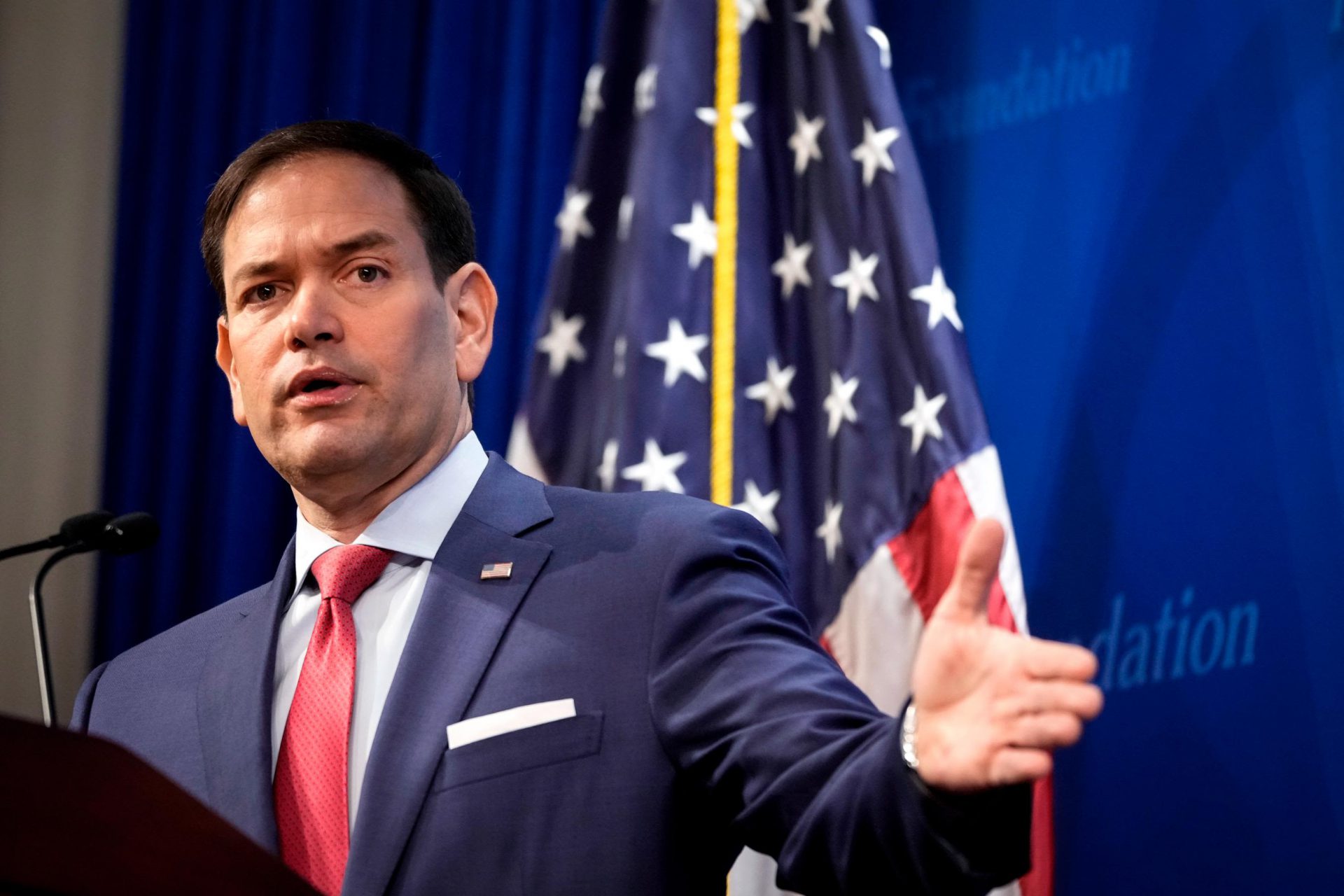

US Senator Marco Rubio Issues Major Warning About BRICS

US Senator Maro Rubio is concerned about the growth of BRICS and its threat to the US and its currency. The Florida Senator says in an article for RealClearWorld that the continued expansion of this group might interfere with the ability to exert sanctions on other nations.

“If current trends continue, it will become harder and harder for the United States to prevent international violence and oppression through sanctions,” Rubio writes. At the beginning of 2024, BRICS officially added multiple new nations to the newly expanded BRICS+, including Egypt and the UAE.

Since its founding, BRICS has worked to end global reliance on the US Dollar. In the past year, the mission has strengthened, with the development of BRICS pay and the expansion of the bloc. In 2024, the alliance is expected to grow again.

Also Read: BRICS: Why Local Currency Bonds is a Blow to the US Dollar

Furthermore, Marco Rubio stresses that the US Government must seal alliances with countries like Argentina and other nations who are interested in BRICS. “Milei is taking the right steps to be a friend to the United States. The Biden Administration would do well to reciprocate that because friends are few and far between these days.”

As sanctions continue between the US and Russia, countries are becoming more inclined to end reliance on the US Dollar. America’s battle with inflation in 2023 and interest rate hikes makes it especially more difficult. Therefore, Marco Rubio finds it important to rebuild and seal these relationships before BRICS swoops in.

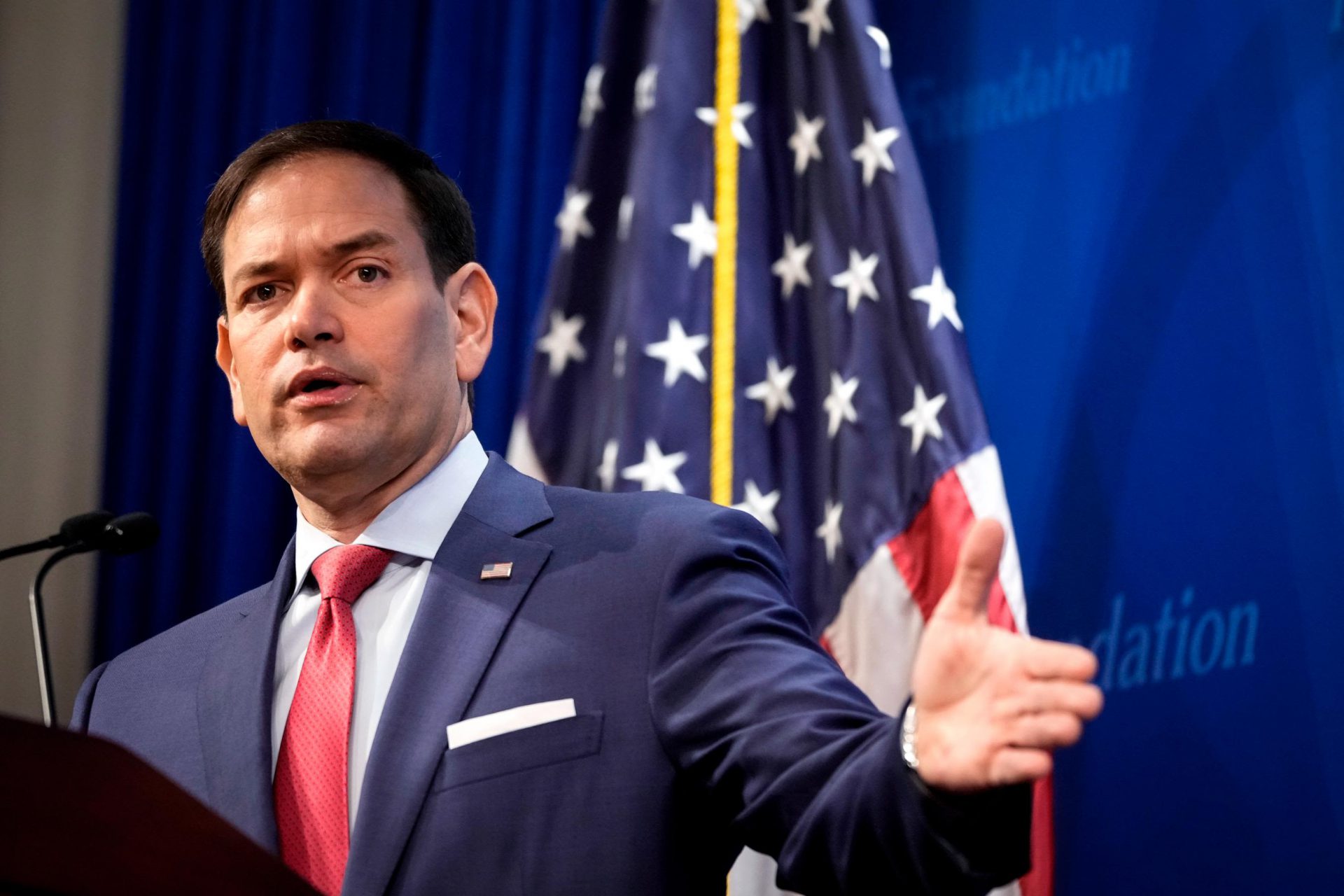

US Senator Marco Rubio Issues Major Warning About BRICS

US Senator Maro Rubio is concerned about the growth of BRICS and its threat to the US and its currency. The Florida Senator says in an article for RealClearWorld that the continued expansion of this group might interfere with the ability to exert sanctions on other nations.

“If current trends continue, it will become harder and harder for the United States to prevent international violence and oppression through sanctions,” Rubio writes. At the beginning of 2024, BRICS officially added multiple new nations to the newly expanded BRICS+, including Egypt and the UAE.

Since its founding, BRICS has worked to end global reliance on the US Dollar. In the past year, the mission has strengthened, with the development of BRICS pay and the expansion of the bloc. In 2024, the alliance is expected to grow again.

Also Read: BRICS: Why Local Currency Bonds is a Blow to the US Dollar

Furthermore, Marco Rubio stresses that the US Government must seal alliances with countries like Argentina and other nations who are interested in BRICS. “Milei is taking the right steps to be a friend to the United States. The Biden Administration would do well to reciprocate that because friends are few and far between these days.”

As sanctions continue between the US and Russia, countries are becoming more inclined to end reliance on the US Dollar. America’s battle with inflation in 2023 and interest rate hikes makes it especially more difficult. Therefore, Marco Rubio finds it important to rebuild and seal these relationships before BRICS swoops in.