Bitcoin Enters Loss Realization Phase as On-Chain Profit Dynamics Flip Negative: CryptoQuant

Share:

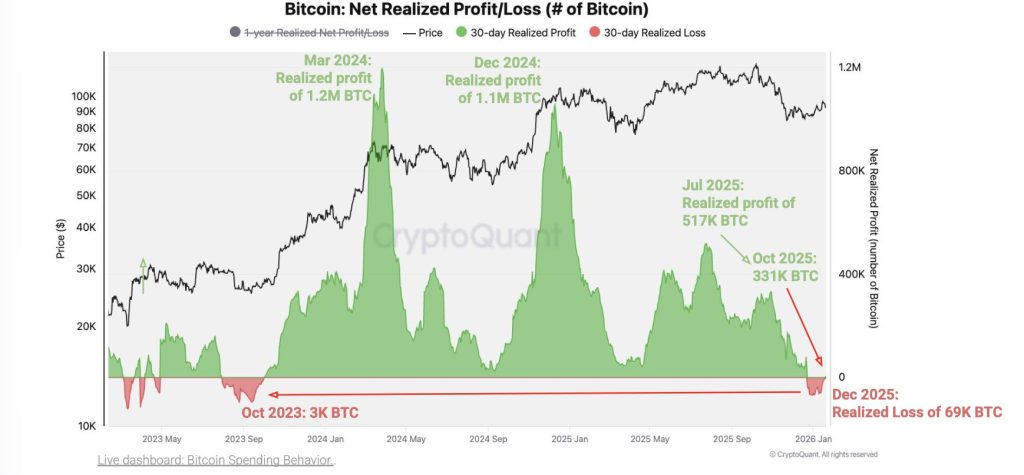

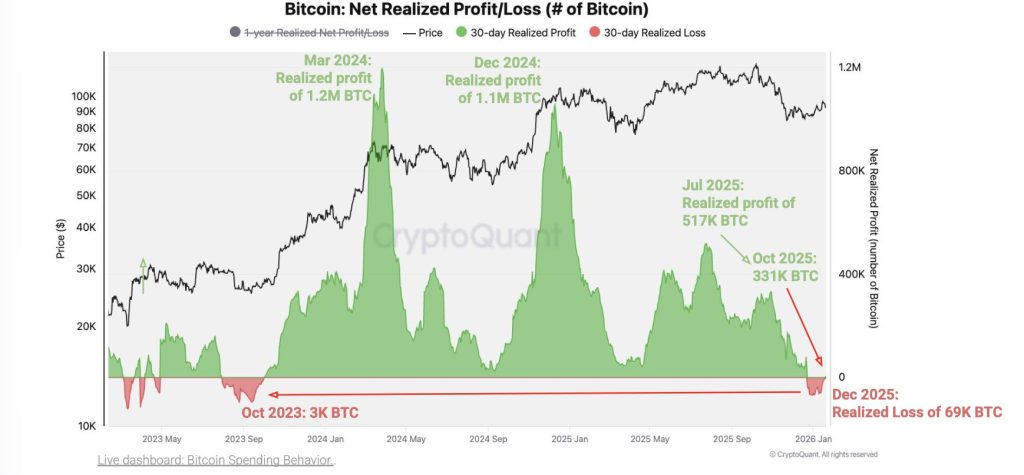

Bitcoin holders have entered a net realized loss phase for the first time since October 2023, according to the latest report from on-chain and market data analytics firm CryptoQuant.

According to the report since December 23 investors have collectively realized losses totaling roughly 69,000 BTC marking a shift away from the profit-taking environment that defined much of the past year.

CryptoQuant reports this latest change represents a shift in on-chain behaviour where holders are now locking in losses rather than distributing coins at a profit. Previously these types of transitions tend to emerge when market conviction weakens and price recoveries fail to sustain momentum.

Realized Profit Momentum Has Been Deteriorating Since 2024

CryptoQuant data shows that realized profit momentum has been declining steadily since early 2024. Rather than a single breakdown the market has formed a series of lower realized-profit peaks—first in January 2024, followed by December 2024, July 2025 and then October 2025.

The pattern also suggests that each rally has generated less profit-taking than the previous one, even when spot prices appeared resilient. On-chain this is often interpreted as a sign of diminishing demand strength where buyers are increasingly unwilling to absorb supply at higher prices.

Parallels With the 2021–2022 Market Transition

The current on-chain structure closely resembles Bitcoin’s 2021–2022 bull-to-bear transition, CryptoQuant notes. During that cycle realized profits peaked in January 2021 and gradually formed lower highs throughout the year before flipping into net losses ahead of the 2022 bear market.

This loss realization phase has coincided with a prolonged downturn as sentiment shifted from optimism to capital preservation. While history does not repeat exactly CryptoQuant analysts highlight the similarity as a cautionary sign rather than a definitive forecast.

Annual Profits Compress to Bear-Market Levels

Another key indicator is the sharp compression in annual net realized profits. CryptoQuant reports that annual realized profits have fallen to approximately 2.5 million BTC down from around 4.4 million BTC in October. These levels are comparable to March 2022, a period widely viewed as early-stage bear market territory.

Such compression implies fewer coins are being sold at a profit across the network, reinforcing the view that Bitcoin’s on-chain profit dynamics are no longer consistent with a strong bull market environment.

What the Shift Means for the Market

While net realized losses alone do not guarantee an immediate price decline, CryptoQuant emphasizes that prolonged loss realization phases typically align with weaker sentiment and reduced speculative appetite.

If this trend persists Bitcoin may face a period where rallies are sold into and downside volatility becomes more pronounced, reflecting a market adjusting to lower expectations.

The post Bitcoin Enters Loss Realization Phase as On-Chain Profit Dynamics Flip Negative: CryptoQuant appeared first on Cryptonews.

Bitcoin Enters Loss Realization Phase as On-Chain Profit Dynamics Flip Negative: CryptoQuant

Share:

Bitcoin holders have entered a net realized loss phase for the first time since October 2023, according to the latest report from on-chain and market data analytics firm CryptoQuant.

According to the report since December 23 investors have collectively realized losses totaling roughly 69,000 BTC marking a shift away from the profit-taking environment that defined much of the past year.

CryptoQuant reports this latest change represents a shift in on-chain behaviour where holders are now locking in losses rather than distributing coins at a profit. Previously these types of transitions tend to emerge when market conviction weakens and price recoveries fail to sustain momentum.

Realized Profit Momentum Has Been Deteriorating Since 2024

CryptoQuant data shows that realized profit momentum has been declining steadily since early 2024. Rather than a single breakdown the market has formed a series of lower realized-profit peaks—first in January 2024, followed by December 2024, July 2025 and then October 2025.

The pattern also suggests that each rally has generated less profit-taking than the previous one, even when spot prices appeared resilient. On-chain this is often interpreted as a sign of diminishing demand strength where buyers are increasingly unwilling to absorb supply at higher prices.

Parallels With the 2021–2022 Market Transition

The current on-chain structure closely resembles Bitcoin’s 2021–2022 bull-to-bear transition, CryptoQuant notes. During that cycle realized profits peaked in January 2021 and gradually formed lower highs throughout the year before flipping into net losses ahead of the 2022 bear market.

This loss realization phase has coincided with a prolonged downturn as sentiment shifted from optimism to capital preservation. While history does not repeat exactly CryptoQuant analysts highlight the similarity as a cautionary sign rather than a definitive forecast.

Annual Profits Compress to Bear-Market Levels

Another key indicator is the sharp compression in annual net realized profits. CryptoQuant reports that annual realized profits have fallen to approximately 2.5 million BTC down from around 4.4 million BTC in October. These levels are comparable to March 2022, a period widely viewed as early-stage bear market territory.

Such compression implies fewer coins are being sold at a profit across the network, reinforcing the view that Bitcoin’s on-chain profit dynamics are no longer consistent with a strong bull market environment.

What the Shift Means for the Market

While net realized losses alone do not guarantee an immediate price decline, CryptoQuant emphasizes that prolonged loss realization phases typically align with weaker sentiment and reduced speculative appetite.

If this trend persists Bitcoin may face a period where rallies are sold into and downside volatility becomes more pronounced, reflecting a market adjusting to lower expectations.

The post Bitcoin Enters Loss Realization Phase as On-Chain Profit Dynamics Flip Negative: CryptoQuant appeared first on Cryptonews.