On-Chain Data Shows Bitcoin Far From Peak as Analyst Maps $240K Bull Case

Share:

On-chain data from Checkonchain and Unchained shows that Bitcoin is far from its peak, as the leading crypto asset has yet to “enter the euphoric right tail in the current cycle.“

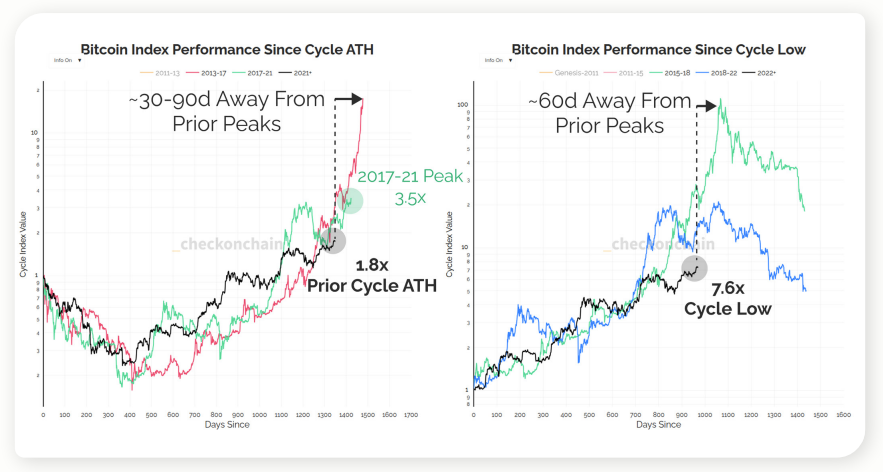

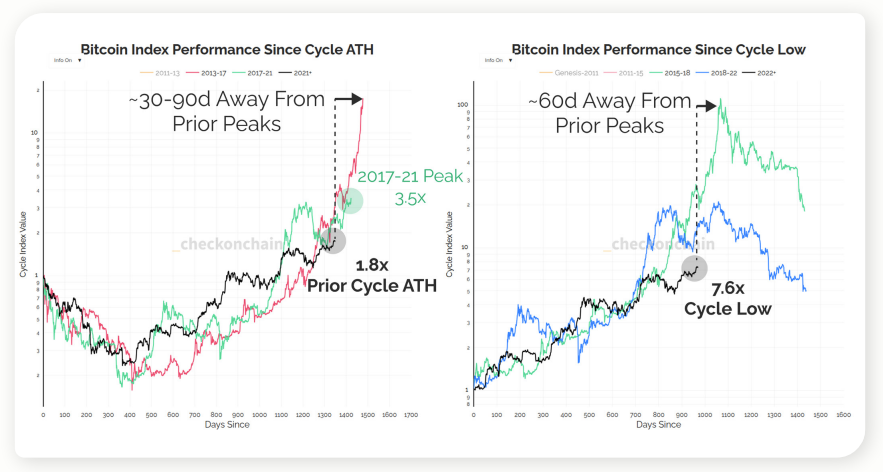

James Check, co-founder and Bitcoin analyst at Checkonchain, reveals that the current all-time high Bitcoin price of $124k is approximately 1.8x the 2021 peak of $69k.

To validate the ‘diminishing returns’ bull case target, the Bitcoin price would need to surpass $240k, hitting a 3.5x multiple from the prior cycle high.

He added that whether Bitcoin reaches $240k or $300k, neither feels completely outside the realm of possibility now that Bitcoin is trading north of $100k.

“It was much harder to envision such heights in the pits of the 2022 bear market,” he noted.

Market Structure Development Shows that Bitcoin is Far from Peak

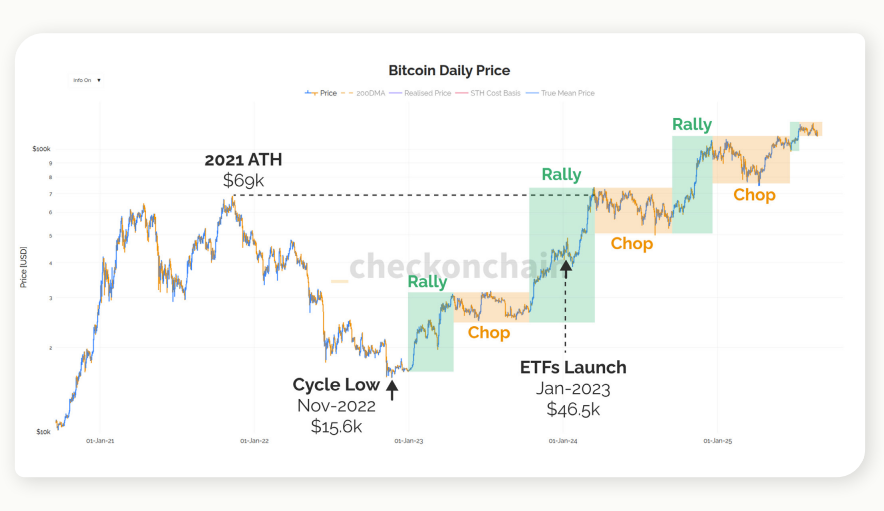

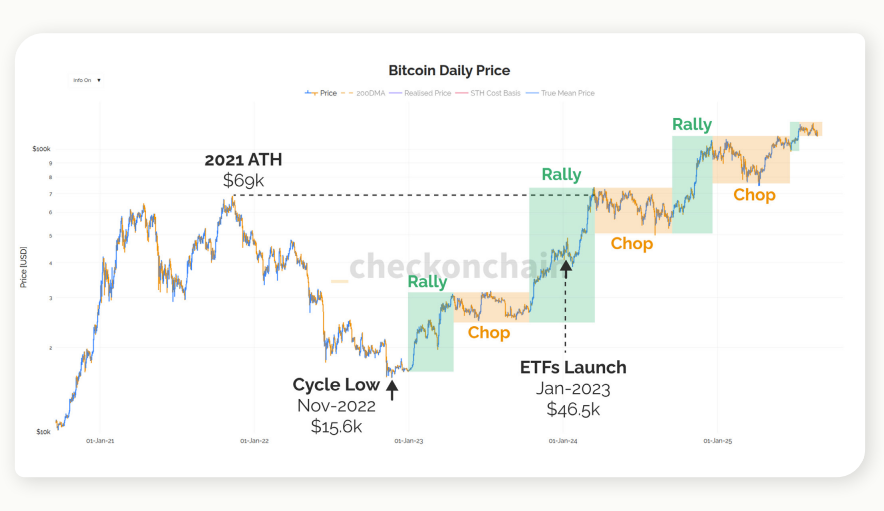

One of the most popular debates of this cycle has been whether the classic four-year halving cycle is likely to play out as it has in the past.

Analysts at Checkonchain reveal that both of the last two bull cycles found their ultimate market peak in the fourth quarter of the calendar year.

The way this cycle is tracking suggests the crypto market is close to discovering if the pattern is destined to repeat once more.

This cycle has not yet seen what would generally be considered a powerful euphoric blow-off top, where YoY returns ran far in excess of 5x in both previous cycles.

Similarly, one of the most important changes to Bitcoin’s performance since 2023 is the comparatively shallow drawdown profile of the prevailing uptrend.

The market has experienced two approximately 32% pullbacks in August 2024 and April 2025, both occurring alongside corrections in broader markets due to the Japanese yen carry trade unwind and the tariff tantrum, respectively.

“It is our view that the 2023-25 bull cycle has been primarily a spot-driven market.“

Analyst Maps out $240K Bull Case, Says Bitcoin Still a Small Fish in a Big Pond

Analysts point out that the $240k target remains very much achievable, as Bitcoin remains a small fish that has now swum into the very large pond that is global wealth.

Despite having a market cap exceeding $2 trillion, Bitcoin still represents less than a tenth of the precious metals market and less than 0.2% of the global asset base.

Bitcoin is one of the very few major assets that have outperformed gold over that time, seeing its value appreciate by over 80% in gold terms since February 2022.

Importantly, this comparison includes the bulk of the 2022 bear market, which saw BTC prices plunge to $15.6k and bottomed out 55% below the November 2021 ATH in gold terms.

The investing world is a relative place, and Bitcoin is an asset that has now earned a place on every Bloomberg Terminal watch list.

As more investors, analysts, and firms analyze how capital is rotating and which sectors are protecting their money best, sound money assets like gold and Bitcoin are becoming increasingly favored.

Crypto analyst ZynxBTC shares the view that we’re barely in a Bitcoin bull market, noting that Bitcoin needs to cross $151k just to equal its all-time high in gold terms.

Every cycle since inception, Bitcoin has more than doubled its price in gold at a minimum, usually much more than that.

According to him, $300k BTC is becoming increasingly likely. “It’s impossible to give a timeframe, but I’m expecting $151k to be crossed within the next 6 months,” he added.

Technical Analysis: Weekly Chart Shows Bullish Structure with $157K Target

On the technical front, the weekly Bitcoin chart shows a strong bullish structure supported by consistent higher highs and higher lows.

The price has been respecting the 20-week moving average as dynamic support, with the 50-week MA providing a deeper floor during corrections.

Each breakout above previous highs has led to major rallies, with pullbacks finding support near prior resistance levels that have flipped into new bases.

The most recent move shows Bitcoin consolidating around $113,880, holding well above the last major support near $95,000.

The chart projects a potential upside extension toward the $157,000 level, which aligns with the historical rhythm of 40–50% rallies after each breakout.

As long as Bitcoin continues to hold above the $100,000–$105,000 support zone and maintains the 20-week MA as a guide, momentum favors the bulls.

The post On-Chain Data Shows Bitcoin Far From Peak as Analyst Maps $240K Bull Case appeared first on Cryptonews.

Read More

On-Chain Data Shows Bitcoin Far From Peak as Analyst Maps $240K Bull Case

Share:

On-chain data from Checkonchain and Unchained shows that Bitcoin is far from its peak, as the leading crypto asset has yet to “enter the euphoric right tail in the current cycle.“

James Check, co-founder and Bitcoin analyst at Checkonchain, reveals that the current all-time high Bitcoin price of $124k is approximately 1.8x the 2021 peak of $69k.

To validate the ‘diminishing returns’ bull case target, the Bitcoin price would need to surpass $240k, hitting a 3.5x multiple from the prior cycle high.

He added that whether Bitcoin reaches $240k or $300k, neither feels completely outside the realm of possibility now that Bitcoin is trading north of $100k.

“It was much harder to envision such heights in the pits of the 2022 bear market,” he noted.

Market Structure Development Shows that Bitcoin is Far from Peak

One of the most popular debates of this cycle has been whether the classic four-year halving cycle is likely to play out as it has in the past.

Analysts at Checkonchain reveal that both of the last two bull cycles found their ultimate market peak in the fourth quarter of the calendar year.

The way this cycle is tracking suggests the crypto market is close to discovering if the pattern is destined to repeat once more.

This cycle has not yet seen what would generally be considered a powerful euphoric blow-off top, where YoY returns ran far in excess of 5x in both previous cycles.

Similarly, one of the most important changes to Bitcoin’s performance since 2023 is the comparatively shallow drawdown profile of the prevailing uptrend.

The market has experienced two approximately 32% pullbacks in August 2024 and April 2025, both occurring alongside corrections in broader markets due to the Japanese yen carry trade unwind and the tariff tantrum, respectively.

“It is our view that the 2023-25 bull cycle has been primarily a spot-driven market.“

Analyst Maps out $240K Bull Case, Says Bitcoin Still a Small Fish in a Big Pond

Analysts point out that the $240k target remains very much achievable, as Bitcoin remains a small fish that has now swum into the very large pond that is global wealth.

Despite having a market cap exceeding $2 trillion, Bitcoin still represents less than a tenth of the precious metals market and less than 0.2% of the global asset base.

Bitcoin is one of the very few major assets that have outperformed gold over that time, seeing its value appreciate by over 80% in gold terms since February 2022.

Importantly, this comparison includes the bulk of the 2022 bear market, which saw BTC prices plunge to $15.6k and bottomed out 55% below the November 2021 ATH in gold terms.

The investing world is a relative place, and Bitcoin is an asset that has now earned a place on every Bloomberg Terminal watch list.

As more investors, analysts, and firms analyze how capital is rotating and which sectors are protecting their money best, sound money assets like gold and Bitcoin are becoming increasingly favored.

Crypto analyst ZynxBTC shares the view that we’re barely in a Bitcoin bull market, noting that Bitcoin needs to cross $151k just to equal its all-time high in gold terms.

Every cycle since inception, Bitcoin has more than doubled its price in gold at a minimum, usually much more than that.

According to him, $300k BTC is becoming increasingly likely. “It’s impossible to give a timeframe, but I’m expecting $151k to be crossed within the next 6 months,” he added.

Technical Analysis: Weekly Chart Shows Bullish Structure with $157K Target

On the technical front, the weekly Bitcoin chart shows a strong bullish structure supported by consistent higher highs and higher lows.

The price has been respecting the 20-week moving average as dynamic support, with the 50-week MA providing a deeper floor during corrections.

Each breakout above previous highs has led to major rallies, with pullbacks finding support near prior resistance levels that have flipped into new bases.

The most recent move shows Bitcoin consolidating around $113,880, holding well above the last major support near $95,000.

The chart projects a potential upside extension toward the $157,000 level, which aligns with the historical rhythm of 40–50% rallies after each breakout.

As long as Bitcoin continues to hold above the $100,000–$105,000 support zone and maintains the 20-week MA as a guide, momentum favors the bulls.

The post On-Chain Data Shows Bitcoin Far From Peak as Analyst Maps $240K Bull Case appeared first on Cryptonews.

Read More

(@_Checkmatey_)

(@_Checkmatey_)