversy. The project has been quite unclear about certain developments over the years, and its constant delays and extensions have frustrated many community members.

One of the critics is Bybit’s CEO – Ben Zhou – who recently described Pi Network as a scam, assuring that the exchange will not list the PI token.

Interestingly enough, his entity became a victim of a major multi-billion dollar hack shortly after his bashing comments. The X user Crypto King noted the incident’s timing and PI’s subsequent price increase, hinting at a potential connection. “Connect the dots,” they mysteriously stated on the social media platform.

The post Pi Network (PI) Hits an ATH: Can the Price Reach $10 This Year? appeared first on CryptoPotato.