Coinbase Warns Canada Risks Losing Global Economic Edge Without Crypto Reforms

Canada is approaching a pivotal federal election, and the future of its crypto industry hangs in the balance.

In light of this, Coinbase is sounding the alarm that unless Canada swiftly implements clear, innovation-friendly regulations, it risks falling behind its international counterparts.

The exchange’s Canadian country director, Lucas Matheson, emphasized in a blog post that while Canada has been a leader in the crypto space, the lack of proactive policymaking presents a danger.

Crypto is Growing In the Hands of Retail in Canada

A growing number of Canadians are already engaged with crypto. According to Coinbase, an estimated five million Canadians hold digital assets, and public sentiment strongly favors financial reform.

Furthermore, 86% of Canadians believe their financial system needs modernization, with many perceiving it as unfair (80%) and out of touch (76%).

If the cryptocurrency industry were more regulated, nearly a third (29%) would be more inclined to invest in it.

In fact, a report from MoonPay shows that over 90% of its Canadian customers choose to buy crypto.

These numbers highlight a pressing need for the next federal government to embrace regulatory changes that foster financial innovation.

However, regulatory roadblocks have already driven several major exchanges out of Canada, particularly due to stringent policies on stablecoins and trading platforms.

The looming election presents a rare opportunity for a new administration to implement reforms that support crypto adoption and position Canada as a leader in the global digital asset economy.

Coinbase’s Call for Regulatory Reform

Coinbase has laid out a detailed proposal urging the incoming government to take decisive action within the first 100 days of its tenure.

The company’s recommendations include establishing a government crypto task force.

This group would bring together industry leaders from the public and private sectors alongside academic experts to create a national crypto strategy and a coherent regulatory framework.

Another key recommendation is the creation of a Bitcoin reserve. With countries like the United States exploring strategic Bitcoin reserves, Coinbase encourages Canada to follow suit.

Another crucial point concerns regulatory clarity on stablecoins. Coinbase argues that stablecoins have the potential to revolutionize payment infrastructure by enabling faster, cheaper, and more efficient transactions.

The company also stresses the importance of clearly defining digital assets. The lack of standardized classification is a major challenge in Canada’s crypto adoption.

Canada’s energy resources also present a unique opportunity for crypto mining. The country has some of the cheapest energy in the world, making it an ideal location for large-scale crypto mining operations.

Coinbase suggests policy adjustments that would make it easier for Canadians to develop crypto and AI data centers, potentially attracting billions in investment.

Finally, Coinbase calls for updated regulations that would allow banks to safely hold and use crypto, integrate digital asset management into banking services, and ensure that financial institutions do not deny essential services to Web3 businesses.

Canada’s Crypto Future

Despite regulatory challenges, Coinbase remains committed to the Canadian market.

In an exclusive interview with Cryptonews last December, Lucas Matheson highlighted Canada’s strong crypto awareness and relatively clear regulatory framework compared to other jurisdictions.

He emphasized that Coinbase’s registration as a Restricted Dealer with the Canadian Securities Administrators in April 2024 was a significant step in legitimizing crypto operations in the country.

“Canada is actually quite far ahead in terms of regulatory clarity,” Matheson stated, noting that regulatory frameworks have provided a stable foundation for crypto exchanges to operate.

However, he acknowledged that additional reforms are necessary to ensure continued growth and adoption.

Looking forward, whether the next government embraces Coinbase’s recommendations or maintains the status quo, the coming months will determine its fate.

The post Coinbase Warns Canada Risks Losing Global Economic Edge Without Crypto Reforms appeared first on Cryptonews.

GTA 6: Should You Invest in TTWO Stock Before The Game’s Release?

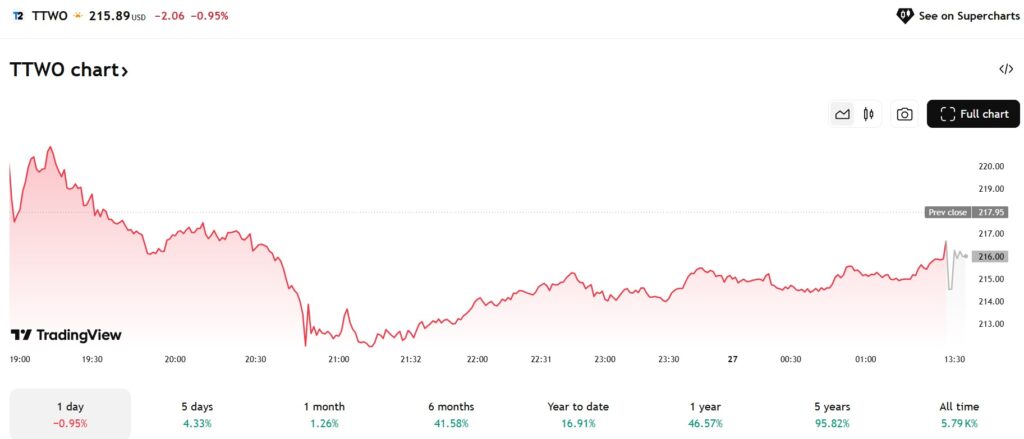

Take-Two Interactive stock (NASDAQ: TTWO), the parent company of Rockstar Games which publishes GTA 6 is up nearly 17% year-to-date. It opened Thursday’s bell at $215 and is trading sideways in the charts. TTWO entered 2025 trading at the $183 level and hit a yearly high of $216 in mid-February. It has relatively moved sideways in the indices and the prices have been stable for over a month.

Also Read: PEPE at Launch vs. Today: What Would a $500 Investment Look Like?

Should You Buy TTWO Before GTA 6 Releases?

Take-Two Interactive stock could gain the most on the heels of the GTA 6 release as it will be the company’s biggest launch. The gaming world has been eagerly waiting for its release for over a decade and the enthusiasm among fans remains high. TTWO could sustainably scale up in the charts when the game is about to be launched worldwide. The first trailer released in December 2023 confirmed that the game will be out sometime in 2025.

Also Read: Jio Financial Shares April 2025 Price Prediction

Taking an entry position now could be beneficial as the exact release date is yet to be confirmed. Once Take-Two Interactive officially announces the release date of GTA 6, the stock could begin to soar with newer investors making the most out of the development. It could ignite a bullish rally as TTWO will remain in the global news cycle for a prolonged period. The sales and revenue it earns will reflect positively in the charts.

GTA 6 could become the highest-grossing game ever making Take-Two Interactive earn billions in revenue from sales that could be positive to TTWO’s stock performance. Reports indicate that GTA 6 could earn $1 billion from worldwide sales on the first day of the game’s release. It took three days for its predecessor, GTA 5 to reach the $1 billion mark in 2013. The upcoming franchise could hit the target on the same day of its launch.

Also Read: GameStop to Follow Strategy’s Bitcoin Playbook: Will GME Stock Skyrocket or Crash?

Read More