U.S. SEC Warns Prediction Markets May Fall Under Securities Law

Share:

- The United States Securities Exchange Commission has signaled greater regulation of prediction markets.

- The SEC officials also noted the potential for investor protections under the Howey Test.

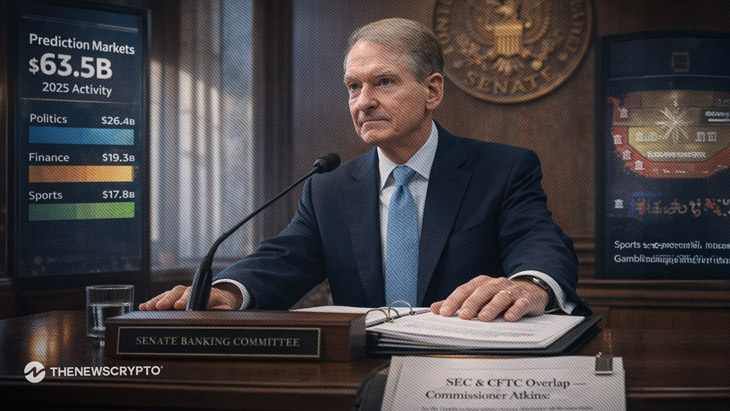

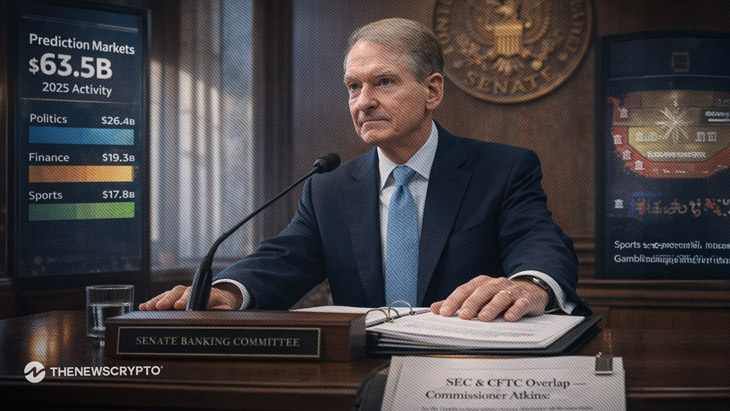

The United States Securities Exchange Commission hinted at the prospect of regulating prediction markets under federal security laws. There is increased interest in the industry, prompting action by the SEC. Officials of the SEC stated that some contracts may fall under the investment contract provision of the Howey Test. The officials made the comments in a statement after the Senate Banking Committee discussed digital asset regulation. SEC Chair Paul Atkins described prediction markets as a “huge issue” and stated that the market is closely monitored by security regulators. The SEC officials stated there is some overlap with commodity market regulators due to the complexities surrounding the issue.

Officials defined the Howey Test as “an investment of money in an expectation of profits” in relation to the investment contract. The Enforcement Division stated the following: “ Certain prediction markets may be considered securities under the securities laws because of the inclusion of profitable opportunities based on the occurrence of an event… cases related to similar digital contracts.” Experts at the conference indicated the following: “Prediction markets share many characteristics with traditional securities.” Some analysts indicated the following: “Clarification of the laws will help the platforms comply with federal laws.”

Observers of regulations pointed out that the SEC’s authority also extends to include derivatives or structured contracts. The regulators again emphasized that “enforcement of compliance” is one of the priorities for investor education. They mentioned that noncompliance may lead to sanctions or an injunction. Some platforms may already be trading outside of the registration rules.

Regulatory Context and Market Implications

Prediction markets allow people to wager on predicted events such as election outcomes, economic announcements, or event schedules. There are tokenized contracts that settle according to the outcome of a specific event. Some prediction markets function without any jurisdictional limitations. The SEC may cooperate with other organizations in the enforcement and development of new policies.

Failure to register might lead to various consequences, such as penalties and trading halts. It was noted that some platforms presented their ideas that may eliminate risks by educating users. There is also a note that there is an attempt to understand if prediction contracts involve any securities. The platforms may be trying to adapt to avoid being a security risk. The engagement might be helpful as a way of developing products.

Highlighted Crypto News:

Israeli Authorities Charge Two Over Polymarket Military Bets

Read More

U.S. SEC Warns Prediction Markets May Fall Under Securities Law

Share:

- The United States Securities Exchange Commission has signaled greater regulation of prediction markets.

- The SEC officials also noted the potential for investor protections under the Howey Test.

The United States Securities Exchange Commission hinted at the prospect of regulating prediction markets under federal security laws. There is increased interest in the industry, prompting action by the SEC. Officials of the SEC stated that some contracts may fall under the investment contract provision of the Howey Test. The officials made the comments in a statement after the Senate Banking Committee discussed digital asset regulation. SEC Chair Paul Atkins described prediction markets as a “huge issue” and stated that the market is closely monitored by security regulators. The SEC officials stated there is some overlap with commodity market regulators due to the complexities surrounding the issue.

Officials defined the Howey Test as “an investment of money in an expectation of profits” in relation to the investment contract. The Enforcement Division stated the following: “ Certain prediction markets may be considered securities under the securities laws because of the inclusion of profitable opportunities based on the occurrence of an event… cases related to similar digital contracts.” Experts at the conference indicated the following: “Prediction markets share many characteristics with traditional securities.” Some analysts indicated the following: “Clarification of the laws will help the platforms comply with federal laws.”

Observers of regulations pointed out that the SEC’s authority also extends to include derivatives or structured contracts. The regulators again emphasized that “enforcement of compliance” is one of the priorities for investor education. They mentioned that noncompliance may lead to sanctions or an injunction. Some platforms may already be trading outside of the registration rules.

Regulatory Context and Market Implications

Prediction markets allow people to wager on predicted events such as election outcomes, economic announcements, or event schedules. There are tokenized contracts that settle according to the outcome of a specific event. Some prediction markets function without any jurisdictional limitations. The SEC may cooperate with other organizations in the enforcement and development of new policies.

Failure to register might lead to various consequences, such as penalties and trading halts. It was noted that some platforms presented their ideas that may eliminate risks by educating users. There is also a note that there is an attempt to understand if prediction contracts involve any securities. The platforms may be trying to adapt to avoid being a security risk. The engagement might be helpful as a way of developing products.

Highlighted Crypto News:

Israeli Authorities Charge Two Over Polymarket Military Bets

Read More