Solana DApps Rake In $22M as Pump.fun Leads Amid $1B Liquidity Slump

Share:

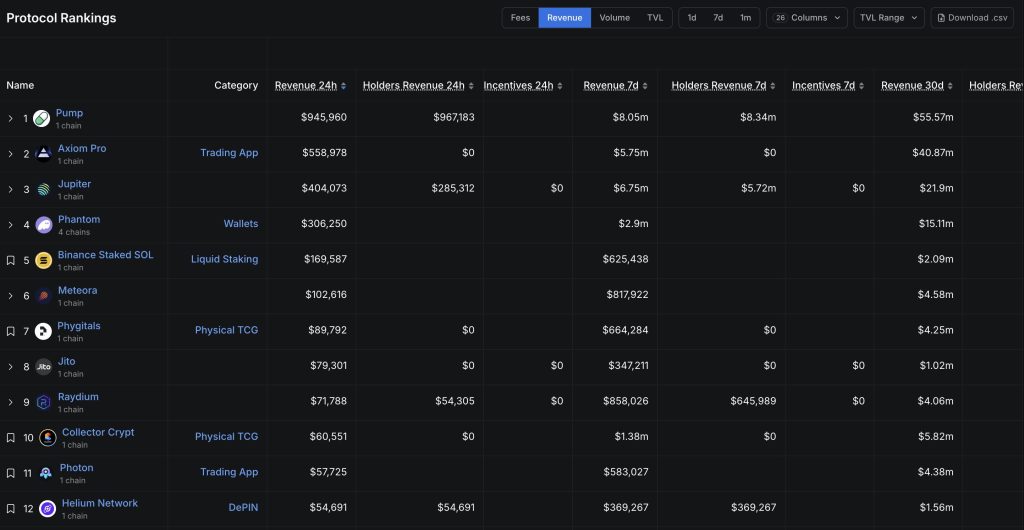

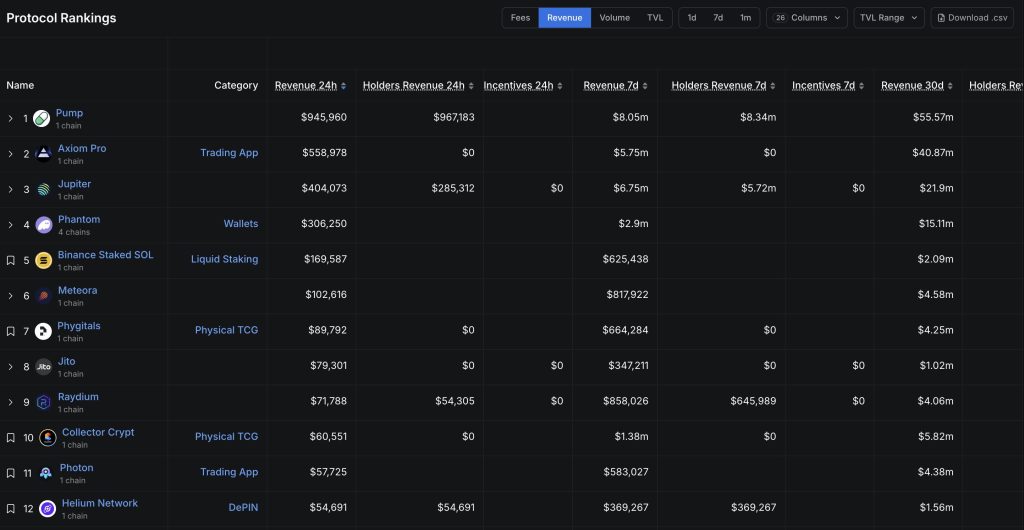

Solana decentralized applications (DApps) generated more than $22 million in revenue over the past week, according to data from DefiLlama, with meme coin launchpad Pump.fun once again leading the pack.

The platform brought in $9.65 million, marking its eighth consecutive week at the top, as user activity around Solana-based trading protocols continues to dominate the chain.

Axiom, an emerging trading platform offering yield farming and perpetual products, followed as the second-highest earner with $5.20 million.

Jupiter, Solana’s largest decentralized exchange aggregator, recorded $6.75 million over the same period, while Phantom wallet added $2.9 million, reinforcing its role as a key entry point for users into Solana’s DeFi ecosystem.

Other contributors included Raydium with $858,000, Meteora with $817,000, and Collector Crypt with $1.38 million, outperforming staking protocols such as Binance Staked SOL, which earned $625,000.

Solana DeFi Surges Past $12B TVL With $4.4B in Daily Trading Volume

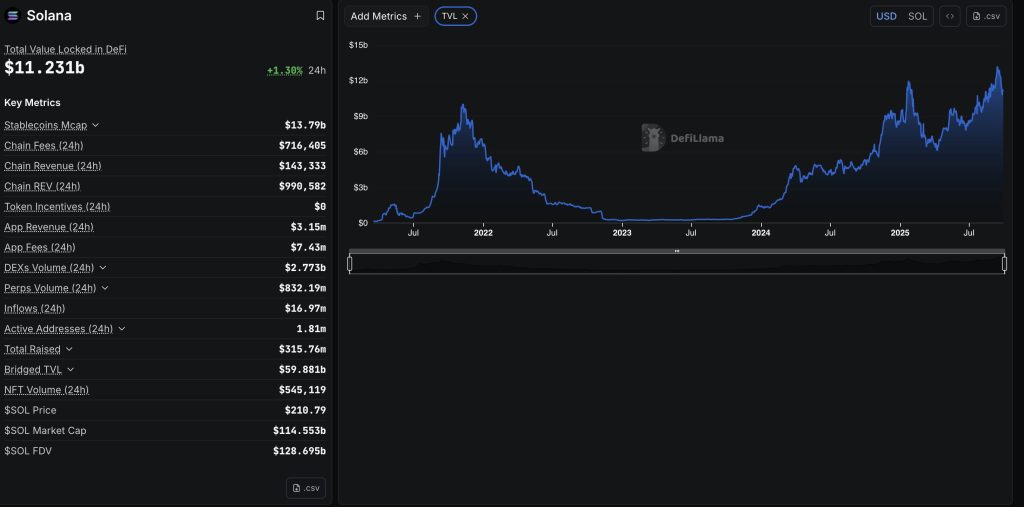

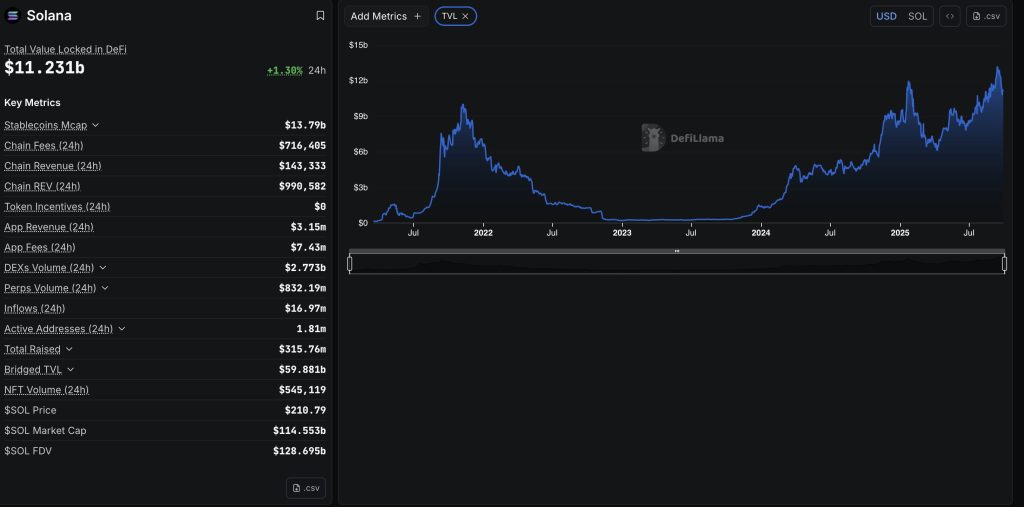

The surge in protocol revenue has coincided with a resurgence in Solana’s broader decentralized finance activity.

The network’s total value locked (TVL) recently climbed above $12 billion for the first time since the 2021 bull run, reaching $12.18 billion on September 10.

At present, Solana holds $11.3 billion in locked assets, up nearly 2% in the past 24 hours.

Trading volumes have also surged across Solana’s decentralized exchanges. On September 26, Solana recorded $4.44 billion in 24-hour DEX volume, well above its baseline of $2.77 billion.

Alongside rising trading volumes, user fees have remained robust. Over a single 24-hour period, Solana users paid $12.38 million in fees across various protocols.

Despite these gains, the memecoin launchpad sector has shown signs of slowing.

Data from Dune Analytics reveals that bonding curve volumes, a key indicator of liquidity on meme-focused platforms, fell below $1 billion last week for the first time in six months.

Total launchpad volume was $796.4 million, with Pump.fun accounting for $669.2 million, or 84% of the total, while BonkFun followed with $95 million.

Sugar and Moonshot trailed with $19.1 million and $9.5 million, respectively. Smaller platforms such as Launchlab and Bags reported negligible volumes.

The decline marks a sharp pullback from earlier weeks when volumes regularly exceeded $1.2 billion, suggesting a cooling of speculative momentum.

Despite the recent slowdown in bonding curve activity, Pump.fun’s grip on the sector remains dominant. The platform has consistently captured the majority of liquidity since May, reinforcing its status as the leading launchpad for Solana’s meme coin economy.

BonkFun has emerged as the only significant competitor, though its market share remains far smaller.

At the network level, Solana continues to show strong fundamentals. Its rising TVL, robust DEX activity, and record protocol revenues place it among the top-performing blockchains in 2025.

Solana Trades at $206 Amid Pullback but Uptrend Still Intact

Solana (SOL) is changing hands at $206.78, up 4.2% over the past 24 hours. Despite the daily gain, the token has slipped 7.1% in the past week and 12.6% over the last two weeks.

On a 30-day view, SOL is up just 2%. The price remains 29% below its all-time high of $293.31.

Chart data shows Solana continuing to move inside a parallel ascending channel that has guided its price action since spring 2025. The token has repeatedly rebounded from the channel’s lower boundary while meeting resistance at the upper line.

After topping out near $260–$270 earlier this month, SOL corrected sharply and now trades around the channel’s midline.

Technical signs point to a possible retest of lower support near $180–$185. A bounce from this zone could set the stage for a renewed push toward the $260–$280 range later this year.

Immediate support sits at $200, while resistance levels are seen near $220 and $260. Analysts caution that a decisive break below $180 would invalidate the channel and risk deeper losses.

On the weekly chart, Solana continues to hold above a rising trendline that has supported multiple rallies. As long as weekly closes stay above this line, the broader bullish structure remains intact.

Projections suggest that if momentum returns, SOL could revisit the $260–$280 area and potentially reach the $300 level in the months ahead.

For now, Solana’s outlook remains cautiously bullish. Pullbacks are viewed as part of a normal uptrend cycle, but traders are watching the $180 support closely as the dividing line between continuation and reversal.

The post Solana DApps Rake In $22M as Pump.fun Leads Amid $1B Liquidity Slump appeared first on Cryptonews.

Solana DApps Rake In $22M as Pump.fun Leads Amid $1B Liquidity Slump

Share:

Solana decentralized applications (DApps) generated more than $22 million in revenue over the past week, according to data from DefiLlama, with meme coin launchpad Pump.fun once again leading the pack.

The platform brought in $9.65 million, marking its eighth consecutive week at the top, as user activity around Solana-based trading protocols continues to dominate the chain.

Axiom, an emerging trading platform offering yield farming and perpetual products, followed as the second-highest earner with $5.20 million.

Jupiter, Solana’s largest decentralized exchange aggregator, recorded $6.75 million over the same period, while Phantom wallet added $2.9 million, reinforcing its role as a key entry point for users into Solana’s DeFi ecosystem.

Other contributors included Raydium with $858,000, Meteora with $817,000, and Collector Crypt with $1.38 million, outperforming staking protocols such as Binance Staked SOL, which earned $625,000.

Solana DeFi Surges Past $12B TVL With $4.4B in Daily Trading Volume

The surge in protocol revenue has coincided with a resurgence in Solana’s broader decentralized finance activity.

The network’s total value locked (TVL) recently climbed above $12 billion for the first time since the 2021 bull run, reaching $12.18 billion on September 10.

At present, Solana holds $11.3 billion in locked assets, up nearly 2% in the past 24 hours.

Trading volumes have also surged across Solana’s decentralized exchanges. On September 26, Solana recorded $4.44 billion in 24-hour DEX volume, well above its baseline of $2.77 billion.

Alongside rising trading volumes, user fees have remained robust. Over a single 24-hour period, Solana users paid $12.38 million in fees across various protocols.

Despite these gains, the memecoin launchpad sector has shown signs of slowing.

Data from Dune Analytics reveals that bonding curve volumes, a key indicator of liquidity on meme-focused platforms, fell below $1 billion last week for the first time in six months.

Total launchpad volume was $796.4 million, with Pump.fun accounting for $669.2 million, or 84% of the total, while BonkFun followed with $95 million.

Sugar and Moonshot trailed with $19.1 million and $9.5 million, respectively. Smaller platforms such as Launchlab and Bags reported negligible volumes.

The decline marks a sharp pullback from earlier weeks when volumes regularly exceeded $1.2 billion, suggesting a cooling of speculative momentum.

Despite the recent slowdown in bonding curve activity, Pump.fun’s grip on the sector remains dominant. The platform has consistently captured the majority of liquidity since May, reinforcing its status as the leading launchpad for Solana’s meme coin economy.

BonkFun has emerged as the only significant competitor, though its market share remains far smaller.

At the network level, Solana continues to show strong fundamentals. Its rising TVL, robust DEX activity, and record protocol revenues place it among the top-performing blockchains in 2025.

Solana Trades at $206 Amid Pullback but Uptrend Still Intact

Solana (SOL) is changing hands at $206.78, up 4.2% over the past 24 hours. Despite the daily gain, the token has slipped 7.1% in the past week and 12.6% over the last two weeks.

On a 30-day view, SOL is up just 2%. The price remains 29% below its all-time high of $293.31.

Chart data shows Solana continuing to move inside a parallel ascending channel that has guided its price action since spring 2025. The token has repeatedly rebounded from the channel’s lower boundary while meeting resistance at the upper line.

After topping out near $260–$270 earlier this month, SOL corrected sharply and now trades around the channel’s midline.

Technical signs point to a possible retest of lower support near $180–$185. A bounce from this zone could set the stage for a renewed push toward the $260–$280 range later this year.

Immediate support sits at $200, while resistance levels are seen near $220 and $260. Analysts caution that a decisive break below $180 would invalidate the channel and risk deeper losses.

On the weekly chart, Solana continues to hold above a rising trendline that has supported multiple rallies. As long as weekly closes stay above this line, the broader bullish structure remains intact.

Projections suggest that if momentum returns, SOL could revisit the $260–$280 area and potentially reach the $300 level in the months ahead.

For now, Solana’s outlook remains cautiously bullish. Pullbacks are viewed as part of a normal uptrend cycle, but traders are watching the $180 support closely as the dividing line between continuation and reversal.

The post Solana DApps Rake In $22M as Pump.fun Leads Amid $1B Liquidity Slump appeared first on Cryptonews.