Goldman Sachs Lifts Alphabet (GOOGL) to $220 on AI, Cloud Momentum

Share:

Goldman Sachs Alphabet stock analysis has been updated with a notably bullish stance, as the investment banking giant just recently raised its price target for the tech behemoth to $220. At this moment, Alphabet stock price target revisions are definitely gaining quite a bit of attention from investors who are hoping to capitalize on the company’s growing strength in AI and cloud computing. The GOOGL stock upgrade comes at a time when the stock has already shown strong performance throughout early 2025.

Also Read: Pi Coin Rallies 155% In 7 Days: New Peak Next Or Major Crash?

Behind Goldman’s Bullish Call: AI Wins and Margin Growth

The Goldman Sachs Alphabet stock evaluation basically highlights several important factors that are currently driving the increased price target. The upgrade follows what has been, for the most part, consistent outperformance by Alphabet, with both AI integration and also cloud growth really leading the way forward.

AI Integration Delivers Results

The Alphabet stock price target was elevated due to the company’s rather aggressive AI investments that are now bearing fruit across its ecosystem of products and services.

Goldman Sachs analysts stated:

“We believe Alphabet’s AI leadership position, particularly within Search, remains underappreciated by investors.”

The firm noted that AI monetization is actually accelerating faster than initially anticipated, driving both engagement and revenue growth.

Also Read: Goldman Sachs Pours $1.4B Into BlackRock’s Bitcoin Fund in Q1 Surge

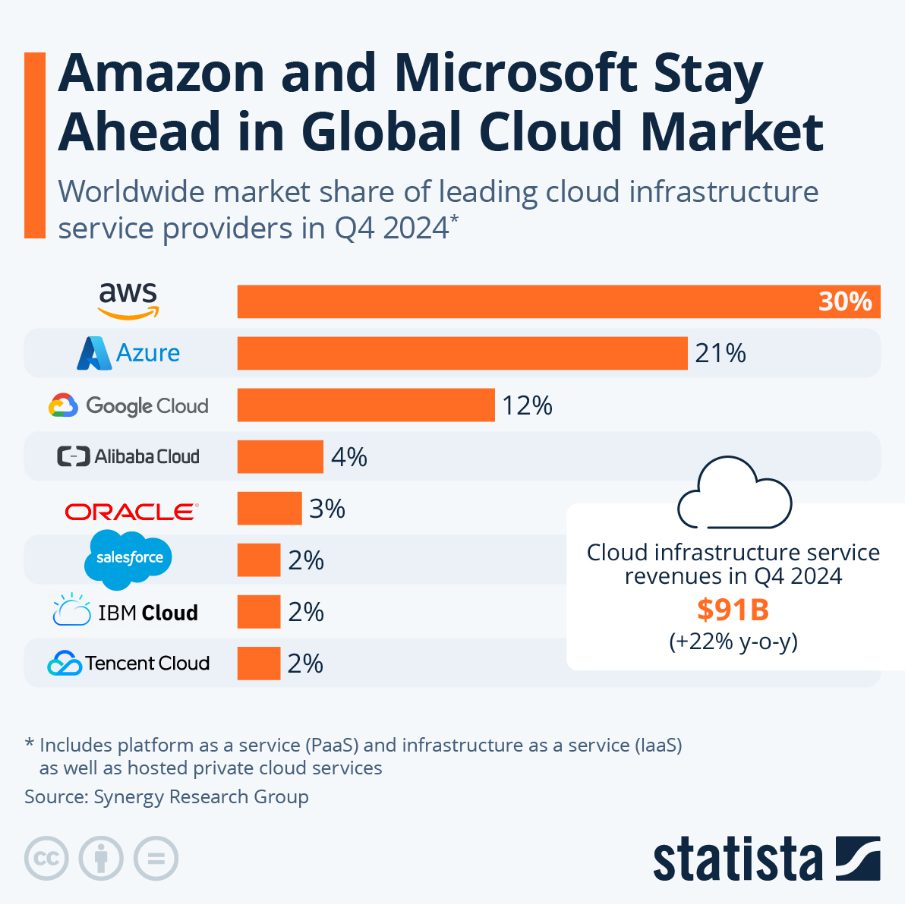

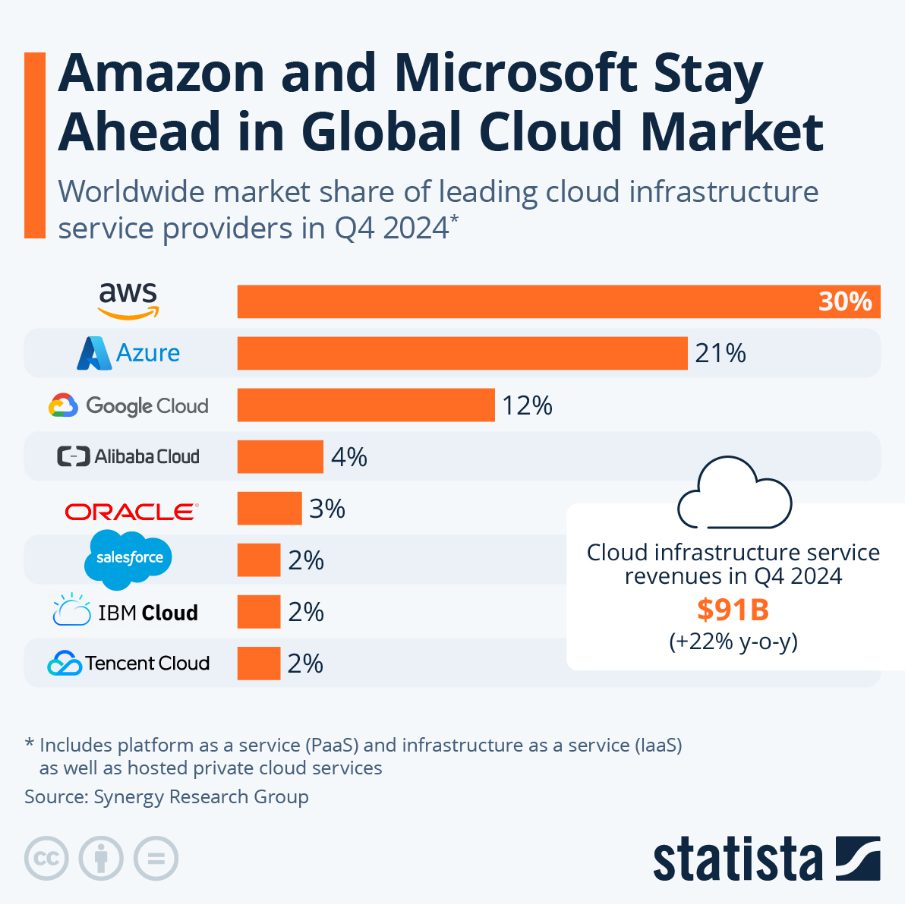

Cloud Business Exceeds Expectations

The Google Cloud Platform has emerged as another really critical growth driver, supporting the Goldman Sachs Alphabet stock upgrade in a significant way.

Expanding Profit Margins

So, why is Alphabet stock rising right now? Well, margin expansion definitely plays a pretty significant role in the equation. The cost-cutting measures that were implemented over the past year or so have somewhat maintained growth momentum, a balance that has been, for the most part, received positively by Wall Street analysts and investors alike.

Goldman’s analysis indicated:

“Alphabet’s operating margins have consistently surprised to the upside for the past three quarters.”

These GOOGL stock upgrade factors essentially demonstrate Alphabet’s operational discipline while the company continues investing in future technologies and innovations.

Should You Invest in GOOGL Right Now?

With the Goldman Sachs Alphabet stock price target representing what appears to be significant upside potential, many investors are currently considering possibly increasing their positions. The Alphabet stock price target of around $220 certainly suggests a good deal of confidence in the company’s overall direction.

Goldman analysts concluded:

“We see multiple catalysts for Alphabet in the coming quarters. The combination of AI monetization, cloud profitability, and margin expansion creates a compelling investment case.”

Despite the somewhat varying Wall Street perspectives on Alphabet’s valuation at the moment, the GOOGL stock upgrade basically adds meaningful weight to the investment case as the company continues executing across its multiple business segments.

Also Read: Trump Eyes $1 Trillion Saudi Mega-Deal, Cuts Netanyahu Ties as Peace Talks Stall

Goldman Sachs Lifts Alphabet (GOOGL) to $220 on AI, Cloud Momentum

Share:

Goldman Sachs Alphabet stock analysis has been updated with a notably bullish stance, as the investment banking giant just recently raised its price target for the tech behemoth to $220. At this moment, Alphabet stock price target revisions are definitely gaining quite a bit of attention from investors who are hoping to capitalize on the company’s growing strength in AI and cloud computing. The GOOGL stock upgrade comes at a time when the stock has already shown strong performance throughout early 2025.

Also Read: Pi Coin Rallies 155% In 7 Days: New Peak Next Or Major Crash?

Behind Goldman’s Bullish Call: AI Wins and Margin Growth

The Goldman Sachs Alphabet stock evaluation basically highlights several important factors that are currently driving the increased price target. The upgrade follows what has been, for the most part, consistent outperformance by Alphabet, with both AI integration and also cloud growth really leading the way forward.

AI Integration Delivers Results

The Alphabet stock price target was elevated due to the company’s rather aggressive AI investments that are now bearing fruit across its ecosystem of products and services.

Goldman Sachs analysts stated:

“We believe Alphabet’s AI leadership position, particularly within Search, remains underappreciated by investors.”

The firm noted that AI monetization is actually accelerating faster than initially anticipated, driving both engagement and revenue growth.

Also Read: Goldman Sachs Pours $1.4B Into BlackRock’s Bitcoin Fund in Q1 Surge

Cloud Business Exceeds Expectations

The Google Cloud Platform has emerged as another really critical growth driver, supporting the Goldman Sachs Alphabet stock upgrade in a significant way.

Expanding Profit Margins

So, why is Alphabet stock rising right now? Well, margin expansion definitely plays a pretty significant role in the equation. The cost-cutting measures that were implemented over the past year or so have somewhat maintained growth momentum, a balance that has been, for the most part, received positively by Wall Street analysts and investors alike.

Goldman’s analysis indicated:

“Alphabet’s operating margins have consistently surprised to the upside for the past three quarters.”

These GOOGL stock upgrade factors essentially demonstrate Alphabet’s operational discipline while the company continues investing in future technologies and innovations.

Should You Invest in GOOGL Right Now?

With the Goldman Sachs Alphabet stock price target representing what appears to be significant upside potential, many investors are currently considering possibly increasing their positions. The Alphabet stock price target of around $220 certainly suggests a good deal of confidence in the company’s overall direction.

Goldman analysts concluded:

“We see multiple catalysts for Alphabet in the coming quarters. The combination of AI monetization, cloud profitability, and margin expansion creates a compelling investment case.”

Despite the somewhat varying Wall Street perspectives on Alphabet’s valuation at the moment, the GOOGL stock upgrade basically adds meaningful weight to the investment case as the company continues executing across its multiple business segments.

Also Read: Trump Eyes $1 Trillion Saudi Mega-Deal, Cuts Netanyahu Ties as Peace Talks Stall