Bitcoin miners outshine Bitcoin in market rebound

Share:

Quick Take

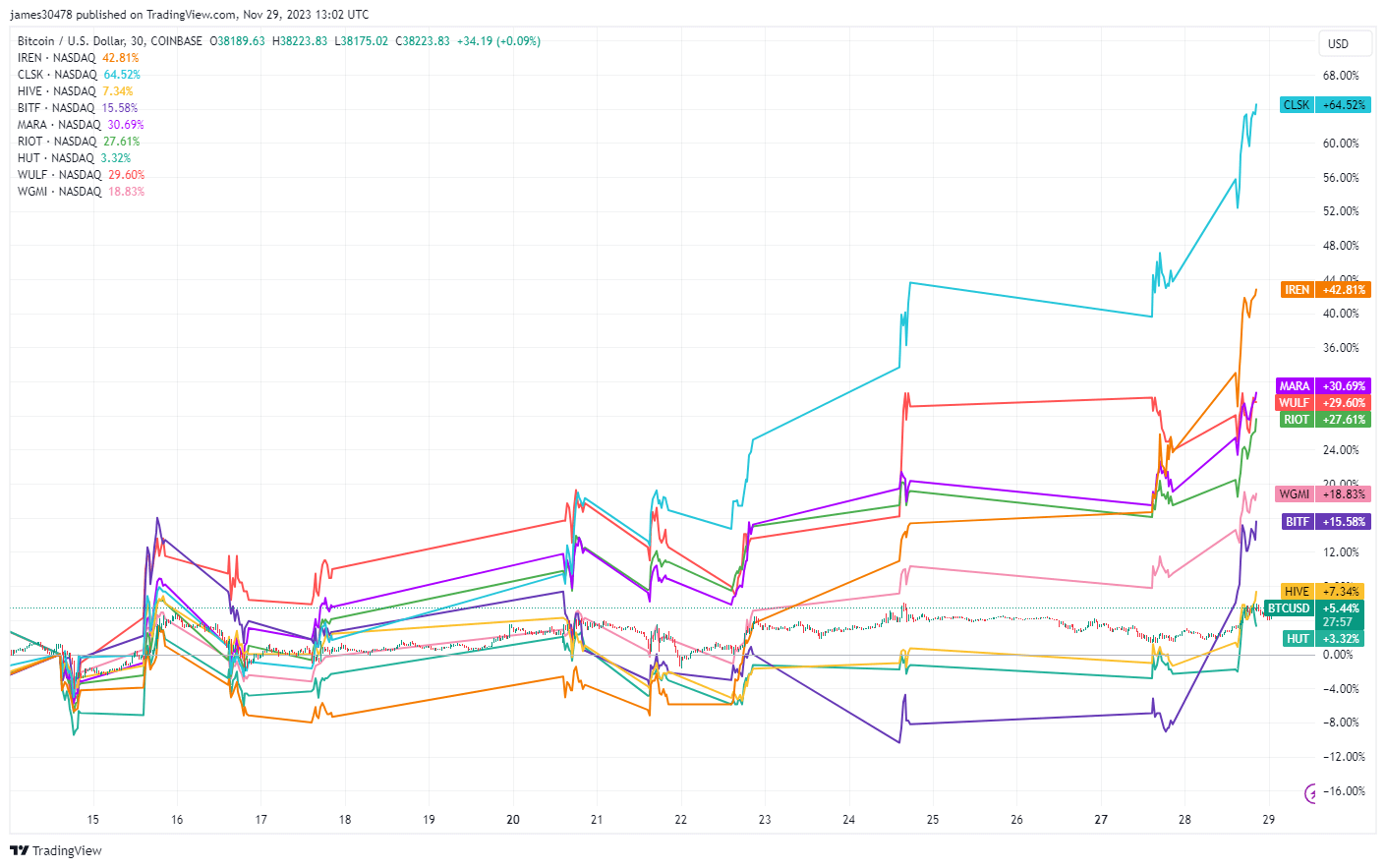

Over the past half-year, a notable divergence was observed between Bitcoin and the prices of Bitcoin mining stocks. However, the past fortnight has witnessed a remarkable turnaround in this trajectory.

Bitcoin has appreciated by a modest 5.37%. Here’s how various Bitcoin mining stocks have performed:

| Bitcoin Miner | % |

|---|---|

| CLSK | 65% |

| IREN | 42% |

| MARA | 31% |

| WULF | 30% |

| RIOT | 28% |

| WGMI | 19% |

| HIVE | 7% |

| HUT | 3% |

Source: Trading View

Following CryptoSlate’s posting of the divergence, Bitcoin has appreciated by a modest 5.37%. Nevertheless, the real story lies in the resurgence of Bitcoin mining stocks, with the majority posting double-digit growth.

Cleanspark (CLSK), a standout performer, soared by 65%, followed by IREN, which increased by 42%. Meanwhile, MARA, WULF, and RIOT exhibited robust growth with increases of 31%, 30%, and 28% respectively. WGMI and HIVE slightly lagged yet still posted healthy gains of 19% and 7%. The sole outlier was Hut 8 (HUT), which experienced a modest 3% uptick.

In addition, on Nov.22, CryptoSlate identified a disparity between the gold miners’ ETF, GDX, and spot gold prices, with GDX seemingly trailing behind. Since that observation, gold has escalated toward its all-time high, while GDX has experienced a significant uptick of 7%.

This reversal indicates a promising upward price discovery for Bitcoin mining companies, signaling potential investor confidence in the sector’s profitability.

The post Bitcoin miners outshine Bitcoin in market rebound appeared first on CryptoSlate.

Bitcoin miners outshine Bitcoin in market rebound

Share:

Quick Take

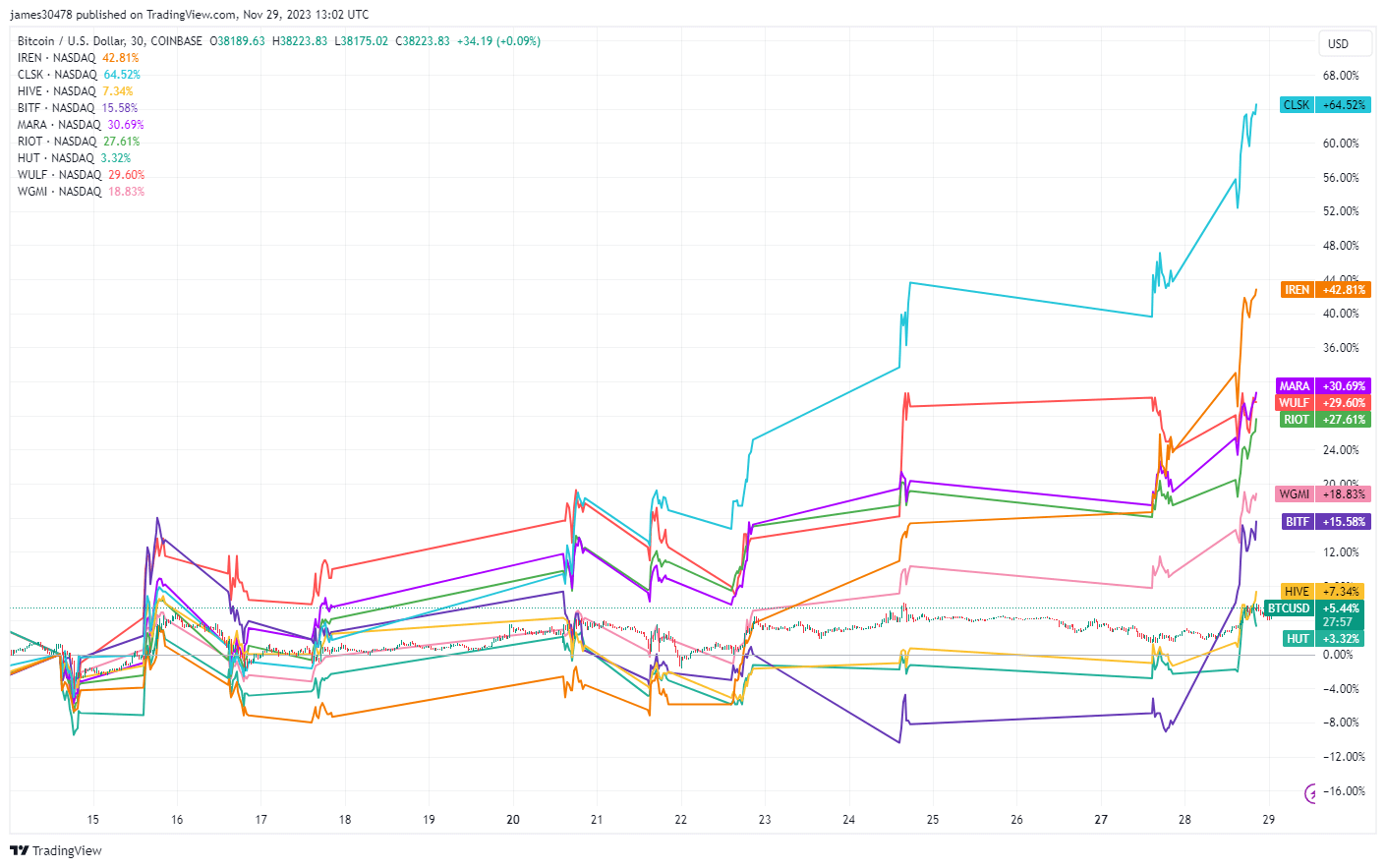

Over the past half-year, a notable divergence was observed between Bitcoin and the prices of Bitcoin mining stocks. However, the past fortnight has witnessed a remarkable turnaround in this trajectory.

Bitcoin has appreciated by a modest 5.37%. Here’s how various Bitcoin mining stocks have performed:

| Bitcoin Miner | % |

|---|---|

| CLSK | 65% |

| IREN | 42% |

| MARA | 31% |

| WULF | 30% |

| RIOT | 28% |

| WGMI | 19% |

| HIVE | 7% |

| HUT | 3% |

Source: Trading View

Following CryptoSlate’s posting of the divergence, Bitcoin has appreciated by a modest 5.37%. Nevertheless, the real story lies in the resurgence of Bitcoin mining stocks, with the majority posting double-digit growth.

Cleanspark (CLSK), a standout performer, soared by 65%, followed by IREN, which increased by 42%. Meanwhile, MARA, WULF, and RIOT exhibited robust growth with increases of 31%, 30%, and 28% respectively. WGMI and HIVE slightly lagged yet still posted healthy gains of 19% and 7%. The sole outlier was Hut 8 (HUT), which experienced a modest 3% uptick.

In addition, on Nov.22, CryptoSlate identified a disparity between the gold miners’ ETF, GDX, and spot gold prices, with GDX seemingly trailing behind. Since that observation, gold has escalated toward its all-time high, while GDX has experienced a significant uptick of 7%.

This reversal indicates a promising upward price discovery for Bitcoin mining companies, signaling potential investor confidence in the sector’s profitability.

The post Bitcoin miners outshine Bitcoin in market rebound appeared first on CryptoSlate.