Strategy (MSTR) Adds 1,142 Bitcoin for $90 Million as Bitcoin Trades Near $69,000

Share:

Bitcoin Magazine

Strategy (MSTR) Adds 1,142 Bitcoin for $90 Million as Bitcoin Trades Near $69,000

Strategy bought another 1,142 bitcoin for about $90 million, extending its long-running accumulation campaign even as the company’s massive treasury remains underwater on paper.

The purchase was disclosed Monday in an 8-K filing with the U.S. Securities and Exchange Commission. Strategy said it acquired the coins between Feb. 2 and Feb. 8 at an average price of $78,815 per bitcoin.

The latest buy lifts Strategy’s total holdings to 714,644 BTC. The stack is valued near $49 billion at current market prices. Strategy has spent roughly $54.4 billion to build the position, including fees and expenses.

The average purchase price across its holdings stands at $76,056 per bitcoin.

The company funded the acquisition through its ongoing at-the-market equity program. The company sold 616,715 shares of its Class A common stock, MSTR, for about $89.5 million last week.

As of Feb. 8, Strategy still had nearly $8 billion in share issuance capacity available under the program.

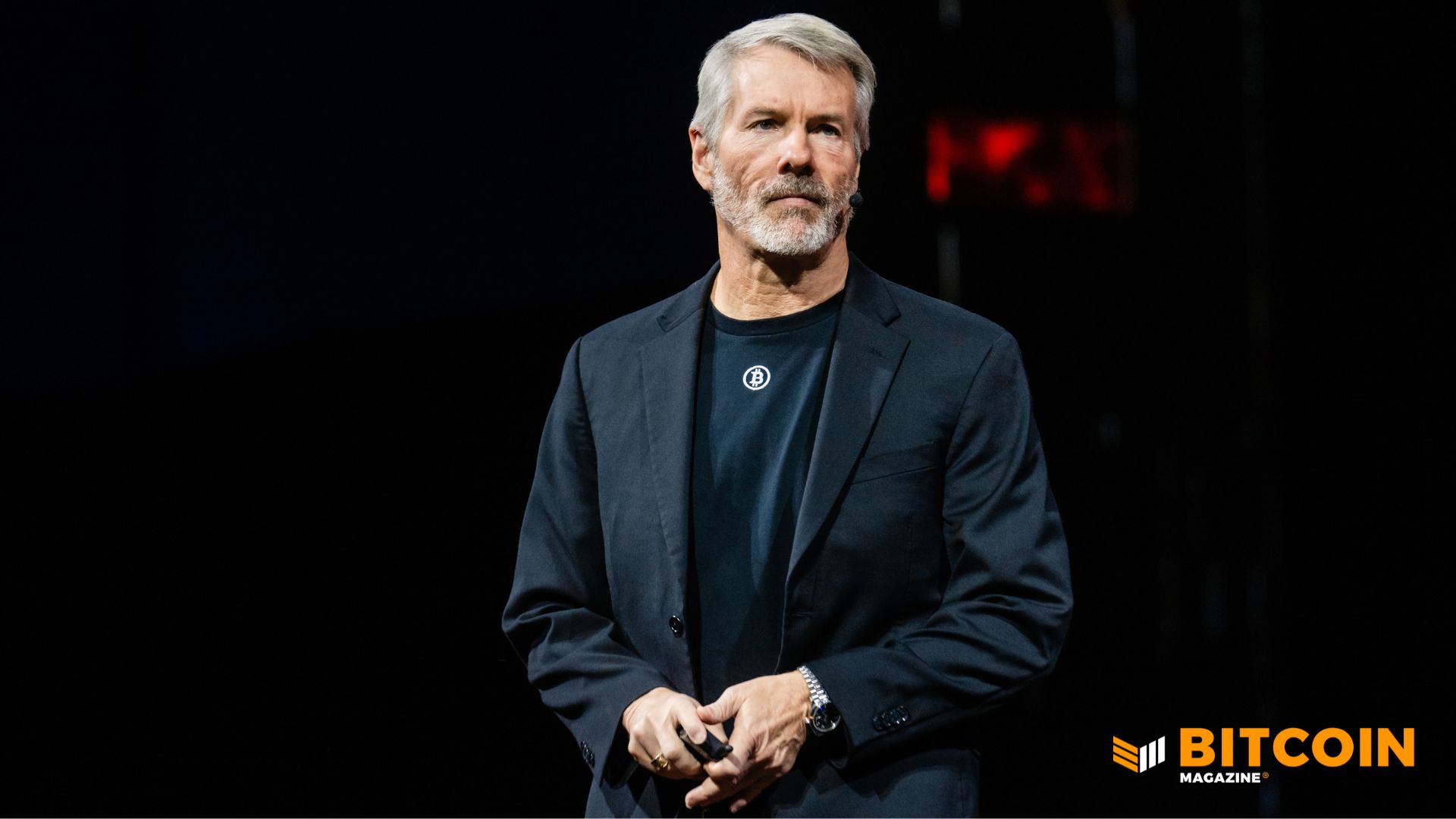

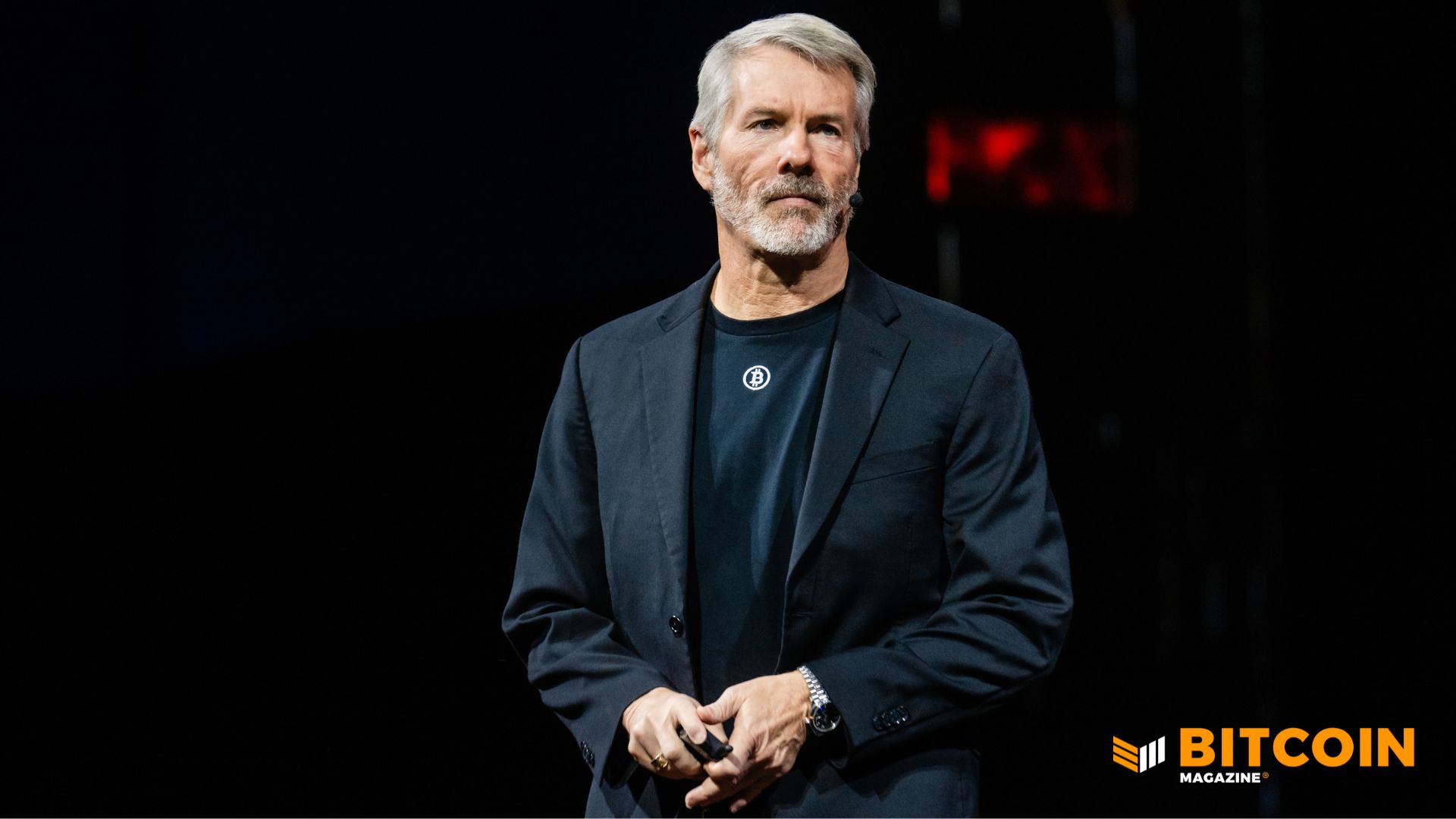

Michael Saylor, the company’s co-founder and executive chairman, signaled the purchase ahead of the filing with his usual Sunday post pointing to Strategy’s bitcoin tracker and the phrase “Orange Dots Matter.”

At the time of publication, Bitcoin is trading near $69,000.

Strategy ($MSTR) stock price volatility

The buy comes after Strategy reported a steep quarterly loss as the bitcoin pullback erased tens of billions of dollars in value from its balance sheet. The company posted one of the largest quarterly losses ever recorded by a U.S. public firm.

During the earnings call, CEO Phong Le addressed concerns around leverage and debt servicing. He said bitcoin would need to fall to $8,000 and remain there for five to six years before Strategy faced serious difficulty covering its convertible obligations.

Also during the call, Saylor said the company will launch a Bitcoin Security Program to coordinate with the global cyber and crypto security community. He argued quantum computing is a long-term issue, not an immediate threat, and said any future Bitcoin upgrade would require broad global consensus.

Analysts remain divided on the approach. TD Cowen said Strategy has reinforced its position as the leading corporate bitcoin treasury company and could benefit from any market recovery. Bernstein analysts also argued the firm has structured liabilities conservatively, with no major debt maturities until 2028.

MSTR stock moved lower in premarket trading Monday, down more than 5%, as bitcoin struggled to hold above $69,000. The shares remain closely tied to bitcoin’s price swings, leaving investors watching both the company’s balance sheet and the broader crypto market.

This post Strategy (MSTR) Adds 1,142 Bitcoin for $90 Million as Bitcoin Trades Near $69,000 first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Read More

Strategy (MSTR) Adds 1,142 Bitcoin for $90 Million as Bitcoin Trades Near $69,000

Share:

Bitcoin Magazine

Strategy (MSTR) Adds 1,142 Bitcoin for $90 Million as Bitcoin Trades Near $69,000

Strategy bought another 1,142 bitcoin for about $90 million, extending its long-running accumulation campaign even as the company’s massive treasury remains underwater on paper.

The purchase was disclosed Monday in an 8-K filing with the U.S. Securities and Exchange Commission. Strategy said it acquired the coins between Feb. 2 and Feb. 8 at an average price of $78,815 per bitcoin.

The latest buy lifts Strategy’s total holdings to 714,644 BTC. The stack is valued near $49 billion at current market prices. Strategy has spent roughly $54.4 billion to build the position, including fees and expenses.

The average purchase price across its holdings stands at $76,056 per bitcoin.

The company funded the acquisition through its ongoing at-the-market equity program. The company sold 616,715 shares of its Class A common stock, MSTR, for about $89.5 million last week.

As of Feb. 8, Strategy still had nearly $8 billion in share issuance capacity available under the program.

Michael Saylor, the company’s co-founder and executive chairman, signaled the purchase ahead of the filing with his usual Sunday post pointing to Strategy’s bitcoin tracker and the phrase “Orange Dots Matter.”

At the time of publication, Bitcoin is trading near $69,000.

Strategy ($MSTR) stock price volatility

The buy comes after Strategy reported a steep quarterly loss as the bitcoin pullback erased tens of billions of dollars in value from its balance sheet. The company posted one of the largest quarterly losses ever recorded by a U.S. public firm.

During the earnings call, CEO Phong Le addressed concerns around leverage and debt servicing. He said bitcoin would need to fall to $8,000 and remain there for five to six years before Strategy faced serious difficulty covering its convertible obligations.

Also during the call, Saylor said the company will launch a Bitcoin Security Program to coordinate with the global cyber and crypto security community. He argued quantum computing is a long-term issue, not an immediate threat, and said any future Bitcoin upgrade would require broad global consensus.

Analysts remain divided on the approach. TD Cowen said Strategy has reinforced its position as the leading corporate bitcoin treasury company and could benefit from any market recovery. Bernstein analysts also argued the firm has structured liabilities conservatively, with no major debt maturities until 2028.

MSTR stock moved lower in premarket trading Monday, down more than 5%, as bitcoin struggled to hold above $69,000. The shares remain closely tied to bitcoin’s price swings, leaving investors watching both the company’s balance sheet and the broader crypto market.

This post Strategy (MSTR) Adds 1,142 Bitcoin for $90 Million as Bitcoin Trades Near $69,000 first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Read More