DOJ recovers $7 million from crypto investment scammers

The United States Department of Justice (DOJ) has recovered $7 million from a global investment scam. According to the authorities, the fraud proceeds were recovered using civil asset forfeiture, with the DOJ announcing plans to return the funds to their rightful owners.

According to documents produced in court, the criminals used social engineering schemes to convince their victims to invest in digital assets using fake investment websites. These websites were spoofed, in the sense that they mimicked the original websites of big crypto exchanges and entities.

Their modus operandi was to first lure their victims, convince them after talking for a long to gain their trust, and introduce them to the fake website they run.

According to authorities, the perpetrators funneled the funds through over 75 bank accounts, using the names of several shell companies. The filing showed that after the victims make their investments, the site falsely represents that their investments are doing well and accruing gains.

DOJ recovers and seizes $7 million from investment scammers

According to the filing, the victims were not allowed to make withdrawals or take profits from the investments. Anytime they attempt it, the perpetrators will convince them to make more deposits, citing several reasons, with taxes on their purported profits the most used excuse. The criminals laundered most of the funds from their operations, often taking the money outside the United States.

After the perpetrators receive the victim’s funds, they move it to the shell company account before transferring it across several banks inside the United States. After the series of internal transfers, the funds are then sent abroad to specific bank accounts that they control. According to the authorities, the group describes the wiring instructions associated with the transfer as domestic wires, while in reality, the funds are being moved outside the country.

In its statement, the DOJ mentioned that it will begin to invite victims who were affected to submit petitions to have their funds returned. “The United States will now begin the process of inviting the victims from whom those funds were stolen to submit petitions to have the funds remitted back to them,” the DOJ said.

Forfeiture actions and the way forward

According to the DOJ filing, the Secret Service, in June 2023, seized some of the fraud proceeds from a bank account being run by a foreign bank. The documents, unsealed in federal court at the time, revealed that the Secret Service executed several seizure warrants to confiscate funds from the bank’s U.S. accounts amid their investigation into “international criminal money laundering syndicates operating cryptocurrency investment and other wire fraud scams.” The seizures were authorized on June 12 and 23.

According to the Secret Service, it received authorization to confiscate up to roughly $58 million from a custodial account opened with Mitsubishi UFJ Trust in New York by Deltec on behalf of its corporate clients. The total amount of funds officials ultimately seized remains unclear.

After the seizure, the United States initiated a civil forfeiture proceeding against the seized funds, filing a public civil forfeiture complaint at the United States District Court. After the filing, the United States then sent notice of the forfeiture actions to every person and entity with an interest in the funds, noting that it gave notices through online publications, allowing the potential claimants the opportunity to contest the forfeiture action in court.

The bank that owned the account made a claim and both parties reached the settlement figure. “Following a claim by the bank that owned the account from which the funds were seized, the United States reached a settlement in which $7 million of the seized funds would be forfeited to the United States, allowing victims to petition to recover on their losses,” the DOJ said.

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot

Bitcoin Stalls, Altcoins Move: This Week’s Top Gainers and Losers (Weekend Watch)

Although it went through some volatility in the past seven days, bitcoin’s price actually stands at the same spot as it did last Sunday.

Many altcoins have produced bigger moves, as ETH has bounced above $2,000 once again, while DOGE is close to breaking below $0.17.

BTC Stalls at $84K

As the chart on the bottom of this article will show, BTC’s price stood at $84,000 last Sunday before it headed south on Monday and later on Tuesday. The weekly bottom came at just over $81,000 at the time as traders were preparing for the conclusion of the FOMC meeting on Wednesday.

Once it became known that the Fed will not change the interest rates again, BTC faced some volatility but ultimately shot up to a multi-week peak of over $87,000 during Thursday morning’s Asian trading session.

However, this was short-lived, and the bears pushed the asset south later on Thursday and Friday. The biggest drop at the time came with a slide to $83,000. Nevertheless, BTC managed to defend that level and has returned to just over $84,000, as mentioned above. The weekend has been quite dull, with little to no movements.

Its market cap has remained still at $1.670 trillion, while its dominance over the alts has been reduced this week to 58.3%.

ETH Above $2K

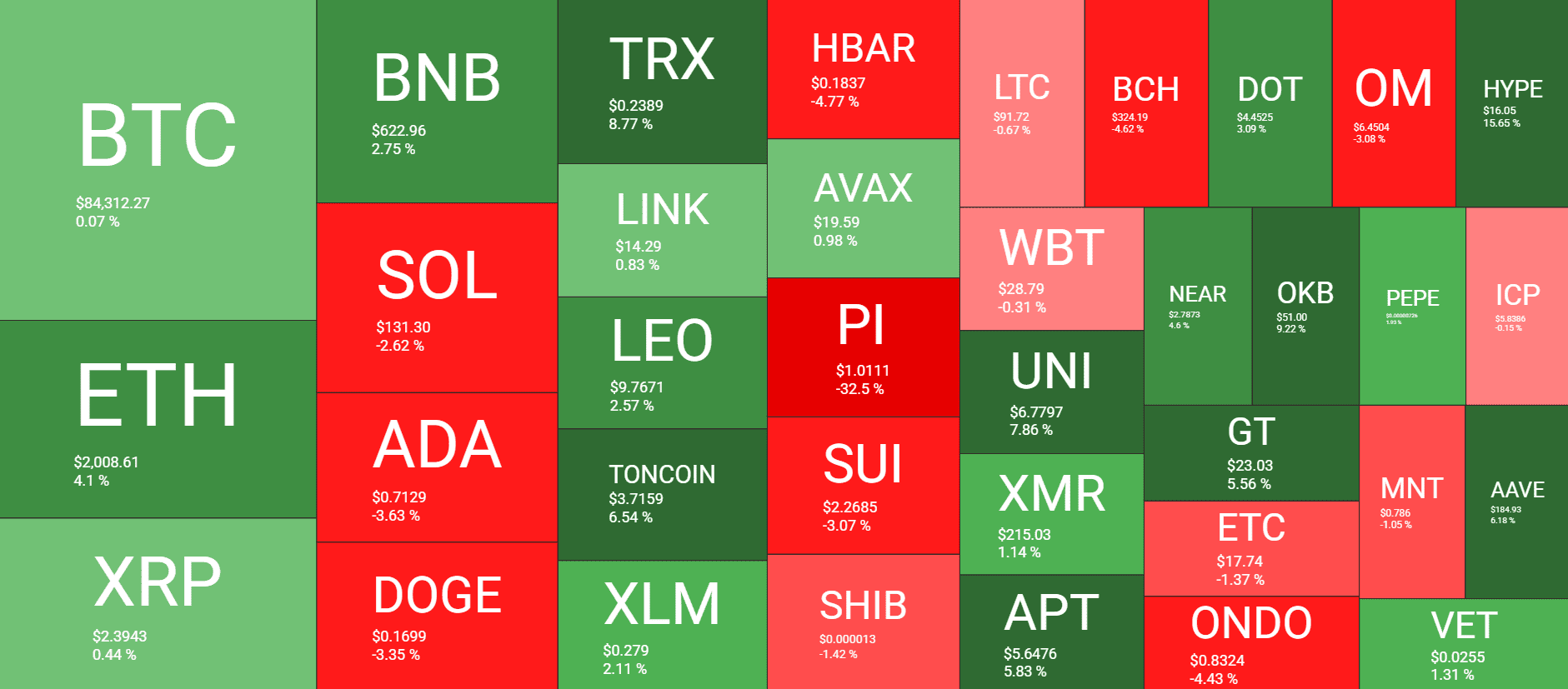

The market moves over the past day have been lacking, so we will focus on the weekly performances. Ethereum is actually up by over 4%, which has helped it jump past the coveted $2,000 mark. Tron and Toncoin have popped up as the top gainers from the larger-cap alts, surging by 9% and 6.5%, respectively.

UNI, APT, KBT, AAVE, GT, and HYPE lead the way from the mid-cap alts. In contrast, Pi Network’s PI token has plummeted by over 32% since last Sunday to $1.

Solana, Cardnao, and Dogecoin are also in the red from the larger-cap alts, with losses of up to 4%.

The total crypto market cap is essentially at the same spot as yesterday at $2.870 trillion on CG.

The post Bitcoin Stalls, Altcoins Move: This Week’s Top Gainers and Losers (Weekend Watch) appeared first on CryptoPotato.