Gold & Crypto Surge As Global Investors Flee the US Dollar

Share:

The dramatic dollar crash and gold surge are becoming the talk of financial circles as investors are desperately looking for safe places to put their money. Many global traders and institutions are actively moving away from the US currency due to growing concerns about America’s new trade policies. And this weaker dollar situation is actually creating quite a boost for alternative investments, especially precious metals and digital currencies.

Also Read: Bitcoin vs. Gold: How Safe-Haven Assets Reacted to the Tariff Announcement

How A Dollar Crash Fuels Gold Surge, Crypto Rise, And Capital Flight

Dollar’s Dramatic Decline Shocks Markets

The US dollar has lost almost 10 percent since Inauguration Day, and what’s really concerning is that over half of that decline has happened just this month after President Trump implemented the highest import taxes since 1909. This ongoing dollar crash and gold surge pattern is actually quite unusual because, normally, countries that impose tariffs tend to see their currencies get stronger, not weaker.

David Page, head of macro research for Axa Investment Managers in London, stated:

“The administration’s approach to policy and its lack of transparency in terms of motivations have all led to a distinct sense of unease in financial markets.”

At the time of writing, the weaker dollar situation is prompting many investors to look elsewhere as confidence in US economic policies continues to deteriorate rather quickly.

Gold Reaches Record Highs

Gold prices have just surpassed $3,300 for the first time ever, gaining around 2.7% in a single trading session and hitting a record high of $3,317.90 as the dollar crash continues to fuel the gold surge we’re seeing in markets today.

Ole Hansen, head of commodity strategy at Saxo Bank, explained:

“Trump’s trade war shows no signs of easing after the President ordered a probe into critical minerals, semiconductors and pharmaceuticals, sparking a fresh move towards safe haven assets and out of stocks.”

And just yesterday, ANZ actually raised its year-end gold price forecast to $3,600, which reflects the growing confidence many analysts have in precious metals during this period of global uncertainty and capital flight.

Also Read: De-dollarization: Goldman Sachs Predicts Grim Future for U.S. Dollar

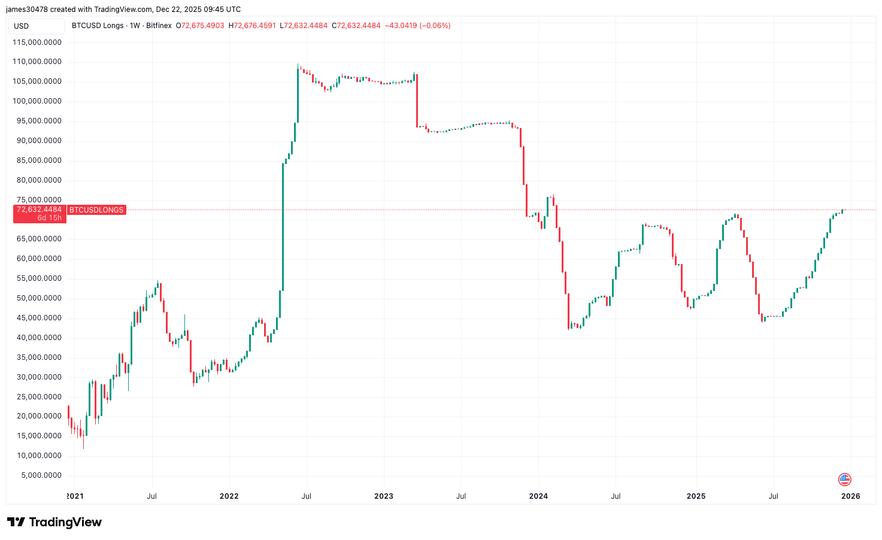

Crypto Benefits From Dollar Weakness

The cryptocurrency markets are also seeing some nice benefits from the ongoing dollar crash and gold surge phenomenon. More and more investors are looking to invest in crypto both as a potential hedge and as an alternative investment while the traditional financial markets are experiencing such significant turbulence.

US Treasury behavior has been particularly alarming recently. Just before Trump’s April 9 tariffs took effect, 30-year bond yields approached 5 percent—up from 4.4 percent just one week earlier. This kind of unusual market activity signals that there’s extraordinary pressure building on dollar-based assets and is driving global capital flight toward alternative investments.

Future of Dollar Dominance

Despite all these current challenges, the dollar remains deeply entrenched in the global financial system. Central banks around the world hold almost $7 trillion in dollar reserves, which is about triple the amount they hold in euros.

Paul Blustein, author of “King Dollar: The Past and Future of the World’s Dominant Currency,” stated:

“The dollar is incredibly entrenched in the global financial system in ways that no other currency is. Importing, exporting, borrowing, hedging, using the dollar for collateral, all of these things that major actors in the international economic system use the dollar for, would be so difficult to modify.”

However, the continued policy uncertainty is definitely threatening this dominant position. Safe haven assets including gold, the Swiss franc, Euro, and also select cryptocurrencies are gaining more and more attention as potential dollar alternatives in this time of market stress.

Hansen had this to say about the situation:

“We are upgrading (gold forecast) to $3,500 supported by a world in disarray where investors seek shelter amid recession fears, geopolitical tensions, fiscal debt concerns and central banks diversifying their holdings away from USD and dollar-based assets.”

Also Read: Here’s How Much $2,000 in Solana at Its All-Time Low Is Worth Today

Both gold and crypto markets continue to attract significant investment flows as the weaker dollar pushes more investors toward non-traditional assets during this unprecedented period of global capital flight from US-denominated investments.

Gold & Crypto Surge As Global Investors Flee the US Dollar

Share:

The dramatic dollar crash and gold surge are becoming the talk of financial circles as investors are desperately looking for safe places to put their money. Many global traders and institutions are actively moving away from the US currency due to growing concerns about America’s new trade policies. And this weaker dollar situation is actually creating quite a boost for alternative investments, especially precious metals and digital currencies.

Also Read: Bitcoin vs. Gold: How Safe-Haven Assets Reacted to the Tariff Announcement

How A Dollar Crash Fuels Gold Surge, Crypto Rise, And Capital Flight

Dollar’s Dramatic Decline Shocks Markets

The US dollar has lost almost 10 percent since Inauguration Day, and what’s really concerning is that over half of that decline has happened just this month after President Trump implemented the highest import taxes since 1909. This ongoing dollar crash and gold surge pattern is actually quite unusual because, normally, countries that impose tariffs tend to see their currencies get stronger, not weaker.

David Page, head of macro research for Axa Investment Managers in London, stated:

“The administration’s approach to policy and its lack of transparency in terms of motivations have all led to a distinct sense of unease in financial markets.”

At the time of writing, the weaker dollar situation is prompting many investors to look elsewhere as confidence in US economic policies continues to deteriorate rather quickly.

Gold Reaches Record Highs

Gold prices have just surpassed $3,300 for the first time ever, gaining around 2.7% in a single trading session and hitting a record high of $3,317.90 as the dollar crash continues to fuel the gold surge we’re seeing in markets today.

Ole Hansen, head of commodity strategy at Saxo Bank, explained:

“Trump’s trade war shows no signs of easing after the President ordered a probe into critical minerals, semiconductors and pharmaceuticals, sparking a fresh move towards safe haven assets and out of stocks.”

And just yesterday, ANZ actually raised its year-end gold price forecast to $3,600, which reflects the growing confidence many analysts have in precious metals during this period of global uncertainty and capital flight.

Also Read: De-dollarization: Goldman Sachs Predicts Grim Future for U.S. Dollar

Crypto Benefits From Dollar Weakness

The cryptocurrency markets are also seeing some nice benefits from the ongoing dollar crash and gold surge phenomenon. More and more investors are looking to invest in crypto both as a potential hedge and as an alternative investment while the traditional financial markets are experiencing such significant turbulence.

US Treasury behavior has been particularly alarming recently. Just before Trump’s April 9 tariffs took effect, 30-year bond yields approached 5 percent—up from 4.4 percent just one week earlier. This kind of unusual market activity signals that there’s extraordinary pressure building on dollar-based assets and is driving global capital flight toward alternative investments.

Future of Dollar Dominance

Despite all these current challenges, the dollar remains deeply entrenched in the global financial system. Central banks around the world hold almost $7 trillion in dollar reserves, which is about triple the amount they hold in euros.

Paul Blustein, author of “King Dollar: The Past and Future of the World’s Dominant Currency,” stated:

“The dollar is incredibly entrenched in the global financial system in ways that no other currency is. Importing, exporting, borrowing, hedging, using the dollar for collateral, all of these things that major actors in the international economic system use the dollar for, would be so difficult to modify.”

However, the continued policy uncertainty is definitely threatening this dominant position. Safe haven assets including gold, the Swiss franc, Euro, and also select cryptocurrencies are gaining more and more attention as potential dollar alternatives in this time of market stress.

Hansen had this to say about the situation:

“We are upgrading (gold forecast) to $3,500 supported by a world in disarray where investors seek shelter amid recession fears, geopolitical tensions, fiscal debt concerns and central banks diversifying their holdings away from USD and dollar-based assets.”

Also Read: Here’s How Much $2,000 in Solana at Its All-Time Low Is Worth Today

Both gold and crypto markets continue to attract significant investment flows as the weaker dollar pushes more investors toward non-traditional assets during this unprecedented period of global capital flight from US-denominated investments.