Is BTC Overdue a Correction Following Epic Rally Above $60K? (Bitcoin Price Analysis)

Share:

Bitcoin’s price has been on an almost vertical rise in the last few days, approaching its all-time high of $69K. Yet, the cryptocurrency might not make a new record right away, as some warning signals are pointing to a short-term correction.

Technical Analysis

By TradingRage

The Daily Chart

On the daily timeframe, it is evident that the price has been rallying aggressively during the last month, breaking past several significant resistance levels. The market is currently one step away from making a new all-time high, as there are no significant long-term resistance levels left apart from the $69K level itself.

Yet, the Relative Strength Index demonstrates a clear overbought signal that could point to a potential consolidation or pullback in the coming days.

The 4-Hour Chart

Looking at the 4-hour timeframe, the price has created a short-term resistance level at the $64K mark. BTC has been consolidating between this level and the $60K support level recently.

Meanwhile, the Relative Strength Index is retreating from the overbought zone without the price showing a significant drop. This can be interpreted as a cooldown for momentum and hint at a potential continuation soon after a breakout from the $64K level.

Sentiment Analysis

By TradingRage

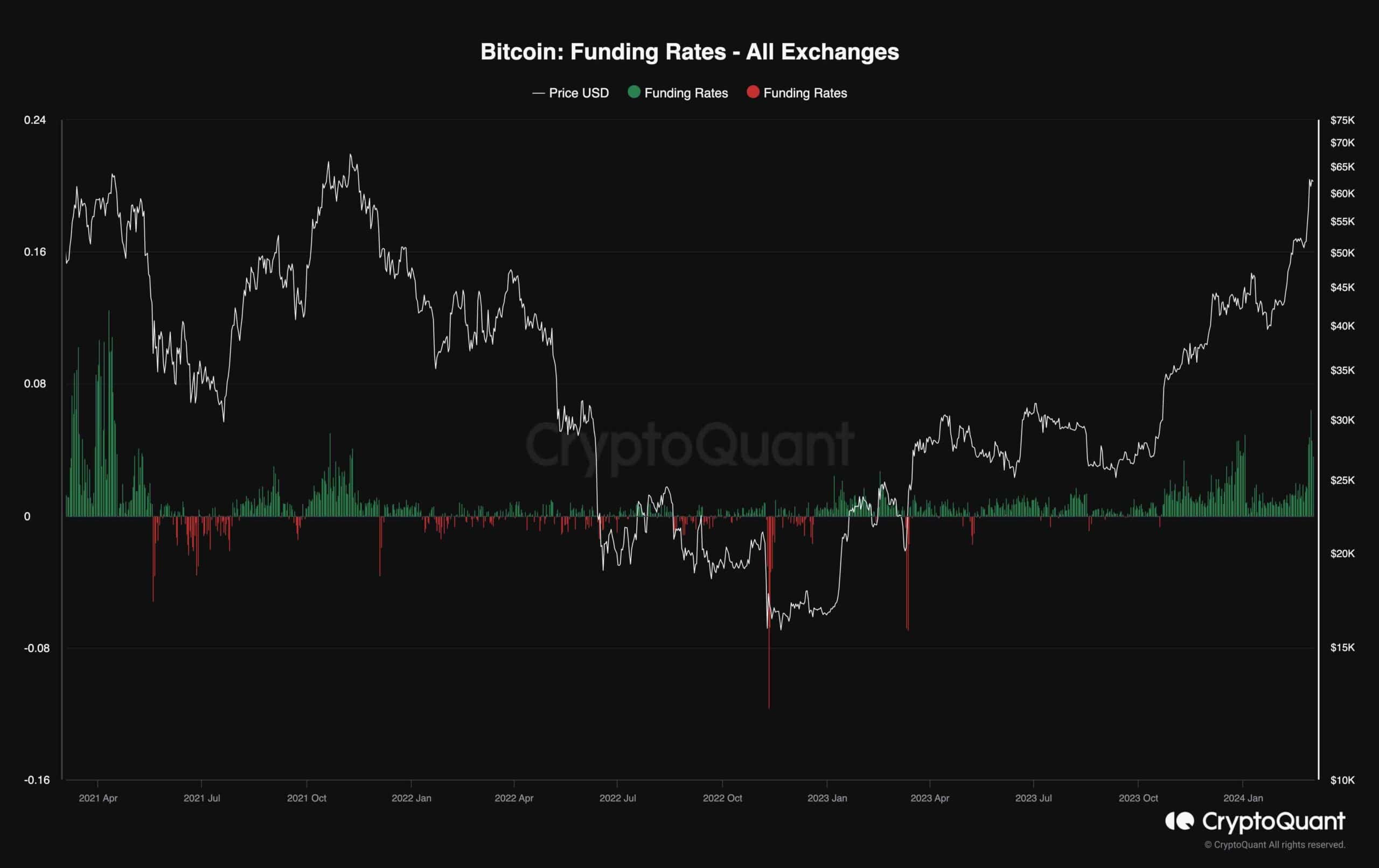

Bitcoin Funding Rates

While Bitcoin’s price is quickly approaching its all-time high, the market attracts many buyers and speculators. However, this extreme optimism might be costly in the short term.

This chart demonstrates the Bitcoin funding rates, one of the most valuable metrics for future market sentiment evaluation. Values above zero are associated with optimism, while negative values indicate bearish sentiment.

Currently, the funding rates are displaying high values, as they have spiked significantly in the last few days. This might result in a long liquidation cascade in the short term, which could then lead to a quick drop. Therefore, a correction might be due shortly before the bullish trend continues.

The post Is BTC Overdue a Correction Following Epic Rally Above $60K? (Bitcoin Price Analysis) appeared first on CryptoPotato.

Read More

Is BTC Overdue a Correction Following Epic Rally Above $60K? (Bitcoin Price Analysis)

Share:

Bitcoin’s price has been on an almost vertical rise in the last few days, approaching its all-time high of $69K. Yet, the cryptocurrency might not make a new record right away, as some warning signals are pointing to a short-term correction.

Technical Analysis

By TradingRage

The Daily Chart

On the daily timeframe, it is evident that the price has been rallying aggressively during the last month, breaking past several significant resistance levels. The market is currently one step away from making a new all-time high, as there are no significant long-term resistance levels left apart from the $69K level itself.

Yet, the Relative Strength Index demonstrates a clear overbought signal that could point to a potential consolidation or pullback in the coming days.

The 4-Hour Chart

Looking at the 4-hour timeframe, the price has created a short-term resistance level at the $64K mark. BTC has been consolidating between this level and the $60K support level recently.

Meanwhile, the Relative Strength Index is retreating from the overbought zone without the price showing a significant drop. This can be interpreted as a cooldown for momentum and hint at a potential continuation soon after a breakout from the $64K level.

Sentiment Analysis

By TradingRage

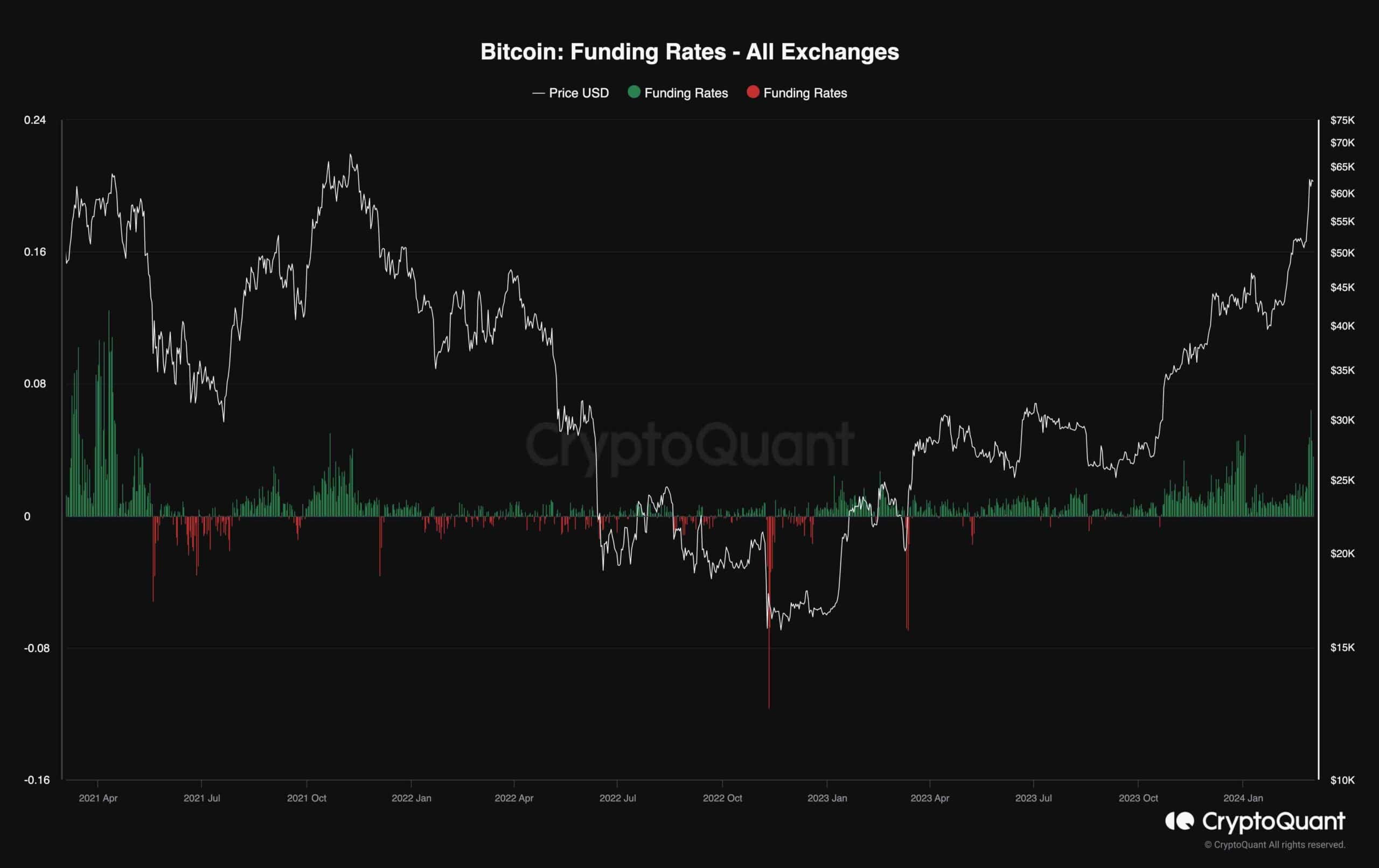

Bitcoin Funding Rates

While Bitcoin’s price is quickly approaching its all-time high, the market attracts many buyers and speculators. However, this extreme optimism might be costly in the short term.

This chart demonstrates the Bitcoin funding rates, one of the most valuable metrics for future market sentiment evaluation. Values above zero are associated with optimism, while negative values indicate bearish sentiment.

Currently, the funding rates are displaying high values, as they have spiked significantly in the last few days. This might result in a long liquidation cascade in the short term, which could then lead to a quick drop. Therefore, a correction might be due shortly before the bullish trend continues.

The post Is BTC Overdue a Correction Following Epic Rally Above $60K? (Bitcoin Price Analysis) appeared first on CryptoPotato.

Read More