Massachusetts’ Bitcoin Reserve Bill Hits a Wall as Lawmakers Go Silent — What’s Next?

A proposal to establish a state-backed Bitcoin reserve in Massachusetts has encountered an early setback after state lawmakers showed little engagement during its first public hearing in eight months.

The bill, titled An Act Relative to a Bitcoin Strategic Reserve, was introduced by Republican State Senator Peter Durant and presented before the Massachusetts Joint Committee on Revenue on Tuesday.

Massachusetts Bill Proposes Allocating Billions From State Reserve to Bitcoin

The measure seeks to authorize the state treasury to allocate up to 10% of the Commonwealth Stabilization Fund, a reserve worth billions, into Bitcoin and other digital assets.

It would also allow Bitcoin and cryptocurrencies seized by state authorities to be added to a dedicated reserve.

“This creates a prudent diversification tool, ensuring full transparency, oversight, and risk management without mandating any action,” Durant said during the session.

However, after opening the floor for questions, the committee members remained silent, offering no responses or follow-up inquiries on the proposal.

The quiet reception marked the bill’s first legislative activity since it was introduced in February 2025.

The committee now has 60 days to either advance the legislation or refer it for additional review, indicating possible movement by early December.

Durant said that he remains optimistic despite the lack of immediate engagement.

“We’ve been having great conversations with our colleagues about the possibility of bringing Bitcoin to Massachusetts, and we’re working hard to move this forward alongside others who have filed similar legislation,” he said.

“Lawmakers have been engaged and open during the process, and we’re focused on continuing to educate every stakeholder.”

Dennis Porter, CEO of the Bitcoin advocacy group Satoshi Action Fund, also testified in support of the bill.

Porter described Massachusetts as “a historic financial hub” well suited to lead state-level Bitcoin initiatives, noting that the state pioneered America’s first mutual fund and has long been central to U.S. financial innovation.

He argued that the measure could be bipartisan in nature and pointed to other U.S. states that have already taken steps to create digital asset reserves.

State Bitcoin Reserve Movement Falters as Massachusetts Adds to Growing List of Delays

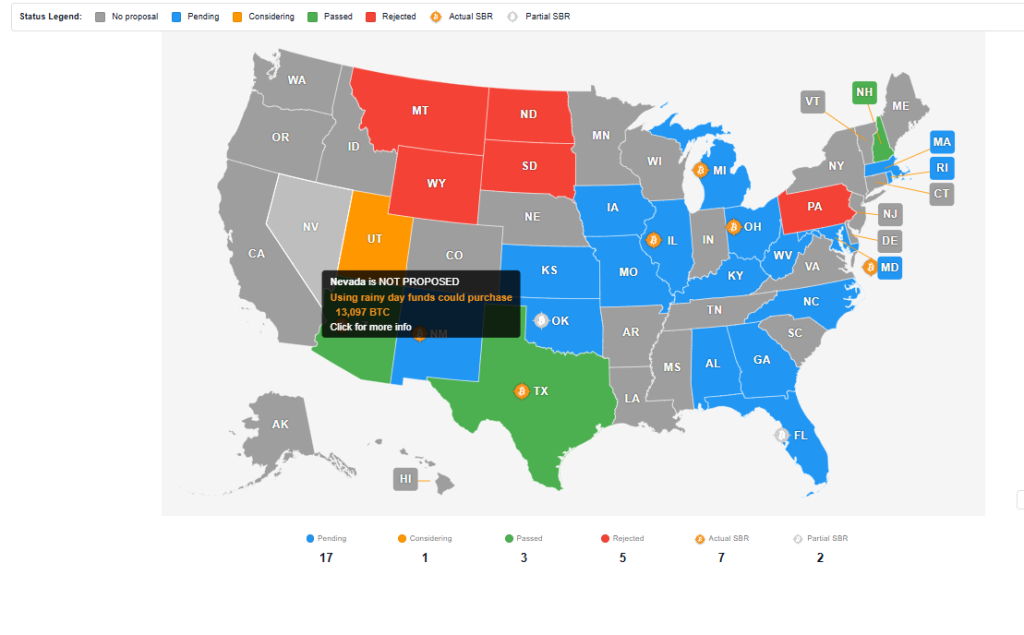

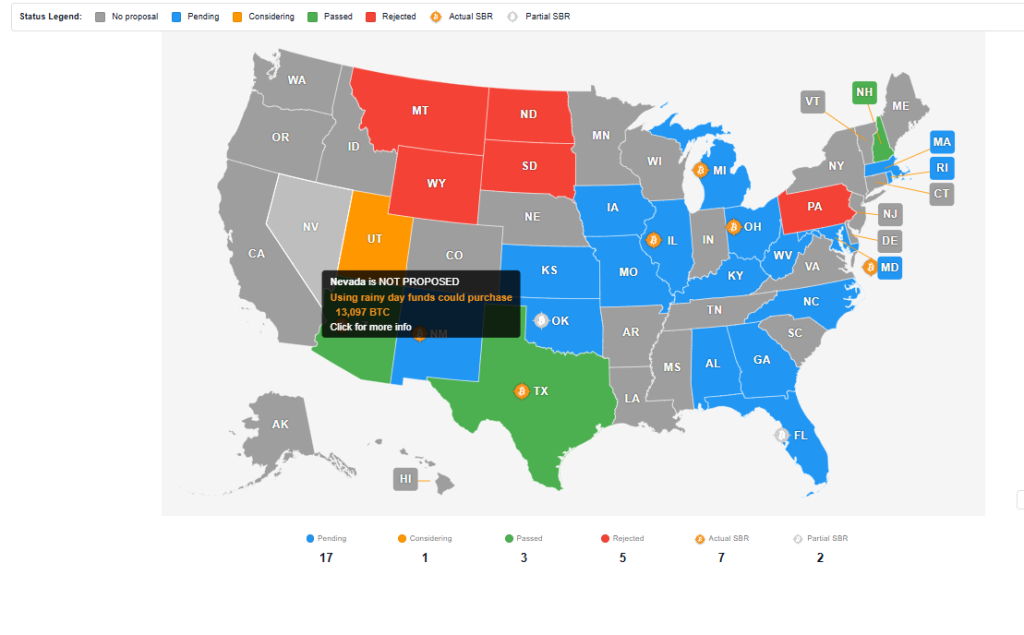

The Massachusetts hearing follows similar activity across the country, where a handful of states have explored or enacted Bitcoin reserve measures.

Texas, Arizona, and New Hampshire have all passed legislation establishing state-level reserves, while proposals in Wyoming, Montana, Pennsylvania, and North Dakota have stalled or been rejected.

As of October 2025, only three states have successfully created Bitcoin reserve frameworks. New Hampshire became the first in May, followed by Arizona and Texas, which approved a modest $10 million allocation earlier this year.

Data from the Bitcoin Reserve Monitor shows that more than two dozen states introduced reserve-related bills in 2025, but most remain in committee or face uncertain prospects.

The tepid response in Massachusetts comes amid a broader cooling of momentum for such initiatives.

Bloomberg reported in February that at least four states rejected Bitcoin reserve proposals in a single month, citing volatility and fiscal risk.

Jennifer Schulp of the Cato Institute noted that even in bullish market conditions, price swings remain a major obstacle for lawmakers tasked with managing public funds.

Under Durant’s plan, the proposed reserve would not compel the state treasury to immediately acquire Bitcoin.

Instead, it would authorize, but not require, up to 10% of the stabilization fund to be allocated toward Bitcoin or similar digital assets as part of a diversification strategy.

State and Federal Bitcoin Reserve Efforts Converge

The bill’s timing coincides with growing federal attention to Bitcoin reserves. In March 2025, President Donald Trump signed an executive order authorizing the creation of a U.S. Strategic Bitcoin Reserve, funded primarily through Bitcoin seized by the Department of Treasury.

Senator Cynthia Lummis has since introduced federal legislation that would authorize the government to purchase up to one million BTC over five years, though the bill remains in Congress.

In a recent post on X, Lummis reaffirmed her support for the federal initiative, calling the Strategic Bitcoin Reserve a “fabulous articulation” of why the U.S. should hold Bitcoin as a strategic asset.

She added that while legislative delays persist, “the acquisition of funds for an SBR can start anytime.”

Critics, however, continue to warn that its extreme volatility makes it unsuitable for taxpayer-backed reserves.

Still, momentum for such measures continues internationally. Sweden recently introduced a parliamentary motion calling for a national Bitcoin strategy, while Kyrgyzstan and the Philippines are considering similar frameworks.

With the Joint Committee on Revenue expected to issue its decision by early December, the Massachusetts Bitcoin reserve bill now sits at a crossroads.

The post Massachusetts’ Bitcoin Reserve Bill Hits a Wall as Lawmakers Go Silent — What’s Next? appeared first on Cryptonews.

Massachusetts’ Bitcoin Reserve Bill Hits a Wall as Lawmakers Go Silent — What’s Next?

A proposal to establish a state-backed Bitcoin reserve in Massachusetts has encountered an early setback after state lawmakers showed little engagement during its first public hearing in eight months.

The bill, titled An Act Relative to a Bitcoin Strategic Reserve, was introduced by Republican State Senator Peter Durant and presented before the Massachusetts Joint Committee on Revenue on Tuesday.

Massachusetts Bill Proposes Allocating Billions From State Reserve to Bitcoin

The measure seeks to authorize the state treasury to allocate up to 10% of the Commonwealth Stabilization Fund, a reserve worth billions, into Bitcoin and other digital assets.

It would also allow Bitcoin and cryptocurrencies seized by state authorities to be added to a dedicated reserve.

“This creates a prudent diversification tool, ensuring full transparency, oversight, and risk management without mandating any action,” Durant said during the session.

However, after opening the floor for questions, the committee members remained silent, offering no responses or follow-up inquiries on the proposal.

The quiet reception marked the bill’s first legislative activity since it was introduced in February 2025.

The committee now has 60 days to either advance the legislation or refer it for additional review, indicating possible movement by early December.

Durant said that he remains optimistic despite the lack of immediate engagement.

“We’ve been having great conversations with our colleagues about the possibility of bringing Bitcoin to Massachusetts, and we’re working hard to move this forward alongside others who have filed similar legislation,” he said.

“Lawmakers have been engaged and open during the process, and we’re focused on continuing to educate every stakeholder.”

Dennis Porter, CEO of the Bitcoin advocacy group Satoshi Action Fund, also testified in support of the bill.

Porter described Massachusetts as “a historic financial hub” well suited to lead state-level Bitcoin initiatives, noting that the state pioneered America’s first mutual fund and has long been central to U.S. financial innovation.

He argued that the measure could be bipartisan in nature and pointed to other U.S. states that have already taken steps to create digital asset reserves.

State Bitcoin Reserve Movement Falters as Massachusetts Adds to Growing List of Delays

The Massachusetts hearing follows similar activity across the country, where a handful of states have explored or enacted Bitcoin reserve measures.

Texas, Arizona, and New Hampshire have all passed legislation establishing state-level reserves, while proposals in Wyoming, Montana, Pennsylvania, and North Dakota have stalled or been rejected.

As of October 2025, only three states have successfully created Bitcoin reserve frameworks. New Hampshire became the first in May, followed by Arizona and Texas, which approved a modest $10 million allocation earlier this year.

Data from the Bitcoin Reserve Monitor shows that more than two dozen states introduced reserve-related bills in 2025, but most remain in committee or face uncertain prospects.

The tepid response in Massachusetts comes amid a broader cooling of momentum for such initiatives.

Bloomberg reported in February that at least four states rejected Bitcoin reserve proposals in a single month, citing volatility and fiscal risk.

Jennifer Schulp of the Cato Institute noted that even in bullish market conditions, price swings remain a major obstacle for lawmakers tasked with managing public funds.

Under Durant’s plan, the proposed reserve would not compel the state treasury to immediately acquire Bitcoin.

Instead, it would authorize, but not require, up to 10% of the stabilization fund to be allocated toward Bitcoin or similar digital assets as part of a diversification strategy.

State and Federal Bitcoin Reserve Efforts Converge

The bill’s timing coincides with growing federal attention to Bitcoin reserves. In March 2025, President Donald Trump signed an executive order authorizing the creation of a U.S. Strategic Bitcoin Reserve, funded primarily through Bitcoin seized by the Department of Treasury.

Senator Cynthia Lummis has since introduced federal legislation that would authorize the government to purchase up to one million BTC over five years, though the bill remains in Congress.

In a recent post on X, Lummis reaffirmed her support for the federal initiative, calling the Strategic Bitcoin Reserve a “fabulous articulation” of why the U.S. should hold Bitcoin as a strategic asset.

She added that while legislative delays persist, “the acquisition of funds for an SBR can start anytime.”

Critics, however, continue to warn that its extreme volatility makes it unsuitable for taxpayer-backed reserves.

Still, momentum for such measures continues internationally. Sweden recently introduced a parliamentary motion calling for a national Bitcoin strategy, while Kyrgyzstan and the Philippines are considering similar frameworks.

With the Joint Committee on Revenue expected to issue its decision by early December, the Massachusetts Bitcoin reserve bill now sits at a crossroads.

The post Massachusetts’ Bitcoin Reserve Bill Hits a Wall as Lawmakers Go Silent — What’s Next? appeared first on Cryptonews.

The Massachusetts Joint Revenue Committee sets hearing on Bitcoin Strategic Reserve bill for Oct 7, examining crypto’s role in state asset strategy.

The Massachusetts Joint Revenue Committee sets hearing on Bitcoin Strategic Reserve bill for Oct 7, examining crypto’s role in state asset strategy.  Senator Cynthia Lummis took to X Wednesday after reports emerged that the U.S. may not hold as much Bitcoin in its reserve as believed.

Senator Cynthia Lummis took to X Wednesday after reports emerged that the U.S. may not hold as much Bitcoin in its reserve as believed.