Epstein Made a $3M Investment in Coinbase, DOJ Email Exposes

Share:

The recent speculation surrounding the Epstein Files, referring to a huge collection of documents related to the case of American financier Jeffrey Epstein, revealed that he made a $3 million investment in the crypto exchange Coinbase over a decade ago.

Per documents released by the U.S. Department of Justice, Epstein invested in Coinbase through Brock Pierce’s Blockchain Capital in 2014.

“Unclear if the deal actually went through, but there is a lot of discussion around investing in Coinbase in the files,” wrote Bitcoin researcher Kyle Torpey.

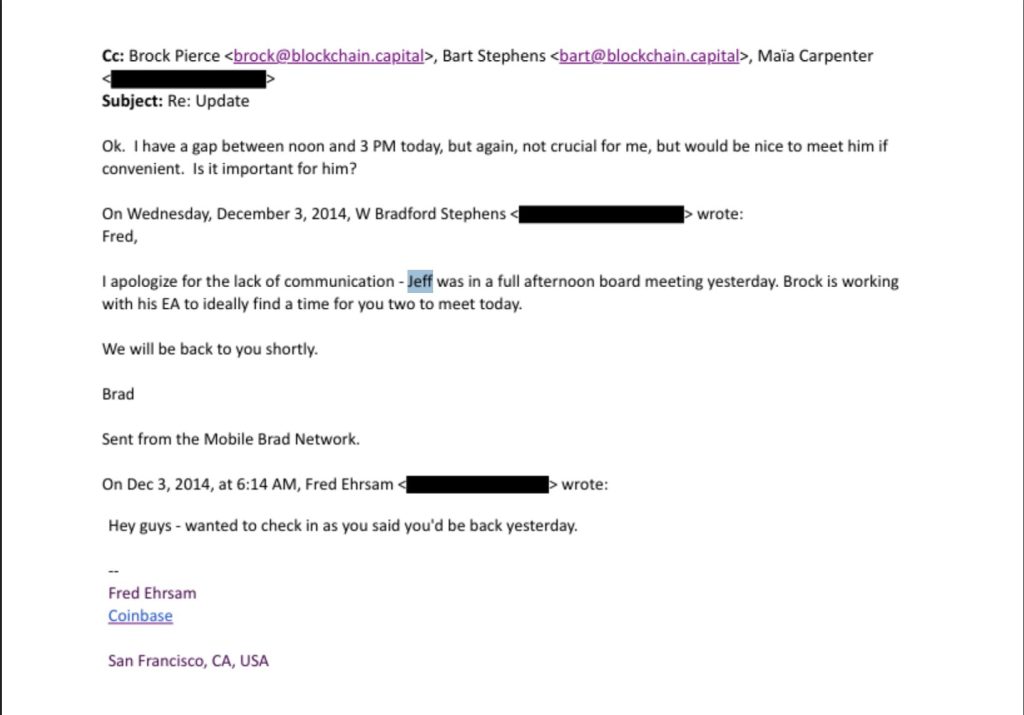

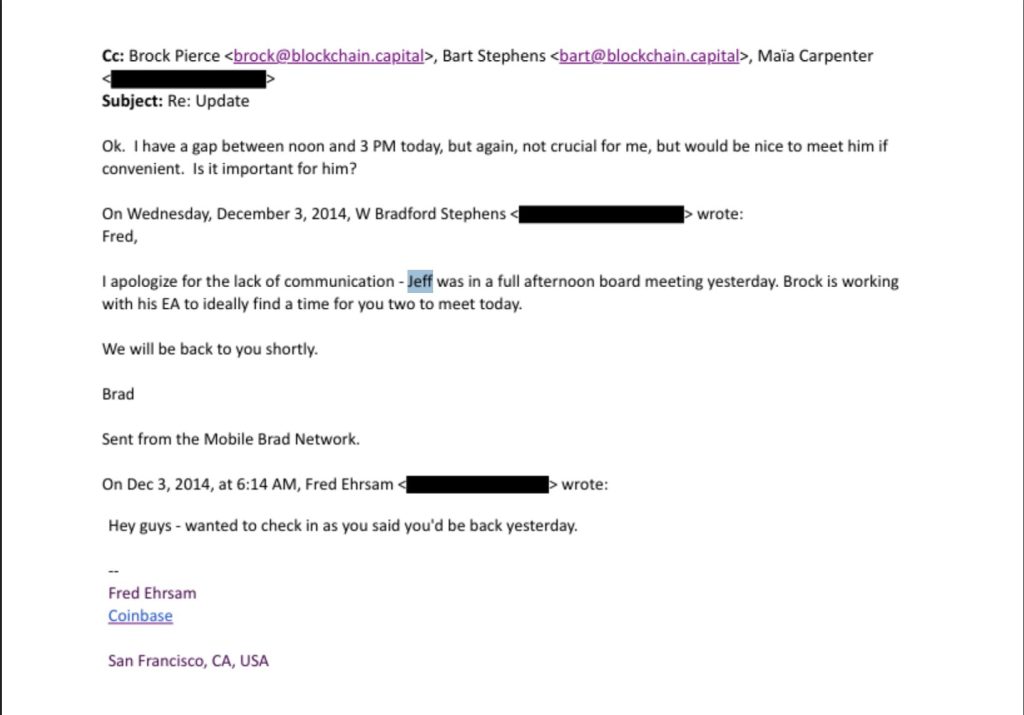

The Connection Between Epstein and Fred Ehrsam

The purchase allegedly secured Epstein a face-to-face meeting with Coinbase co-founder Fred Ehrsam. In a leaked email screenshot, “Jeff” is mentioned along with Ehrsam, indicating that Ehrsam might have known about his involvement in Coinbase.

“I have a gap between noon and 3pm today, but again, not crucial for me, but would be nice to meet him if convenient. Is it important for him,” Ehrsam wrote.

Four years later, in 2018, another email confirmed that Epstein got his Coinbase allocation. It appears that he later sold 50% of the stake back to Blockchain Capital for around $11M.

In 2008, a Florida state court convicted Epstein of procuring a child for prostitution and soliciting a prostitute.

Blockstream Has No Connection, Says CEO

Meanwhile, Blockstream CEO Adam Back pushed back claims from Epstein Files regarding his ongoing connection with the convict.

“Blockstream has no direct nor indirect financial connection with Jeffrey Epstein, or his estate,” Back wrote on X.

One of the documents released by the U.S. DOJ corresponding to July 2014 says that Blockstream co-founder Austin Hill discussed the company’s seed round with Epstein and Joi Ito, then director of the MIT Media Lab.

“Hi Joi & Jeffrey; We are down to the wire on closing this round,” Hill wrote in an email. “We are 10x oversubscribed on an $18m seed round and Reid at the last minute told us to bump your allocation from $50k to $500k.”

In the Monday post, Adam Back noted that Blockstream met with Jeffrey Epstein, who was described at the time as a “limited partner in Ito’s fund.”

“That fund later invested a minority stake in Blockstream. A few months later, Ito’s fund divested its Blockstream shares due to a potential conflict of interest, and other concerns.”

The post Epstein Made a $3M Investment in Coinbase, DOJ Email Exposes appeared first on Cryptonews.

Read More

Epstein Made a $3M Investment in Coinbase, DOJ Email Exposes

Share:

The recent speculation surrounding the Epstein Files, referring to a huge collection of documents related to the case of American financier Jeffrey Epstein, revealed that he made a $3 million investment in the crypto exchange Coinbase over a decade ago.

Per documents released by the U.S. Department of Justice, Epstein invested in Coinbase through Brock Pierce’s Blockchain Capital in 2014.

“Unclear if the deal actually went through, but there is a lot of discussion around investing in Coinbase in the files,” wrote Bitcoin researcher Kyle Torpey.

The Connection Between Epstein and Fred Ehrsam

The purchase allegedly secured Epstein a face-to-face meeting with Coinbase co-founder Fred Ehrsam. In a leaked email screenshot, “Jeff” is mentioned along with Ehrsam, indicating that Ehrsam might have known about his involvement in Coinbase.

“I have a gap between noon and 3pm today, but again, not crucial for me, but would be nice to meet him if convenient. Is it important for him,” Ehrsam wrote.

Four years later, in 2018, another email confirmed that Epstein got his Coinbase allocation. It appears that he later sold 50% of the stake back to Blockchain Capital for around $11M.

In 2008, a Florida state court convicted Epstein of procuring a child for prostitution and soliciting a prostitute.

Blockstream Has No Connection, Says CEO

Meanwhile, Blockstream CEO Adam Back pushed back claims from Epstein Files regarding his ongoing connection with the convict.

“Blockstream has no direct nor indirect financial connection with Jeffrey Epstein, or his estate,” Back wrote on X.

One of the documents released by the U.S. DOJ corresponding to July 2014 says that Blockstream co-founder Austin Hill discussed the company’s seed round with Epstein and Joi Ito, then director of the MIT Media Lab.

“Hi Joi & Jeffrey; We are down to the wire on closing this round,” Hill wrote in an email. “We are 10x oversubscribed on an $18m seed round and Reid at the last minute told us to bump your allocation from $50k to $500k.”

In the Monday post, Adam Back noted that Blockstream met with Jeffrey Epstein, who was described at the time as a “limited partner in Ito’s fund.”

“That fund later invested a minority stake in Blockstream. A few months later, Ito’s fund divested its Blockstream shares due to a potential conflict of interest, and other concerns.”

The post Epstein Made a $3M Investment in Coinbase, DOJ Email Exposes appeared first on Cryptonews.

Read More