SEC Chair Atkins Signals Crypto Regulatory Coordination, Fraud Focus in 2026 Agenda

Share:

- Paul Atkins said the SEC will prioritize traditional fraud enforcement in 2026 while continuing crypto-related cases.

- The SEC will coordinate with the CFTC on crypto regulation and review disclosure rules.

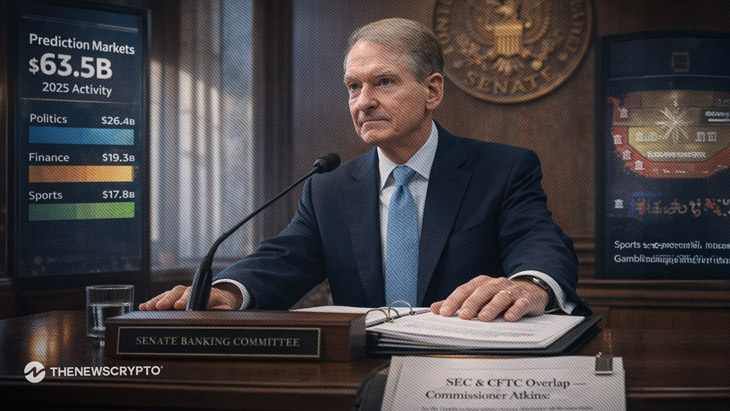

The U.S. Securities and Exchange Commission (SEC) Chair Paul S. Atkins used congressional testimony on Wednesday to outline a 2026 regulatory agenda that includes closer coordination with the Commodity Futures Trading Commission (CFTC) on digital assets, alongside a renewed emphasis on traditional fraud enforcement.

Testifying before the House Financial Services Committee, Atkins said the SEC is working with CFTC Chair Mike Selig under a joint initiative known as “Project Crypto” to improve regulatory coordination in digital asset markets. The effort is intended to reduce overlapping oversight and clarify how certain tokens and trading platforms are regulated under existing securities and commodities laws.

Atkins referenced the bipartisan CLARITY Act, which proposes clearer jurisdictional boundaries between the SEC and CFTC for digital assets. He said the agency is evaluating token taxonomy frameworks and potential exemptions that could allow certain on-chain market activity to operate within defined regulatory parameters while maintaining investor protections.

SEC Moves Toward Coordinated Crypto Oversight and Core Enforcement

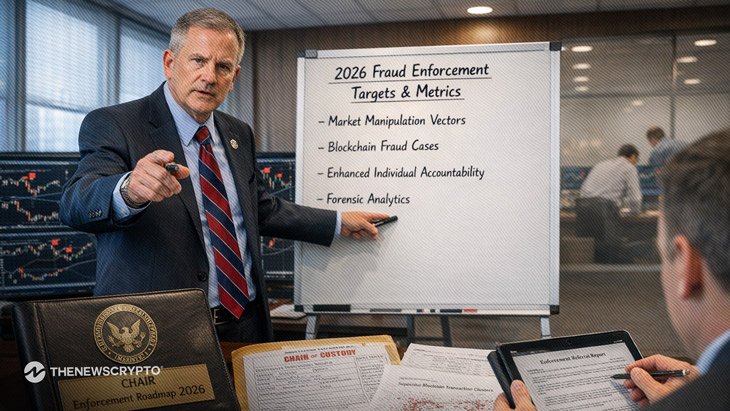

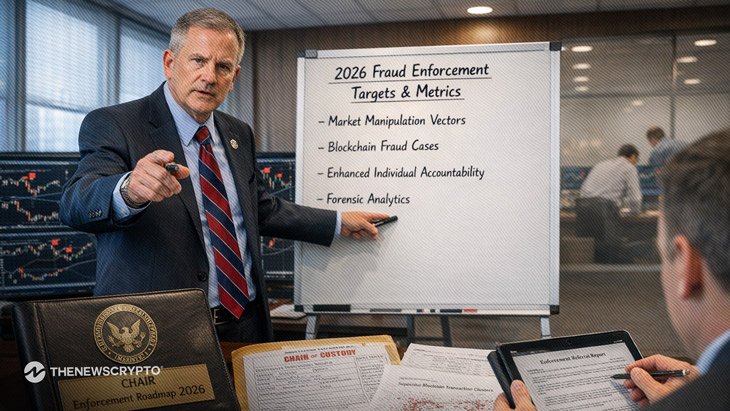

The testimony signals a shift from broad crypto-focused enforcement toward structured rulemaking and interagency cooperation. While the SEC will continue pursuing cases involving fraud and misconduct in digital asset markets, Atkins said enforcement resources are being directed toward traditional securities violations, including offering fraud, insider trading and accounting misconduct.

In parallel, the SEC is reviewing corporate disclosure requirements, citing an estimated $2.7 billion annual compliance cost for public companies. The agency is considering ways to streamline reporting while preserving material information for investors. This move could affect token issuers and crypto firms that access U.S. public markets.

The SEC’s 2026 examination priorities, released in late 2025, place less emphasis on standalone crypto-sector examinations compared to prior years, instead integrating digital asset oversight into broader risk-based supervision categories.

Atkins’ remarks outline a regulatory approach for 2026 centered on fraud enforcement, disclosure reform and coordinated digital asset oversight rather than expansive enforcement-driven policymaking.

Highlighted Crypto News Today:

US Jobs Data Clarifies Fed Rate Cut Stand, Crypto Prices Fumble Further

Read More

SEC Chair Atkins Signals Crypto Regulatory Coordination, Fraud Focus in 2026 Agenda

Share:

- Paul Atkins said the SEC will prioritize traditional fraud enforcement in 2026 while continuing crypto-related cases.

- The SEC will coordinate with the CFTC on crypto regulation and review disclosure rules.

The U.S. Securities and Exchange Commission (SEC) Chair Paul S. Atkins used congressional testimony on Wednesday to outline a 2026 regulatory agenda that includes closer coordination with the Commodity Futures Trading Commission (CFTC) on digital assets, alongside a renewed emphasis on traditional fraud enforcement.

Testifying before the House Financial Services Committee, Atkins said the SEC is working with CFTC Chair Mike Selig under a joint initiative known as “Project Crypto” to improve regulatory coordination in digital asset markets. The effort is intended to reduce overlapping oversight and clarify how certain tokens and trading platforms are regulated under existing securities and commodities laws.

Atkins referenced the bipartisan CLARITY Act, which proposes clearer jurisdictional boundaries between the SEC and CFTC for digital assets. He said the agency is evaluating token taxonomy frameworks and potential exemptions that could allow certain on-chain market activity to operate within defined regulatory parameters while maintaining investor protections.

SEC Moves Toward Coordinated Crypto Oversight and Core Enforcement

The testimony signals a shift from broad crypto-focused enforcement toward structured rulemaking and interagency cooperation. While the SEC will continue pursuing cases involving fraud and misconduct in digital asset markets, Atkins said enforcement resources are being directed toward traditional securities violations, including offering fraud, insider trading and accounting misconduct.

In parallel, the SEC is reviewing corporate disclosure requirements, citing an estimated $2.7 billion annual compliance cost for public companies. The agency is considering ways to streamline reporting while preserving material information for investors. This move could affect token issuers and crypto firms that access U.S. public markets.

The SEC’s 2026 examination priorities, released in late 2025, place less emphasis on standalone crypto-sector examinations compared to prior years, instead integrating digital asset oversight into broader risk-based supervision categories.

Atkins’ remarks outline a regulatory approach for 2026 centered on fraud enforcement, disclosure reform and coordinated digital asset oversight rather than expansive enforcement-driven policymaking.

Highlighted Crypto News Today:

US Jobs Data Clarifies Fed Rate Cut Stand, Crypto Prices Fumble Further

Read More