White House Used for Trump Family Crypto Gains, Democrats Claim in New Report

Share:

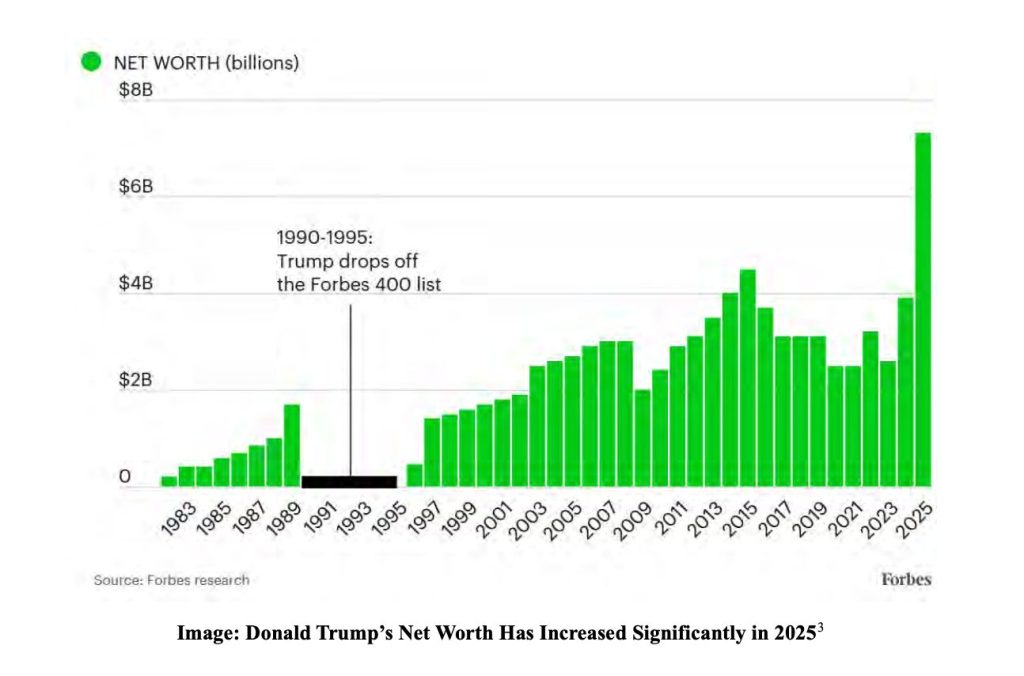

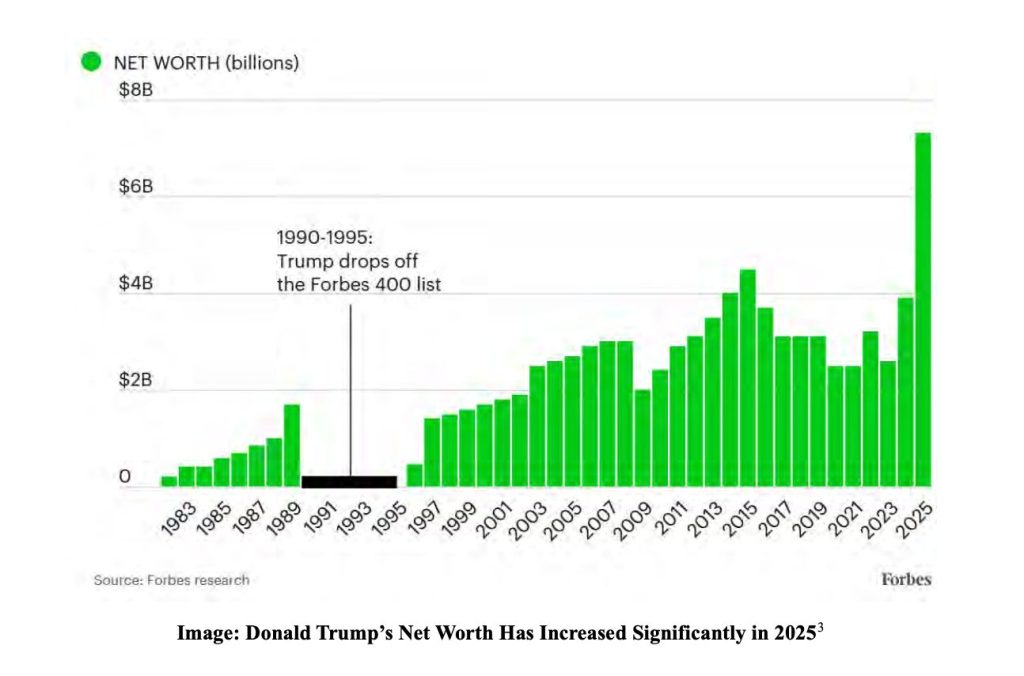

House Judiciary Committee Democrats released a report Monday accusing the Trump administration of using presidential powers to benefit the Trump family’s cryptocurrency ventures, alleging they generated around $800 million from token sales in early 2025.

The 60-page report titled “Trump, Crypto, and a New Age of Corruption” alleges the President transformed his office into what Ranking Member Jamie Raskin described as “the world’s most corrupt crypto startup operation.”

According to the document, Trump family crypto holdings could reach $11.6 billion, though precise valuations remain difficult to determine given market volatility.

Report Details Foreign Investment Concerns

Democrats highlight what they describe as questionable foreign investments in World Liberty Financial’s $WLFI governance token.

According to the report, Chinese-born crypto billionaire Justin Sun invested $75 million in WLFI while facing SEC scrutiny. The agency later requested to stay its enforcement action, citing “public interest.“

Another investor, Aqua 1 Foundation, reportedly purchased $100 million in WLFI tokens. Congressional investigators say they found no Emirati public records confirming the fund’s corporate existence.

The report identifies the fund’s leadership as including Guren “Bobby” Zhou, allegedly under investigation in Britain for money laundering, and Dave Lee, who the report suggests may be connected to China National Petroleum Corporation.

The allegations also touched on the timing of state-backed Emirati firm MGX’s announcement that it would invest $2 billion in Binance using World Liberty’s USD1 stablecoin.

They note that this deal emerged as the UAE negotiated for American AI chips, and that Trump subsequently dismissed six National Security Council officials who opposed the arrangement.

Enforcement Changes Follow Industry Donations

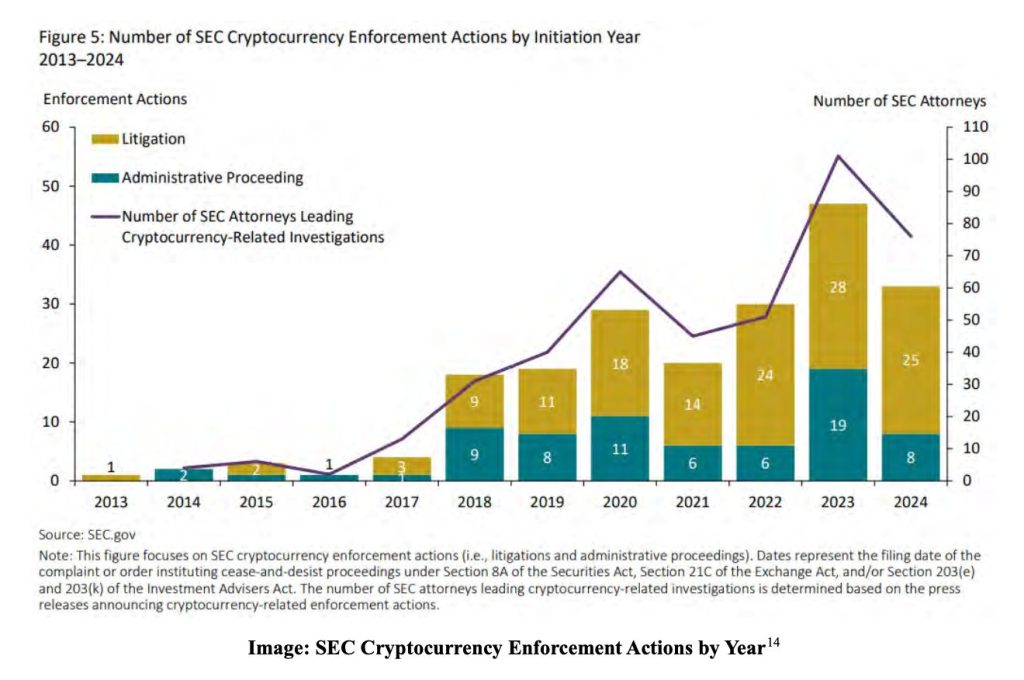

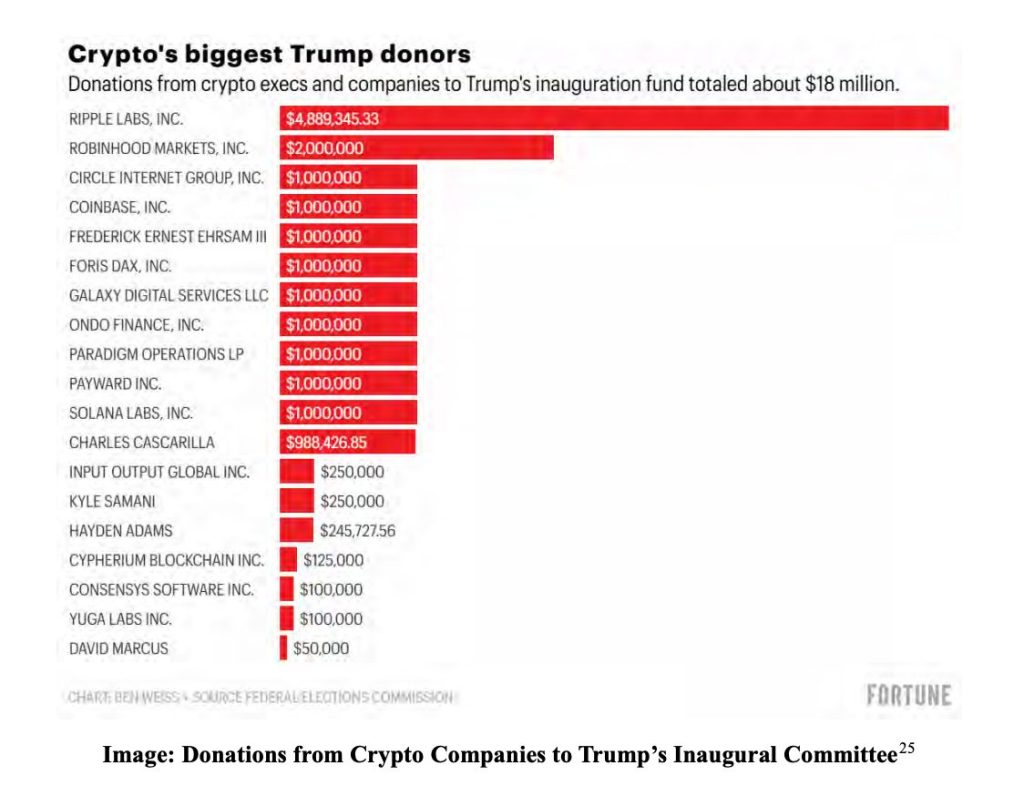

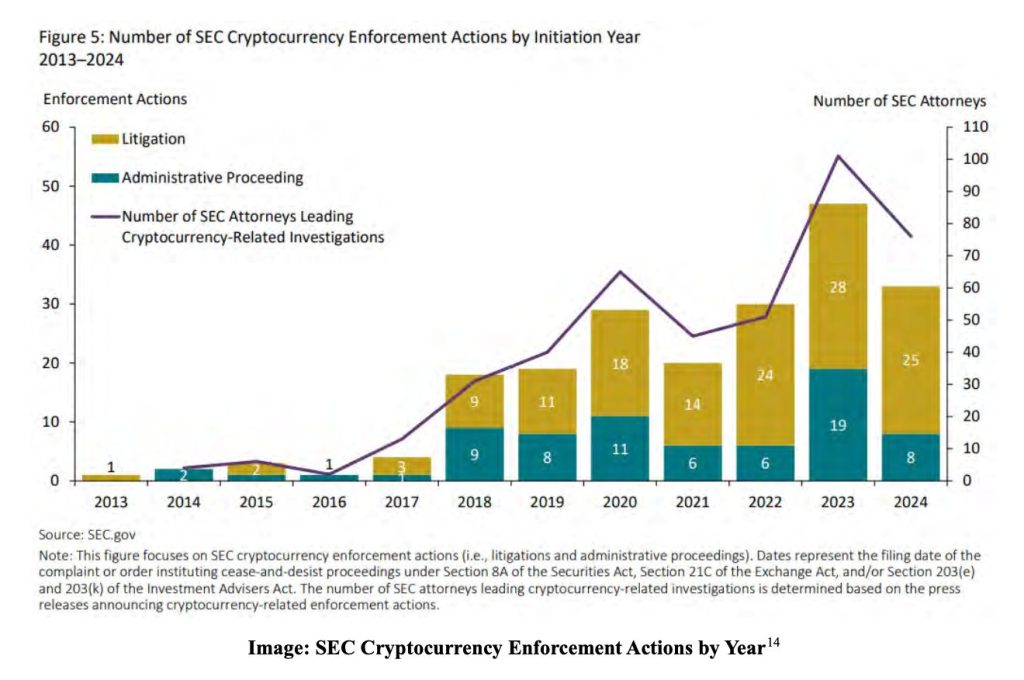

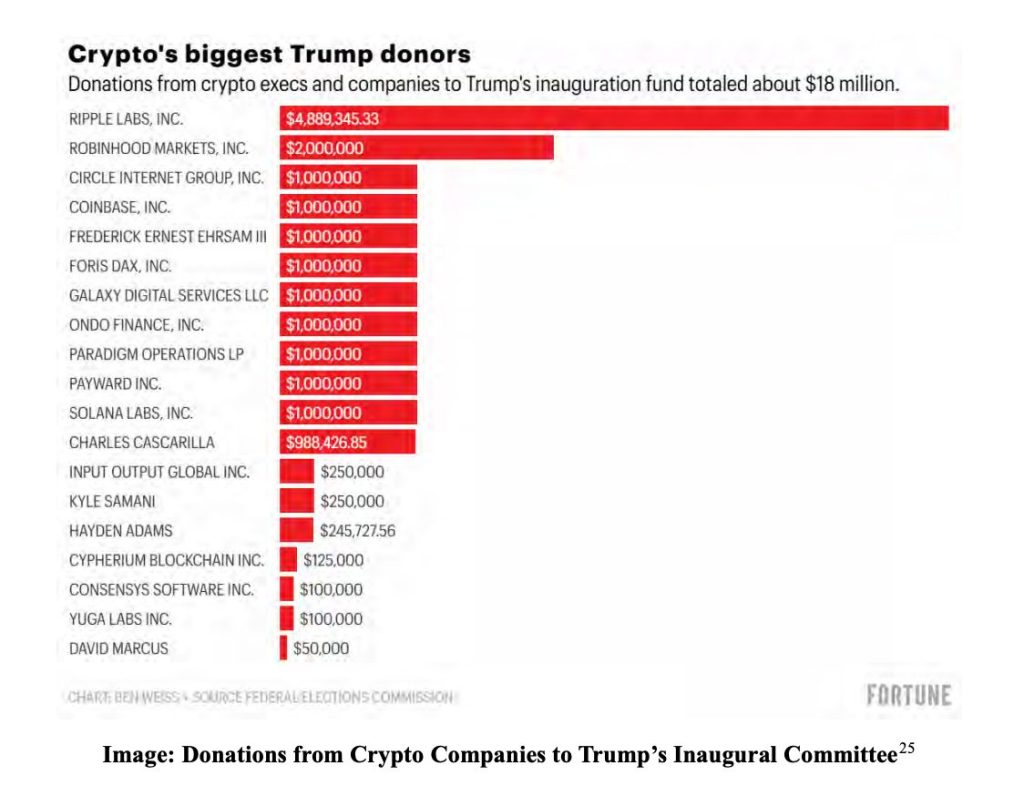

The report claims the administration dismantled crypto enforcement mechanisms while ending investigations against companies that donated to Trump’s campaign.

According to Democrats, the Justice Department dissolved its National Cryptocurrency Enforcement Team, which had handled major crypto crime cases.

The SEC closed investigations into Coinbase, Gemini, Robinhood, Ripple, Crypto.com, Uniswap, Yuga Labs, and Kraken, companies the report identifies as Trump donors or business partners.

When Ripple and Solana were included in Trump’s proposed crypto reserve, their token prices rose by 33% and 25%, respectively, according to market data.

In October, Trump pardoned Binance founder Changpeng Zhao, who pleaded guilty to money laundering in 2023 as part of Binance’s $4.3 billion settlement with the DOJ.

The report alleges the pardon came after Zhao and Binance supported World Liberty Financial.

Token Performance Shows Mixed Results

According to the report, WLFI initially raised only $2.7 million from 348 investors at launch. Following Trump’s election victory, the token reportedly surged over 2000%, generating $550 million from approximately 85,000 investors.

The report states that trading debut on major exchanges in September valued the Trump family’s WLFI stake at over $6 billion.

The $TRUMP memecoin, launched days before the inauguration, allegedly generated $350 million in trading fees.

Market data shows the token peaked at $75 before losing nearly two-thirds of its value over the next week.

According to the report, while 45 crypto wallets cleared $1.2 billion in profits, over 712,000 wallets collectively lost $4.3 billion.

Trump hosted a dinner for the top 220 WLFI holders, with the report estimating the average cost at over $1 million.

Democrats claim more than half the attendees were likely foreign individuals, including He Tianying, identified as a member of China’s Political Consultative Conference.

According to Financial Times estimates cited in the report, World Liberty earned around $42 million from its USD1 stablecoin, which grew from $128 million to nearly $2.7 billion in market capitalization.

The report alleges Binance helped develop USD1’s underlying technology.

Democratic lawmakers warn in the report that Trump’s reported ability to accumulate billions through cryptocurrency exposes weaknesses in campaign finance and anti-bribery laws.

They cite polling suggesting that 60% of Americans haven’t heard that the President’s family runs a crypto business.

Cryptonews previously reported in September that the Trump family’s paper fortune surged by as much as $6 billion when WLFI began trading on major exchanges, with early investors seeing 15x gains.

Financial Times estimated in October that the Trump family’s crypto ventures generated around $1 billion in pre-tax gains over the past year.

The post White House Used for Trump Family Crypto Gains, Democrats Claim in New Report appeared first on Cryptonews.

White House Used for Trump Family Crypto Gains, Democrats Claim in New Report

Share:

House Judiciary Committee Democrats released a report Monday accusing the Trump administration of using presidential powers to benefit the Trump family’s cryptocurrency ventures, alleging they generated around $800 million from token sales in early 2025.

The 60-page report titled “Trump, Crypto, and a New Age of Corruption” alleges the President transformed his office into what Ranking Member Jamie Raskin described as “the world’s most corrupt crypto startup operation.”

According to the document, Trump family crypto holdings could reach $11.6 billion, though precise valuations remain difficult to determine given market volatility.

Report Details Foreign Investment Concerns

Democrats highlight what they describe as questionable foreign investments in World Liberty Financial’s $WLFI governance token.

According to the report, Chinese-born crypto billionaire Justin Sun invested $75 million in WLFI while facing SEC scrutiny. The agency later requested to stay its enforcement action, citing “public interest.“

Another investor, Aqua 1 Foundation, reportedly purchased $100 million in WLFI tokens. Congressional investigators say they found no Emirati public records confirming the fund’s corporate existence.

The report identifies the fund’s leadership as including Guren “Bobby” Zhou, allegedly under investigation in Britain for money laundering, and Dave Lee, who the report suggests may be connected to China National Petroleum Corporation.

The allegations also touched on the timing of state-backed Emirati firm MGX’s announcement that it would invest $2 billion in Binance using World Liberty’s USD1 stablecoin.

They note that this deal emerged as the UAE negotiated for American AI chips, and that Trump subsequently dismissed six National Security Council officials who opposed the arrangement.

Enforcement Changes Follow Industry Donations

The report claims the administration dismantled crypto enforcement mechanisms while ending investigations against companies that donated to Trump’s campaign.

According to Democrats, the Justice Department dissolved its National Cryptocurrency Enforcement Team, which had handled major crypto crime cases.

The SEC closed investigations into Coinbase, Gemini, Robinhood, Ripple, Crypto.com, Uniswap, Yuga Labs, and Kraken, companies the report identifies as Trump donors or business partners.

When Ripple and Solana were included in Trump’s proposed crypto reserve, their token prices rose by 33% and 25%, respectively, according to market data.

In October, Trump pardoned Binance founder Changpeng Zhao, who pleaded guilty to money laundering in 2023 as part of Binance’s $4.3 billion settlement with the DOJ.

The report alleges the pardon came after Zhao and Binance supported World Liberty Financial.

Token Performance Shows Mixed Results

According to the report, WLFI initially raised only $2.7 million from 348 investors at launch. Following Trump’s election victory, the token reportedly surged over 2000%, generating $550 million from approximately 85,000 investors.

The report states that trading debut on major exchanges in September valued the Trump family’s WLFI stake at over $6 billion.

The $TRUMP memecoin, launched days before the inauguration, allegedly generated $350 million in trading fees.

Market data shows the token peaked at $75 before losing nearly two-thirds of its value over the next week.

According to the report, while 45 crypto wallets cleared $1.2 billion in profits, over 712,000 wallets collectively lost $4.3 billion.

Trump hosted a dinner for the top 220 WLFI holders, with the report estimating the average cost at over $1 million.

Democrats claim more than half the attendees were likely foreign individuals, including He Tianying, identified as a member of China’s Political Consultative Conference.

According to Financial Times estimates cited in the report, World Liberty earned around $42 million from its USD1 stablecoin, which grew from $128 million to nearly $2.7 billion in market capitalization.

The report alleges Binance helped develop USD1’s underlying technology.

Democratic lawmakers warn in the report that Trump’s reported ability to accumulate billions through cryptocurrency exposes weaknesses in campaign finance and anti-bribery laws.

They cite polling suggesting that 60% of Americans haven’t heard that the President’s family runs a crypto business.

Cryptonews previously reported in September that the Trump family’s paper fortune surged by as much as $6 billion when WLFI began trading on major exchanges, with early investors seeing 15x gains.

Financial Times estimated in October that the Trump family’s crypto ventures generated around $1 billion in pre-tax gains over the past year.

The post White House Used for Trump Family Crypto Gains, Democrats Claim in New Report appeared first on Cryptonews.

The Trump family’s wealth ballooned by $6B after

The Trump family’s wealth ballooned by $6B after